Trade anatomy - short strangle in NUGT

Post mortem for the 2025/09/11 signal du jour.

Two weeks ago we wrote about NUGT as the market was digesting inflation and jobs data, bracing for the FOMC. Gold has been in a parabolic run this year—up 42% in 2025, with little sign of cooling. And when gold runs, miners fly. NUGT, the levered ETF on the gold miner index, has ripped 291% as investors piled into mining names to ride the wave.

That’s the backdrop. Now, what about our short strangle? Technically, it worked. We sold around 5.7 and took 25% profit. Clean. But retail trading is rarely that tidy. If you didn’t have working orders in to exit during the post-FOMC volatility crush, you might be sitting in a tricky spot right now. Or are you? Stick around—we’ll see if there’s still edge in this trade, and whether it’s worth managing the position.

Let’s dig in.

The trade

We put on a short strangle in NUGT in the October 17th contract, selling the 100/150 strikes. At the time, NUGT was trading right in the middle—124.83—and the setup carried solid odds of success.

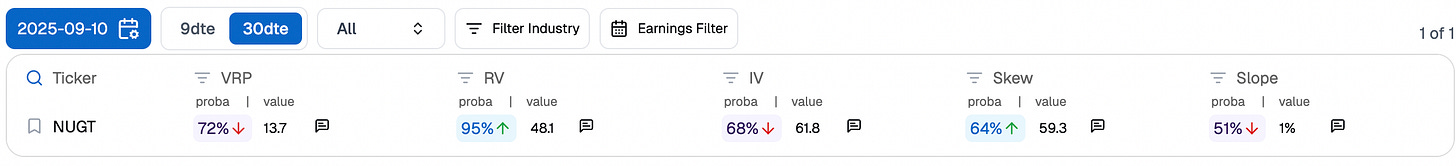

The numbers backed it up: a 72% chance that implied volatility sold at entry would outpace subsequent realized volatility, with implied also likely to retreat from its then-elevated 61.8%.

The wrinkle? We knew realized vol would pick up from where it was. With the FOMC and September expiration just a week away, that was almost guaranteed. Still, a full-blown spike seemed unlikely, and the 13.7 points of VRP made the trade worth taking—collecting on a potential implied crush while time decay worked in our favor.

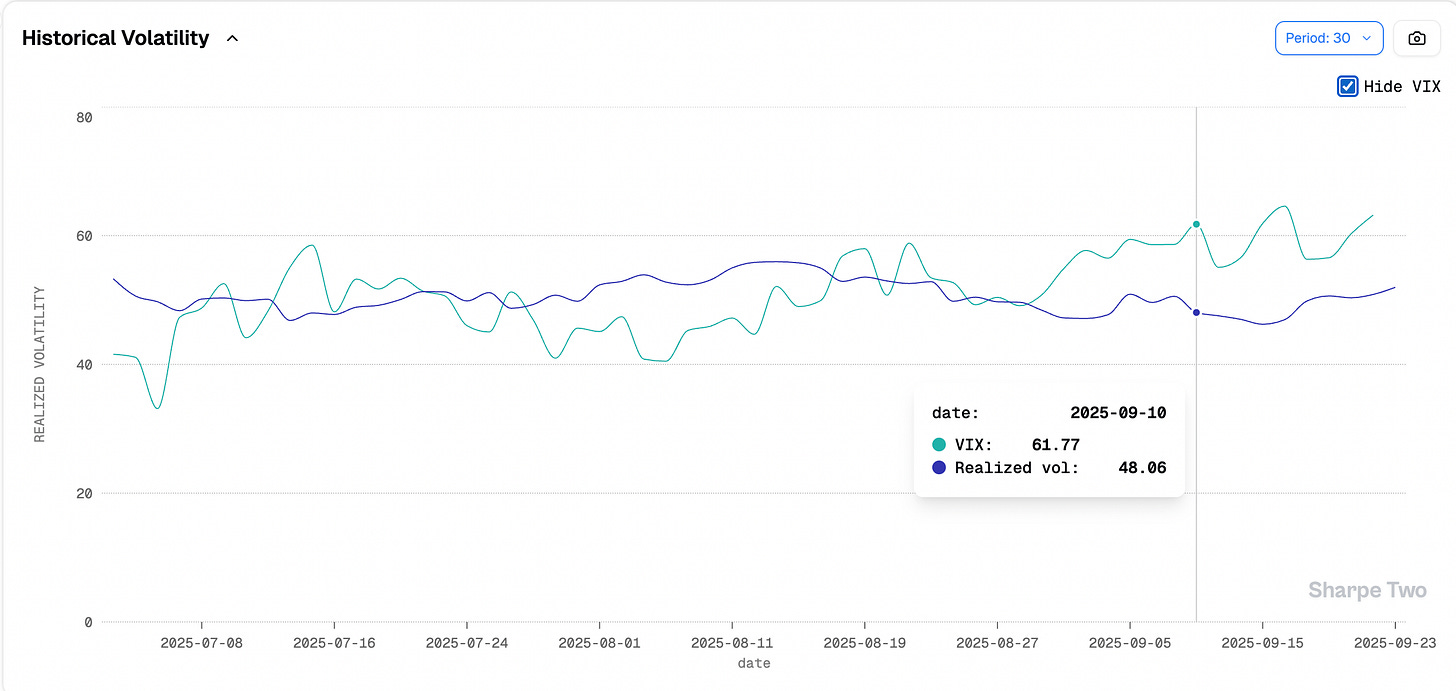

And indeed, realized volatility climbed. It started at 48.1% when we put on the trade and pushed to 52%. That’s not negligible—especially since the bulk of the move came in the last seven days, with realized now printing 61%.

Implied volatility did come down, though not in a straight line. It spiked again right before the FOMC, got crushed immediately after, and then steadily climbed—now sitting at 63%, against our forecast. That creep higher matters, and we will see the impact on PnL in the next section.

And what about the underlying? The path matters even more here since we do not delta hedge. The rapid jump on triple witching Friday would have been painful for anyone who overstayed the position.

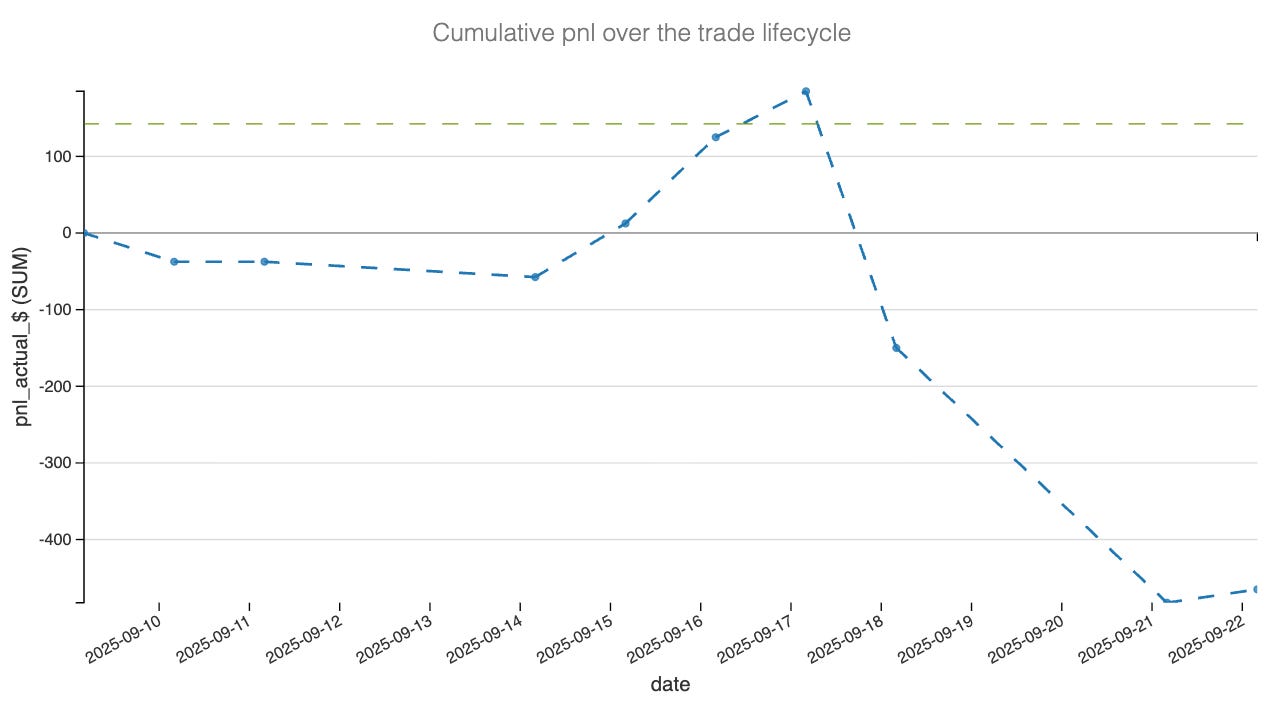

Everything looked perfect until Friday the 19th, when NUGT ripped 20 handles higher, putting stress on our short OTM calls. Let’s check how that move filtered into the PnL.

If you had take-profit orders at 25%, as we laid out in the Signal du Jour, you were fine. If not, that sharp Friday rally would have bitten hard. Layer in the grind higher in implied vol, and what started as an ideal setup quickly turned into a nightmare.

This is the retail trader’s curse: you don’t have the luxury of a full desk watching your book. You need to think through every possible hazard. Maybe you’re away from screens, maybe liquidity dries up—but the simplest protection is obvious: have your exit orders in place.

Let’s break down the actual PnL now—where the trade made money, and where it gave it back.

The greeks decomposition

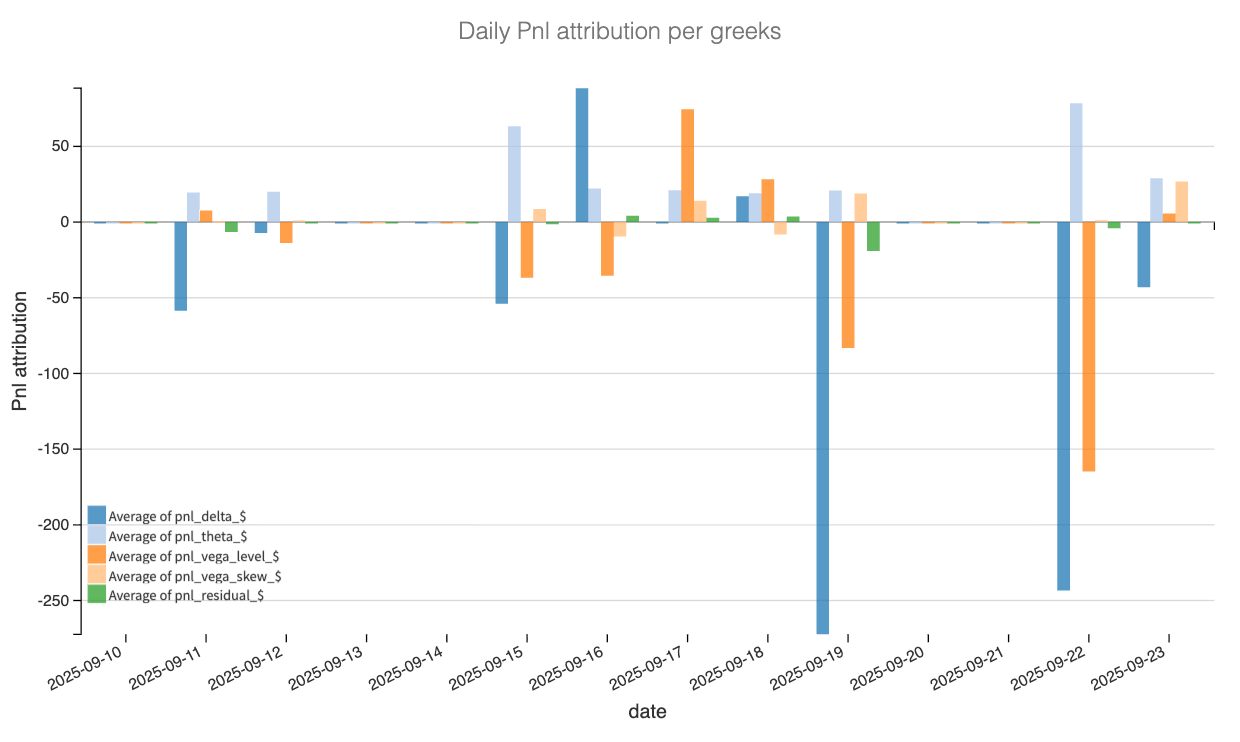

We decomposed the 100/150 strangle day by day, using end-of-day mid prices for options and translating the Greeks into dollar terms. As a reminder, our main buckets are delta, theta, vega level (parallel shifts in the surface), and vega skew (put/call shape). Finally, we use a residual bucket to capture higher-order path and effects.

The PnL decomposition makes the story clear. At initiation, the position behaved as expected: theta did the heavy lifting, steadily delivering positive carry while implied volatility remained elevated relative to realized. That carry tailwind shows up consistently across the early days, offsetting small negative contributions from delta and vega.

But the balance shifted quickly with the underlying’s relentless grind higher. Delta losses crept in, and on the worst days they turned into sharp drawdowns. The decomposition highlights just how violent those swings can be in a leveraged product like NUGT: delta attribution alone reached –$200 to –$250 on triple-witching Friday and the following Monday.

This is a prime example of the cost of not delta-hedging. You likely would have offset at least some of those Monday losses had you hedged. But our stance on hedging does not change: we accept certain path risks if it means making our operation cleaner and easier to manage. As always, there is no free lunch.

Interestingly, vega did not play the starring role here. It paid well right after the FOMC, but the grind higher in option demand—defying our forecast for where implied would land—ultimately worked against us.

This is the anatomy of a short-vol trade gone difficult, not because the volatility call was fundamentally wrong, but because path dependency overwhelmed it. The realized volatility forecast was broadly right—there was no explosive new regime—but the tape direction mattered more.

The decomposition carries an important lesson: short vol can look perfect on the metrics, but if spot refuses to cooperate, mark-to-market will not wait for your probability edge to materialize.

Even more important, chasing extra “theta” can backfire badly if execution discipline slips. Taking the 25% premium clip early—as laid out—was the difference between a clean win and a grinding drawdown.

Let’s now test whether it is worth keeping the position, or if the edge has evaporated.