Thursday Shopping List

Low vol regime - who is laughing now?

Another week with very limited volatility, and markets keep grinding higher. As we’ve noted for a few weeks already, the CPI data and Powell’s interventions don’t have the same effects on participants' moods: they may react in the very short term, but give it a few hours, and all these moves are absorbed by the constant flow of orders lifting the offers. How long will it last? We have no idea.

What is certain right now is that worries are pushed far away unless something major and new emerges to shape the American economy. Investors do what they do best—spend money on stocks and aim to deliver their benchmark at the end of the year.

What is left for options traders? Let’s be clear: at VIX 12.44, crumbs. Let’s look at a chart from our friends at Moontower.ai.

Do you see the concentration of tickers, regardless of the asset classes, stacked up on the left-hand side of the chart? Realized volatility has disappeared, and while the VRP is still present, it is not particularly stretched and is subject to much gamma risk. As soon as realized volatility reappears, it will pop up again. When will that be exactly? We have no idea. But considering Memorial Day weekend is a week from now, our money is not necessarily in the short term despite NVDA earnings next week.

Needless to say, finding corners of the market where things may be mispriced in this super-low volatility regime is borderline masochistic—why would you fight in illiquid markets when you can simply… be long?

Notice how market makers constantly bid at VRP <=1 and how the spread has seriously increased over the last few months? Trading vol in the names we traditionally look into has been a lot of work lately. This will be the subject of a longer analysis.

Yet, fight for mid-price, or your chances of entering a bad trade are much higher than at the end of 2023. Once again, why wouldn’t you just… be long?

If you insist on using options, risk reversals are a great place to start, but they are slightly out of the scope of this newsletter, where we focus much more on ATM volatility and straddles. Focus on products with a clear upward bias (like equity baskets) and where you observe positive put skew and negative call skew. You can then sell an expensive put and buy a cheap call. We’ve been managing that position for months, and it is one of the best trades in the Discord group in the current market setup.

That being said, we still have to trade volatility. And like every Thursday, we will look into 1 DTE contracts that may be overpriced. Yet, with such a low level of volatility in the market, the reward to cost is far from optimal. As stated earlier, the overall gamma risk in these options is such that controlling your sizing in this super short tenure is more important than ever. We insist on that—increasing the sizing to increase your “take home” on each trade may be tempting. Mr. Market is unforgiving, though, and will eventually levy the variance tax.

Do you know what sucks more than no volatility in the market? Losing months of hard work and PnL acquired in stressful periods because you became greedy and complacent when there was nothing to do.

The rules

Before we start, let’s do a quick round-up about the rules.

Short an ATM straddle in the 1DTE contract 17/05 as close as possible to Thursday night's close. In all our metrics and charts, we assumed an execution at 3.50 p.m., but the entry timing doesn’t matter too much: avoid getting in too early, but getting in too late gets you less premium.

Exit the position as close as possible to Friday's expiration. Again, we assume an execution at 3:50 p.m., but depending on your risk tolerance and satisfaction with the returns, it can be useful to manage the position earlier. We also have noticed a trend lately where liquidity evaporates in the last hour of these options—another reason why it may be best to manage earlier.

One word of caution: if you get assigned, leave the trade altogether and eliminate the underlying. If you decide to keep it and “sell premium against it,” it is at your discretion and outside this strategy's scope. It’s okay to keep the other leg expiring out of the money; there is no reason to pay an extra dime to your broker. Ensure it is far enough from any post-market move — the settlement happens at 4.15 pm, not 4 pm.

As mentioned above, our Discord community keeps growing. You can find a few industry professionals, professional retail traders, and absolute beginners.

We monitor the Thursday Shopping List, the Signal Du Jour, and many others mentioned in this newsletter. It is a great place to hold yourself accountable for key mandatory success principles. Contact us if interested, and we will share the pricing details.

The list

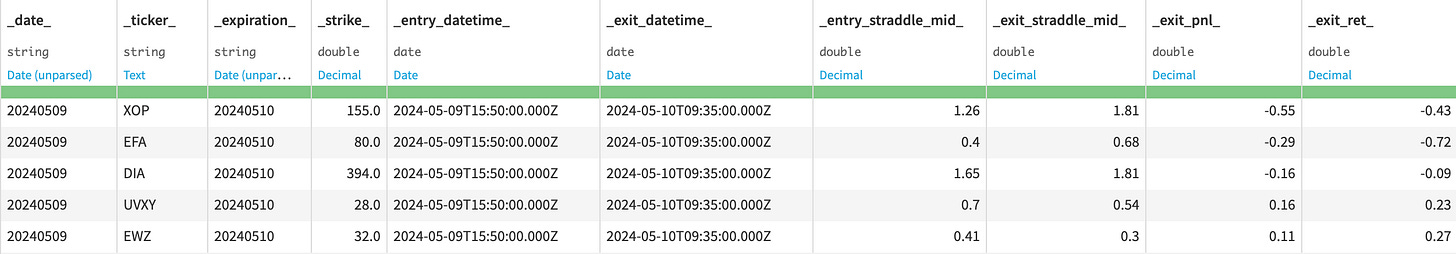

Let’s start by having a look at last week's results:

The results were bleak, with some major moves happening in XOP and EFA.

Keep reading with a 7-day free trial

Subscribe to Sharpe Two to keep reading this post and get 7 days of free access to the full post archives.