Forward Note - 2025/05/04

Don't look up.

A third of the year is gone (sorry for the blunt reminder), but April alone could have counted as a full one. Funny how time compresses and expands: we remember the slow, soul-crushing sessions from last year — when nothing happened and every minute dragged as you stared at intraday screens.

Fast forward to now: we just lived through a -15% week followed by a +15% rebound across the following two. Intraday, every minute felt like a day. The whole month? Easily the story of a year in trading. And yet, we’ve ended up right where we started. The VIX closed back at 22, the S&P and Nasdaq tacked on another 3% this week, and with YTD performance now at just -3%, equities are… back in a bull market?

The relief is real. On social media and in the financial press, everyone suddenly agrees: a deal with China is just around the corner, the impact on trade will be minimal, and in a few months this will all feel like a distant bad dream.

We’re not in the business of predicting geopolitics or macro — we’ll leave that to those better equipped (or at least more confident).

But on the data front, we have a few doubts.

Important disclaimer before we go further: this isn’t a call for renewed bearishness or a return to the kind of extreme nervosity we saw a few weeks back. Far from it. But if we had to sum up the year so far in one word, it might be… denial? Or coping, if we want to borrow from the generation below us.

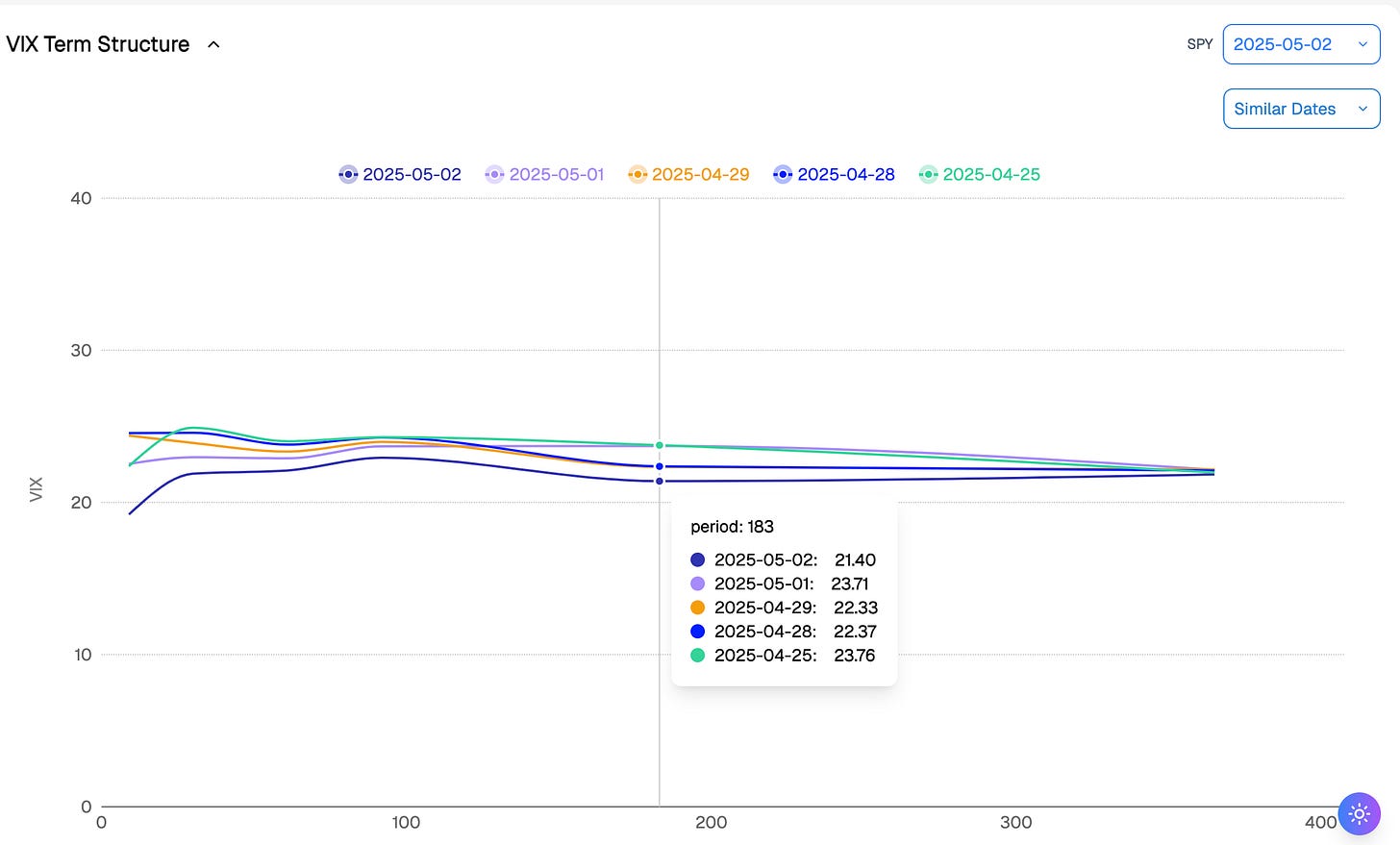

Let’s take a look at the SPY term structure.

This week, the curve has been dead flat — and the market kept nudging it lower as sentiment leaned further into optimism. While some might squint hard enough to spot the early signs of contango, we see the same movie we’ve been watching for months, ever since pre-election: a regime where the term structure stays flat. And it will likely remain that way as long as glaring uncertainties continue to hang over this market.

Could that change next week with the FOMC? Sure: in a perfect scenario, Powell cuts rates, market add another 5% and the week after the US and China sign a deal. But that is fiction. Nobody knows whether the U.S. and China will actually settle on a lasting truce — we just hope. And nobody really knows what the long-term economic consequences of the Rose Garden experiment will be: we just hope it won’t be as bad as what the GDP data show this week, and the job market will remain strong.

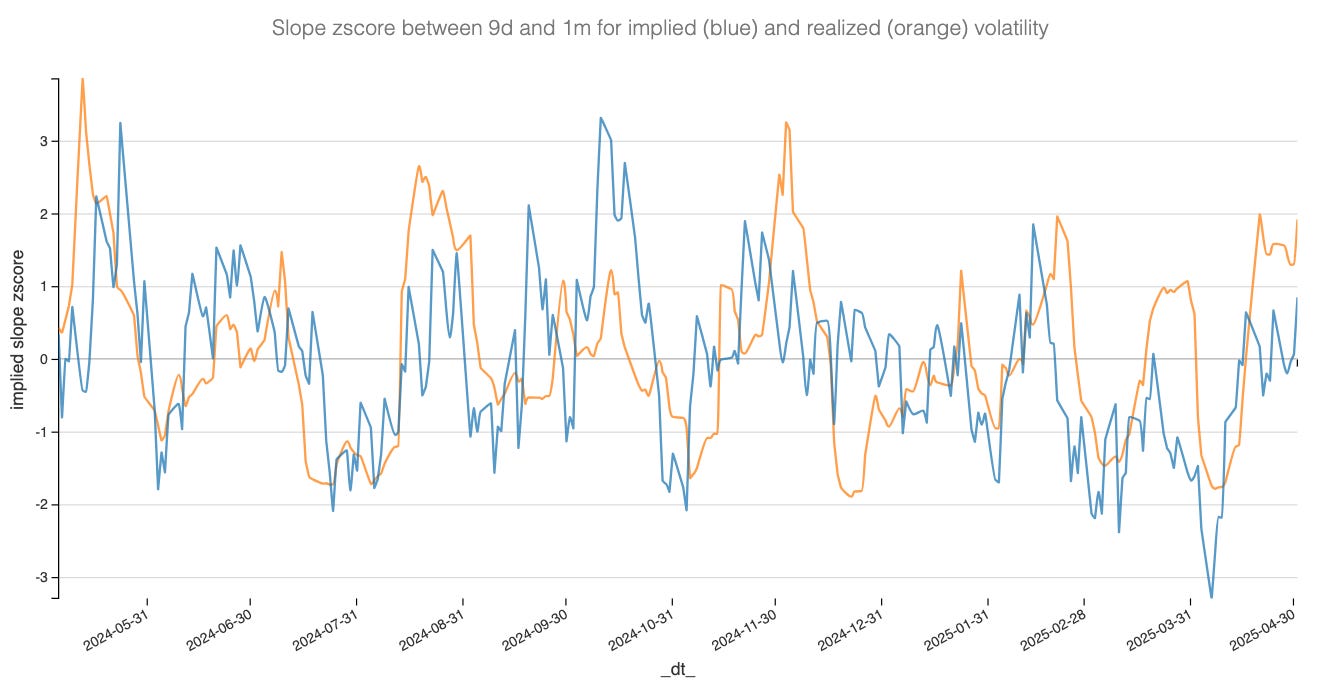

Still, there’s something worth watching: the front-end slope has started to show a touch more steepness. With realized volatility already drifting into >2 z-score territory while implied sits just under 1, this feels less like a calm, measured repricing — and more like an overexcited reaction trying to front-run peace.

Ready for another tell? Let’s take a look at the volatility of implied volatility.

After flashing deep red — like nearly every indicator over the past two weeks — vol-of-vol has now returned to more neutral levels, dragging VVIX down to a stunning close at 97. Remember how, earlier this year, the market refused to touch SPX puts but clung to VIX calls like their lives depended on it? That ratio has now flipped entirely.

As a reminder: predicting when things will go awry is far harder than spotting the mean reversion. At the start of the year, we leaned heavily on this signal to justify buying SPX puts and financing them by selling VIX calls. We would not recommend doing the inverse here.

That said, keeping these charts in perspective is useful. The bulk of the mean reversion has already played out — and expecting much more at this stage would require a healthy dose of caution.

That is the nuance of our message. Once again, we are not calling for an outright long vol trade — as we did a couple of times earlier this year. However, if you are running a sizable short vol book, this is a good moment to pause and remember: collecting theta is not a strategy. By many metrics, volatility has overextended its mean reversion. Pushing for more — trying to squeeze a few extra dollars out of the tape — is how you get slapped on the next wave of fear.

The spot/vol correlation in SPY is now among the strongest it has been in recent memory. Which means even a mild move lower in the index should have an immediate impact on implied volatility. Rule of thumb: a 1% decline in SPY typically translates into a 7–8% increase in the VIX.

Therefore, the real question is: if, for any reason, the market were to drop 3% this week on the back of Powell’s FOMC comments, can your portfolio comfortably absorb a 4 to 6 point spike in the VIX — that is, a 25% move off the 22 handle?

The inverse holds as well: why be so aggressively short at VIX 22, when a perfectly plausible 25–27 could be around the corner for any number of reasons?

And if that does not happen? Well, then the joke is on us — and the theta rider lives to ride another day. Until…

In other news

After Google’s stunning earnings last week — particularly its reaffirmed strength in search despite the generational threat posed by AI-driven interfaces like ChatGPT and Claude — it was Microsoft’s turn to sweep investors off their feet. And swept they were: MSFT rallied 9% on the back of strong cloud growth, reinforcing the idea that AI hype is, in fact, translating into real enterprise demand.

We may not see it yet, but something is clearly brewing beneath the surface. It would not surprise us to see the first wave of specialist models emerge this year — in contrast to the generalists like GPT, Claude, or Mistral. Think AI agents tailored to customer support or recommendation — goodbye endless Netflix scroll, hello smart assistant with actual opinions.

Frankly, we are a little surprised we have not yet seen it in the options trading space. A Sharpe Two trading assistant, for instance — imagine that…

Thank you for staying with us until the end. As usual, here are a couple of interesting reads from last week:

Chair Powell is back in the spotlight with the FOMC announcement due this Wednesday. A timely read from Claudia Sahm reflects on the importance of an independent Fed — worth your attention before the press conference fireworks.

Prompt engineering — the phrase alone might trigger an eye-roll from anyone dabbling in AI. If your data is bad, no prompt will save you. But once you do have good data, prompt design becomes a real edge. Here is a thoughtful long-form piece from The Rogue Quant that dives into the nuance.

That is it from us. We wish you a studious FOMC week — and as always, happy trading.

Ksander

Contact at info@sharpetwo.com.

Disclaimer: The information provided is solely informational and should not be considered financial advice. Before selling straddles, be aware that you risk the total loss of your investment. Our services might not be appropriate for every investor. We strongly recommend consulting with an independent financial advisor if you're uncertain about an investment's suitability.