Forward Note: 2024/04/28

No rate cut already priced in?

A 5% discount was too good of a deal to pass up. After three consecutive weeks of losses, the equity markets staged a rather convincing rebound. With the geopolitical tensions toning down, the S&P 500 gained 2.61%, while the Nasdaq added 3.9.

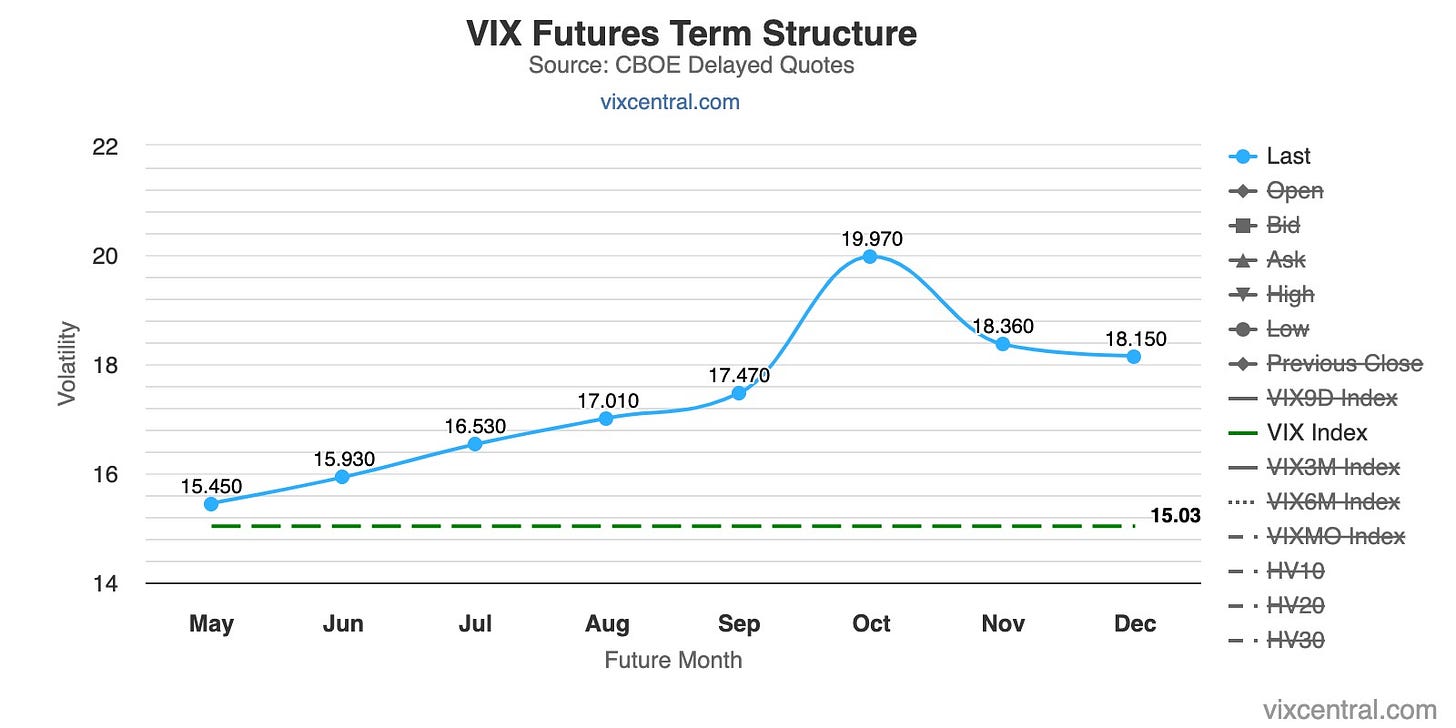

The VIX closed right on the 15 handle.

Last week, we recommended staying neutral and were open to any scenario. With realized volatility picking up and the downward movement accelerating, it would not have been surprising to see stocks yield another 4 or 5 percent. But the bears had the burden of proof.

With the VIX index above the futures, realized volatility had to keep rising to justify the current level.

Well, it didn't, despite many valid reasons, and surely, this week will leave commentators scratching their heads.

Things started with a rather worrying quarter for Tesla. The electric vehicle manufacturer posted revenue below expectations. Yet, in a conference call, it only took another perfect communication from Musk, explaining that "if you think Tesla is just an electric car company, you were wrong" for the stock to surge... 10%. It had been beaten down so much, leading to earnings, that it wasn't surprising to see people jumping on the bandwagon. But up 10%, really?

We were among those scratching our heads, especially when the very next day, Zuck and Meta took a serious beating while posting what had been a stunning quarter.

So why the 15% sell-off post-earnings? Because Zuckerberg announced that Meta would return to its path of investing in AI technology. The market is still "traumatized" by the spending spree in R&D to give life to the metaverse, and many investors want out after a stratospheric 18 months. Fair enough. But down 15%? Really?

At this stage, we knew we needed a miracle from Google and Microsoft to prevent the Mag 7 from dragging the index down further. Again, we received some contradictory signals. Google and Microsoft didn't disappoint. Google once more demonstrated that those burying it in the AI race might have been too quick to do so. Microsoft, carried by its cloud division, did what it does best again and stayed at the top of the class. No, the worry didn't come from here.

It came from the lowest GDP reading in almost two years at 1.6% for Q1. This is the first clear sign of the economy cooling off since the unprecedented rate hike cycle started by the Fed in 2022. And to make matters worse, inflation data on Thursday and Friday were hotter than expected.

"Meh" was the answer from market participants. And the equities went on a 48-hour strong bid cycle, the strongest rally in April.

What conclusion can we draw from that? We shrugged off Iran-Israel tensions like they were nothing. We shrugged off the economy cooling off despite inflation being sticky now. With the VIX at 15, despite the eventful month of April, the market says, "You'll need something much more serious than that to get us from all-time highs." We won't comment on whether or not this is sensible; you have enough macro commentators for that. However, next week will see the May FOMC meeting, and this should serve as a strong reminder that Powell will have to say something truly disappointing to see volatility pick up and stocks start a prolonged downward movement.

Yes, by now, it is most likely priced in that there won’t be a rate cut in June, and expecting a 10% drawdown on this news alone is farfetched. For comparison, when he unexpectedly closed the door in January to a March cut, the market went down 2% and took them back within 48 hours, as the VIX went back to close below 14.

History isn’t bound to repeat itself, but we should keep that in mind when reading macro commentary. The same goes with technical analysis: they will tell you, "Yeah, but we are below this and that, with this indicator crossing over that one, while the support line does this blah blah." That's all nice.

We see a VIX at 15 and a VVIX at 80. These are the only forward-looking measures, and they are far from bearish right now. Bet against them at your own risk.

In other news

The presidential election in the US is now seriously picking up steam as we're just six months away from Super Tuesday. While Trump is still fighting a litany of legal battles, Biden made a surprising proposal: a 44.6% tax on capital gains.

Again, we will refrain from commenting on such a measure's social/political impact. However, this had us pondering all week - how would a private equity firm deal with such a drastic change? The same question goes for venture capitalists. Would this make it more difficult for startups to access liquidity, as the prospect of a juicy exit would become much less appealing? Would you see a rush of exit before such a measure becomes unforced? Would it trigger an overall flow of capital from risky assets to income-generating ones and favor bonds or real estate in mundane areas? These are interesting perspectives, and while we certainly don't have the answers, if you have some interesting takes on the matter, do drop us an email.

Thank you for staying with us until the end. As usual, here are some interesting reads from last week:

The cloud - everybody understands its importance now, but it may still be tricky to fathom how much money it generates. If you want to get an order of magnitude, read this article from Clouded Judgement reviewing in detail the earnings from Azure

Why Everything is Becoming a Gain by Gurwinder is a long and interesting piece about the dangers of gamification in our society, which can distract us from meaningful life pursuits.

This week at Sharpe Two, we explored 0 DTE again and showed that waiting for realized volatility to be high was maybe the best moment to sell straddles.

That is it for us for this week. We wish you a fantastic week ahead. Happy trading!

Ksander

Data, charts, and analysis are powered by Thetadata and Dataiku DSS.

Have access to our indicators using our API.

Book a consultancy call to talk about the market with us.

Contact at info@sharpetwo.com.

Disclaimer: The information provided is solely informational and should not be considered financial advice. Before selling straddles, be aware that you risk the total loss of your investment. Our services might not be appropriate for every investor. We strongly recommend consulting with an independent financial advisor if you're uncertain about an investment's suitability.