Trade Anatomy - Short Vol in URA

Post mortem Signal Du Jour - 2025/12/04

Two weeks ago, we took a short volatility position in URA, the ETF giving investors exposure to uranium miners, a sector that performed extremely well in 2025 on the back of the AI theme and the strength of the hyperscalers. That said, the sector was not immune to the heightened volatility observed in October and November.

While this trade felt “safer,” as we put it after the Thanksgiving week when the market had found some footing, the main risk was still the potential for renewed stress as we approached the last FOMC of the year and the implications surrounding monetary policy.

Stress never materialized, and the trade played out smoothly, aside from the fact that the underlying was up almost 5% on the day the article was published. We received a number of messages asking for advice on how to handle the position. Our answer was simple: the volatility thesis was intact. This was a reminder that while spot and volatility are related and often move together in fairly predictable ways, as volatility traders we focus on the level of volatility, not on where the underlying is going.

In the end, this was yet another positive Signal du Jour. A 100% hit rate since September is becoming notable, especially considering that while the past few months were not exactly April 2025 or August 2024, they still delivered a few cold sweats across the market. More importantly, it reinforces a broader point: harvesting volatility is a problem that can be forecasted and approached systematically when the right signals are in place.

The trade

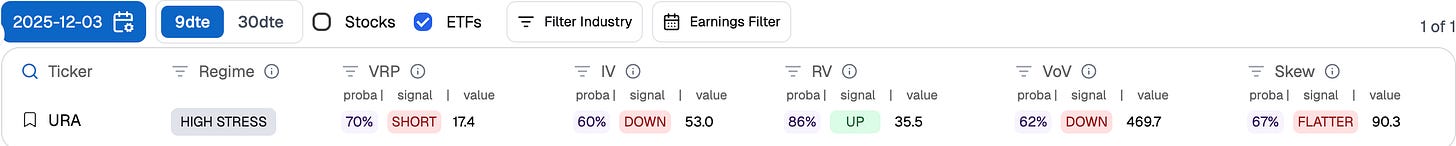

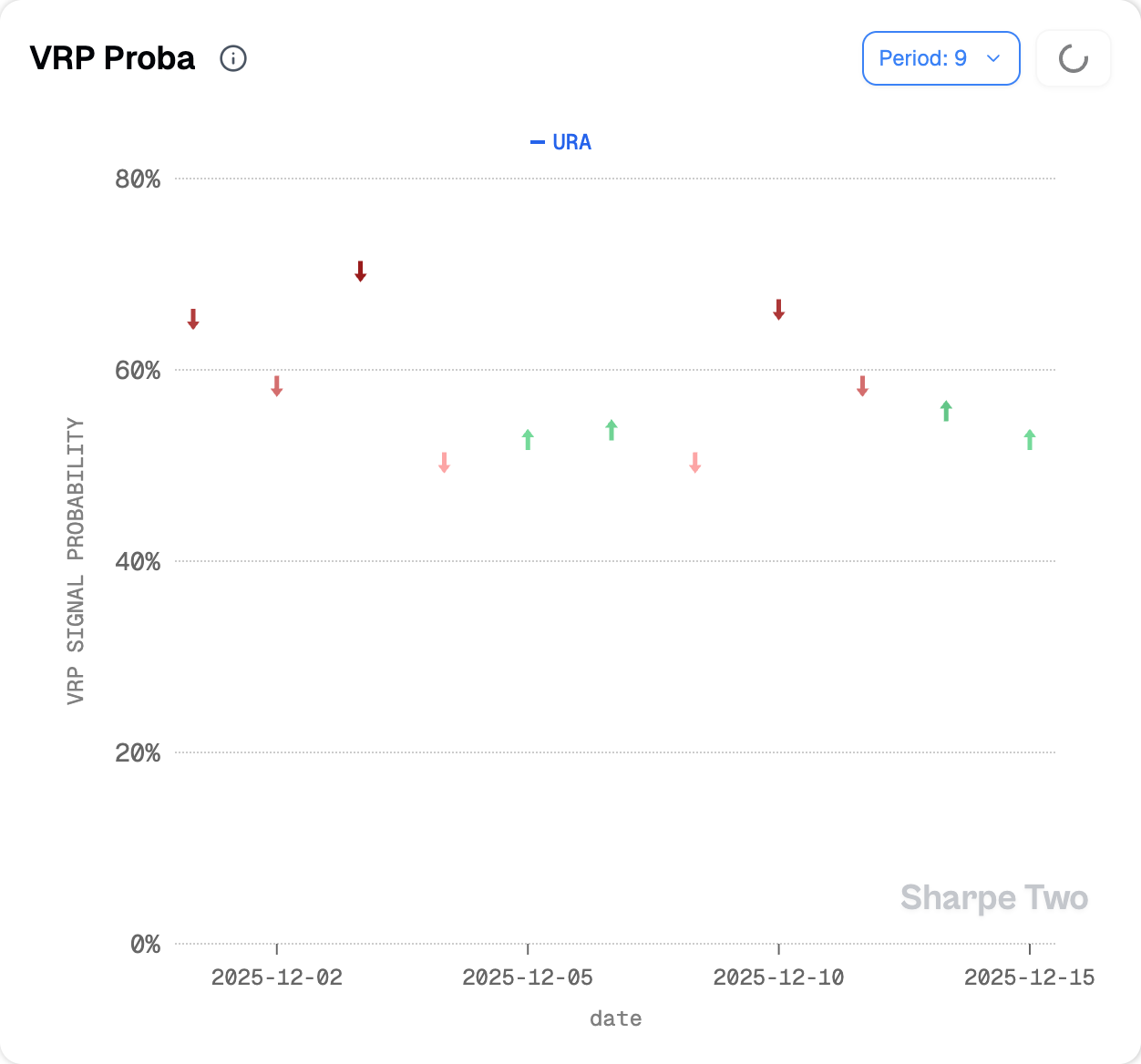

n our Signal du Jour from two weeks ago, we highlighted a short volatility opportunity in URA through the 45/52 strangle expiring on Dec 12. The particularity of this trade was the absence of a variance risk premium when measured at 30 dte, combined with a strong one at 9 dte. This made it a slightly riskier trade than what we usually take: if volatility had come back after Thanksgiving and the short-dated thesis at 9 dte had shifted quickly, there would have been little room to fall back on the longer timeframe and give the position some breathing space.

Yet, the probabilities were pretty strong.

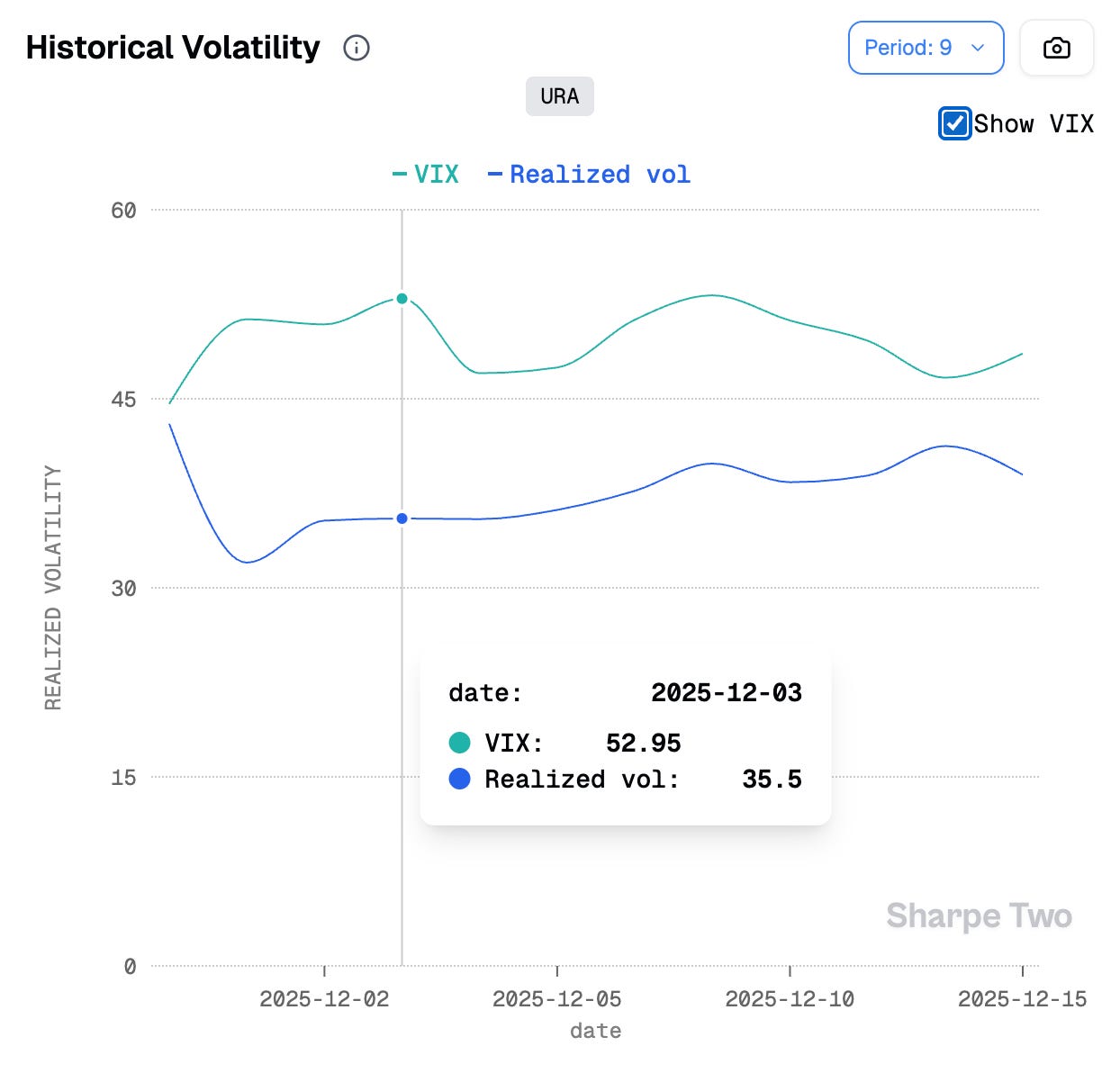

With a 70% chance to see implied volatility sold that day (roughly at 53%) exceed the subsequent realized volatility over the next nine days, and a VRP sitting at 17.4, there was enough margin of error to weather a potential storm, as long as gamma did not join the party and the underlying did not start a trend for the ages. More on that in a second. First, let us review how implied and realized volatility behaved throughout the trade.

As expected, implied volatility declined, particularly early in the trade, which clearly helped move PnL into a more comfortable zone. At the same time, we were anticipating realized volatility to be higher than 35.5 over the following week, and we can indeed see that it gradually rose throughout the trade. Still, it never came close to the level at which we sold volatility (around 53), meaning that, all else equal, we should expect to harvest premium as time passed.

That is the theory. In practice, variance harvesting is path dependent, even more so when one does not actively delta hedge, which is the case at Sharpe Two. We therefore implicitly assume that the underlying will not trend hard enough to challenge the boundaries of the structure we sell. And the least we can say is that the +4% move on the day we put the trade on could have made things uncomfortable.

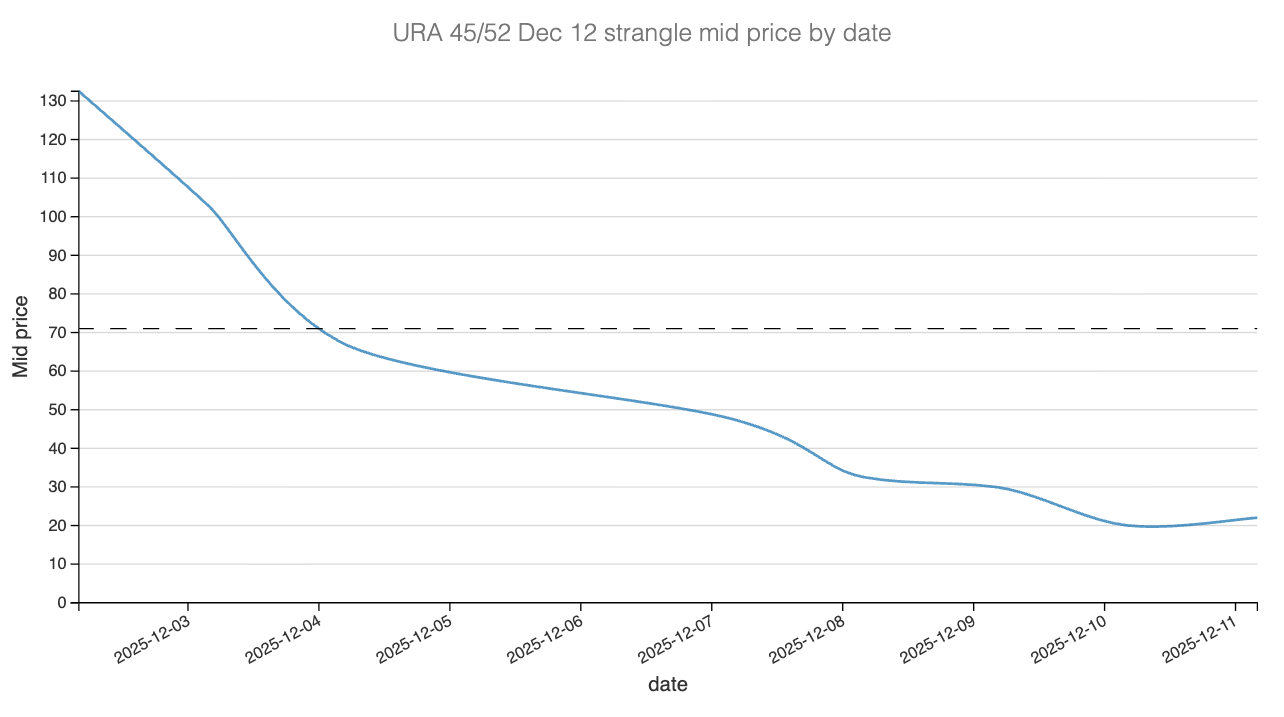

We climbed from 46 to 49.5 in a couple of hours, which would most certainly have hurt the trade early on. Things calmed down over the following days, and in the end the path taken by the underlying allowed our edge to play out. We exited the position fairly quickly, after a little less than three days in the trade.

Considering the rapid jump in URA on Thursday morning, it would have been difficult to enter the trade at Wednesday’s close. That said, an entry above 90 cents was possible, which would have implied an exit at 70 cents or lower the following week.

Then comes the eternal question: should we have stayed in the trade and tried to extract as much premium as possible? Of course, you could have. But you first need to ask whether the edge was still on your side. And while we often feel more comfortable around 30 dte, one needs to remember that the weather can change fast in gamma land.

The signals were not as strong during the trade itself, and under normal circumstances you should have exited once we were back in “flip of a coin” territory. Had you still been in the position, the strong short signal on 12/10 could have justified putting on a new trade.

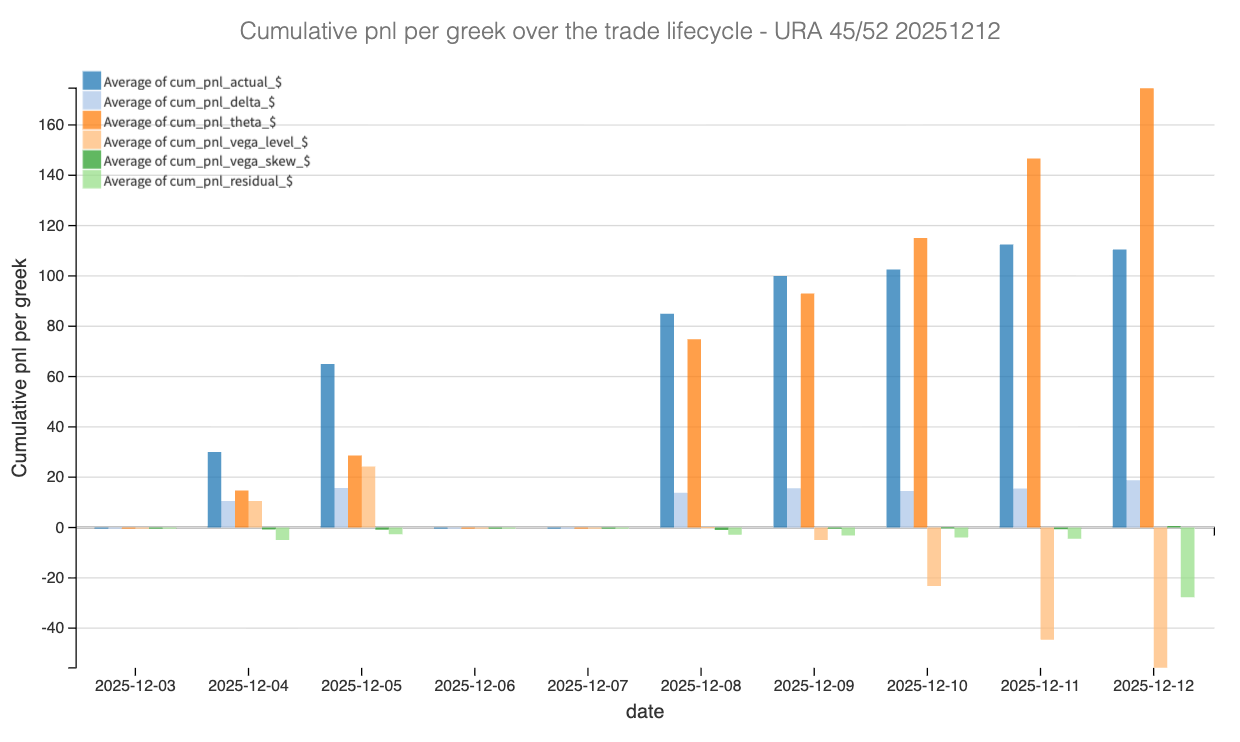

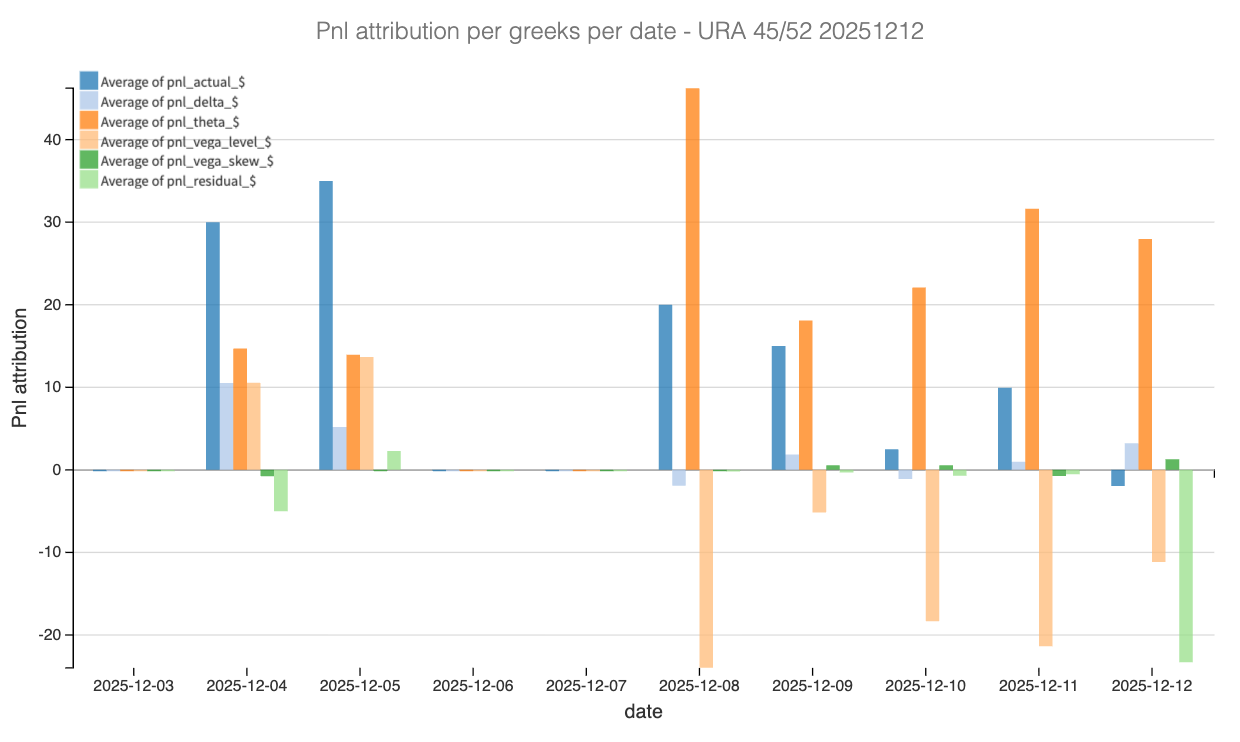

Now that we have gone through all of this, let us take a look at the actual Greek decomposition to see where the PnL was coming from as the trade unfolded.

The Greeks Decomposition

The dominant contributor was theta. From the moment the trade was put on, time decay worked relentlessly in our favor. This is particularly visible after the first couple of sessions, once the initial spot shock had been absorbed. Every quiet day translated mechanically into PnL, and theta ended up being the single largest and most stable source of gains throughout the lifecycle of the trade. This is the clean expression of variance harvesting when the underlying cooperates.

Vega came in as the second major pillar. The compression in implied volatility early in the trade provided a meaningful boost to mark-to-market, especially around the middle of the holding period. Importantly, this was not a dramatic vol collapse, but a gradual normalization from elevated short-dated levels. This is precisely the environment where short volatility trades feel “boring” but effective: nothing spectacular happens, and that is exactly the point.

Delta, as expected, was noisy and episodic. The +4% move in URA on the day of entry shows up clearly as an initial drag on PnL. However, this impact remained contained and never snowballed into a structural problem. The lack of follow-through was key: once the underlying stopped trending, delta stopped mattering, and the trade reverted back to being driven by carry and vol.

Gamma-related effects are implicitly captured in those early delta fluctuations. They were real, uncomfortable for a few hours, but short-lived. As time passed and spot stabilized, gamma decayed rapidly, allowing theta and vega to fully take over.

Finally, skew and residual components remained marginal throughout, slightly negative at times but never material enough to alter the thesis. In short, this was a textbook short-vol trade: initial gamma nerves, followed by steady carry and orderly vol normalization doing the heavy lifting.

At this stage we would normally wonder if we should put the trade back on but, it is the holiday season and it is better to enjoy more time with the family, rather than stress about a position not cooperating on a very thin market. Our advice therefore; do not nothing, or if you insist, go read more of our pnl attribution exercises they are all interesting to understand how a good thesis can play out in different type of market. And of course, subscribe to the platform, join us in the Discord; we make trades like this one every single day.

Your trade dissections are such great learning tools! I hope others enjoy them too.