VRP Is Real But Not Free in INTC

How to capture edge without being caught in upside volatility.

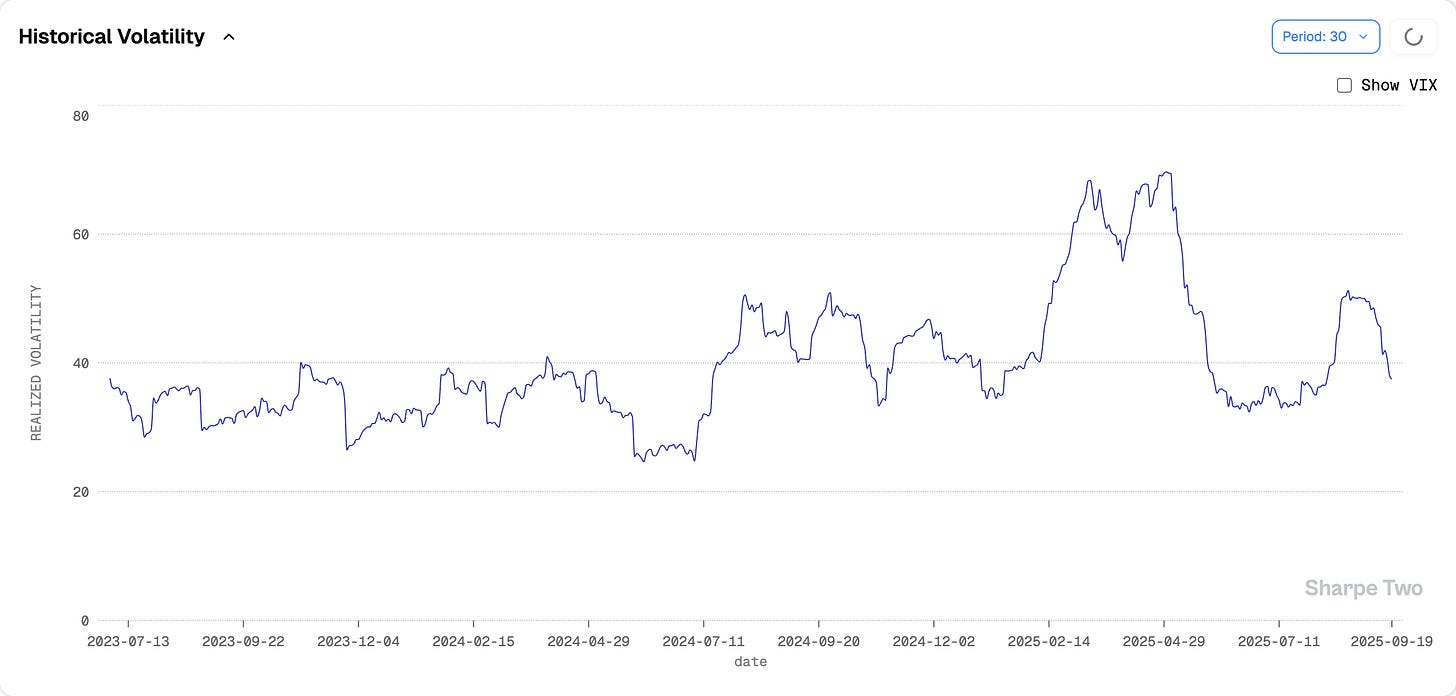

Remember when Intel’s realized volatility lived comfortably in the low 20s? That feels like a lifetime ago. In 2025, it has held stubbornly in the 35–45 range, with little sign of drifting back into calm seas.

INTC has become synonymous with turbulence, shaped as much by politics as by fundamentals. The administration’s 9% stake, announced just three weeks ago, keeps the company squarely in the headlines and adds fuel to already elevated swings.

Semi-variance makes that story visible. Earlier spikes were dominated by downside shocks — the classic selloff profile — but more recent bursts have been balanced by upside variance. Vol is no longer just a crash hedge; rallies now stir turbulence too.

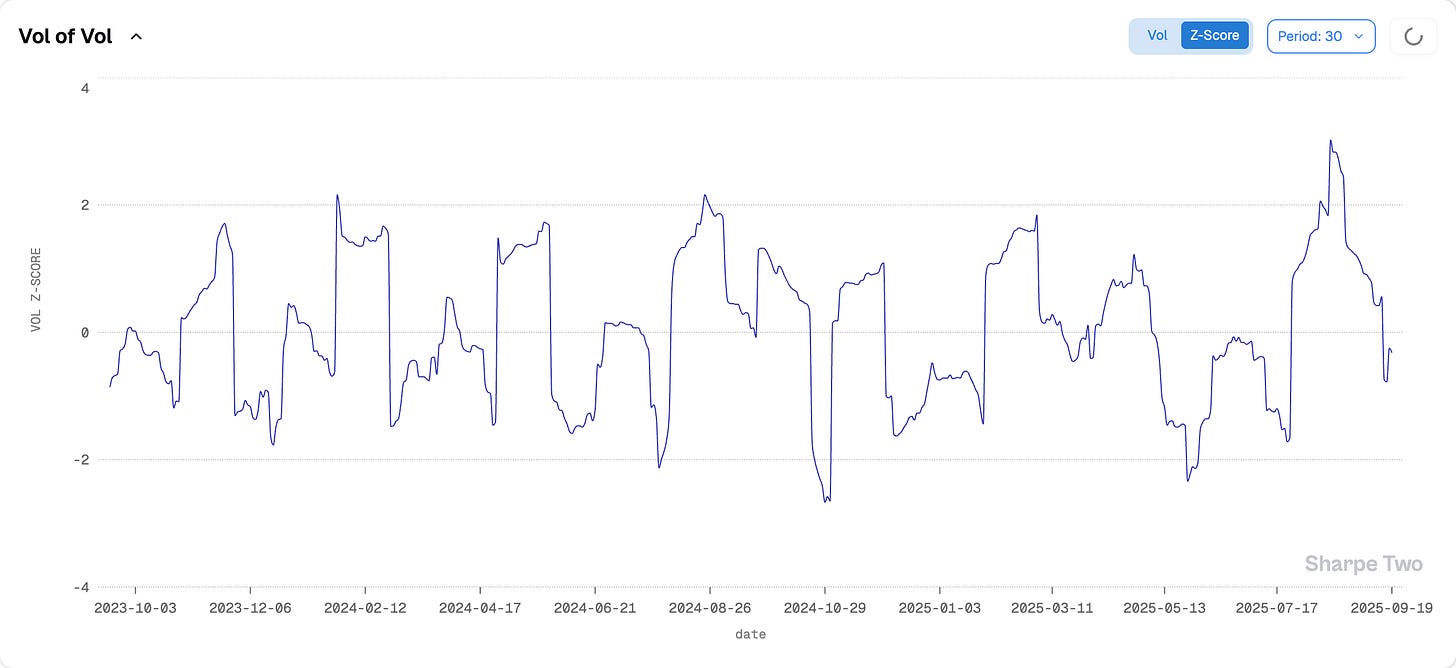

The same balance shows up in vol-of-vol. It has rolled off from the spring highs but remains elevated, reinforced by the summer stake announcement. Add Intel’s continued lag in the semiconductor race, and realized volatility has every reason to stay sticky.

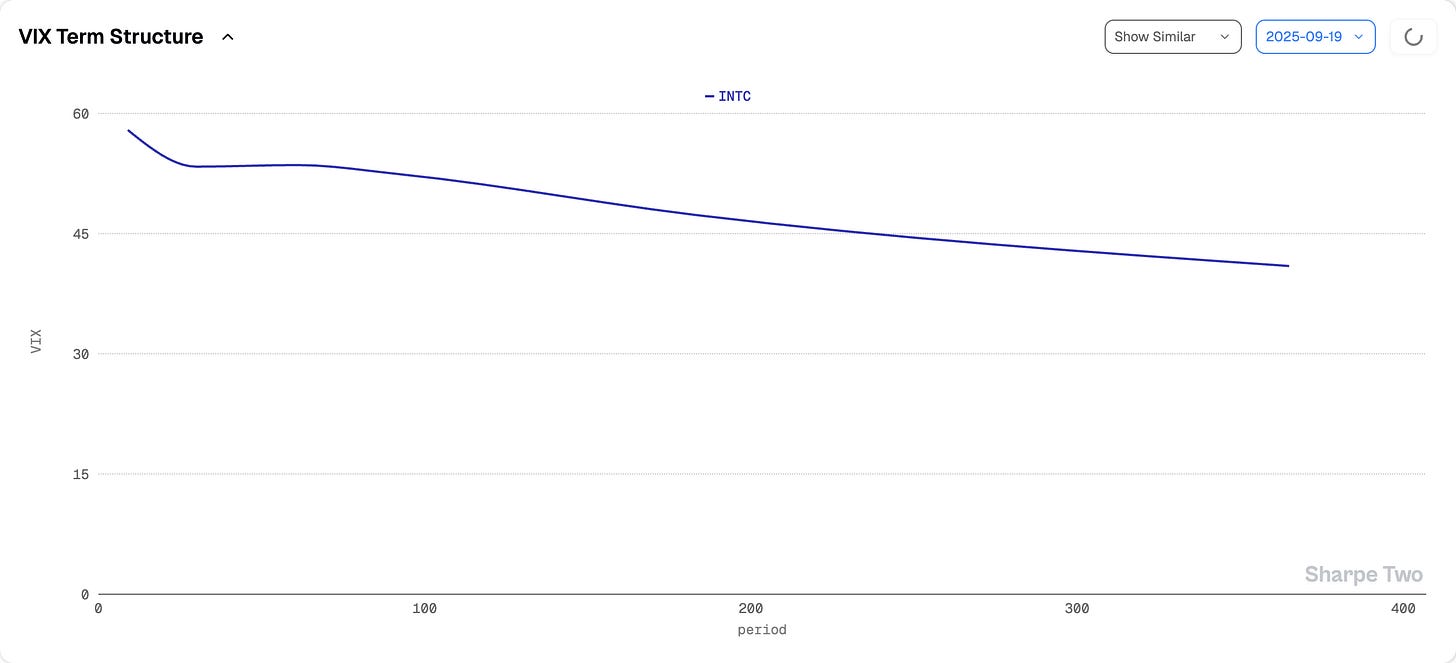

The implied term structure mirrors this uncertainty: front maturities remain heavy while the curve only drifts lower into the belly. Traders aren’t betting on a swift return to Intel’s quiet baseline — they’re still paying up for protection.

And that sets the stage for the real story: not realized itself, but the gap between realized and implied — the variance risk premium — and the unusually strong probabilities attached to it.

How to harvest the strong VRP in INTC

Our prediction about how IV and RV will behave are more anchored in the uncertainty surrounding INTC, and barely better than a coin flip: things could slow down, but you never know and the last few trading days reaching highs of several month before losing 10% are not saying anything else.

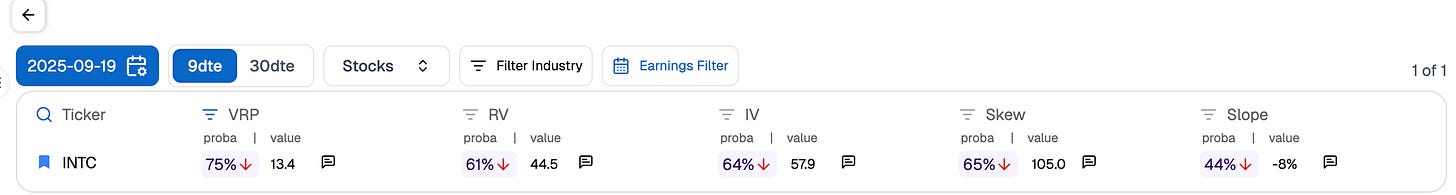

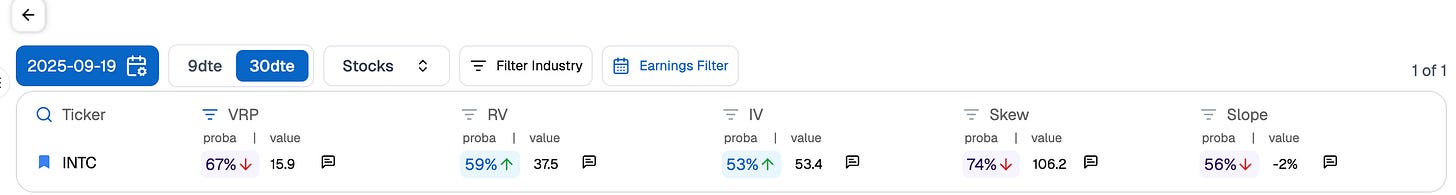

In comparison, the variance risk premium forecast are backed by conviction. The numbers are clear:

9d tenor: +13.4 points, with a 75% probability that implied sold today will finish above the subsequent realized volatility (over the next 9 days.)

30d tenor: +15.9 points, with 67% probability of the same outcome.

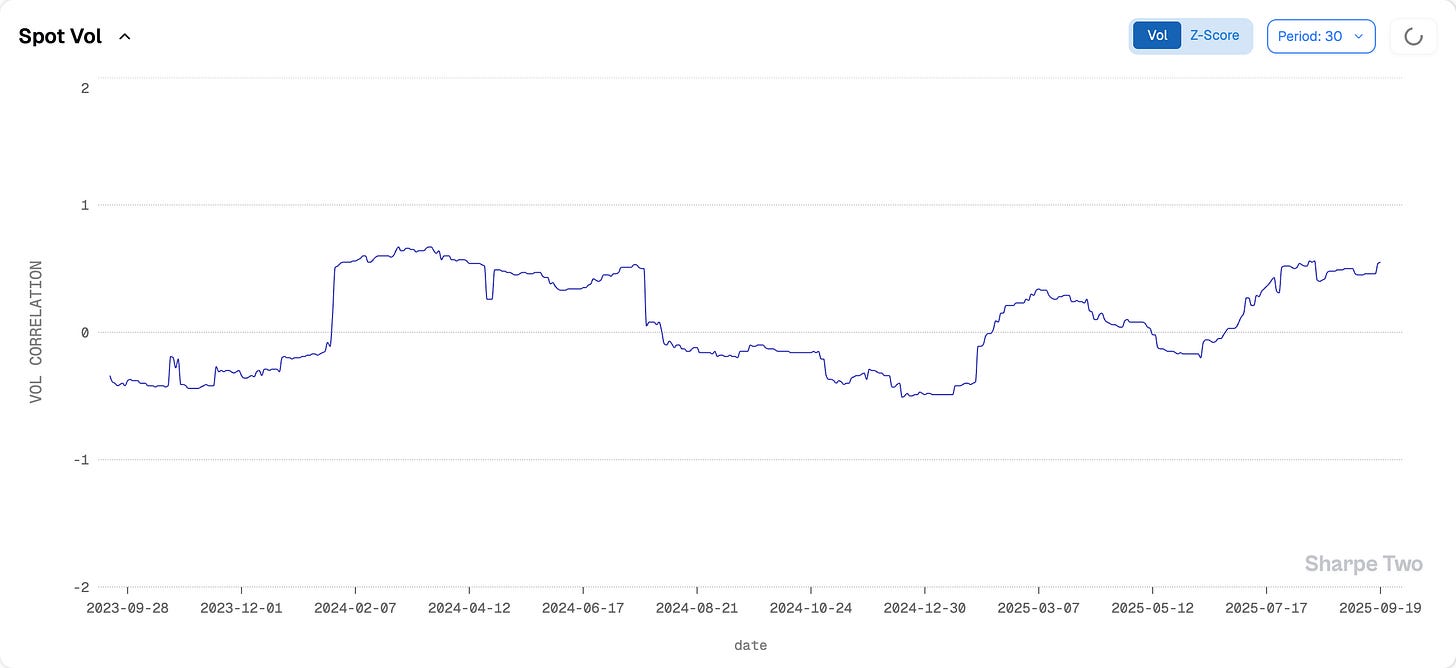

But conviction doesn’t mean free money and one has to be particularly careful of how volatility now reacts to spot. With spot/vol correlation positive, rallies push implied higher just as selloffs used to. Going up has become its own form of turbulence.

That shift complicates the trade. Even with VRP firmly on your side, structuring requires respect for a surface where upside moves are now volatility events in their own right.