Forward Note - 2025/12/14

Would you eat everyday at McDonalds?

The year is almost over, with the last FOMC now behind us and only one real week of trading left. Stocks ended the week on a down foot, with the S&P 500 losing a little more than 0.5% while the Nasdaq 100 shed over 2%. The AI bubble narrative resurfaced with perfect timing, right as we enter the portfolio dressing window.

The VIX finished the week largely unchanged, glued to the 16 handle, although some interesting developments took place on Friday. It traded below 15, flirted with 18 intraday, and then gave back all its gains by the close.

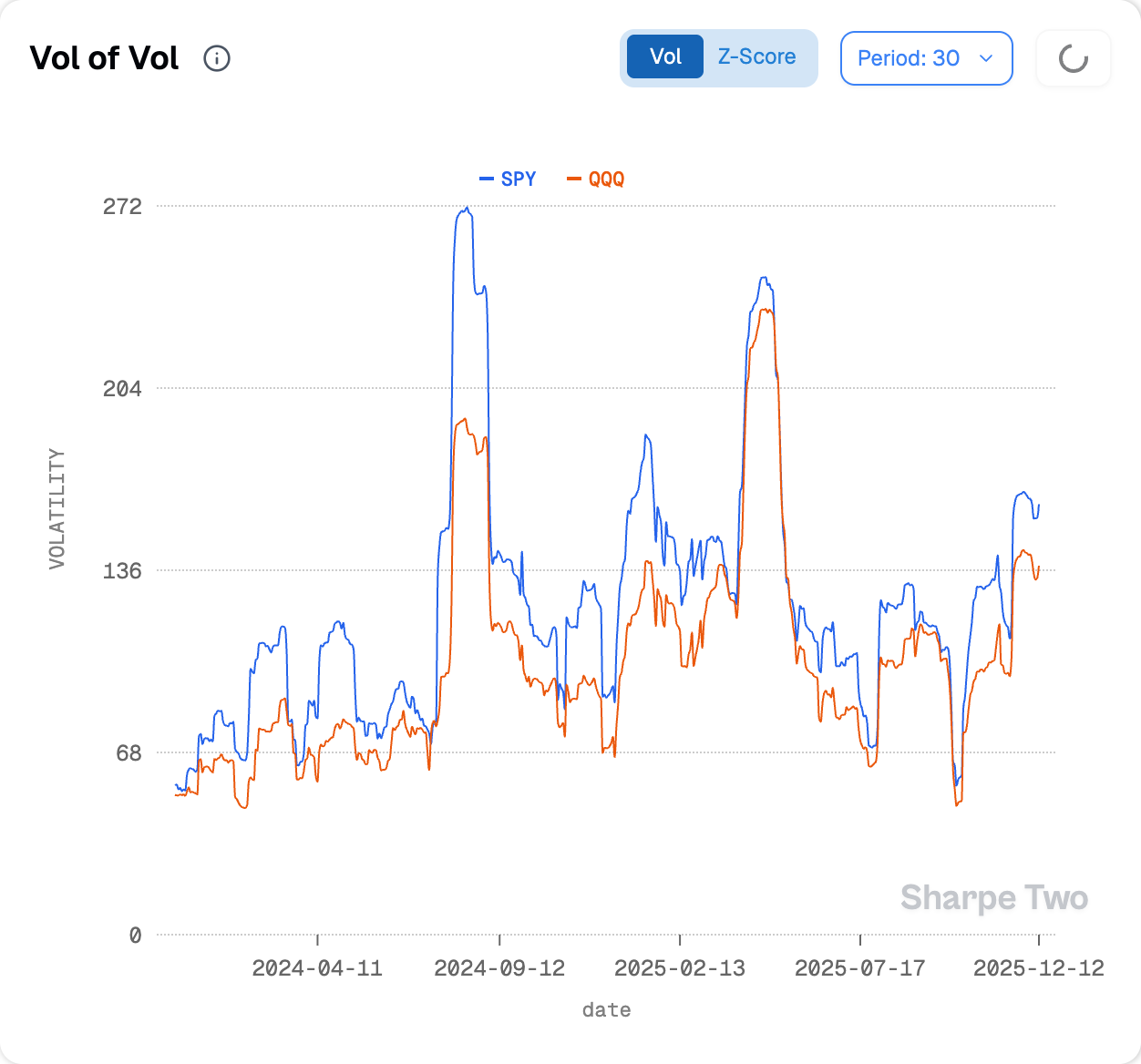

As we have written repeatedly over the past two months, the move observed on Friday should not come as a surprise. Vol-of-vol remains elevated, and 2 to 3 point intraday swings are still very much within expectations.

With only NFP left on the calendar next week, the list of catalysts looks rather slim for one last rodeo in a 2025 that will be remembered on many levels. The obvious ones are the tariff announcements from Trump in April, which sparked a selling wave for the ages, the war between Israel and Iran culminating in the bombing of a nuclear facility buried more than 60 meters underground, the ongoing arm wrestle between the US and China, and the mix of awe and fear surrounding the tech sector, AI in particular.

It is a little early to read about the performance of star hedge funds, but we are genuinely curious to see whether they will report returns outpacing the last two exceptional years. If that is not the case, it is easy to imagine how one could spin a narrative around the many events listed above to justify why the market did not cooperate, and why elevated volatility made it hard to beat the index this year.

But here is the paradox. If you were not overthinking things and simply stuck with the idea that stocks tend to go up, buying the occasional, and sometimes genuinely scary, dip would have been a fairly decent strategy. The market tends to reward those willing to rent their balance sheet when the entire marketplace is freaking out about the latest trendy issue supposedly set to vaporize the economy in a concert of memes and clever social media posts.

The problem lies in the age of information. Too much information ends up muddying your understanding of the market and, ultimately, killing your ability to make money. When Guy Spier referred to the Bloomberg terminal as crack cocaine in his Value Investor book, Twitter and Reddit could easily qualify as a cocktail of methamphetamine, ketamine, and LSD all at once.

Let us switch to something we know extremely well: volatility and the variance risk premium. A Twitter-famous fund manager sat in an interview with another fund manager, this one famous for his emoji game, and we were genuinely baffled to hear them state that there was no variance risk premium anymore, because of all the people selling volatility, from funds to retail.

We had to scratch our heads for a few days. Maybe our data were wrong? Maybe they were seeing something hidden in gamma flows or call walls that we were missing? But once there was no skin left to scratch and no stone left unturned, we had to settle on the obvious conclusion: this was total BS.

In 2025, once the tariff story imploded, you saw us take a step back on the term structure and focus on the 30 dte area, where the gamma risk was lower. After all, we trade our own money and wanted some protection from another salvo of Trump manip… sorry, folly. Yet the chart above says it all. You consistently had at least 3 points of VRP, and sometimes much more, concentrated in the very front week in SPY.

Translation: selling an ATM straddle in SPY and holding it to expiration was a particularly prolific trade, especially in the 6 to 8 dte bucket.

There is no delta hedging involved in the chart above, no normalization, just some simple, naive, or some would say dumb-money options selling.

Well, it worked. Just open Reddit and you will see the resurgence of retail money patting themselves of the back for having found the right strategy, the right dte, the right delta.

Nuance though: it will not work forever and in fact, seeing VRP dwindling quite a bit the past few weeks should be an invitation to caution and at the very least downsize the trade. So to the original point: yes trading variance is much more competitive than 10 years ago, stating that it has disappeared is a terrible misleading take.

Our biggest problem is not so much the amount of noise in the marketplace, but the lack of ownership from industry authorities. This ends up leading retail to their demise, either by talking about things that are far too complex, or by dismissing the simple stuff as uninteresting, because managing billions of dollars is not the same as managing a Roth IRA.

And therefore, when you command such a large audience, you have to do better than talking about cryptic flows no one can actually verify, unless you have access to proprietary data or can hear orders on an actual trading floor. You also have to do better than making statements like “VRP is dead”, which only distract people from the obvious trade ahead.

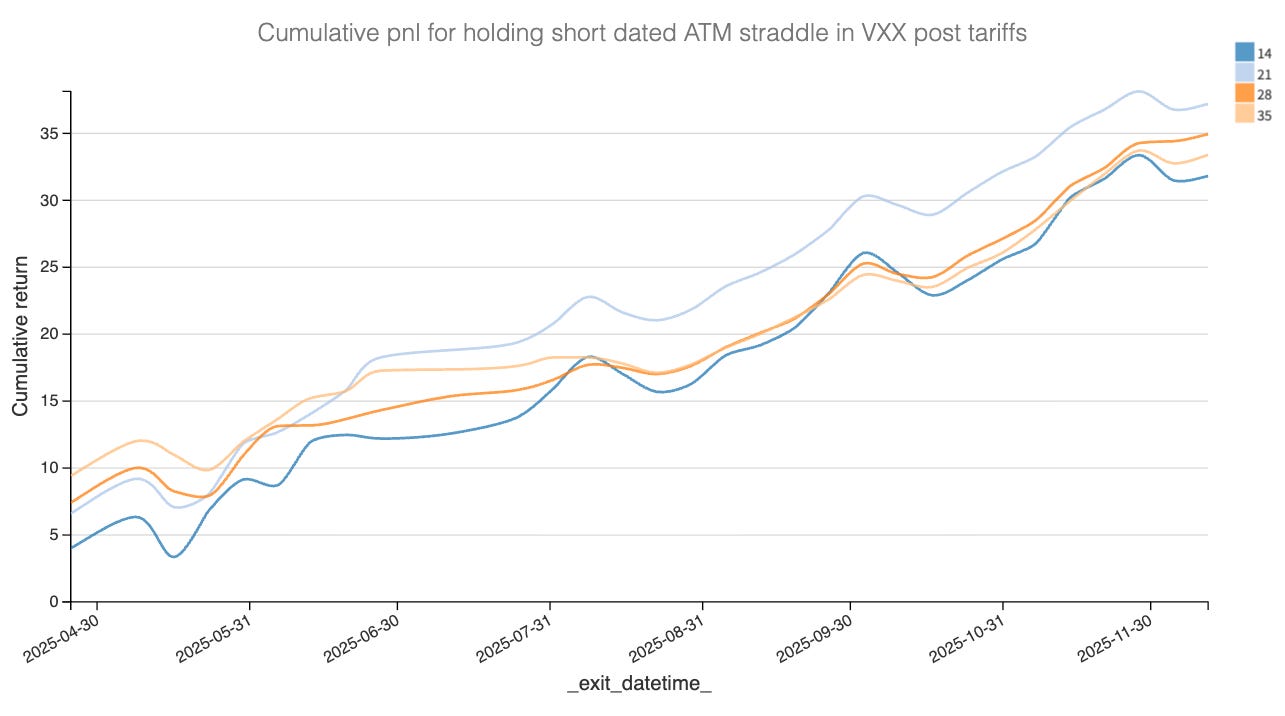

Here is another one, a personal favorite, obviously very risky and not something you should attempt without a deep understanding of how to manage it when things go wrong.

As we were reminded again this week, the same Twitter-famous hedge fund manager lost money personally while selling calls in VXX. That must be a terrible trade to do then, must it not? The reality is, of course, much more nuanced. Selling very expensive VXX calls to finance cheap SPY puts tends to be a good idea more often than not, for instance, and particularly profitable trade early this year.

And it does not have to be SPY puts. If NVDA or TSLA puts happened to be cheap, the idea remains valid. It is unlikely, although not impossible, to see a large move in VIX that is not followed by SPY, and more generally by the high beta, overweight constituents of the index.

That said, individual traders also bear some responsibility. More information does not mean more edge. If anything, we wish the marketplace would trade information for nuance. Things are rarely black or white, but if you insist on staying in that two-dimensional frame, you only need to remember one thing, and one thing only: stocks. go. up. Despite everything, in 2025 the S&P 500 is up 15%.

Refer again to the chart above and buy them, a little bit, every week, every month, whatever timeframe you choose. Whatever Burry has to say about it, or Constant(ly wrong), does not matter. The market is a formidable machine when it comes to equalizing opinions. And while the marketing behind these accounts is extremely effective at spinning narratives baked either in fear of missing out (yes CNBC we are looking at you), or in the need to be involved, the reality is much simpler.

On the grand scheme of things, these companies contribute to human progress and they make money (Yes, NVDA makes a s*** ton of money, which is precisely why it is expensive to own). The market notices this and wants a piece of it.

And therefore, in the same way we know the smiles on a Coca-Cola or McDonald’s hide another reality, and we do not dine there day in, day out because of the obvious health consequences, it is every retail trader’s responsibility to binge responsibly on social media. Otherwise, you may indeed be missing out, and for good

.

In other news

There was an FOMC this week, believe it or not. The Fed cut rates by a quarter of a percent and decided to resume balance sheet expansion at a pace of roughly $40 billion per month. That is not nothing, and it is already a sign that Jay Powell is being forced into some fairly hefty concessions as his reign as Chairman comes to an end. With four meetings left, we expect them to be largely anecdotal, especially if President Trump ends up announcing his candidate as early as January.

That would create a rather awkward situation where Powell may say one thing, and the next Chair something else. Who do you think the market will listen to? It was a sad and particularly boring press conference. Pretty much every journalist in the room knew, deep down, that the man who dedicated, fairly successfully, the past eight years of his life to keeping the economy afloat had become, for all intents and purposes, irrelevant.

So who is next? While Trump has already opened the door to the White House’s special economic advisor, Kevin Warsh, that candidate has also received a rather strong endorsement: the king himself, Jamie Dimon. Dimon, whose own succession process is underway and taking far longer than expected, has effectively given his green light.

That is quite a turnaround from JPM lately. From backing a candidate close to the White House, with inflation only a few steps away, to accepting bitcoin as collateral. Yet another reminder that in markets, certitude can be very costly. It is usually best to never say… never.

Thank you for staying with us until the end. As usual, here are a couple of interesting reads from last week.

When we switched from trading to data science more than ten years ago, we were surprised by how highly regarded Netflix was from an analytics perspective. You may remember being an avid reader of their technical blog. While they were not the pioneers of recommender systems, they were certainly among the first to deploy one at scale to drive their business. This is an excellent piece showing that AI, once again, often sits in places that may not be obvious to you, Mr Consumer.

And because we are fully aware that many of you have developed a certain addiction to the AI bubble narrative in 2025, here is a solid piece from a reliable dealer of information, the FT. We like the FT. They tend to be dry, sarcastic, and measured. This article is on point and makes a genuine attempt at finding nuance beneath the noise.

That is it for us. We wish you a wonderful week ahead, and as usual, happy trading.

A quick note to remind you that we will be taking our annual break at the end of next week and will be back on January 8th.

Ksander