Signal du Jour - skew trade in the tech sector

Riding the NVDA waves.

A staggering 80% growth year over year, and Nvidia has shrugged off Deep Seek concerns without breaking a sweat. Demand remains strong, and according to CEO Jensen Huang, there’s nothing to worry about. Not too surprising—Deep Seek is barely four weeks old. Let’s revisit the conversation in June or September.

With NVDA earnings out of the way, the entire equity market seems to be breathing a little easier this morning after a few choppy sessions. One of our Discord members pointed out that shorting vol overnight paid off quickly, delivering an easy 25% as soon as the results were behind us. Again, no big shock—NVDA earnings have become as much of a market-moving event as an FOMC meeting or an NFP report.

So, were investors over-preparing for the worst these past few days? And is there still some lingering overpriced volatility in the tech sector that we can take advantage of? Let’s dig in.

The context

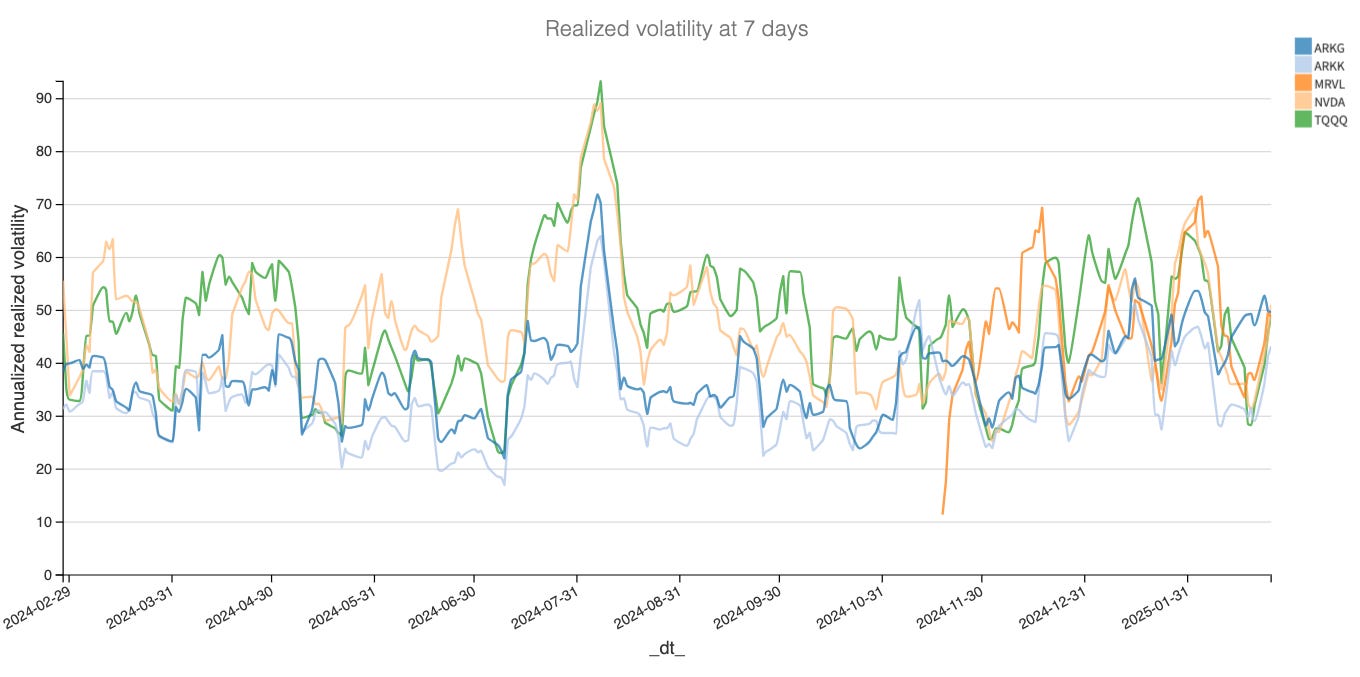

While February has seen realized volatility cooling off and implied volatility remaining slightly elevated—ushering in a welcome return of the VRP—the tech sector had been bracing for NVDA earnings. Over the past week, realized volatility had been steadily climbing.

Now that earnings are behind us, the market will likely take a breather before the next catalyst prompts investors to rush back into hedges. To be clear—we’re not making a bullish case for tech here. We’re simply pointing out that realized volatility is likely to decline. The market could continue moving sideways, and we’re not placing bets on direction.

From a forecast perspective, the tickers we’re watching indicate that realized volatility will remain elevated in the short term.

A 50% realized volatility is no small feat. If you’re not accustomed to these kinds of swings—or if you have a smaller account—you should be especially cautious with these names.

That said, as interesting as these forecasts are, what truly matters right now is how much premium is embedded in the options market and, more importantly, whether one side (puts or calls) has been bid up to an unreasonable degree.

Let’s take a closer look.