Signal du Jour - short vol in XLV

Quiet product and razor thin edge.

October kicked off with a government shutdown and fresh all-time highs in US indices. Apart from a quick overnight scare where futures flashed –0.8%, the big sell wave never came. Quite the opposite. With realized volatility still scraping the floor, it is hard not to start eyeing an end-of-year rally with growing confidence. Once again, every so-called catalyst has been dismissed, and fighting this tape can prove costly. You can disagree with VIX at 16 — but do it at your own risk.

After shorting implied volatility in US equities last week, this week we turn to a sector ETF: XLV, healthcare. It has been a hot topic in our Discord as traders run setups through the platform — and XLV is just one of many tickers delivering strong signals so far.

Let’s dig in.

The context

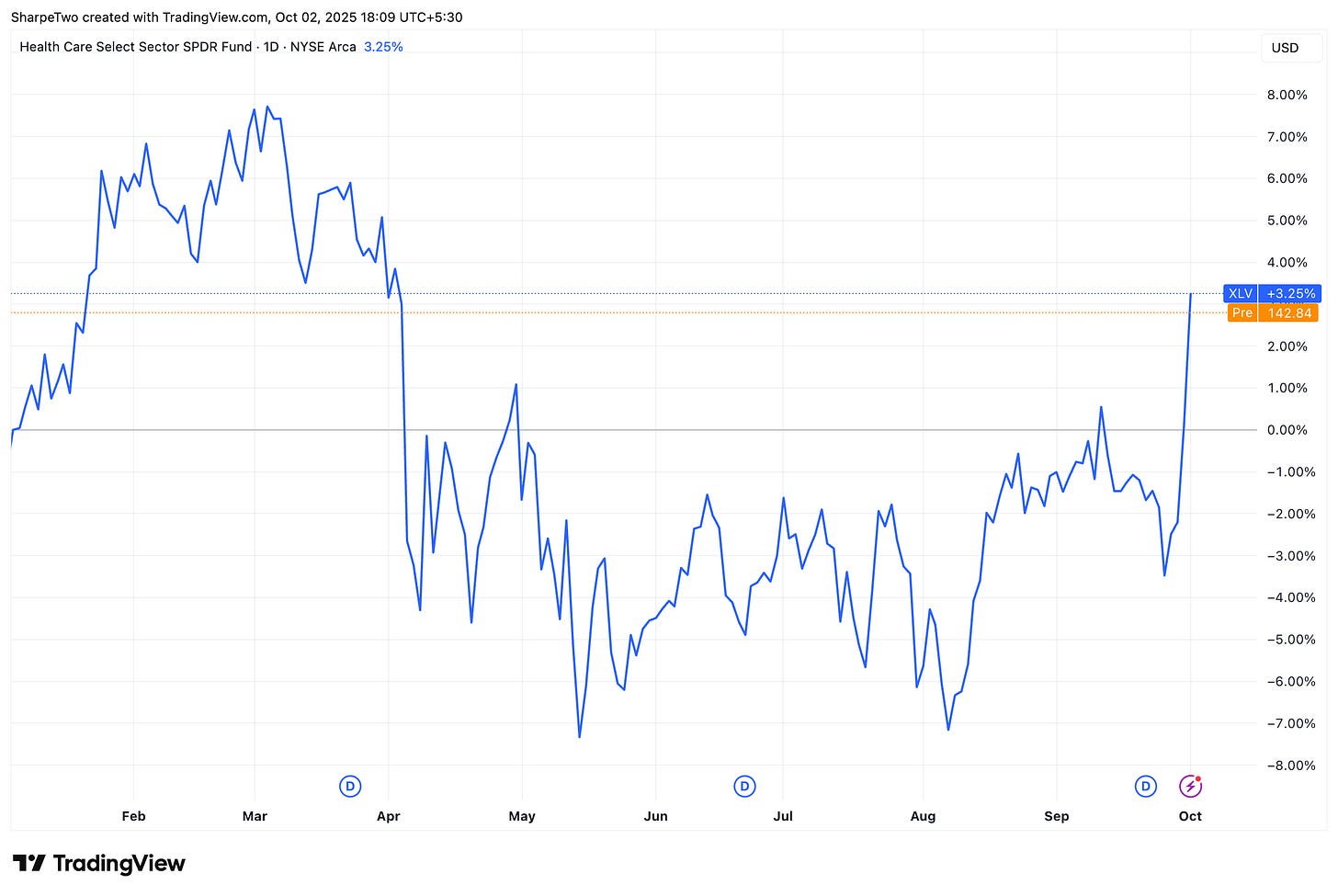

Everything has been said about the low-volatility regime we have now lived through for more than a quarter. A sharp contrast to the first three months of the year, which climaxed with April’s tariff fireworks. XLV was not immune, though the damage was far lighter: at the peak of the April storm, the sector was only down about 5%. It drifted lower through the summer, but has since stabilized and even turned positive over the past month.

As you might guess, realized volatility runs naturally low in this sector. XLV is dominated by heavyweight healthcare names and does not swing like its noisier evil twin, XBI — the biotech ETF. Still, since this low-vol regime began, the two have started to look more alike in their behavior.

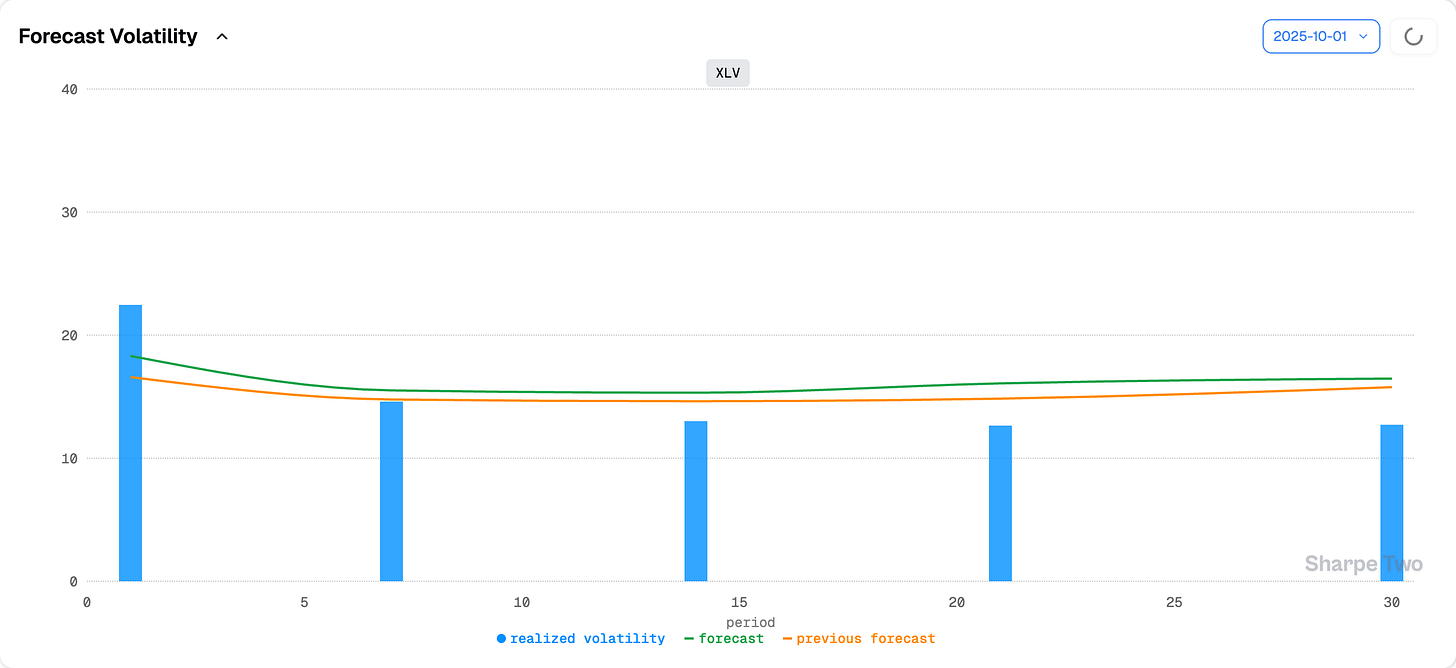

Compare that with 2023, when XBI traded around 30 annualized realized volatility while XLV sat at half that. Today XLV is at 12, XBI at 18. If you were playing the long–short volatility spread, that divergence might spark some ideas — though of course you would need to weigh their implied volatilities before making any move.

At 12, XLV’s realized vol is not especially low. For this product, which rarely pushes above 15, it is perfectly normal. And our forecasts do not point to anything wildly different from what has been realized recently.

At best, expect realized vol to run two or three points above the current print — but do not expect a sharp return to higher levels anytime soon. The catalysts simply are not there.

Now, let’s see what option prices are telling us and how to structure a trade in XLV.