Signal du Jour - short vol in XLP

Thin edge but great signal.

A second red day in less than a week? That hasn’t happened in almost a year and must have caught a few traders off guard. We're monitoring the situation, but so far, the VIX hasn’t been able to challenge 15. While it could spike at any time, it's advisable to avoid deltas when uncertain and hedge your positions.

Speaking of avoiding deltas, and given the current market agitation, today we’re focusing on XLP, the ETF that provides exposure to the consumer staples sector. The earnings cycle began about a week ago, and with this, some sectors are seeing their implied volatility slightly overpriced.

This doesn’t come without risk: let’s see if it’s worth taking.

The context

The consumer staples sector is traditionally a defensive one. Market participants tend to favor stocks with predictable business plans and results when nervous. Be careful here—we are not saying this is what is currently happening or why the Nasdaq is down, nor are we suggesting you buy XLP. We have no opinion on the direction of XLP.

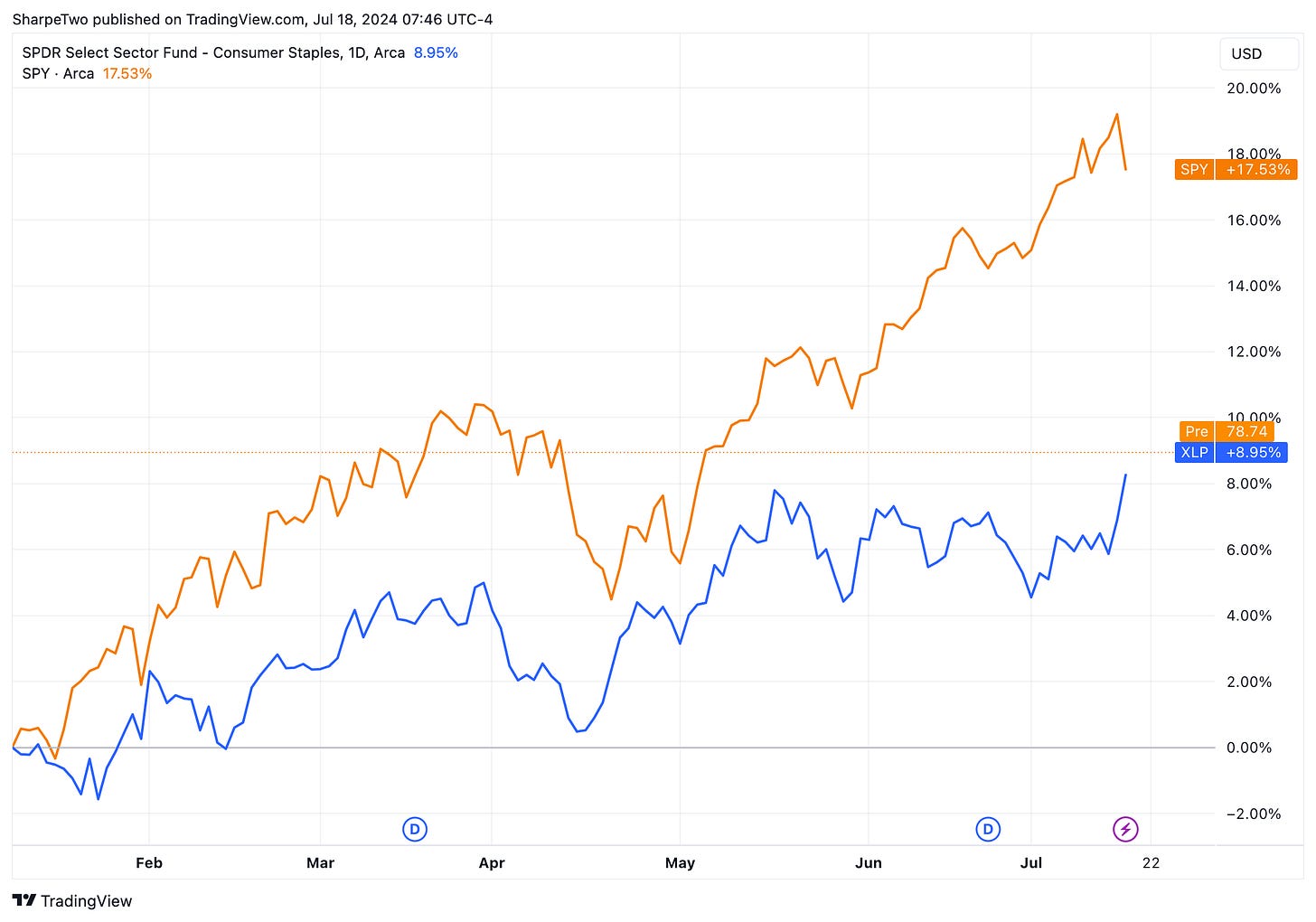

Since the beginning of the year, the sector has been up roughly 9% and is seriously trailing the SP500. However, the premise is that for a lower return, you are supposed to have less volatility in the returns. The least we can say is that since 2023, that fact isn’t as crystal clear as it used to be:

When market conditions were much tougher, you used to observe a significant added level of risk when holding SPY over XLP. Since the regional bank crisis, that premium has completely disappeared. Yes, it did come back in April when tensions between Israel and Iran showed that fund managers are less likely to get rid of this sector when things go crazy, but it disappeared as soon as things calmed down.

Despite a few red days over the past week, we are still in a very unusual situation where the realized volatility for XLP is above that of SPY.

Now, once again, realized volatility is extremely poor at predicting future returns, and we wouldn’t want you to read that as yet another signal that we are due for a correction in SPY. We are saying that if things accelerate on the way down, XLP shouldn’t be less impacted than SPY.

With that in mind, let’s look at the options prices and see how they compare to the current level of risk observed in XLP.

The data and the trade methodology

As one could guess, when you have little risk (measured as realized volatility), you can’t expect the market to be willing to pay a hefty premium. That is perfectly reflected in the prices of options in XLP.