Trade anatomy - short strangle in KRE

Post mortem Signal du Jour 2025/09/18

This is a perfect record of 4 out 4 since we’ve started that series early September. VRP harvesting and delta neutral trading is easier with the right forecasts: get access to our platform and get access to the probability to see IV exceed the subsequent realized volatility. That is the number one metric we follow to put a trade on.

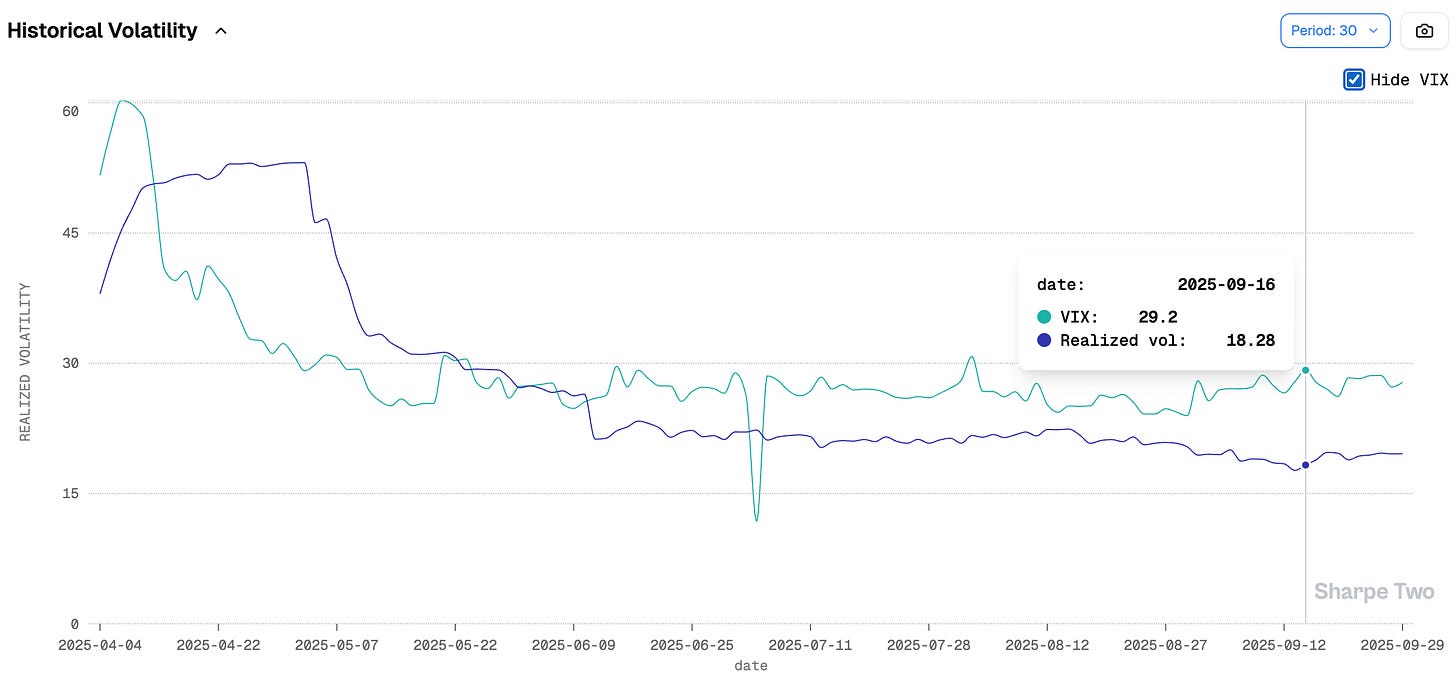

Still and quiet. The market is not moving and yet the premium it is willing to pay in anticipation of a potential move is very expensive. Of course, if you focus on levels: the VIX may seem low. VIX1d even more so, if you refuse to look anywhere beyond 0DTE. But all of that is relative. What matters is the comparison between implied volatility and realized volatility. And by every standard, options are on the expensive side.

We wrote two weeks ago about KRE, the ETF tracking regional banks, always prone to bouts of wild speculation, especially around FOMC days. At the time, the VIX for KRE was 29 while realized volatility sat well below 20. That opened the door to a great opportunity for those on the sell side of volatility. So how did it play out? Nice, smooth, and easy. If only trading could always be like this…

Let’s dig in.

The trade

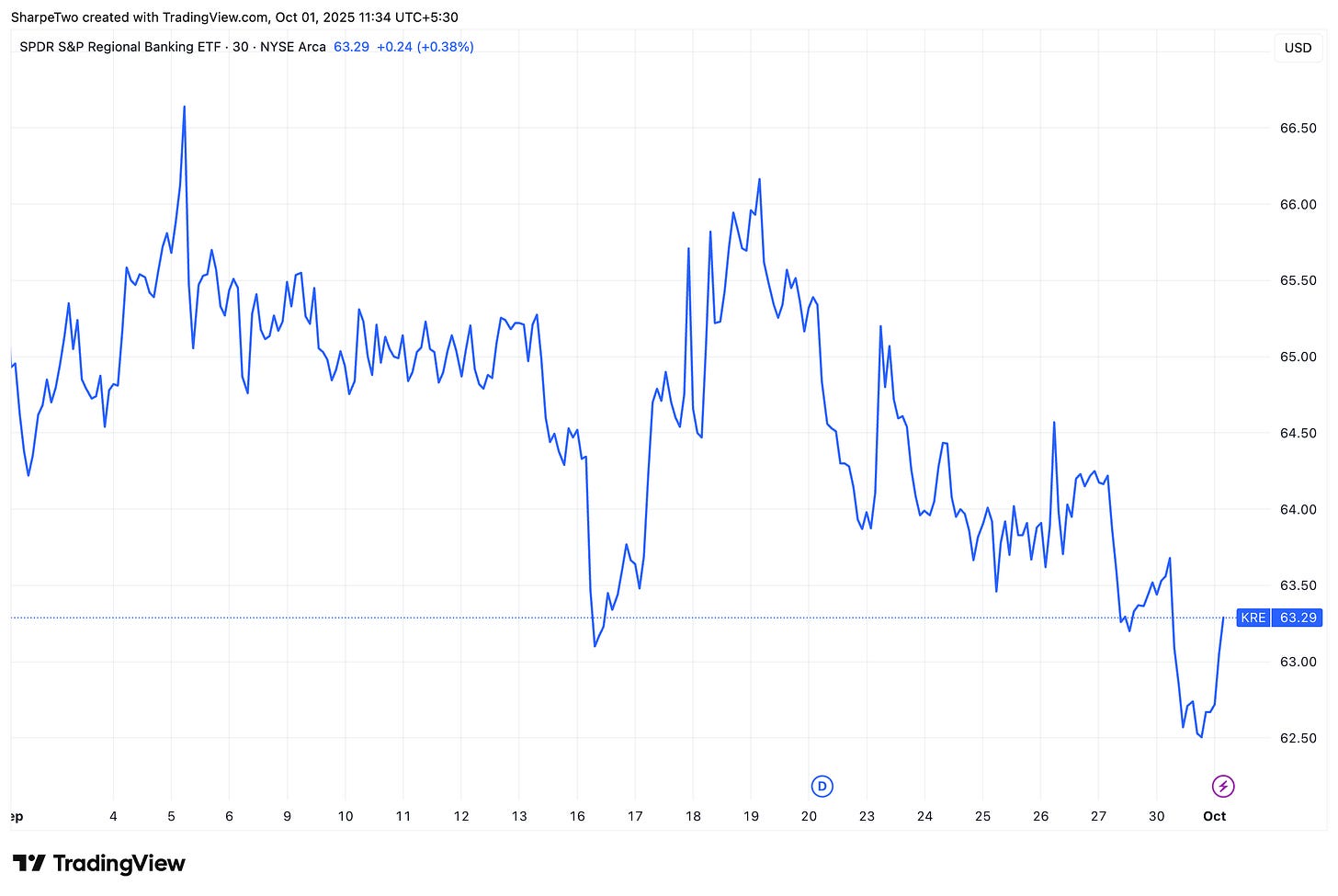

We put on a short strangle in KRE in the October 24 expiration, selling the 62/68 strikes. At the time, KRE was trading at 63.6, and if anything we were more concerned about the upside risk. Still, the delta-neutral approach carried some meaningful odds of success.

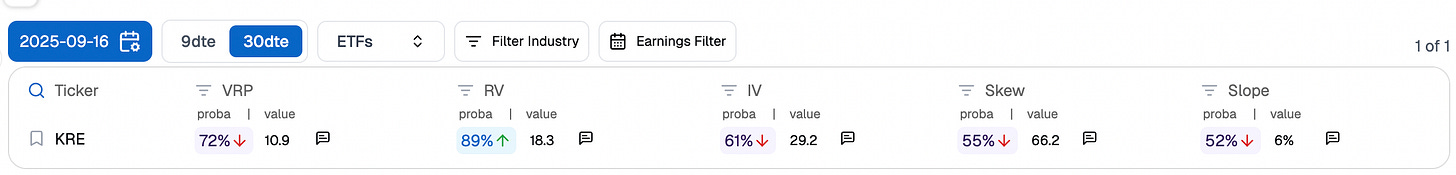

There was a 72% chance that the 30-day implied volatility we sold would exceed the realized volatility over the subsequent 30 days. We also knew IV was likely to come down from its elevated level: a 61% probability that some of the PnL would come from vol compression. Not the most compelling statistic ever, but enough to make it interesting.

The catch was on the realized side. We judged the likelihood of realized volatility staying this low as extremely slim—an 89% chance it would rise from its current level of 18.3. That expectation was central to how we structured the trade.

And indeed, implied volatility came down mildly from its elevated 29.2, while realized nudged slightly higher from 18.28. Nothing that would dampen the mood when it comes to VRP harvesting: we still had a solid 8-point margin at yesterday’s close. That even opens the door to potentially putting the trade back on. More on that at the end of the article.

Now, what about the underlying? We do not delta hedge our positions—we accept the risk that realized volatility could stay low while the asset drifts into a trend that ultimately breaches one of the strikes. In this case, that did not happen.

KRE stayed well contained within the boundaries. If anything, the hedge we bought in the form of a December risk reversal was not particularly useful this time—we could have done without it.

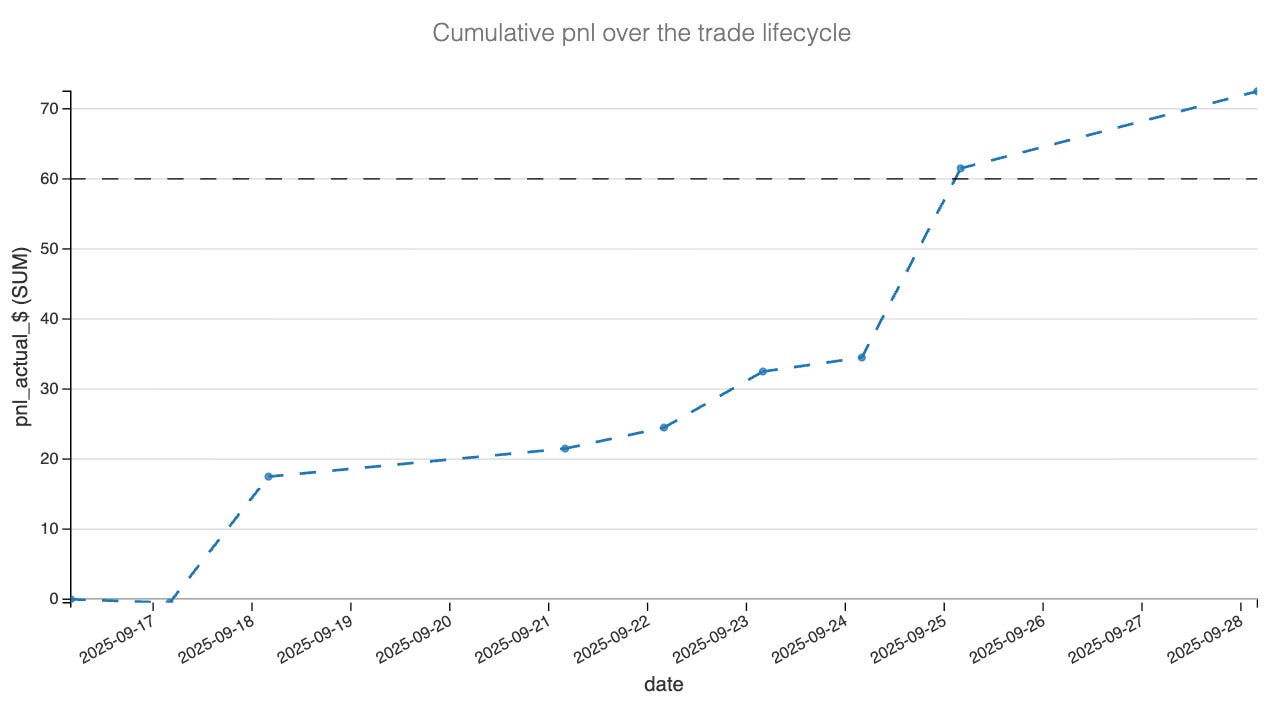

All in all, the short strangle played out smoothly, with PnL climbing steadily as time passed.

We had set the profit target at 25% of the credit received, and you could have closed the trade just eight days after entry, on September 25. But what explains the sudden jump in PnL between the 24th and the 25th? That move is what pushed us to target quicker than the two-week horizon. Given how little the underlying moved over that stretch, the most likely driver was implied volatility dropping.

Let’s take a closer look.

The greeks decomposition

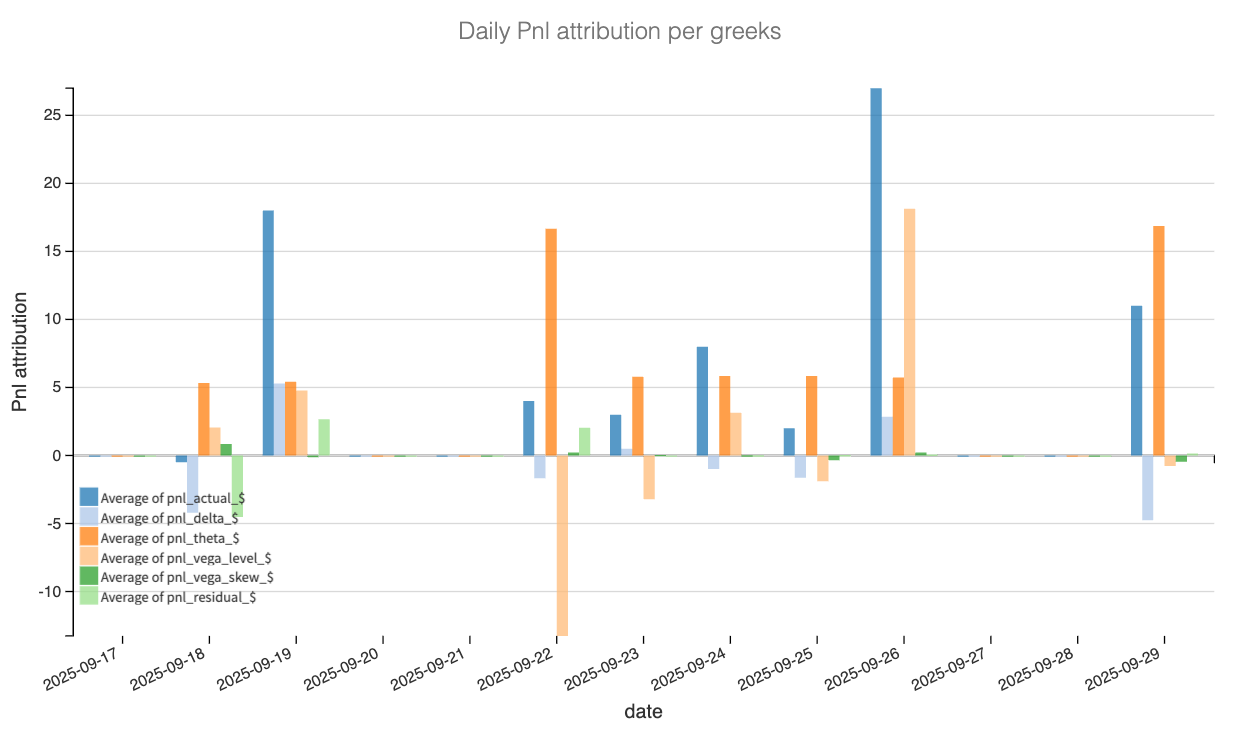

We decomposed the 62/68 strangle day by day using end-of-day mid prices for options and translating the Greeks into dollar terms. As a reminder, our main buckets are delta, theta, vega level (parallel shifts in the surface), and vega skew (put/call shape). Finally, we use a residual bucket to capture higher-order path and effects.

So what actually paid? Theta was the growth engine: it did the heavy lifting day after day and accounts for roughly three-quarters of the cumulative PnL. In a quiet tape with IV > RV, carry did exactly what it’s supposed to do.

But the swing factor was the vega level. As we hinted in the introduction of the article it is the big reason why we could exit the trade early. It hurt on Sept 22 when front-end IV popped post-FOMC and post triple witches, but then paid back with interest on Sept 26 as the surface relaxed. It was a very nice boost, aligning with our forecast that implied volatility should go down over the next two weeks.

The directional risk was a small drag overall but nothing substantial. KRE oscillated but stayed well inside the 62/68 rails; occasional pushes showed up as light blue dips but nothing was ever thesis-breaking.

Finally the vega skew and residual were rounding errors. Our forecasts had no strong opinion on the skew: at 55%, puts vs calls could have gone either way, and same goes for the slope in the term structure.

So in the end, theta kept grinding as the carry of IV over RV was almost extreme for a ticker like KRE, and a one-off parallel IV drop added a chunky vega-level gain. That combo pushed the position to the 25% profit target eight days in, earlier than the two-week budget.

Considering how things went, it is only fair to ask if it is worth keeping the trade on. After all, the VRP is still quite pronounced and the position is still overal delta neutral. Let’s have a look at what the forecasts says.