Forward Note - 2024/03/31

189 sessions left in 2024 - what's the game plan?

Happy Easter and Happy Holiday - we hope you’ve spent some wonderful moments with your loved ones.

The first quarter has already come to an end. Time usually flies, but we must admit it has gone even faster since we embarked on this journey of daily market commentaries.

Exactly a year ago, Wall Street was shaken by the crisis in the regional bank sector. A perfect storm of severe mismanagement and a high-rate environment brought back the worst fears of a 2008 remake in everyone's mind.

No one will ever forget the brutal Russian invasion of Ukraine in Q1 2022, the threat of nuclear war, and, with it, the promise that oil would cross $200, leading us into a long-lasting and painful bear market. This was a certainty.

Four years ago, things were even wilder: the world froze due to the first global pandemic of the century, and markets worldwide were in free fall. If it hadn't been for the swift reaction of the Fed at the time, things could have gotten much uglier.

And what about 2018, only six years ago? Volmageddon witnessed the terrible implosion of multiple VIX ETNs, destroying wealth at a speed rarely seen in financial markets history.

2017 was quiet as hell. In fact, it was the last long period of prolonged low volatility—or, in a different context, quite like 2024.

The least we can say is that Q1 has been as quiet as the aforementioned years, were dense and intense, diametrically opposite to the scary forecasts made a year ago.

Do you remember when the IMF predicted a global recession? We are not pointing fingers: the IMF is one of the highest economic governing bodies and, therefore, a gold standard. When they didn't get it right, no one did.

Why are we saying all of this?

We've observed an interesting phenomenon on social media recently: retail traders are moving away from rock star accounts, realizing they are as clueless as they are and that, despite their authority in the field, they just missed one of the most glorious bull runs in stock market history.

We can only applaud that the markets humble some really questionable accounts. Trading was never about getting likes or followers but about making money, even though social media conflated the two ideas.

However, the temptation to think we could know more than these guys is immense and incredibly dangerous—it should be resisted at all costs.

Let's return to March 31, 2017, when you could "sell Vol and spend the day at the beach." No one knew that a year later, we would deal with Volmageddon, and 36 months after that, Covid would hit, resulting in a fight against inflation.

At VIX 13, there are two big mistakes one can make, and the wall separating the two is extremely thin:

Trying to anticipate when it is going to be at 35

Thinking that this prolonged period of calm will last forever

The first one is costly because you are missing out no matter how cleverly you structure that trade. Things are going up, and you are too busy focusing on something that isn't there yet.

The second one is costly because you size unreasonably, and when the wind finally turns, your account disappears in a bang. Low vol fatigue is a bitch, and if you think you're not affected, look at how sloppy your risk profile has become over Q1 and think again.

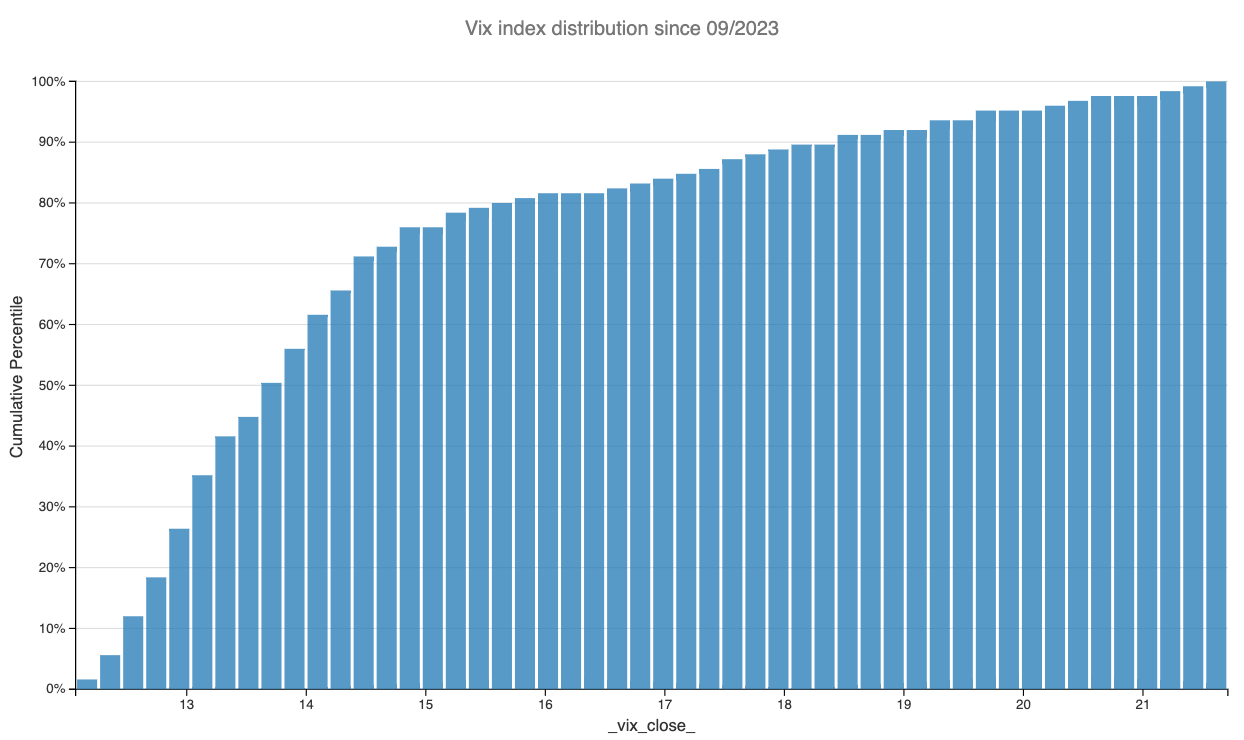

Once again, the most sensible thing to do is the hardest thing—staying unfazed and selling VIX at 13 because it is expensive, and the distribution over the past six months is a glaring confirmation. Yet, going through the same mechanics every morning, as if it was scripted that it would be at 35 in the evening.

The good news is that it's never too late to make small adjustments, tidy the house, and return with a better mindset as Q2 starts. Nothing is better than a three-day weekend to reset at the end of Q1. Trading is equally about prediction as it is about preparation and execution over 252 iterations a year.

You still have 189 games ahead of you—how will you play them?

In other news

The markets were extremely quiet last week, as is usually the case during Easter week. We still had two major economic releases—GDP came in higher than anticipated at 3.4%, while the PCE rose slightly but was mostly in line.

The big events happened on Friday, when everyone was away from their desks. Powell spoke about inflation, and guess what? He stayed true to himself: "There's no rush to cut the rates, but waiting too long risks hurting the economy." Want to read between the lines? He doesn't know but is vigilant and open about it.

And Wall Street loves that for now. Let's hope he continues to deliver.

Thank you immensely for staying with us for another week. As usual, here are two very interesting reads we've come across last week:

It is no secret that we are big fans of Claudia Sahm, and if you need a good macroeconomic fix, here is her latest piece. Discover the power of the Sahm rule, a simple yet highly accurate economic indicator designed to trigger automatic stimulus checks during recessions.

Finance and philosophy are two of our favorite reads. So when we saw the title "Financial nihilism," from Market Sentiment we couldn't resist. What is it? A pervasive sentiment among younger generations fueling risky behaviors from meme stocks to crypto gambling, as the American Dream slips further out of reach.

We published an Easter Egg on Wednesday before the long break. In case you missed it, it is available here.

That is it for us. We wish you a wonderful week ahead and happy trading!

Ksander

Data, charts, and analysis are powered by Thetadata and Dataiku DSS.

Have access to our indicators using our API.

Book a consultancy call to talk about the market with us.

Contact at info@sharpetwo.com.

Disclaimer: The information provided is solely informational and should not be considered financial advice. Before selling straddles, be aware that you risk the total loss of your investment. Our services might not be appropriate for every investor. We strongly recommend consulting with an independent financial advisor if you're uncertain about an investment's suitability.