Easter Shopping List

Capitalizing on the GDP effect

With only 48 hours to go until the traditional long Easter break, volatility has already packed its bags and jetted off to Thailand, soaking up the sun, lounging by turquoise waters, and working on its tan. It's not like it has been super busy since the start of the year, but hey, it's 2024, and even volatility deserves a better work-life balance.

Since the market will be closed on Friday evening, we're bringing you the traditional Thursday shopping list a day early, on Wednesday. And in the spirit of Easter, this article is on the house. We hope you enjoy it!

We're in luck because the GDP data is the only thing standing between us and the long weekend. Remember how NFP numbers tend to inflate options prices as market participants try to anticipate every possible scenario? Well, the same goes for GDP data. Selling a straddle just before the release has a much higher chance of success than selling on any regular day.

Now, this doesn't mean we can rule out the possibility of a genuinely disappointing figure popping up on our screens Thursday morning, throwing a wrench in everyone's plans to cut out early and beat the traffic to the countryside. But, just like with NFPs, the market is tough to beat, and the potential outcomes are likely already baked into the straddle prices.

As always, proper risk management is crucial to avoiding unpleasant surprises. As we've said repeatedly, don't put all your eggs in one basket with this trade—keep it sensible.

Let's dive in.

The rules

Before we start, let’s do a quick round-up about the rules.

Short an ATM straddle in the 1DTE contract 01/03 as close as possible to the close on Wednesday night. In all our metrics and charts, we assumed an execution at 3.50 pm, but the entry timing doesn’t matter too much: avoid getting in too early, but getting in too late gets you less premium.

Exit the position as close as possible to Thursday’s expiration. Again, we assume an execution at 3:50 p.m., but depending on your risk tolerance and satisfaction with the returns, it can be useful to manage the position earlier.

One word of caution: if you get assigned, leave the trade altogether and eliminate the underlying. If you decide to keep it and “sell premium against it,” it is at your discretion and outside this strategy's scope. It’s okay to keep the other leg expiring out of the money; there is no reason to pay an extra dime to your broker. Ensure it is far enough from any post-market move — the settlement happens at 4.15 pm, not 4 pm.

One last thing—we still have a few spots left in our Discord community, where we monitor this strategy, and many others mentioned in this newsletter. If that resonates with you, the early bird offer is still available. Contact us if you're interested!

A few statistics

First, let's take a look at how well this trade performed in 2023 and 2024. We're assuming $1 of credit was collected per straddle. The rest of the methodology is outlined in the paragraph above. We'll focus on the main indices with expirations available Thursday night through 0-DTE.

The data clearly shows that IWM outperformed its two counterparts last year. Last week, we discussed the structural reasons why selling volatility in IWM tends to yield better results. Since it's an index made up of small and mid-cap companies, its risk profile is much higher compared to the more established companies in the S&P 500 or the Nasdaq 100. As a result, investors typically demand a significantly larger premium.

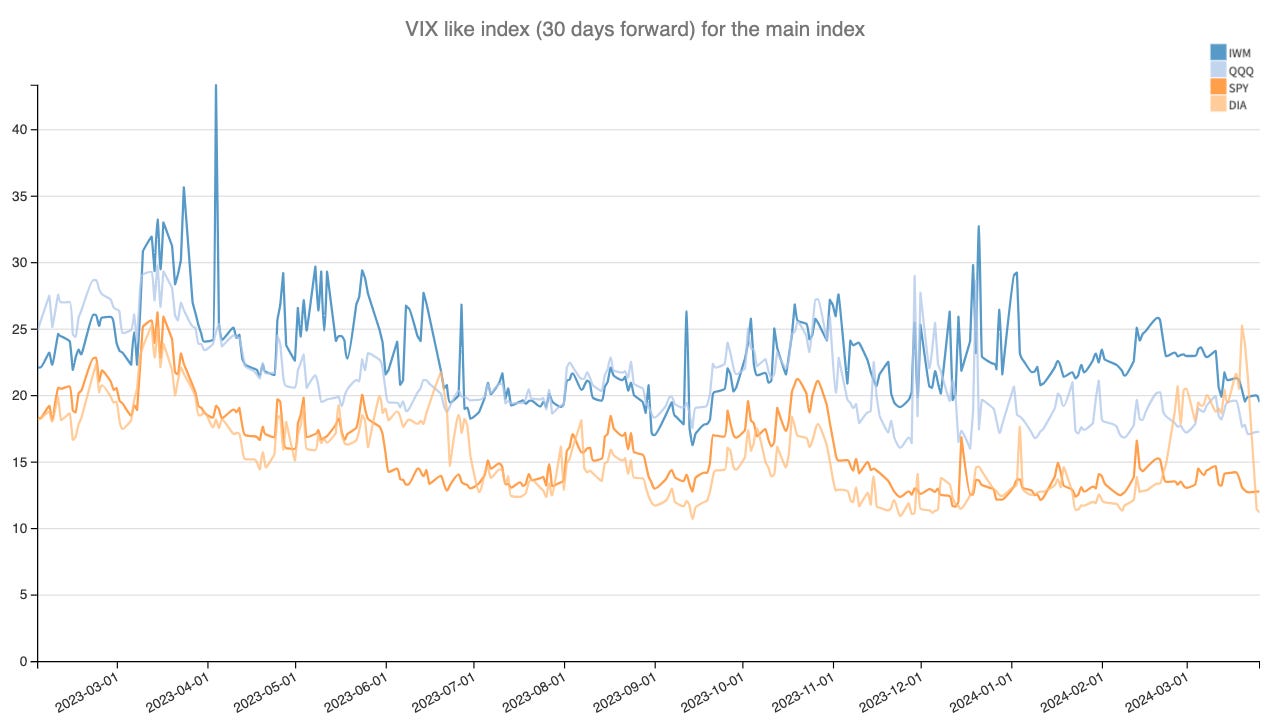

A reconstruction of the VIX index for the four indices aligns with these observations.

Now that we've established this, we can also try to see what happened on GDP day for tickers that would normally expire the following Friday. These options effectively become 2-DTE because they're sold on Wednesday. To really ensure that we capture a "GDP effect," we'll consider selling them right at the open on the morning of the release.

Let's take a look at the top performers:

As expected, some of our usual suspects, like VXX and XLF, show nearly a 10% inflated price just for the GDP release.

FXI, the ETF for China, also performed exceptionally well in 2023, which is a bit harder to explain. Sure, one could consider the interdependence of the two leading economies, and a poor figure in the US is likely to impact China. However, beyond that, we don't have a more solid explanation.

JNK is another interesting case – the ETF tracking junk corporate bonds. It makes sense to see the price of its options inflated before the release date, considering that a disappointing figure could highlight some tension on the weaker elements of the economy. In that sense, it aligns with what IWM was showing earlier on.

With that in mind, let’s focus on a few names that we will consider at the close this Wednesday and manage throughout the day on Thursday

The List

Considering the observations above, we propose an extended list for this week:

Main indices - IWM/SPY/FXI

Volatility indices - VXX

Financial/real estate - XLF/IYR/KRE/JNK

Others - XRT/XLI

As always, combining multiple names helps to smooth out potential variance. To achieve this, it's best to harmonize the premium collected per ticker as much as possible. This way, a single bad surprise won't overshadow the profits from the rest of the group.

That said, if the numbers are really disappointing, volatility will likely spike, and all these positions could be challenged simultaneously. So, keep your sizing reasonable in the event of that possibility.

Finally, remember, the goal is to capitalize on the inflated options prices leading up to the GDP release while effectively managing your risk. Stay focused on the effect we are trying to capture.

We hope this Easter Shopping List has given you valuable insights and ideas for trading this week. If you have any questions or want to share your experiences, feel free to contact us.

Data, charts, and analysis are powered by Thetadata and Dataiku DSS.

Have access to our indicators using our API.

Book a consultancy call to talk about the market with us.

Contact at info@sharpetwo.com.

Disclaimer: The information provided is solely informational and should not be considered financial advice. Before selling straddles, be aware that you risk the total loss of your investment. Our services might not be appropriate for every investor. We strongly recommend consulting with an independent financial advisor if you're uncertain about an investment's suitability.