Forward Note - 2024/02/11

What would Jay Z rap about, live on CNBC?

As the weeks go by, they all keep looking alike: the VIX is lingering comfortably below 14, and the S&P 500 has made history once again by closing above 5000 for the first time, capping off a remarkable streak of finishing green 14 out of the last 15 weeks.

A few Federal Reserve speakers shed some light on the decision-making process, cautiously signaling that rate cuts are on the horizon. Not that market participants needed much convincing; their determination to keep bidding seems unshakeable, consequences be damned.

Yet, for all its excitement, this kind of week is fairly boring. And with it, the siren’s call to overtrade is stronger than ever, especially for retail traders, betting on the short side in anticipation of a retracement: “We’ve climbed so much; surely there is going to be a retracement now.”

Spoiler alert: indeed, a retracement is inevitable. They are an integral part of the life of financial markets. However, the concept of 'now' is misleading and potentially harmful. Does 'now' mean in the next few minutes, in the next two weeks, or perhaps in the next six months?

Despite the flurry of expert predictions dominating financial news lately, no one can claim with certainty what will trigger the market's next downturn. Yet, they keep playing the same game — uncover the Black Swan, time its impact precisely, and make a name for themselves in the process.

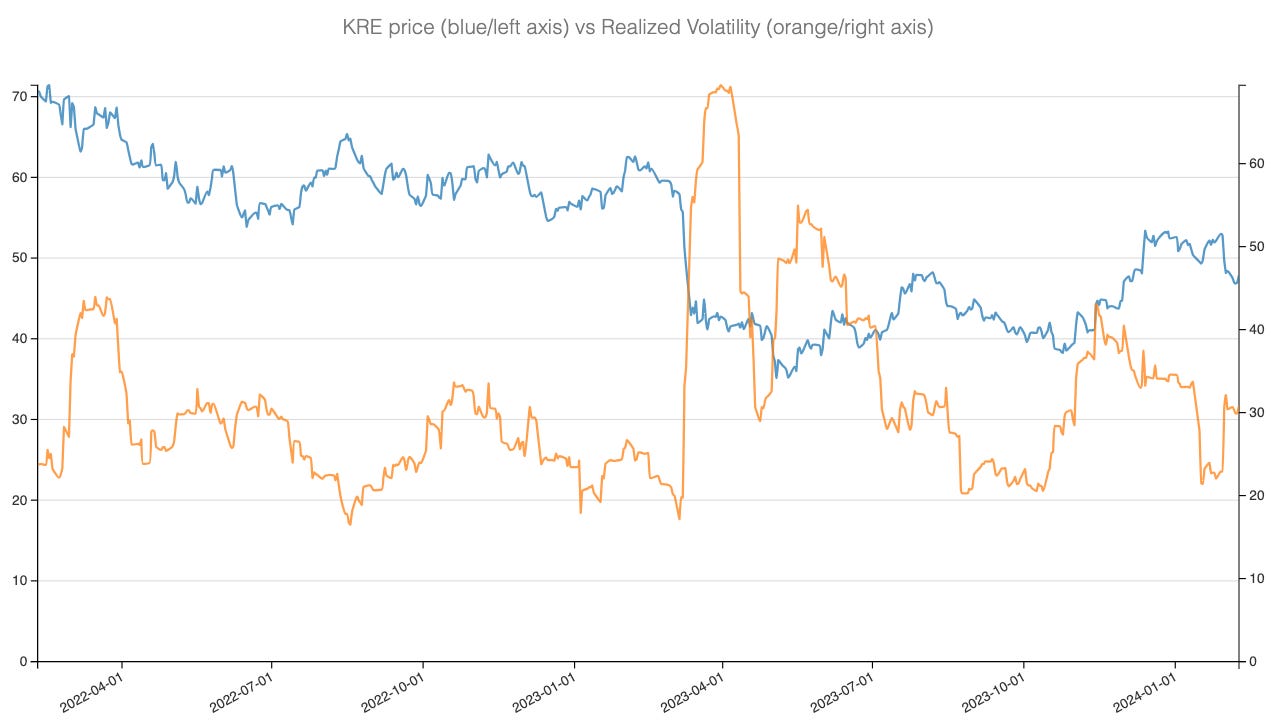

It’s in that fashion that this week's focus shifted back to regional banks, reminiscent of last year's scrutiny. With the sector's vulnerabilities under the microscope, persistent high-interest rates have reignited concerns. Revelations during the earnings season contributed to a 5.2% decline in the regional bank index, marking it as one of this week's notable laggards.

Inflation is the other hot topic on everyone's mind, with upcoming CPI data poised to influence market sentiment. Given the Fed's emphasis on data-driven decisions, any deviation from the expected downward trend in inflation could reignite market jitters. The threshold for concern is uncertain, but there's a sense that even an inflation report in line with forecasts could hint at a stagflation scenario and potentially unsettle traders.

Why is stagflation bad? Persistently high rates to tame prices can place significant pressure on financially weaker sectors, such as commercial real estate. With the shift towards remote work, the looming problems in this area, highlighted by vacant office spaces, become increasingly apparent.

Yet, whether this crisis will manifest imminently remains uncertain. Taking a broader perspective, one might even question if a crisis will occur at all: remember the much-anticipated student debt crisis? It has yet to upheave the American economy as predicted.

A side note: This observation isn't to downplay the profound impact of student debt on millions of Americans but to highlight that it hasn't triggered a widespread economic downturn. We empathize with your personal circumstances and wish you a swift victory in your uphill battle for financial independence.

Recent history has demonstrated that economies can undergo deleveraging without catastrophic impacts, especially when competent leaders are in charge. And despite concerns, the financial landscape has been navigating high interest rates for over a year without showing clear signs of widespread distress—at least not to the extent that Wall Street has taken note. And that should be an important reminder: as traders, we should trade what we see, not what could potentially be.

The burgeoning AI bubble is another focal point, especially with NVDA's earnings announcement just 10 days out. Given its outsized influence on index performance recently, any negative surprise could potentially unleash a cascade of selling. "Could" being the operative word here, as certainty in these matters is elusive. Once more, we're navigating the unknown.

Traders hold an advantage over analysts in that our role doesn't require predicting the future but rather responding accordingly to unfolding events. A common fallacy is the overemphasis on timing, believing that foresight alone can secure profits by acting before everyone else.

But trading is difficult enough without complicating it with speculative gambles often fueled by ego. After all, the end-of-year scorecard doesn't award points for cleverness. What counts is your profit-and-loss statement, indifferent to whether your gains came from consistently selling volatility—even with the VIX at a docile 13—or from successfully surfing a major market movement from inception to conclusion. The bottom line remains starkly binary: you're either in the green or the red.

Therefore, in these slow periods where the urge to act can be overwhelming, it's crucial to maintain patience and respond to the market's actual movements, not our restlessness. Embrace the serenity—after all, who laments the rarity of a sunny day in the depths of winter? Storms will inevitably arise, presenting their own set of challenges, so there's no need to add complexity to our strategies in times of calm.

And if you really feel like speculating about something, think about what Jay Z would respond to Bill Ackman live on CNBC about the current environment:

“If you are long VIX 13, I feel bad for you, son. I’ve got 99 problems, but a spike ain’t one.”

In other news

As we discussed earlier, the regional bank crisis is back at the forefront of news media, and this time, it’s the New York Community Bank that is under the radar.

Are we really about to experience a repeat of March 2023? It's unlikely: Wall Street may enjoy crying wolf, especially during dull moments, but it detests being caught off guard. The likelihood of being taken by surprise by the same issue twice in a row is lower than finding a needle in a haystack. Moreover, even if the situation were to deteriorate, the Federal Reserve has already demonstrated its playbook: the Big Four would step in to carve up the smaller entities, effectively absorbing any turmoil into the vast financial ecosystem.

Thank you for staying with us until the end, and here are a few captivating reads from last week

You know that we don’t like to spend too much time and resources predicting stock direction. It doesn’t mean you can’t try: here is an exhaustive article showing the avenue you need to consider.

In this great piece featured in The Psychology of Wealth , Alejandro Lopez reminds us that status is a currency we cannot discount too much despite its seemingly bad reputation.

Finally, this week at Sharpe Two, we talked about using the steepness in the volatility term structure to identify set-ups for volatility sellers. Don’t miss it!

That’s it for this Forward Note; we wish you a great week ahead and happy trading.

Ksander