Forward Note - 2026/01/11

Are we already too late?

Let’s start the year by reenacting your best student days, when you would play with the limit and arrive a few minutes late. Especially if you went to a French school, where the under-seven-minutes rule meant you were technically not late and it was still accepted. How does that translate in calendar days? Three weeks into January, perhaps. Pushing it to January 25 might be a bit much.

Well, it definitely was for President Trump. You needed to be back on January 2, because by January 3 the geopolitical order had already been shaken rather abruptly. The US unilaterally removed Maduro from power, brought him back to the US, and announced it would “manage” the oil reserves indefinitely. It felt like a throwback to our best Age of Empires days, when looting an opponent’s natural resources was normal and accepted. We thought that under the UN’s watch, those things would not happen anymore. Turns out we were wrong.

And judging by prediction markets and the tone of the financial press, there may be another major shift by the end of the month. Is Iran next? Too early to tell. But pressure has definitely risen over the past week.

With all these latest developments, it almost feels like we are a bit late, do we not? Surely the VIX did not wait for us and must already be flirting with 30, right? Right…?

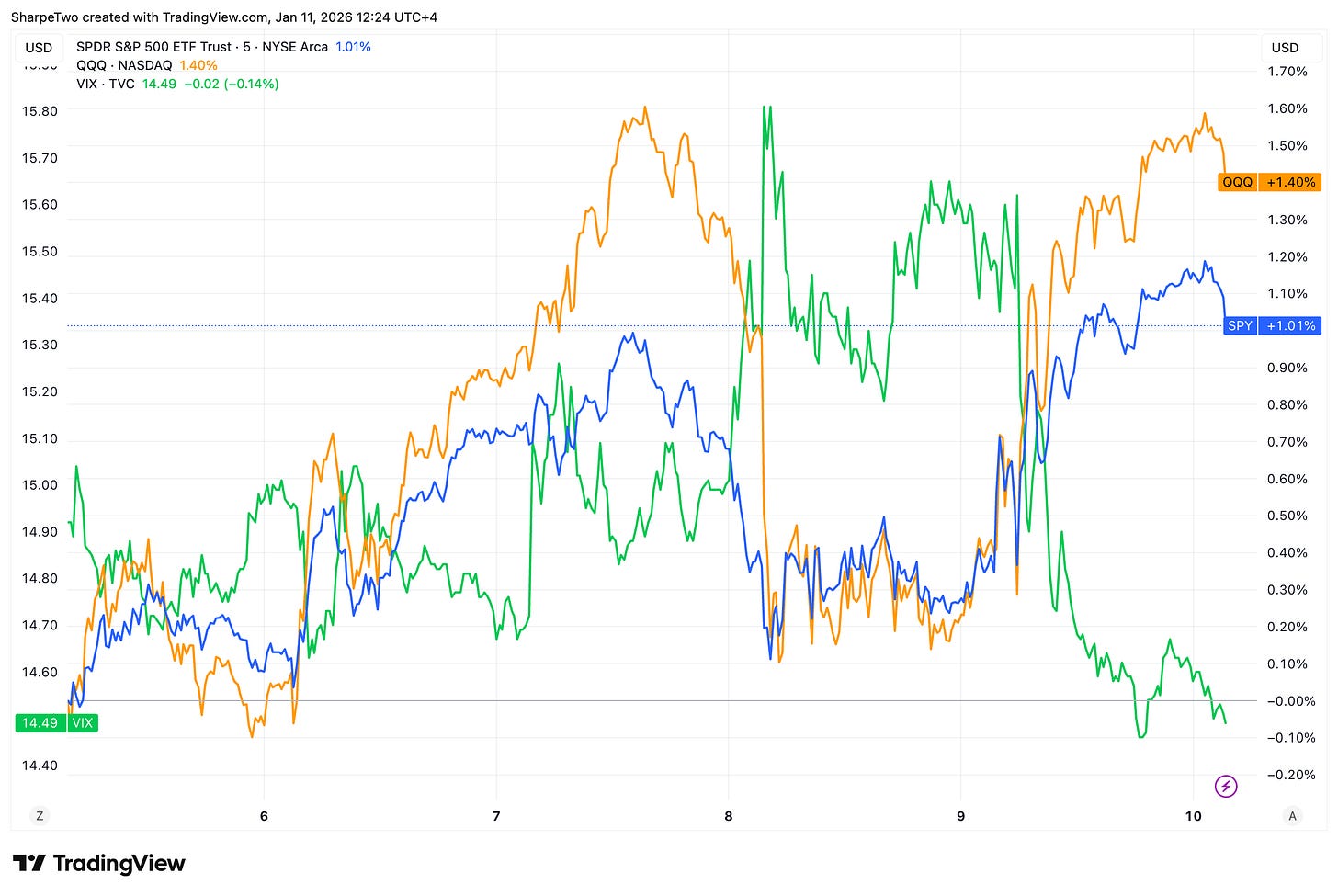

Well, not exactly. After the first full week of trading, the VIX is either late as well or still on holiday, sipping margaritas below 15. That alone tells you, so far, everything you need to know.

The equity market drifted higher, with the S&P 500 adding 1% and the Nasdaq almost 1.5%, helped in no small part by the energy sector, in anticipation of what could be a particularly fruitful year for names like OXY or CVX.

We have received a few messages expressing confusion about why the market did not react to so many events during the first week. Some even tried to argue that it was simply because most people were still on holiday. The answer is much simpler. Venezuela, in and of itself, is not enough to truly disrupt global trade. It would certainly be interesting to see whether the market reacts more forcefully to the situation in Iran, although if the job were as clean and surgical as what was done in Venezuela, that reaction would likely remain limited.

The implicit line in the sand may very well not be sand at all, but ice instead: Greenland. We have a hard time believing that an escalation of tensions there would go unnoticed by markets, as trade relationships between the EU and the US could be directly affected. But we are far from that scenario, at least for now. Six months away, which in Trump-time is an eternity.

In the meantime, while we want to keep a close eye on these developments that could turn into clear catalysts, we still have to stick to what the data says. And so far, the message is clear: we are not too concerned.

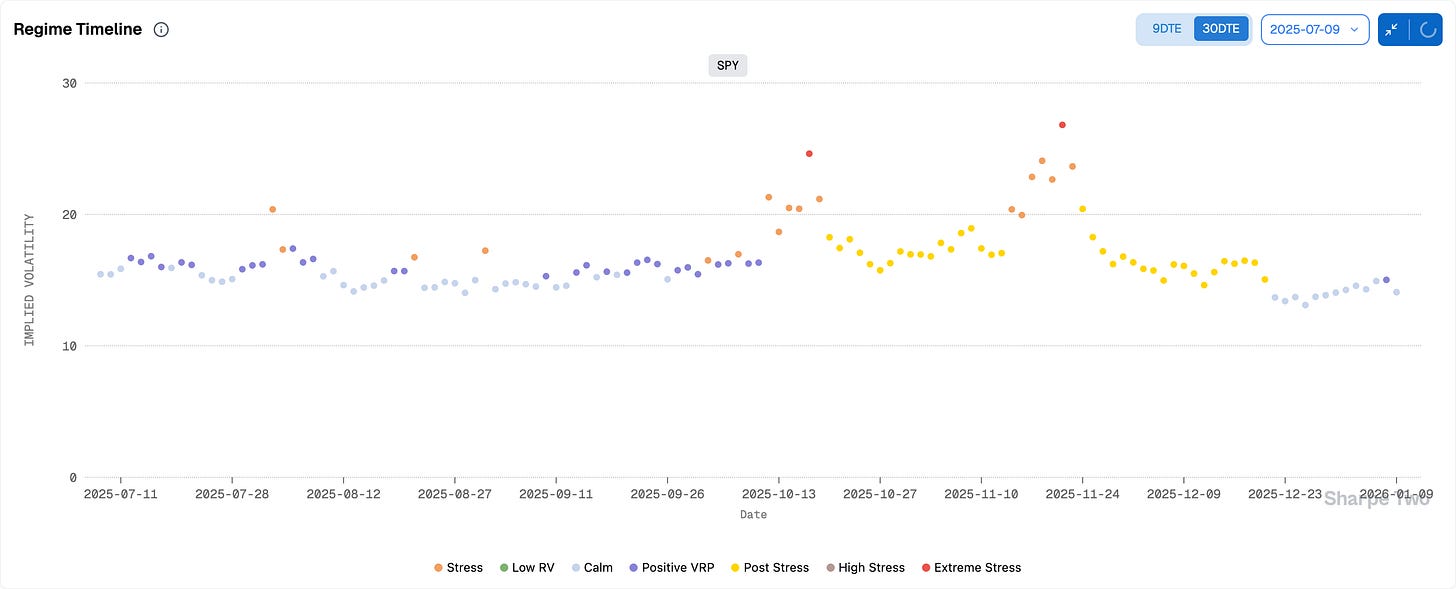

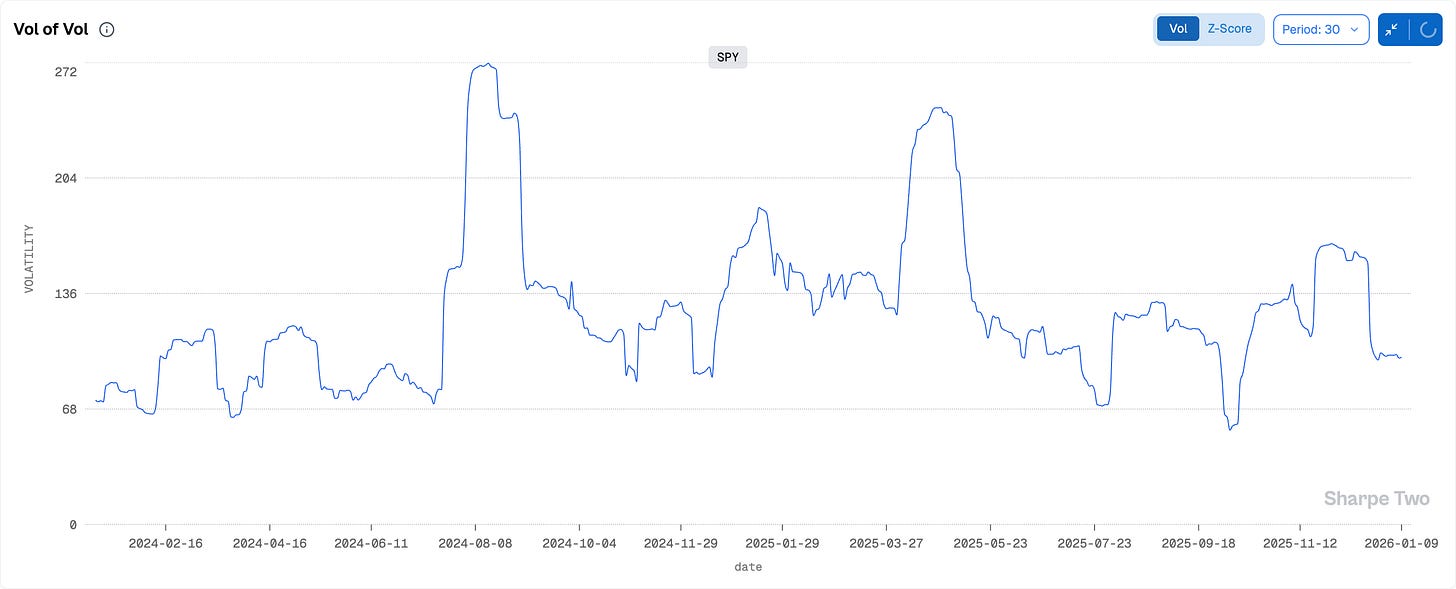

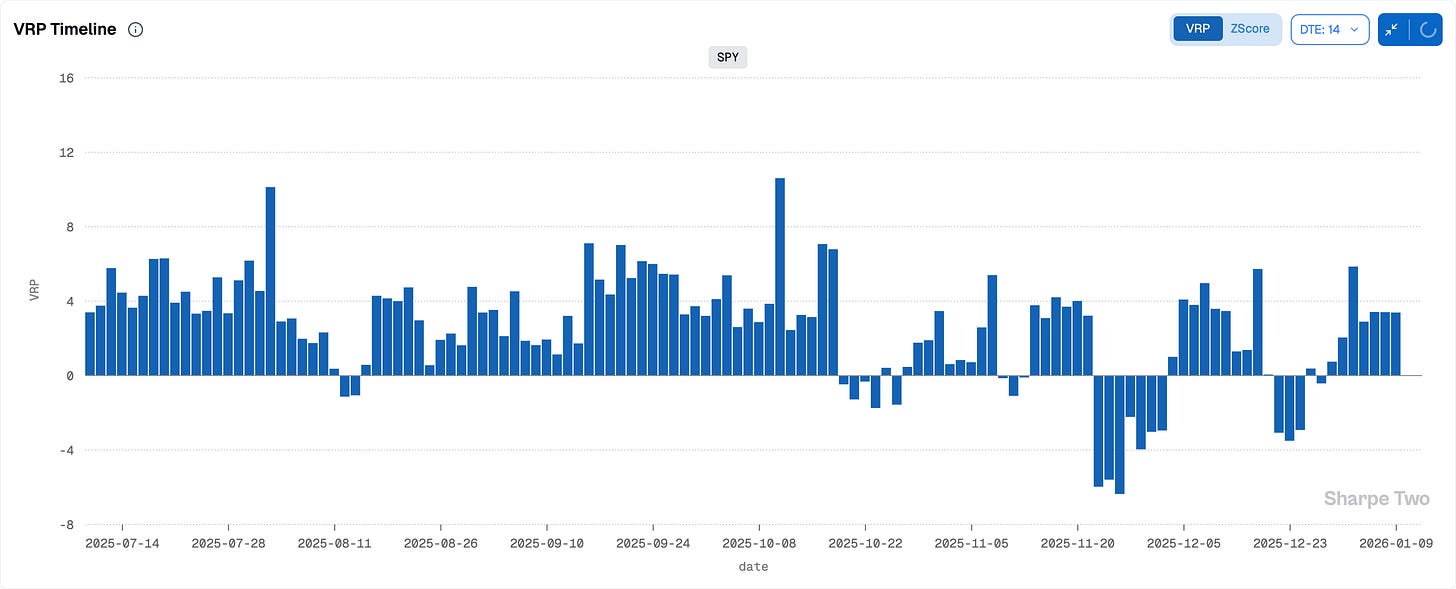

The regime has been back to normal since the start of the holiday period, and it is hard to argue otherwise. Realized volatility has come back down to flirt with 9%, which once again opens up 4 to 5 points of VRP in SPY. But more importantly, you may remember us moaning quite a bit about elevated vol of vol and the need to be, at the very least, cautious, as 4 to 5 point intraday moves in the VIX were very much on the table. That is no longer the case. Vol of vol is back to much more reasonable levels at the moment.

Now, this does not mean a VIX spike cannot happen. Once again, you only need a catalyst, and more often than not, those come from places we did not necessarily expect. With the start of earnings season, or even a simple CPI print on Tuesday, one has to keep an eye on what it could be, without becoming paranoid. It is tempting to fall prey to all the reasons why you should go long volatility. And to be fair, buying some three to six month hedges while they are cheap makes sense, precisely so that we can keep harvesting the expensive front part.

Expensive because if realized volatility stays tame around 9%, or even keeps drifting lower, a VIX at 15 becomes very expensive and will punish options buyers.

It is still a little early to tell whether we are heading into another extended VRP harvesting period like we had throughout Q2 and Q3 2025, and for now we remain in wait-and-see mode. In fact, our models are showing a slight lean toward a long volatility signal in SPY. What do we do with that? We are not implementing it. Everything still points to severe bleed in the front month with each passing day. But it is at least a signal to stay out for the moment. And as mentioned above, we are very much shopping in longer expiries right now to make sure the book remains properly hedged.

As usual, you do not have to trade when the conditions are not in place, even if the news flow is exciting and the market feels a little too dormant.

In other news

January is also the time when we start receiving annual performance figures from hedge funds. Needless to say, after a fairly volatile 2025, these results are closely watched. Many funds are still yet to report, but some numbers are already out and broadly in line with expectations. Citadel and Millennium both reported around 10%, consistent with what they have delivered over the past three years. That may sound modest, but when you consider the sheer size of these platforms, it is genuinely exceptional. Especially when you remember that Millennium has had only one truly bad year in more than 35 years: in 2008, it reportedly lost about 3.5%, while the S&P 500 was down 38%.

But let us also address the elephant in the room. Was this a year where managers actually beat the index? As a reminder, over a long enough period, only 5 to 10% of professional managers manage to do so. A report from Goldman Sachs shows that the average return for stock-picking hedge funds was around 16.2%, while the index returned 16.4%.

This should serve as a useful reset of expectations for 2026. Chasing gains and eye-catching performance often comes at the cost of significant volatility and a very real risk of ruin. Blowing up an account has become oddly normalized on social media, almost a badge of honor. It should not be. So here is a simple resolution: no catastrophic drawdown of 30%, and at the very least, do everything you can to get to a Sharpe of 1. You would already be ahead of many participants, retail and professional alike.

Thank you for staying with us until the end. As usual, here are two good reads.

It is still performance review season, and in case you are new to Sharpe Two, or may have missed it, this is the review of our trades since we exposed our machine learning models in the newsletter and on the platform. The results are promising, and we will continue to report everything diligently, until… perhaps more by the end of 2026.

We discovered the letters of Dan Wang about five years ago, as the world was trying to find its footing after the Covid-19 pandemic. Since then, it has become a January staple for us, a reliable way to reset one’s thinking on the geopolitical landscape. This year is no different. You should absolutely take the 45 to 60 minutes needed to get to the bottom of his ideas. To name just a few: the parallels between Silicon Valley and the Chinese Communist Party, or the argument that it is time for the US to accept that China is perfectly capable of producing technology, not merely stealing it.

That is it for us this week. We wish you a good week ahead, with CPI and the kickoff of earnings season. And as usual, happy trading.

Ksander