Forward Note - 20260201

Traders' scars and Silver Lining

In your career, there are moves you never forget. As far as we are concerned, the first one happened when we were not even “professionals”: the Flash Crash of May 2010. We were convinced New York was under attack and that something terrible was happening faster than the news could report.

A close second is the unpeg of the Swiss Franc against the Euro in a cold January 2015. This is arguably the fastest, cleanest bloodbath (or money maker, depending on which side you were on) we have ever witnessed.

And how could we forget the frenzy around GME? Three days of absolute madness where the moves themselves lost any meaning, yet the volatility was so destructive it was frightening.

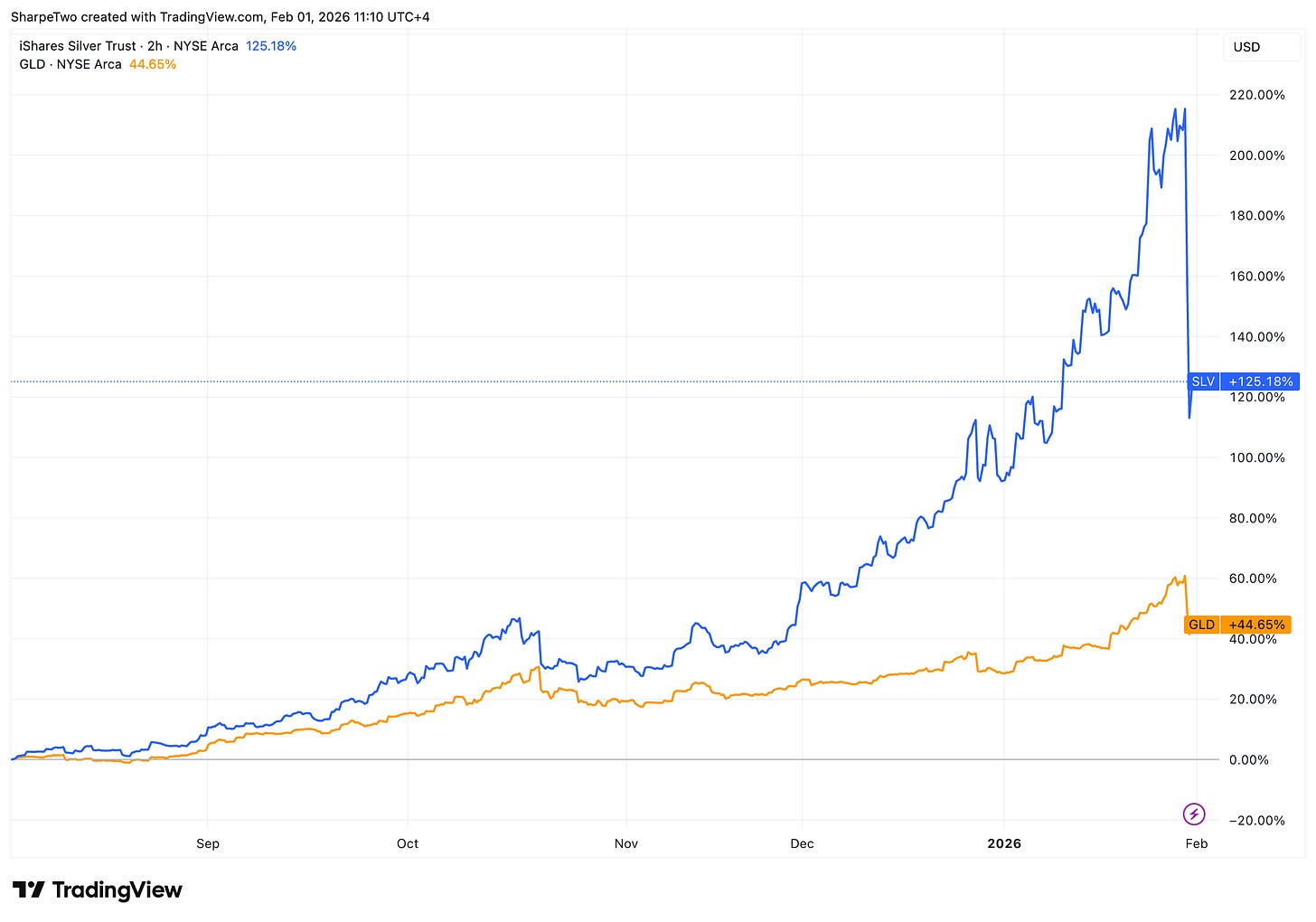

And now, Silver.

It’s not like there were no signs: the 10% reversal on Monday, in hindsight, should not have been ignored. The same goes for the 5% gap down once the nomination of Kevin Warsh was confirmed and the financial world woke up to a next Fed Chairman who is far more hawkish than anticipated. But down 33% at the worst of the crash? Nope, we definitely didn’t have that on our bingo card.

In fact, we were on the put-selling side as the precious metal kept its relentless walk forward: +60% at some point this week, just for the month of January. +10% now, and we are talking about one of the major commodities on the planet. Not a meme stock or a shitcoin.

What exactly happened? It is hard to tell, as usual with the market, but one thing is certain: when panic sets in, the current takes no prisoners.

We were amongst the casualties. We sold puts, betting that a hypothetical retracement would come with a meaningful drop in implied volatility. Instead of leaving some good profit on the table, it turned out to be an outright directional exposure. Silver dropped so hard and so fast that delta and gamma annihilated the little money you would have made on vega.

The recipe for a pretty annoying Friday evening? Perhaps, but not annoying for too long. It is never nice to lose money, but when you size small enough, by Monday things are forgotten and you are ready to go again.

That lesson, for some reason, has a hard time sticking with many market participants. You know things are really bad when you don’t even find the usual sarcastic banter on Reddit, where losses are sometimes more celebrated than wins.

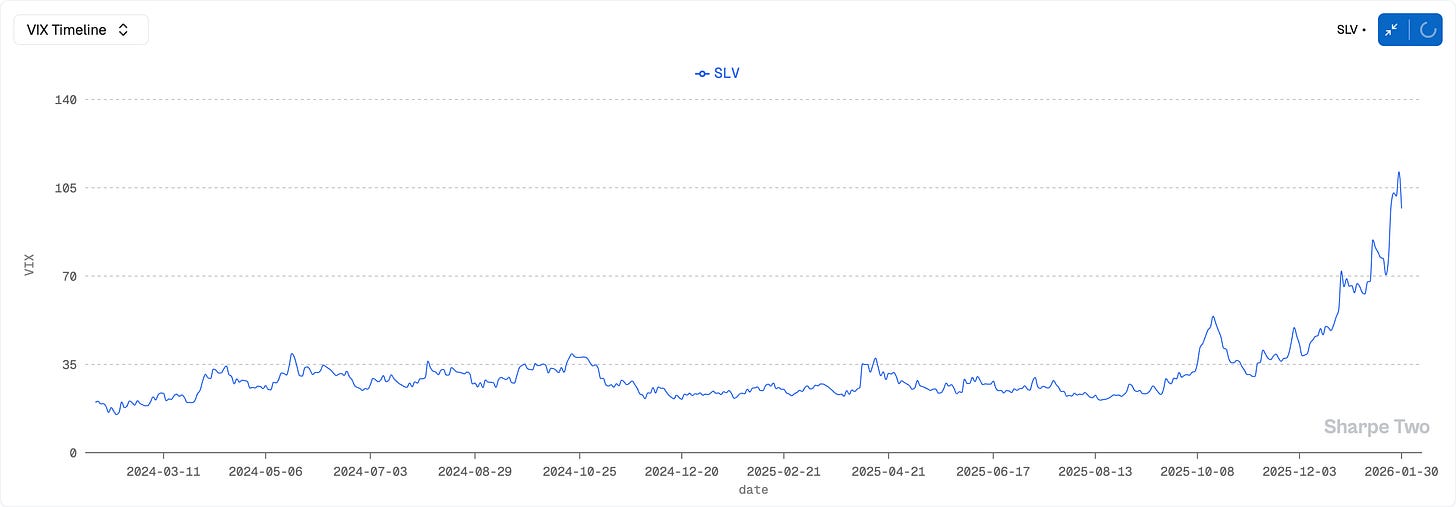

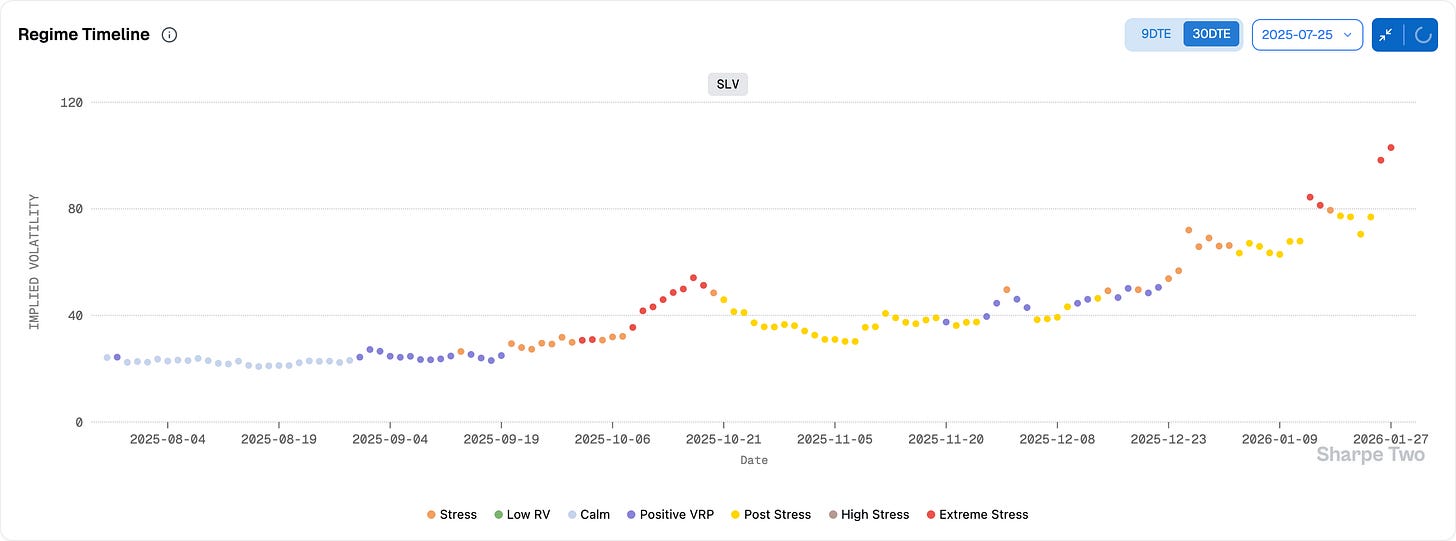

So here is the Silver Lining: in a few weeks or months, when realized volatility invariably collapses, traders will still be burned so hard by this move that you will be able to sell options (puts and calls) at a pretty hefty premium versus what is realized.

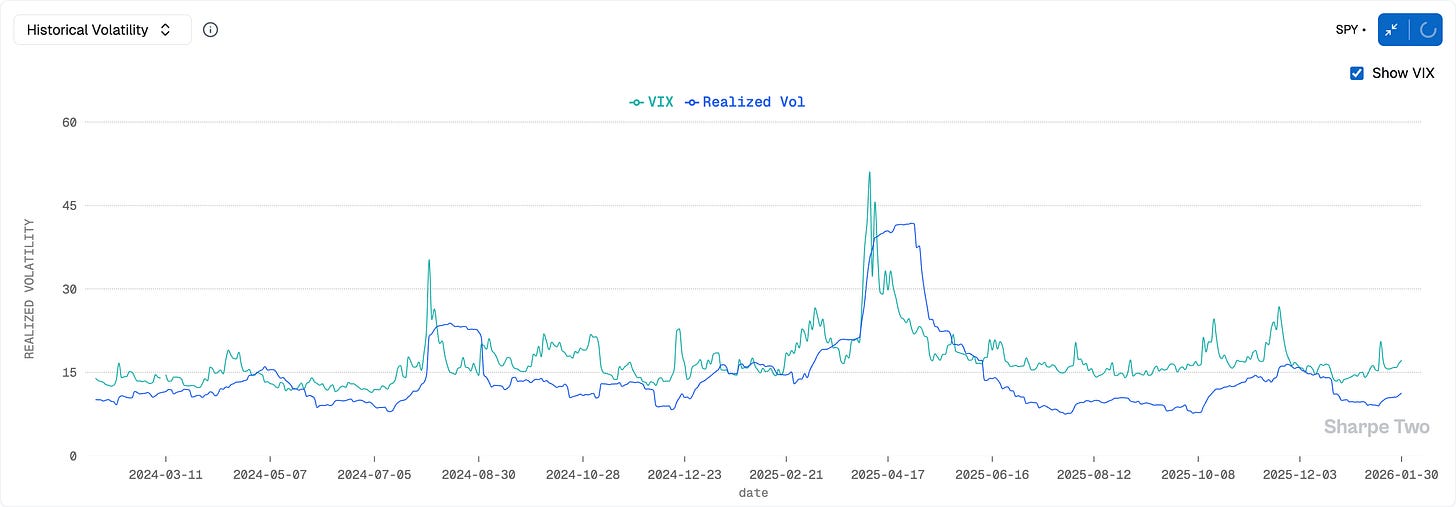

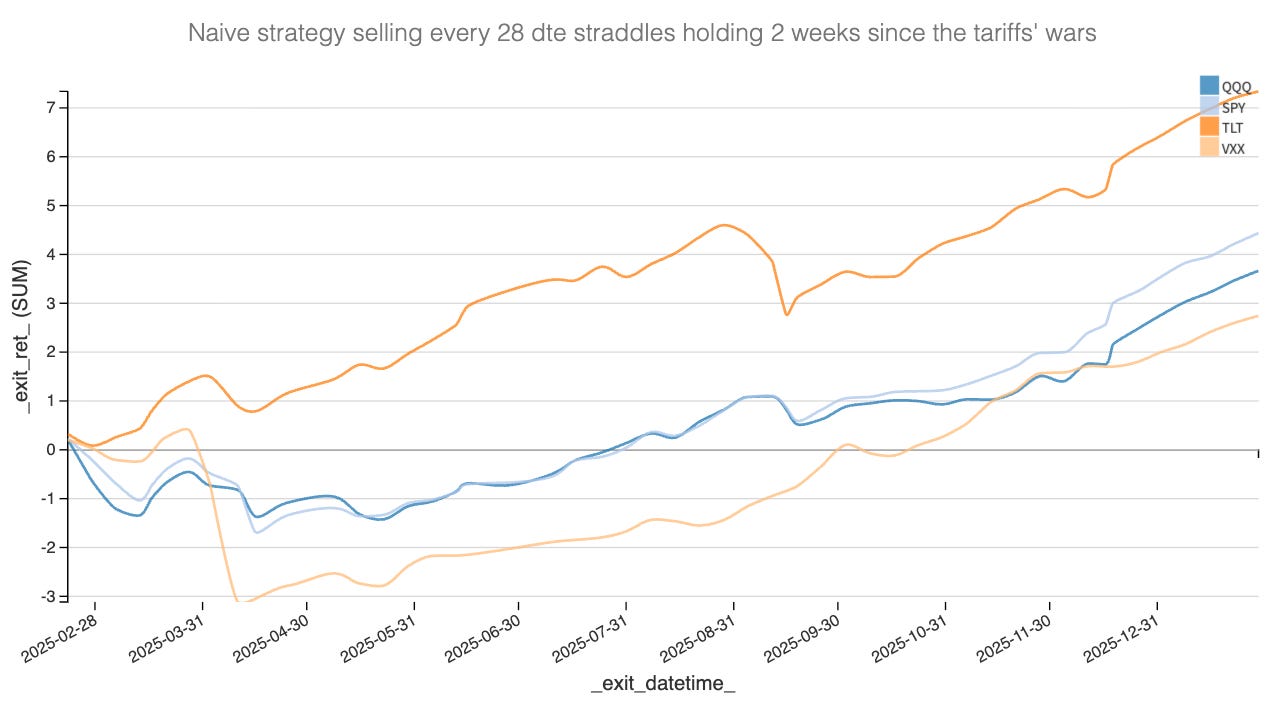

It is almost guaranteed. If you need more convincing, review the US equity market and its six months of glorious trading (some would argue we are still in that phase). During that time, a 6-point VRP (Volatility Risk Premium) was a hefty cushion for sure, but not too heavy a price to pay for those taking either side of the trade to protect against a potential remake of the tariff wars, or whatever is on the menu of the realpolitik agenda from the White House these days.

Therefore, do not revenge trade over the next few days. Whatever your loss, it is done. It is in the past; the money won’t come back now. An old mentor used to tell us: “Go about your day and keep fishing. The river, one day, will bring you the body of thoughts living rent-free in your mind right now.”

But in a few weeks and months, the market will return with interest and most likely widely in excess of that mildly annoying loss you may have experienced on Friday, provided you were disciplined on sizing.

In 2024, we had ASHR. In 2025, we had NUGT. Now, in early 2026, the entire commodities sector has decided to tell an unscripted story. While SLV was losing 30% (we gave up at -23% and couldn’t believe our eyes when an hour later SLV was trading below $70), UNG was tacking on another 10%, pushing BOIL up 20%.

We are often asked how we think about risk, and we often say that we do not have a great answer. People expect data-driven decisions, and many risk departments are built around just that: VaR, Monte Carlo simulations, modeling the jumpy nature of volatility and the non-heteroscedasticity of returns.

However, our trader mindset always remembers one of the cardinal rules of trading: “Your biggest loss is the one you haven’t seen yet.” With that, you have to perform the difficult mental exercise of thinking: what if this asset gains or loses 30% overnight?

When we say that, we can see incredulity in people’s eyes: “Oh Ksander, just say you do not have a good answer and you do not know how to do it.”

Well, you are right. I do not have a good answer for “how would I know what my worst-case scenario will be, when by definition, I have no way to know what the worst-case scenario will be.” And we just had a prime example: SLV down 30% was not enough in itself, you also needed this to happen when Nat Gas was up 10%, bringing BOIL another 20% up on the week.

Trying to stay away from equities after a rocky end to last year was the right decision, but being struck by lightning shouldn’t stop you from jumping back on the bike; just avoid taking it out when it is thundering outside.

Funny enough, these events tend to happen a lot under this administration: stocks in 2025, commodities in 2026. You know where our money is now? The next asset class will be bonds. Watch out for volatility there starting September this year. How do we know? Oh, we don’t. Just our scars having a hunch.

In other news

The Fed left interest rates unchanged and didn’t show any rush to decrease them. As for the many questions regarding the criminal investigation launched by the FBI against him, the Chair had “nothing for you.” Nor did he make any comment about his future working relationship with the next Chairman. If you ask us, he knew at that moment it was Kevin Warsh.

So who exactly is Kevin Warsh?

At 35 years old, he was the youngest appointment to the Board of Governors at the FOMC in 2006. He is a close ally of Stan Druckenmiller, whom he joined at the Duquesne family office after resigning from the Fed in 2011. These are some serious accolades accomplished before 40 years old.

The legendary investor spoke of him as someone going beyond the simple hawkish-versus-dovish view of the world. And his voting record at the Fed was indeed more often a dissent, based on the view that keeping rates down for too long was not a good idea to stimulate the economy, opposing the President at the time, Ben (Helicopter Money) Bernanke. Therefore, his nomination may have come as a surprise to those expecting Kevin Welsh, who was seen as much more accommodative and in line with the White House view of economics.

Now let’s be rational for two seconds: do we really think that Warsh will not cut rates? Absolutely no chance,, certainly not under the President’s watch with whom his association goes back to 2016, when the then President-elect to provide strategic and policy advice on economic issues.

We can’t wait to be proven otherwise.

Thank you for staying with us until the end. As usual, here are a couple of good reads from last week:

AI is obviously everywhere. But things are getting more interesting by the minute. If you haven’t heard of MoltBot, you should pay attention to it. We just spent a full week working with Claude Code; this is indeed revolutionary. But do not take our word for it: listen to this interview from the Pragmatic Engineer about the inventor of PSPDFKIT. He is someone who surely knows a thing or two about software engineering and is the author of one of the most popular apps ever on the smartphone marketplace.

Another great article from Arm about how being at the right place at the right time often pays off. You obviously need to be prepared and do your homework. But here is another cardinal rule of trading: “No one will ever give you a great price because you are cute. You will have to work for it.”

That is it for us this week. We wish you a wonderful (NFP) week ahead, and as usual, happy trading

Ksander