Trade Anatomy - Short Vol in USO

Post mortem review of Signal Du Jour from 2026/01/15.

Two weeks ago, we presented a short volatility opportunity in the oil complex. Two weeks later, while the position didn’t generate a loss, it certainly didn’t generate a profit either.

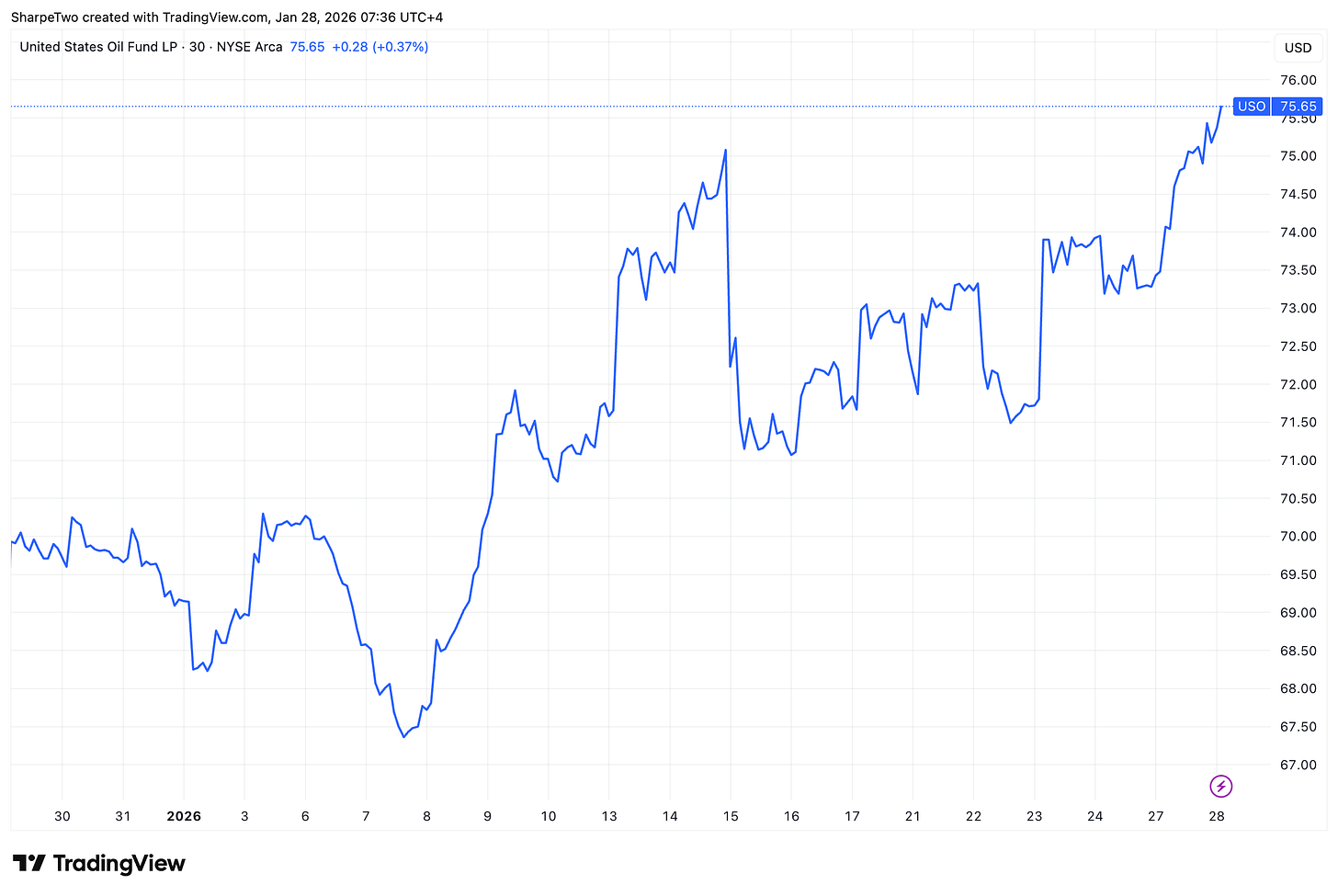

Contrary to the violent moves seen in tickers like SLV or BOIL, USO has been fairly contained. There was no terrifying trend fueled by constant buying pressure, nor a last-minute reversal erasing billions in market cap in minutes like we saw in Silver at the close on Monday. Truly, the underlying asset hasn’t really gone anywhere.

The typical theta harvester might wonder: How on earth have I not made money despite holding the position for two weeks? They might be tempted to blame market makers for blatant market manipulation, conspiring together to refuse to pay their due.

That would be missing the obvious truth: the thesis was wrong.

2026 is definitely a “year of firsts.” After our first loss last week, this marks our first glaringly incorrect thesis since we started this series. Under these circumstances, we can consider ourselves fortunate to escape with a scratch, a small loss, or a small win depending how you manage your entry.

This is why this series is vital. Conducting a PnL attribution keeps our reasoning in check. It helps us understand what went wrong, what we could have done differently, and, most importantly, what the thesis is now.

Let’s dig in.

The trade

In our Signal Du Jour two weeks ago, we presented the short 67/84 strangle in the Feb 20 expiry for USO. This was structured to capture the variance risk premium (VRP) offered in the options market.

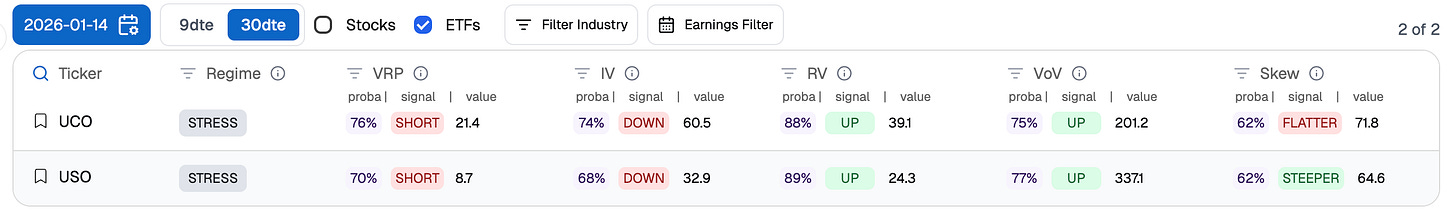

At the time, the probabilities were strongly in our favor.

There was a 70% chance that the implied volatility sold would exceed the subsequent realized volatility throughout the life of the option. That probability climbed to 76% for UCO.

Yet, the trade fell flat, so what exactly happened?

The explanation is simple: not only did implied volatility (IV) go up instead of down, making our directional prediction incorrect, but realized volatility (RV) also increased significantly.

We shorted implied volatility at roughly 33%, only to see it climb to 45%. In these circumstances, Vega presents such a strong headwind that it becomes nearly impossible to turn a profit. Consider the math: you sold at 33% when the variance risk premium was about 9 points. The mark-to-market loss on the implied volatility expansion alone ate most of your expected PnL.

Add to this the fact that realized volatility also ticked up, and it becomes clear why this trade failed to deliver. This serves as a stark reminder: while a data-driven exercise will usually lead you in the right direction, the true risk in markets often comes from exogenous catalysts.

The rising tension between the US and Iran was the primary driver here. In hindsight, critics might ask: why sell insurance when the US has already intervened in Venezuela and tensions in Iran are brewing?

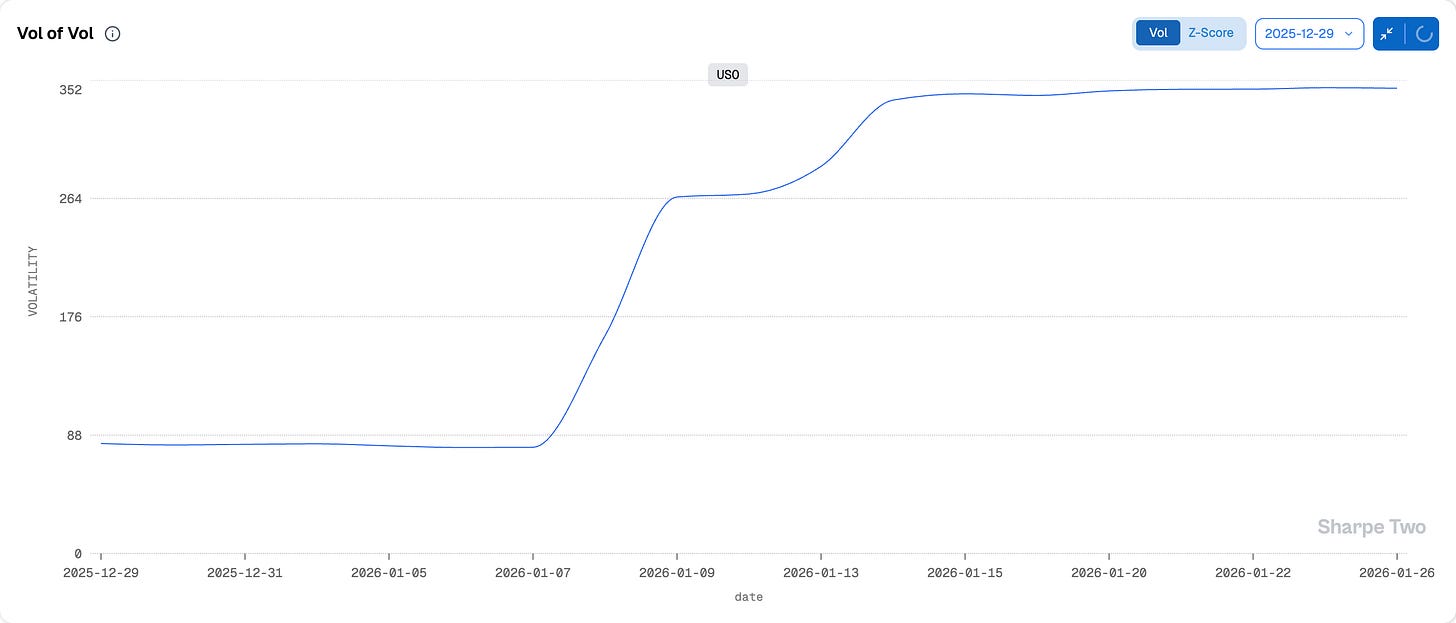

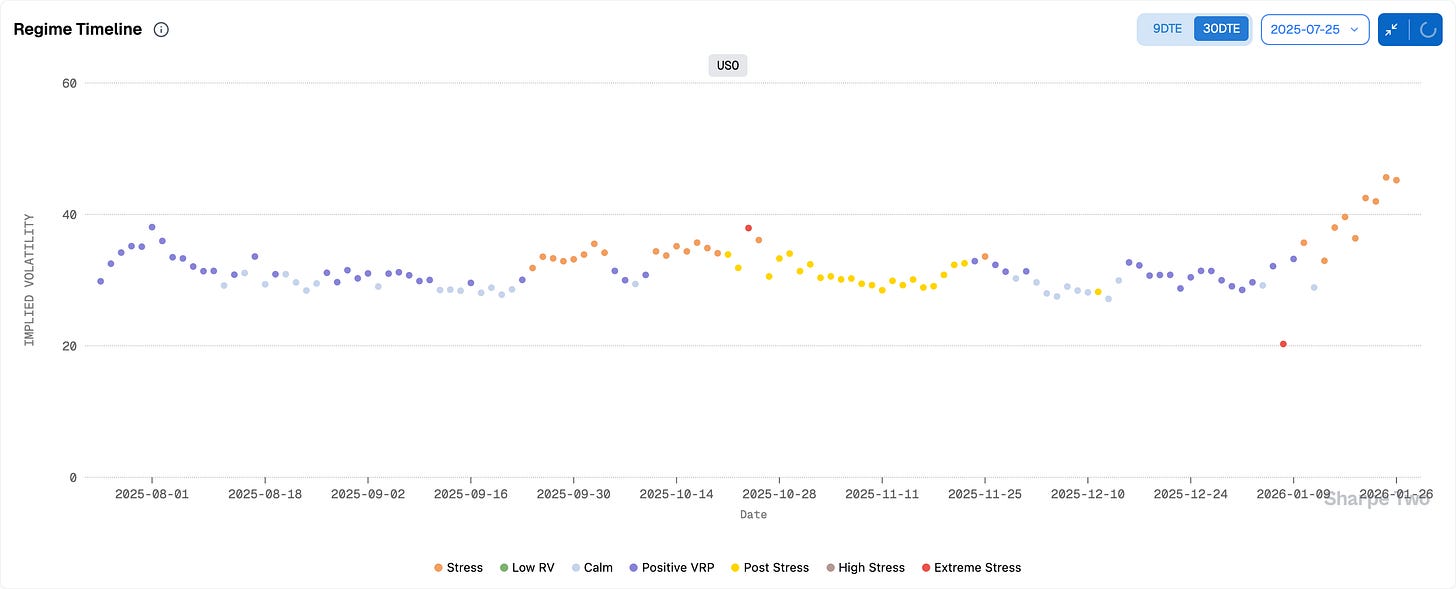

While our models pointed toward early signs of stress, the general market regime wasn’t flashing “extreme concern” at entry. However, there was one element we mentioned that should have led to greater caution: vol-of-vol.

In the days leading up to the trade, Vol-of-Vol had nearly tripled. This increased the likelihood of an adverse move against our short position.

Our data indicated a strong probability that vol-of-vol would continue to rise. At the very least, this should have dictated smaller sizing. We were presented with a “risky customer” showing reckless tendencies; insuring them without demanding a higher premium, or worse, covering a large portion of their claim, was the true error.

Ultimately, the trade ended flat. Depending on your entry timing on Thursday, you might have even scratched out a tiny profit. But do not mistake this for a win.

This outcome reinforces a critical lesson: trading the passage of time is not a strategy.

Theta is merely the quiet companion pushing your boat if your thesis is correct. However, every option trade is fundamentally a trade on volatility and even though the underlying price was mostly directionless, the passage of time was insufficient to counter the effects of a failed volatility prediction.

Let’s now look at the greek PnL attribution for that trade.

The Greeks PnL Attribution

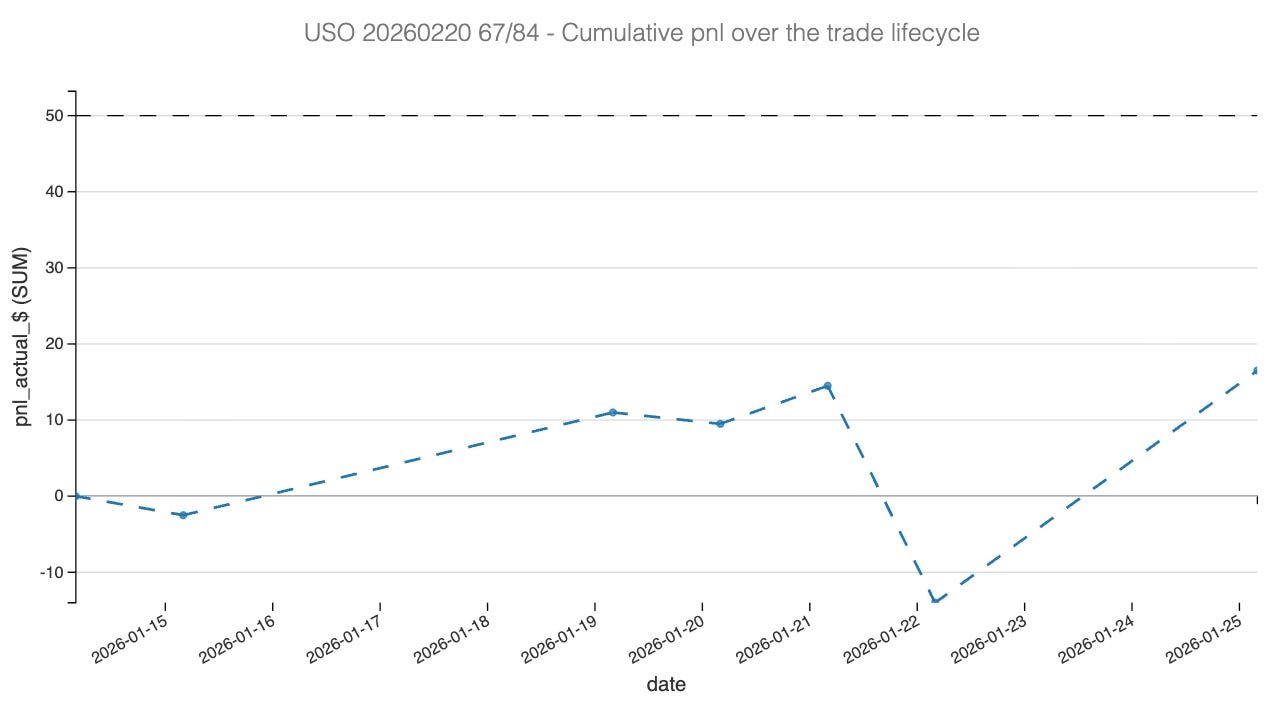

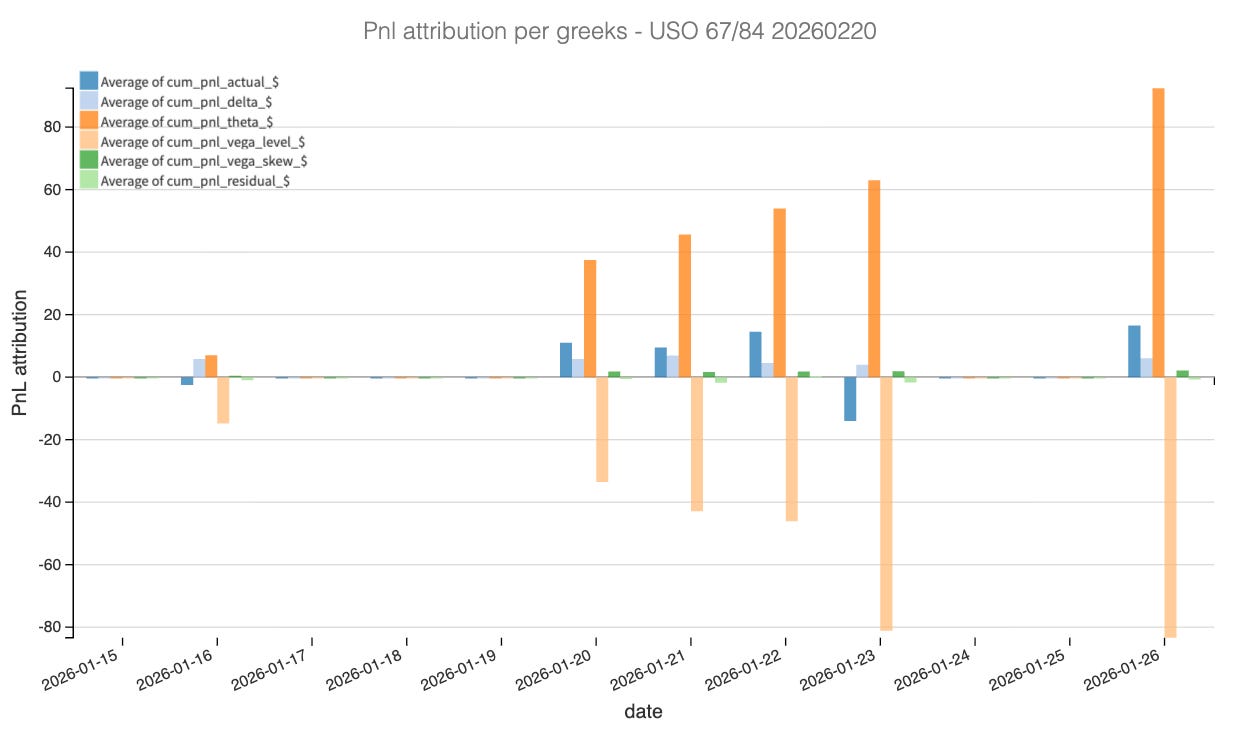

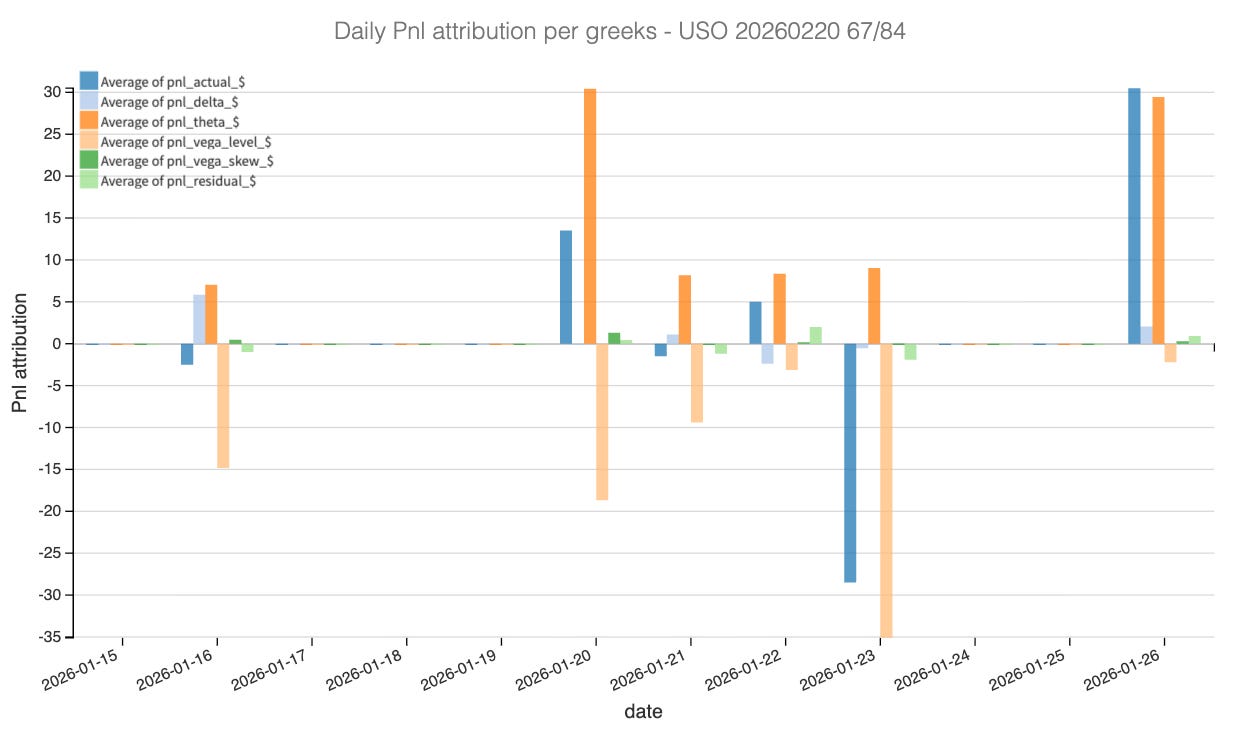

Looking at the attribution, the story of this trade becomes immediately clear: it was a battle between Theta and Vega, where Vega refused to surrender.

As expected with any short premium strategy, time decay (theta) provided the primary source of potential profit. Over the two-week holding period, the passage of time worked in our favor, chipping away at the option premium as we approached the February expiry. Under normal circumstances, this steady accumulation would result in a healthy profit.

However, the Vega component tells a different, painful story. As illustrated in the volatility charts, implied volatility did not compress as we hoped; it exploded from roughly 33% to 45%. Since we were short vega, this expansion acted as a massive headwind. The market panic surrounding Iran repriced the variance risk premium significantly, inflating the value of the strangle we eventually needed to buy back.

Furthermore, the Delta and Gamma impact reflects the “grind higher” visible in the USO price chart. While the underlying remained safely within our 67/84 strikes, the increase in realized volatility meant we were constantly fighting small directional fires. Ultimately, the massive loss generated by the Vega expansion completely neutralized the gains harvested from Theta. This confirms our earlier conclusion: shorting options is never just about waiting for time to pass, it is a specific bet on volatility remaining contained. When that thesis fails, no amount of time decay can save the PnL.

Now, to the difficult question: Should you roll this position, or stay in it considering the PnL isn't horrendous?