Trade Anatomy - Short Vol in XLV

Post mortem Signal Du Jour - 2025/10/02

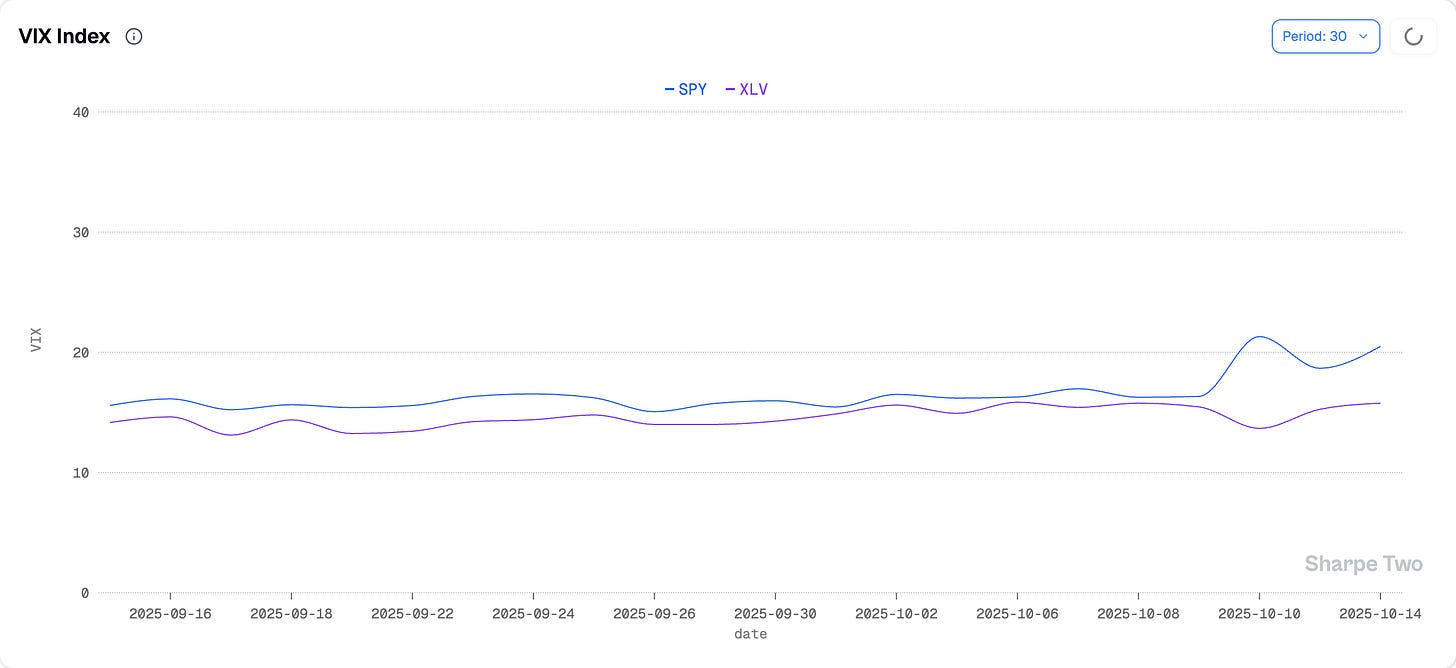

Two weeks ago, we talked about shorting vol in XLV. Back then, we did not know that the VIX would jump from 16 to 21 by Friday. And while the market is not exactly on fire, there is definitely some tension as traders expect a prompt resolution on the government shutdown and the trade war with China.

Had we known about that spike, would we have done things differently? We might be tempted to say yes, but it is always easier to sound wise in hindsight—especially when the trade ended up working as planned.

That is exactly why post-mortems matter. Did we make money because we got lucky and the underlying, after a few wilder swings than expected, simply landed where it needed to? Or did things truly unfold according to plan?

Let’s dig in and see where the PnL came from on yet another successful trade, keeping the success rate at 100% since we started these article early September. Yes, that’s right: if you had joined Sharpe Two back then, you would have already paid for your yearly subscription. Imagine having access to every setup and insight directly inside the platform…

The trade

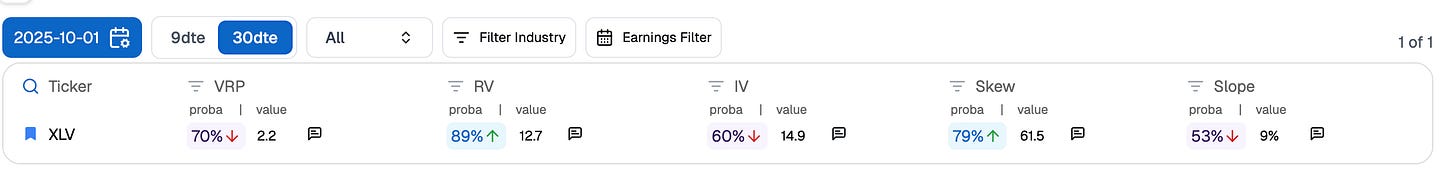

In our Signal du Jour two weeks ago, we highlighted an opportunity in the 136/152 strangle expiring November 21 on XLV. At the time, XLV had just rallied +6.5%, climbing from 134 to 142 after the FOMC announcement, as any immediate risk conveniently failed to materialize. Our forecasts then pointed to near-perfect conditions to harvest implied volatility in the ticker.

The edge was thin but present: you could sell implied volatility at 14.9 with roughly a 70% probability that subsequent realized volatility would stay below it. XLV — the healthcare ETF — is far calmer than its evil cousin XBI (biotech). And while a 2-point VRP may look slim, we also knew it would take a major shock to push realized volatility above that level.

Well, we did get a spike on Friday, which continued into early this week — effectively invalidating our view on implied volatility declining over the trade’s lifecycle. Yet not quite in the way you would expect: IV initially dropped on Friday despite the selloff, only to catch up early this week.

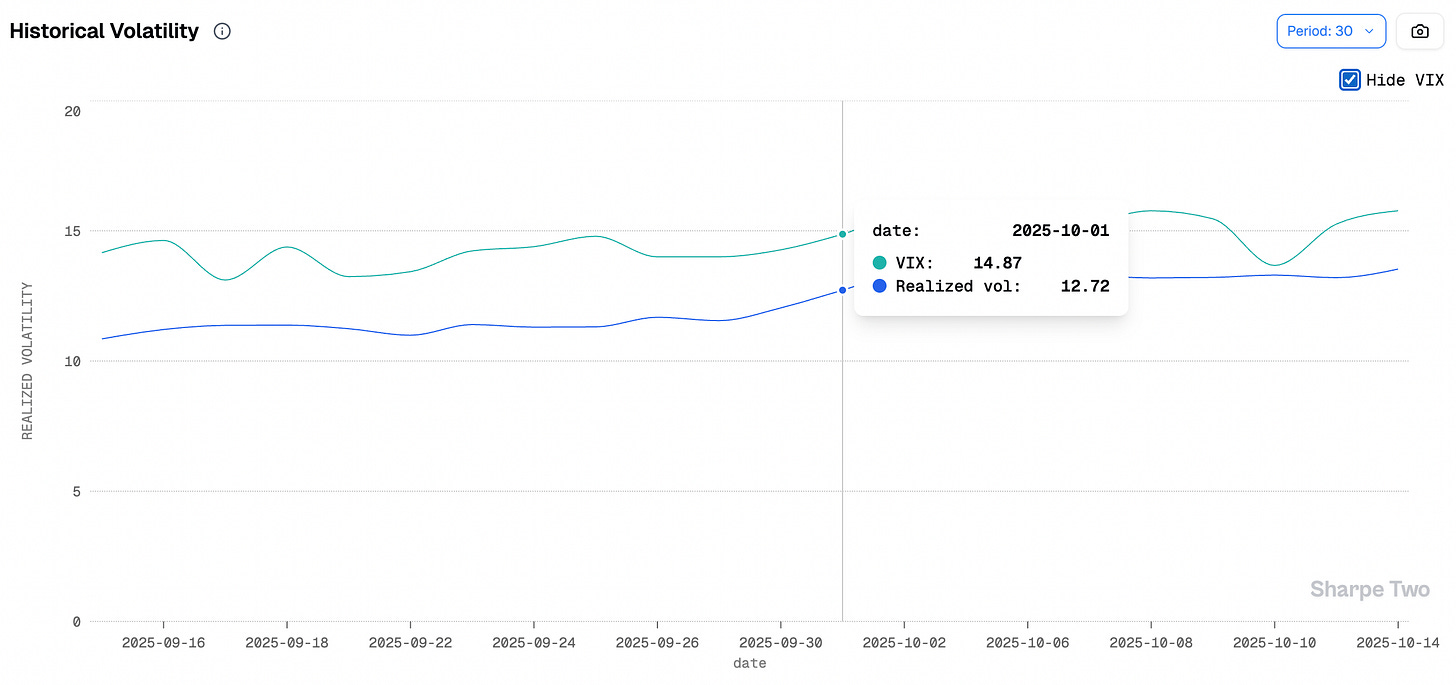

In any case, the blow was far from terrible. From the 14.9% implied volatility available when we entered the trade, IV never seriously challenged the position. What about realized volatility — where the real risk sits? It did rise over the life of the trade, climbing from 12.7 to 13.5.

Still not enough, in just two weeks, to raise early concerns. But options are multidimensional, and a pickup in realized volatility combined with a solid trend could easily threaten our strikes. As a reminder, we do not delta-hedge these positions. We trade them on a terminal-distribution basis, fully aware that our biggest risk is directional.

This time, however, XLV did not trend. It stayed range-bound and finished neatly between our strikes — almost exactly where we initiated the trade in the first place.

A little bit of luck here? Definitely. The underlying showed some continuation of the move that began at the end of September, before dipping lower as the market tanked on Friday. Yet nothing in the data suggests a glaringly wrong call: implied volatility came down somewhat, realized volatility rose but without blowing out, and in the end, conditions aligned for us to hit our profit target right around the two-week window we had planned for this trade.

We had recommended selling the strangle for about $2 and taking profits at 25%, which happened late on Monday as the market recovered and implied volatility retreated from Friday’s high.

With that said, let’s break down the PnL attribution to validate the observations we just made.

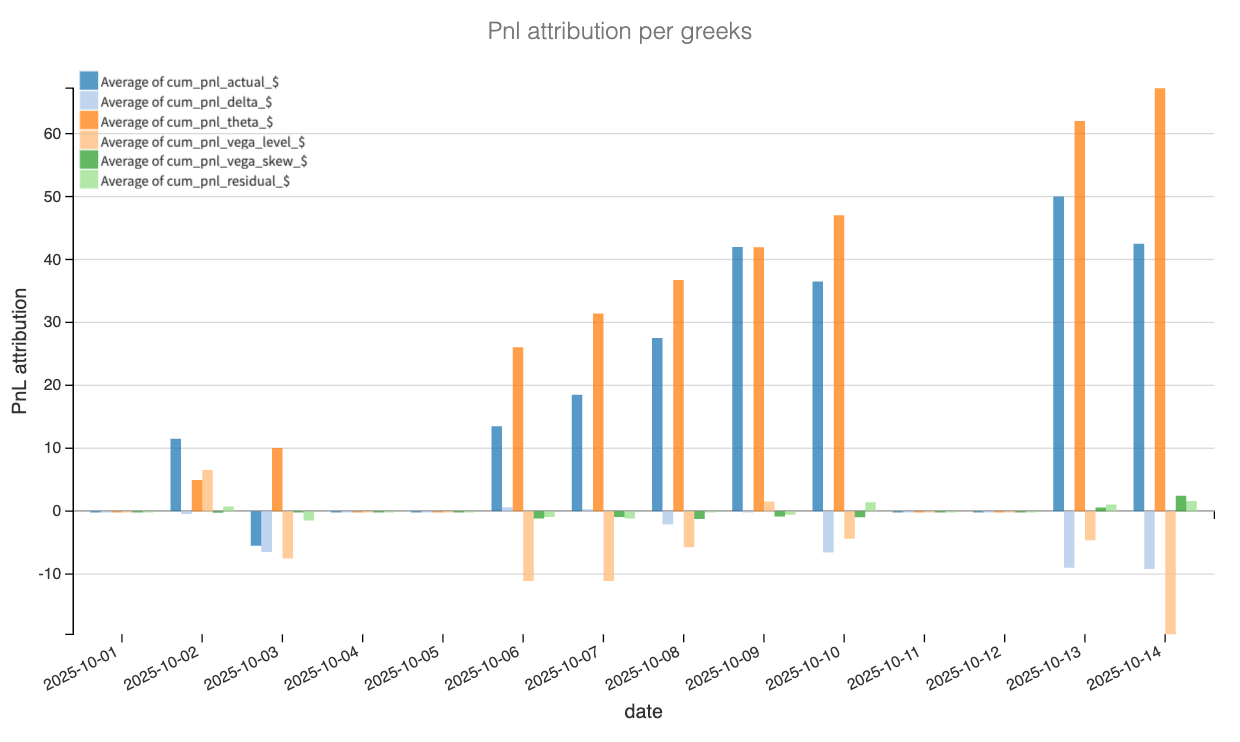

The Greeks Decomposition

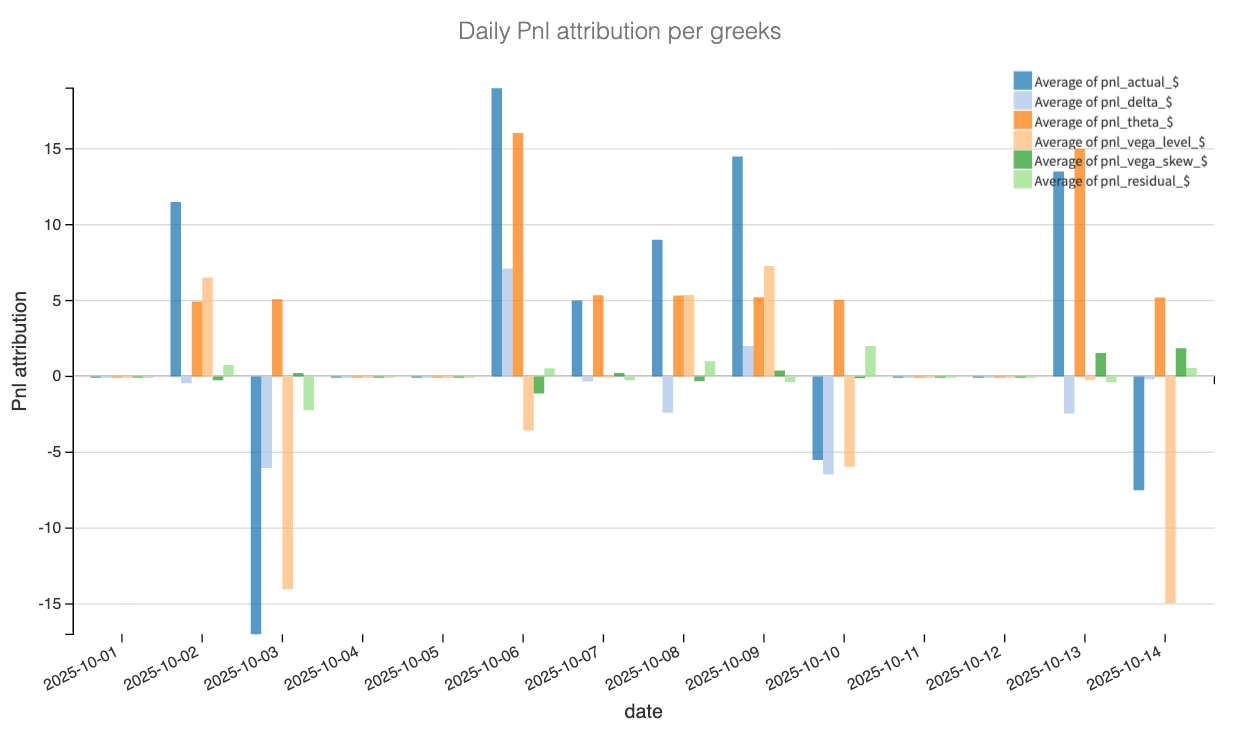

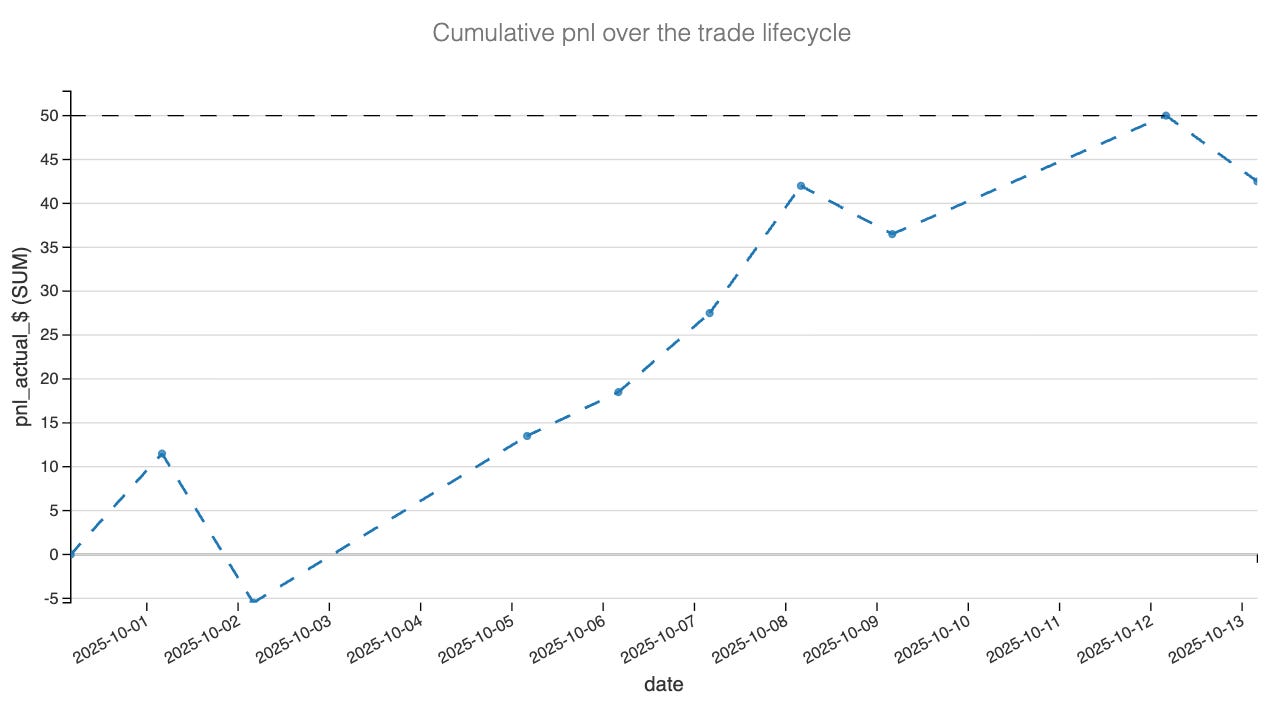

Looking at the attribution, most of the gains came exactly where we wanted them to — from vega level and theta. The cumulative PnL chart shows a steady rise over the two-week window, peaking near our exit target. Daily PnL fluctuations were modest, and there was no evidence of large gamma-induced noise, which reinforces that the short-vol thesis behaved as intended.

The vega level contribution clearly dominates: option prices gradually deflated as implied volatility softened after the initial Friday 10/03 spike. Even though implied vol briefly firmed up early in the second week, it never challenged the entry levels, allowing the position to mark steadily higher. Only a Tuesday 10/14 did vega penalized again the position, but at that stage the take profit order should have been triggered and if not, it was the cue to exit a position that was still well in profit by a solid 20%.

Theta provided a constant positive drift, consistent with the carry profile of a short-premium trade held through a calm period. On the flip side, delta attribution oscillated around zero — a sign that XLV’s small directional swings largely offset one another. The ETF’s mid-range close between the strikes was ideal for a non-hedged strangle. Vega skew and residual components were negligible, which is expected for a balanced structure on a low-dispersion underlying like XLV.

In other words, the trade delivered textbook behavior for a short-vega position in a quiet sector: slow and steady theta harvest, moderate vega compression, and minimal directional bleed. The cumulative Greek breakdown validates the thesis that edge came from harvesting a stretched VRP — not from guessing direction.

Now, the market conditions have clearly changed over the last two weeks. On one hand, implied volatility is now much higher and this could be very interesting for volatility sellers. However, it is not without risk: realized is also on the way up, and the rather thin edge from two weeks ago could be jeopardize. So, should we go back into the trade? Let’s find out.