Thursday Shopping List

Struck by variance

It’s already the last Thursday of May, leaving us wondering what happened to Q2. The tensions between Israel and Iran feel like a decade ago, and NVDA is now so well anchored above the $1000 mark that it’s hard to believe it was flirting with it for weeks without ever breaching it. On a personal note, this is also the last bulletin we are sending from Mexico City, as we will be migrating to Europe for the summer.

Time is a weird notion—it compresses when volatility is high and expands to feel like forever when volatility is low. The May sessions could blend into one long session; it would probably feel the same. However, there are some nuances and subtleties—VIX 14.5 is low. Yet, in the context of May, it is the highest it’s been in a while.

This is somewhat expected as several key figures and FOMC meetings are on the calendar for the next 14 days, and market participants are gearing up for that, just in case. But how do we know this is not the beginning of a spike? Last week, we faced this question when the VIX jumped from 11 to 13 in 48 hours. The truth is, you never know, and there are no clear-cut metrics to assess that. You could employ some fancy machine learning techniques, but the reality is, when there is a spike, it feels like it: time “feels” different, and the sentiment will be all over the financial outlets.

In that context, how can we not look at VIX 14.5 as a gift from the market gods? Beggars can’t be choosers, and we’ll take that any day over VIX 11. Be careful here: we are not suggesting it can’t go to 20. However, the burden of proof is on realized volatility, and it doesn’t feel like it right now.

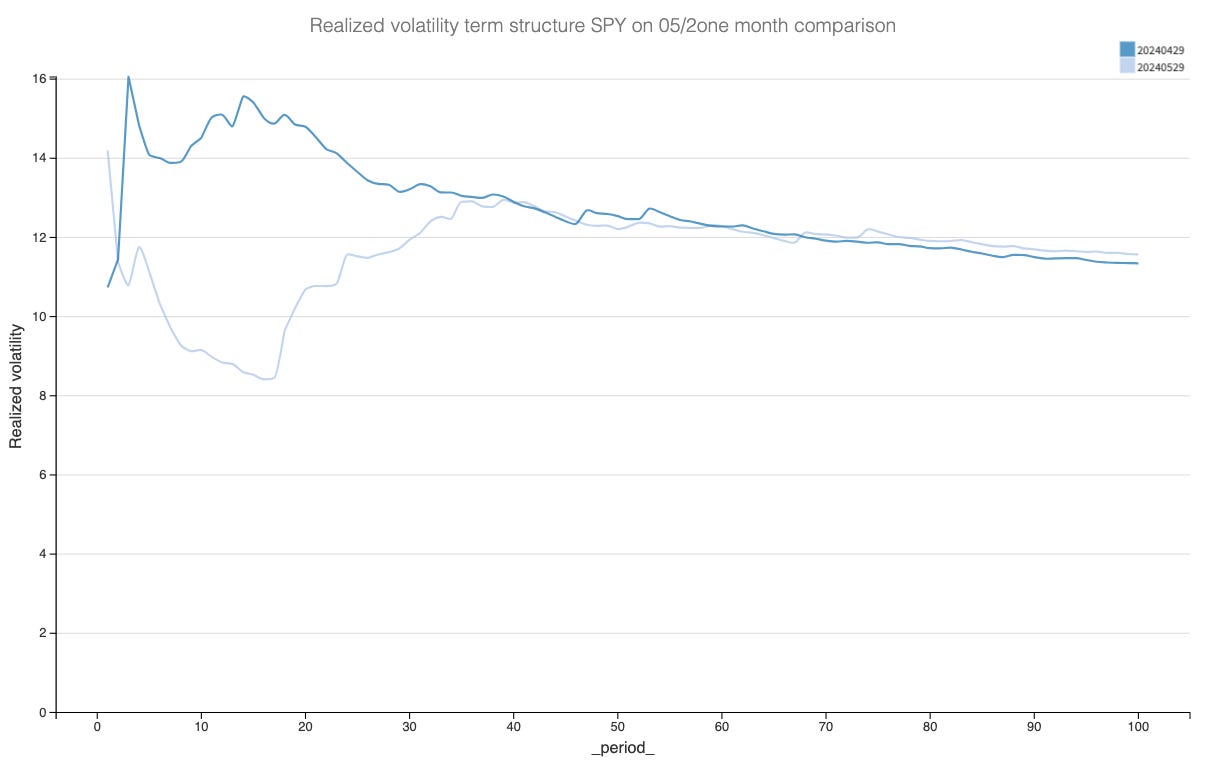

We barely realized 16 when missiles were flying. And given that we’ve realized less than ten over the past two weeks, it would take some serious black swan event to invert that curve.

With all that in mind, it is Thursday, which means it’s time for our fun trade of the week. We are not going to lie; it hasn’t always been fun these past few weeks—a low volatility regime means higher gamma risk and shorter-dated tenures.

Needless to say, we’ve had our fair share of realized gamma in the names we picked (yes, GLD, we are looking at you). If variance is the name of the game, we must embrace both the thrill of the ride and the inevitability of the unexpected.

The rules

Before we start, let’s do a quick round-up about the rules.

Short an ATM straddle in the 1DTE contract 31/05 as close as possible to Thursday night's close. In all our metrics and charts, we assumed an execution at 3.50 p.m., but the entry timing doesn’t matter too much: avoid getting in too early, but getting in too late gets you less premium.

Exit the position as close as possible to Friday's expiration. Again, we assume an execution at 3:50 p.m., but depending on your risk tolerance and satisfaction with the returns, it can be useful to manage the position earlier. We also have noticed a trend lately where liquidity evaporates in the last hour of these options—another reason why it may be best to manage earlier.

One word of caution: if you get assigned, leave the trade altogether and eliminate the underlying. If you decide to keep it and “sell premium against it,” it is at your discretion and outside this strategy's scope. It’s okay to keep the other leg expiring out of the money; there is no reason to pay an extra dime to your broker. Ensure it is far enough from any post-market move — the settlement happens at 4.15 pm, not 4 pm.

As mentioned above, our Discord community keeps growing. You can find a few industry professionals, professional retail traders, and absolute beginners.

We monitor the Thursday Shopping List, the Signal Du Jour, and many others mentioned in this newsletter. It is a great place to hold yourself accountable for key mandatory success principles. Contact us if interested, and we will share the pricing details.