Don't Get too Close to Gamma

It's radioactive to your trading account.

It's the final countdown to Christmas, and we're unwrapping a bounty of gifts for you this week. If you haven't subscribed yet, don't miss out on our 50% off offer to access all our premium content.

Today, we're excited to share three of our favorite trades from 2023, which we'll be closely monitoring throughout 2024.

But first, let's dive into an exploration of how straddles are mispriced based on their position in the expiration cycle.

Warning - We may get exposed to some nasty gamma radiation while doing this analysis. Please wear the necessary equipment for your own safety.

Let’s dive in.

Walking (intuitively) alongside the expiration cycle

At Sharpe Two, our specialty is volatility. We shy away from predicting market direction – it's just too complex. Volatility, on the other hand, is mean-reverting and more straightforward to understand. However, pure volatility trading can be challenging and costly, potentially introducing operational risks contradicting our goal of simplifying our trading approach.

So, what's our strategy? We concentrate on such significant mispricings in volatility that they're likely to be reflected in the terminal distribution of the underlying asset. Put simply, we're looking for 'fat' straddles, where the underlying is expected to stay within the initial boundaries.

This means no delta hedging, no defensive maneuvers, no rolling.

The key question, of course, is where to find such trades.

A great starting point for understanding our approach is the expiration cycle. When browsing retail traders' forums, we typically encounter two camps: the 0DTE degens, who operate at the very short end of the cycle, and the Thetaharvestors, who prefer selling far out-of-the-money options with longer durations.

We don't judge either group – these strategies appeal to different types of individuals and tap into distinct emotional aspects:

'With my uber skills, I can make money from the market while risking a limited amount of capital because 0DTE options are cheap,' boasts the 0DTE degen.

'Even if something nasty happens, the market will have plenty of time to recover,' reasons the Thetaharvestor.

These two approaches overlook a crucial fact: the market isn't foolish. It represents the collective views of all its participants, making it a formidable opponent to outsmart.

That said, the market isn't infallible either.

The key is to look in the right place, somewhere in the middle between these two camps.

First, let's acknowledge something important. Straddles with only a few days left until expiration tend to be more overpriced than their longer-duration counterparts.

The reason? Unlike long-term trends, where events tend to balance out, short-term risk is much trickier to predict.

In the long run, the underlying price dynamics will absorb and reflect any external shocks, much like a physical system reaching a state of equilibrium after disturbances. However, accurately gauging the impact of news in the short term is a different challenge. A major piece of information can dramatically skew prices, creating a temporary disequilibrium before the market fully processes the information and re-establishes a new balance.

This interplay of forces, reactions, and counter-reactions in market data is strikingly similar to the principles observed in physics, explaining why many physics quants are drawn to the stock market.

Last week was a prime example, with a significant market reversal following the CPI release and a notably bullish sentiment during the FOMC meeting.

Predicting the magnitude of such movements can be as challenging as estimating the size of a tsunami immediately after an earthquake. While there's some correlation between the strength of the initial event and the subsequent waves, the relationship is far from linear.

This unpredictability holds true in the market as well. As the saying goes, even if you knew critical information in advance, you could still lose money due to the market's sometimes unforeseeable reactions.

For this reason, sellers of options at the short end of the expiration cycle demand a higher premium that buyers are often willing to pay. Let's take a moment to digest this fully: The overpricing of short-dated options isn't a result of manipulation by market makers or figures like Ken Griffin. It's simply the mechanics of supply and demand at work. Buyers are inclined to pay more for their short-term 'insurance' because they, too, find it challenging to predict how an underlying will react accurately.

From theory to practice

Let's validate our theory by examining three distinct asset classes, each represented by a specific ETF:

IWM, tracking the Russell 2000, represents our equities candidate (orange in the chart).

UUP is tracking the dollar index (light blue).

CORN is tracking corn prices (deep blue).

We analyzed the average returns from selling straddles in these underlying and holding them until expiration. The results are categorized by the days to expiration at the time of the trade.

Visually, the effect is striking. The average returns from selling a straddle with about 10 to 20 days to expiration and holding it until expiration are almost 2-3 times higher than those in the 20 to 30-day bucket across all three asset classes.

Now, let's put this into practice. We expanded our analysis to include a broader pool of ETFs (60 in total), covering different geographies and all major asset classes (equities, bonds, currencies, commodities, excluding crypto), and studied the effect over the past two months.

The results somewhat align with our theory, offering some very important insights.

The chart shows the cumulative returns in dark blue, while the average returns (referenced on the right axis) are in light blue.

Interestingly, although the average return in the 10-20 day bracket was almost 50% lower (8% to 12%), it generated more profit than the 20-30 day bucket.

Returns in the 30+ days to expiration (DTE) bracket are negligible. While you're not losing money, you're not making any significant gains either.

The 0-10 DTE bracket has underperformed notably in the past two months.

Is this surprising? Not particularly, once you factor in the gamma risk.

The last two months have witnessed major movements across all asset classes that weren't adequately priced into the premiums for the short end of the expiration cycle.

The gamma risk greatly outweighed the volatility premium, leading to substantial losses.

Spending too much time in the 0 or 10-DTE zone is like exposing yourself to intense, prolonged gamma radiation. It's hazardous, and over the long term, it can be detrimental to your trading account’s health if not managed carefully.

This result sharply contradicts various articles encouraging retail traders to focus on long-term, out-of-the-money options. Often, this approach is a recipe for disaster. Yes, you avoid gamma risk, but there's hardly any premium in writing these distant contracts. Essentially, you provide liquidity to those who need it and are more than willing to pay a 'fair price' for that protection.

The graphs make it clear: selling straddles with 30+ days to expiration (DTE) is hardly a surefire way to make money. You probably won't lose much, but you're unlikely to make much either. Engaging in defensive maneuvers might give the illusion of control, but mathematically speaking, your expected return is virtually zero. And who benefits from this activity? Your broker, happily collecting fees on each trade.

In such scenarios, the ThetaHarvestor might spend considerable time fine-tuning entry setups or exit strategies. However, there's not much they can do in reality – they're merely reacting to market noise. The market is a tough competitor, and in the past two months, it was pretty good at estimating the fair price of 30DTE + straddles and pretty bad on the range from 0 to 10DTE.

Period.

Although the result was just over two months, it is consistent on longer timeframes, and there is a sweet spot in how close to expiration is ideal — depending on your risk tolerance, between 10 and 30 days tends to give you the best bang for your buck.

Our top 3 favourites ETFs in 2023

Now, onto the fun part, and let’s unwrap the Christmas present.

Our top three ETF darlings of 2023. Selling short-dated straddles on these beauties was as breezy as a sleigh ride and just as rewarding. But hey, don't get too cozy. Remember, just because it glittered like gold in the past doesn't mean it'll shine forever. Markets are savvy and might soon stop overpaying for risks that don’t materialize.

So, what's our game plan? The best predictor of success for a strategy is often how successful it has been recently, so we will dance until the music stops, and when the market adjusts – and it will – we'll tip our hats and move on to the next trade.

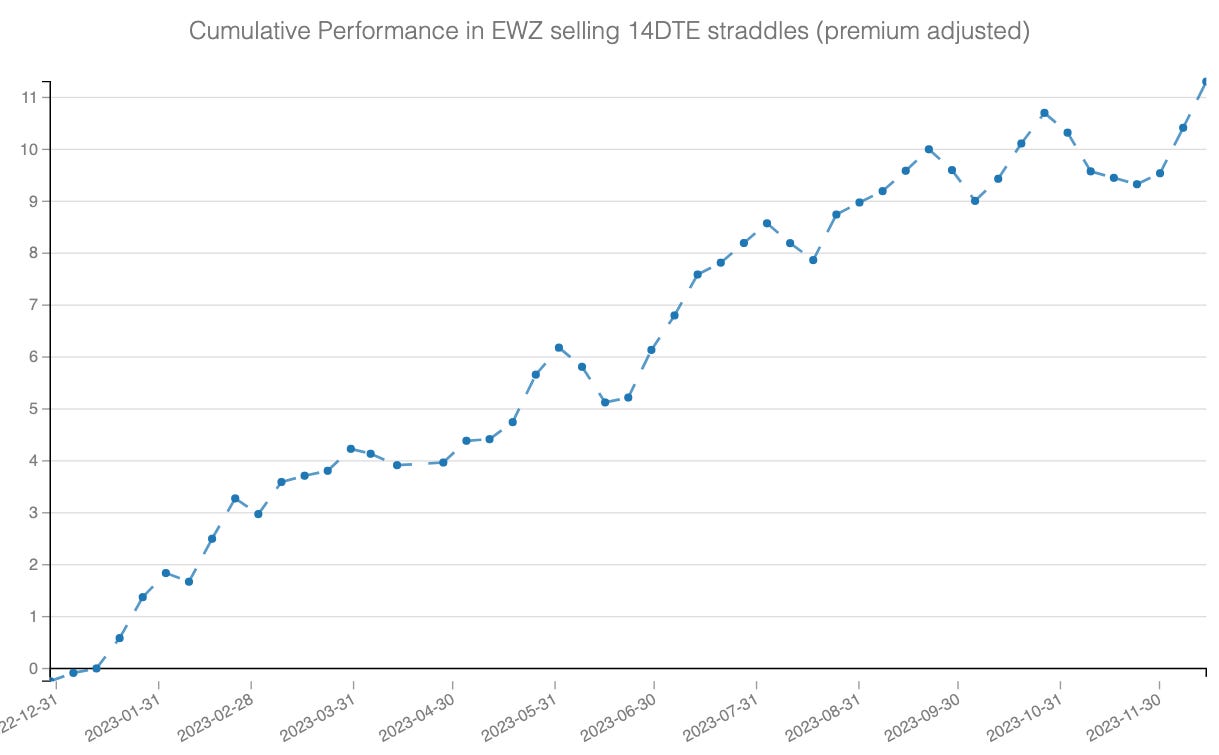

EWZ - 14DTE

The trade methodology is straightforward. Every Friday, sell the ATM straddle expiring two weeks late and hold until expiration. Despite a couple of bumps on the road, this trade has performed exceptionally well, and we expect it to continue, considering the natural premium associated with robust yet developing economies.

UUP - 10DTE

Selling premium on the dollar index has been a great trade this year with all the uncertainty around the Fed policies. Is this going to last? It’s hard to tell, but the insurance premium could diminish with an expected normalization of the rate next year. However, until proven otherwise, we will stay in this trade.

One word of caution, though - the liquidity is not always amazing in this ETF, and you may want to do some price discovery to get a fill.

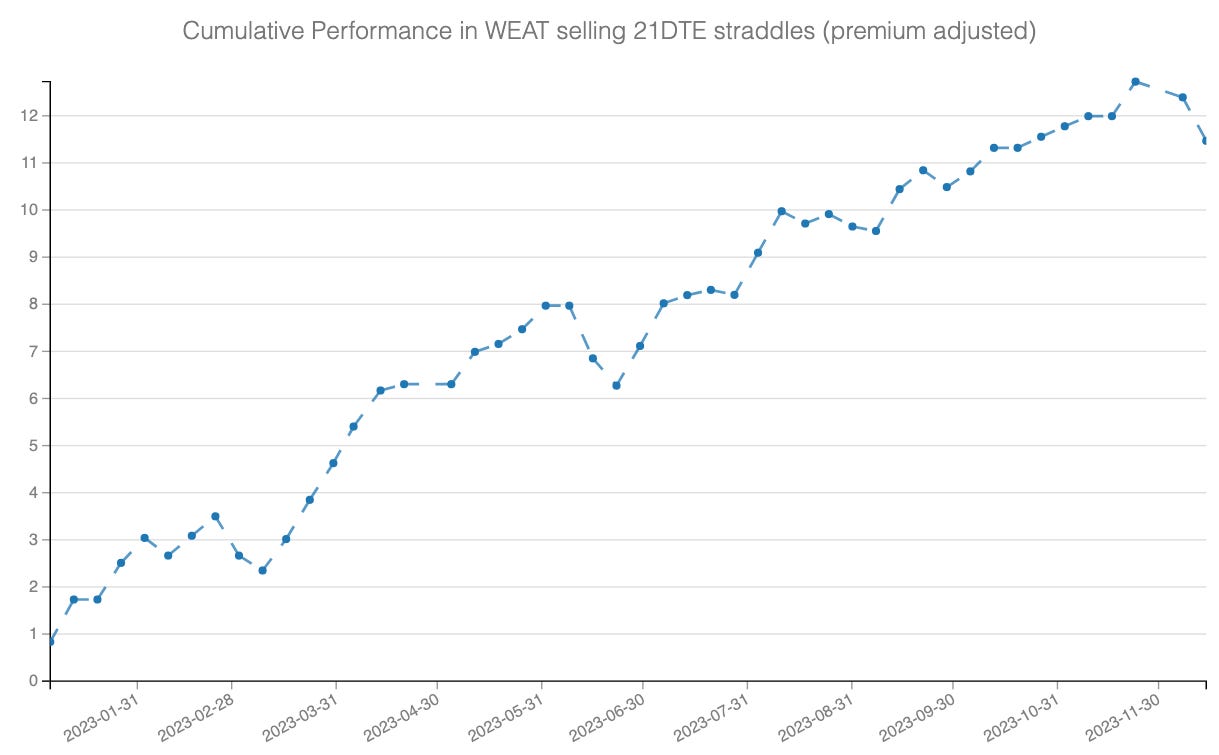

WEAT - 21DTE

Commodities always have a variance risk premium built in, considering the nature of the business. The weather can be difficult to predict a few months in advance, making it difficult to anticipate price fluctuations. Add to that the recent geopolitical risks with the war in Ukraine, and you have the premise for a great trade in the WEAT, the ETF tracking wheat prices.

These results are all premium adjusted, meaning that we assume $1 of premium collected on each trade, and we strongly recommend sizing accordingly. Selling volatility is risky: something can happen anytime, and it will be at your own risk.

Invest wisely.

If you’ve liked these recommendations, don’t miss out on our Christmas special and 50% off your subscription for all of 2024!

Happy Christmas and happy trading in 2024!

Data, charts, and analysis are powered by Thetadata and Dataiku DSS.

Disclaimer: The information provided is solely informational and should not be considered financial advice. Before selling straddles, be aware that you risk the total loss of your investment. Our services might not be appropriate for every investor. We strongly recommend consulting with an independent financial advisor if you're uncertain about an investment's suitability.