Signal du Jour - XOP Sharpe Ratio 1.94 Win Rate 69%

Looking for some diversification prior to the Fed

The equity markets are soaring to new heights, fueled by enthusiasm for the AI sector and positive expectations regarding interest rate trends in 2024. This Thursday is particularly noteworthy as Chairman Powell is scheduled to speak before Congress on monetary policy. Market participants are waiting for any clues about potential rate cuts by year-end.

In light of this, we're turning our attention to XOP, the ETF focused on the oil and gas exploration and production sector. This area often shows resilience against the broader market's ups and downs, offering an essential safeguard ahead of Powell's address.

Let's dig in.

The context

Let’s start with the obvious: the oil and gas exploration and production sector's performance is intrinsically linked to the dynamics of the underlying commodities. Essentially, when the price of oil and gas rises, the sector thrives. This uptick makes even the most challenging and expensive exploration projects viable, as the expected returns can outweigh the costs.

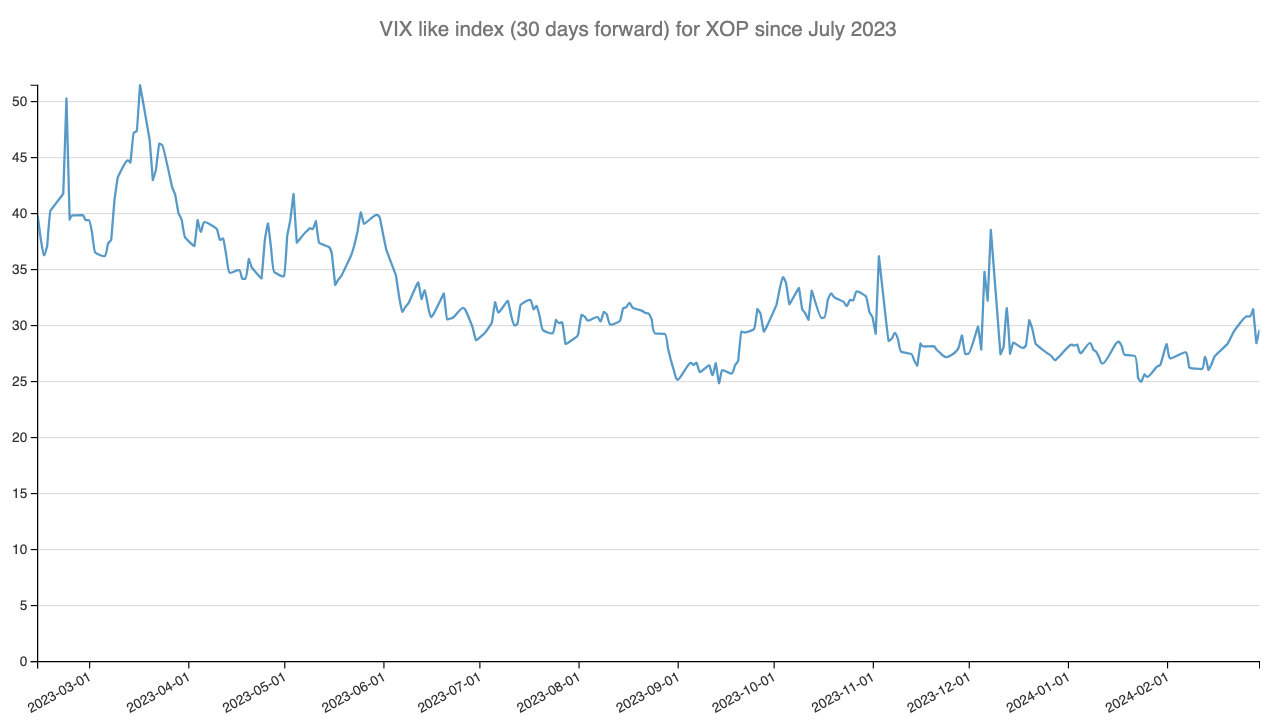

XOP, the ETF we're focusing on, adopts an equal-weight index strategy. This approach mitigates the impact of individual companies' misfortunes on the ETF as a whole, contributing to more stable realized volatility. Despite recent geopolitical tensions in the Middle East, Ukraine, and OPEC's efforts to maintain elevated commodity prices, XOP has exhibited consistent trading patterns. Its historical volatility is currently at a two-year low, signaling a period of relative calm in what is often a turbulent sector.

Despite the current stability within the index, market participants are likely to remain cautious, keeping insurance premiums higher than one might expect given the calm. This caution stems from the understanding that the sector could be significantly impacted by any major external shock—whether from geopolitical escalations or deteriorating economic conditions that could lead to reduced commodity prices.

Given these considerations, there's a substantial likelihood that the implied volatility will exceed the actual movements in the underlying asset. This discrepancy between expected and realized volatility presents a valuable opportunity for those looking to sell volatility.

Let's dive into the data.

The data and the trade methodology

By applying the CBOE methodology, we've reconstructed a VIX-like index for XOP, focusing on options with approximately 30 days until expiration.