Forward Note 2025/05/11

Truce, talks, and theatrics.

Hard to believe it has only been thirty days since markets were gasping at the prospect of an all-out trade war between the US and, well, everyone else. Back then, each day brought its own round of escalation. Fast forward a month, and as we approach the halfway mark of the tariff truce graciously granted by President Trump, markets have just logged a second straight week of relief — pricing in the hope that negotiations will stay smooth and lead to fresh deals.

They have reason to stay optimistic. This week brought news that the UK has become the first to strike a bilateral agreement with the US — removing cars and steel from the list of goods facing a 25% import levy. In return, the US secured preferential access to the UK market to ramp up meat exports.

And to top it all off, Chinese and American negotiators arrived in Geneva this week to officially bury the hatchet. Or at least to wave a white flag while sharpening the next round. True to form, Trump set the mood by suggesting that an 80% tariff on China “felt about right” — a modest proposal we are sure the Chinese will receive with open arms.

You call that a deal? We call it a farce. A pretty good one, too. Though admittedly, it’s always easier to laugh when VIX is sitting at 21 rather than 55.

If we sound a touch cynical, rest assured — we are not rattled. It would hardly be the first time markets have done something that flies in the face of common sense, and it won’t be the last. Just last week we were urging caution, suggesting it was time to take off some of those short volatility trades. Mean reversion had overstayed its welcome. This week, we are simply reiterating the call.

Let’s start with realized vol. Despite a tight-lipped Powell on Wednesday, who acknowledged the uncertainty stirred by his own government’s policies, we still realized 18% last week. Is that high? Keep in mind we were flirting with 50 just three weeks ago.

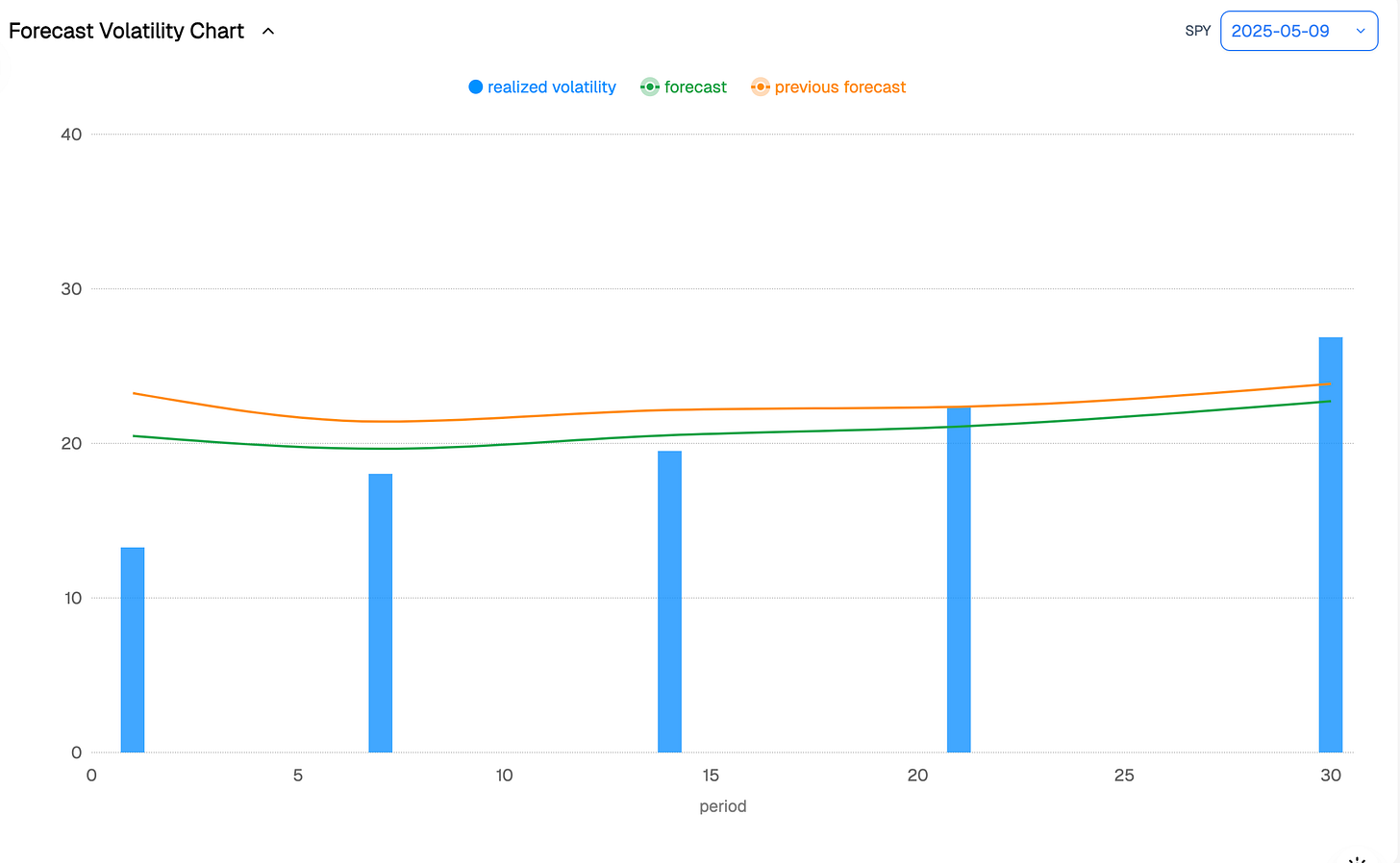

We now project realized volatility to hover around 25 over the next 30 days. And while forecasts exist mostly to be proven wrong, the encouraging bit is this: the stage is being set for the grand return of the variance risk premium.

As shown below, the VRP term structure remains deeply skewed beyond the one-month mark — realized vol is still haunted by April’s fireworks, while implied has drifted toward a more hopeful, wait-and-see equilibrium that’s taken hold over the last two weeks.

But zoom in on the front of the curve, and you start to see something more interesting — slivers of edge beginning to form. So the real question becomes: is it time to step back in?

It is a fair question. We saw VIX flirt with 25 earlier in the week, especially in the run-up to the Fed’s decision. While it never quite crossed into no-brainer territory, fading vol — via put selling or risk reversals — did look like the right approach in the moment.

Still, we stand by last week’s message: hold your horses. The market is bracing for more headline roulette, and while theta may look attractive, it might not be enough to compensate for the next policy surprise. The data supports that view.

Last week, SPY had drifted back into almost perfectly neutral territory — both VIX and skew z-scores were hovering around zero. That is no longer the case. While implied volatility is not exactly screaming “cheap” here (z-score: -0.34), the skew tells a different story: puts are clearly in lower demand than calls.

Given the relentless bid over the past two weeks, that checks out. But, as always with skew, things tend to mean-revert. So while selling puts on the next dip might feel like the obvious move, caution here — just be sure you are not walking into the kind of headline that could send the market spinning for longer than a coffee break.

To be clear, this is not a call to go fully long volatility. But picking up a few puts? Not the worst idea. Just in case. Because despite all the cheer, no one really knows how these negotiations will evolve. And while the term structure remains flat-ish, it is in more of a contango than we have seen in weeks — a subtle shift, but one worth noting.

Some might look at this and see further signs of normalization — a reason to resume business as usual. We see something else: a regime that has stayed flat, but is starting to show a few more bends than usual. In that context, trimming risk and keeping the book lightly hedged may not be the worst move.

That said, there is still nothing in the data screaming for a full-on long vol play. So perhaps the most prudent course, once again, is simply… to wait. Or better yet, look for corners of the market where the signals are a bit more decisive.

As it happens, we are in luck — NVDA earnings are fast approaching. Let’s take a look at how its implied volatility is shaping up over the next 9 days.

We had to double-check the dataset to make sure this was not a glitch in the pipeline. It wasn’t. The 9-day implied VIX-equivalent for NVDA is now sitting at its lowest level of the year. Sure, this week brought whispers of a new chip potentially unlocking more access to China, and maybe they will deliver yet another quarter to remember — especially with MSFT and Google having set the tone.

Still, if you are scanning for something that looks suspiciously underpriced… this is a good place to start.

In other news

Not a week goes by without another reminder of how fast the world is shifting under the weight of artificial intelligence. Still need convincing that the hype might be justified? This week we learned that insurers are now launching policies designed to protect companies from the errors — and hallucinations — of chatbots and AI agents.

It might sound amusing at first, but it reveals two important truths: companies are willing to break eggs to make the AI omelette, and insurers would not be offering this kind of (fairly opaque) coverage unless the demand was real.

Naturally, it made us wonder — would we take the other side of that trade? And at what price? Technically, this is a seller’s market: companies need to press forward to stay competitive, so they will insure at any cost. That should allow underwriters to command hefty premiums.

Yet, that is not an easy one to answer. For now, no major scandals have emerged (and hopefully none will), but let’s be honest — it is likely just a matter of time before the first real blow-up. And second, there is no market price yet for this kind of exposure - think fine, lawsuit or financial numbers to anchor premium pricing.

So whether or not you would take that risk, it may be worth watching the insurers to get a sense of how the AI hype is developing. Track the ones writing these policies and see how much of their business is growing in this space. It is a different lens — and probably a healthier one — than refreshing NVDA’s earnings deck every few hours.

Thank you for staying with us until the end, and as usual, here are two good reads from last week:

A fascinating mix of geopolitics and geography, this piece reframes Canada’s vulnerabilities with the blunt realism usually reserved for military briefings. It reads like a wake-up call to a country long reliant on politeness and proximity. You may not agree with all the conclusions, but you’ll walk away with a sharper lens on North American power dynamics.

A sharp, unsettling read on how persuasion, hallucination, and opacity are converging in modern AI. This piece does a great job connecting the technical failures of alignment with the broader stakes — from national security to mental health. If you care about how truth survives in an algorithmic world, this one lands hard.

That is it for us, we wish you a (cool) inflation week and as always, happy trading.

Ksander

Contact at info@sharpetwo.com.

Disclaimer: The information provided is solely informational and should not be considered financial advice. Before selling straddles, be aware that you risk the total loss of your investment. Our services might not be appropriate for every investor. We strongly recommend consulting with an independent financial advisor if you're uncertain about an investment's suitability.