Signal du Jour - Short vol in XBI

Ripping the benefits of an equally weighted ETFs.

The markets have been relatively stagnant since last Friday, and we're on the cusp of a wave of economic data, starting this morning with durable goods orders. Could this data spur market movement? Absolutely. However, as mentioned in yesterday's discussion, we're observing backwardation in realized volatility, a situation unlikely to persist for long.

Today, we're exploring another interesting setup for volatility sellers, focusing on XBI this time. XBI offers exposure to the biotech sector, a realm famed for its volatility and the potential for its constituents to experience drastic swings within a single day.

Let's dive in.

The context

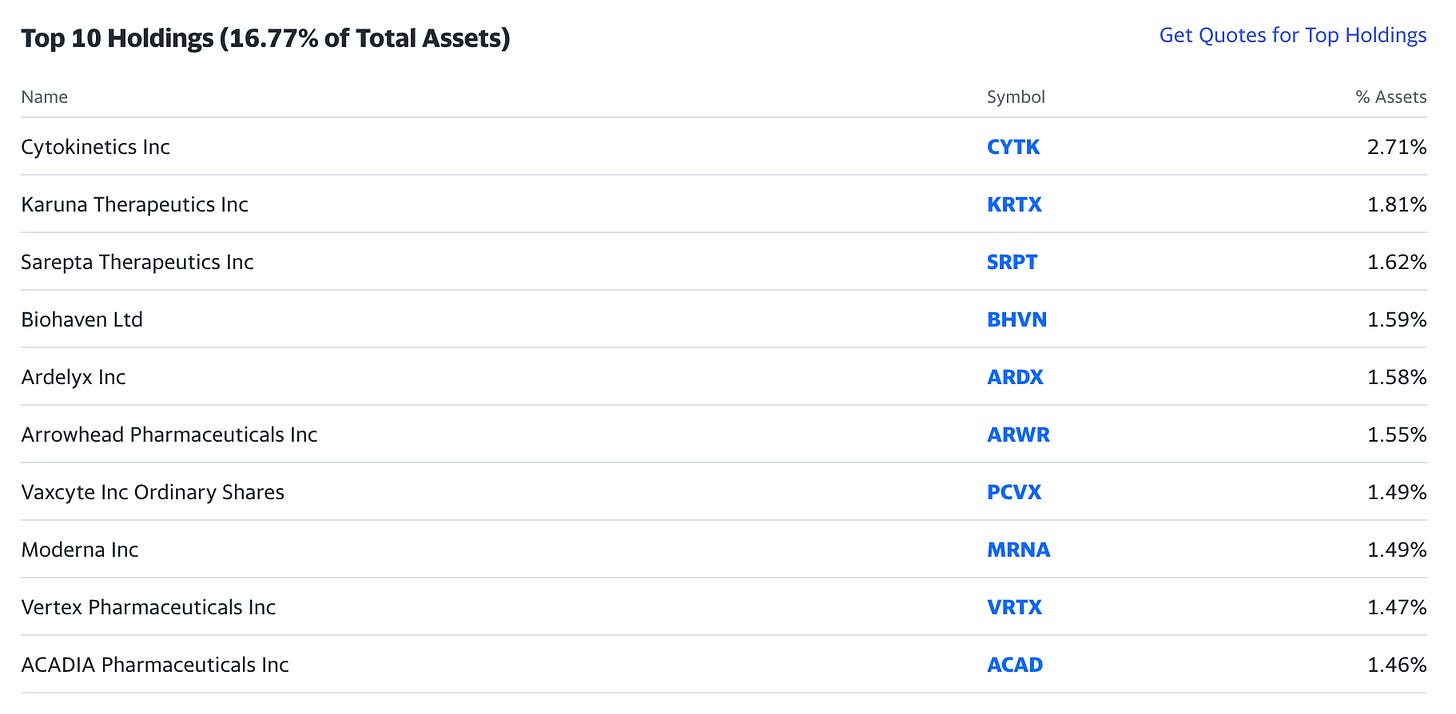

XBI is an equally weighted ETF dedicated to the biotechnology sector, making it an excellent tool for investors seeking diversification. The biotech sector is notorious for the dramatic fluctuations its stocks can undergo. News of drug approval or the failure of a critical test can dramatically affect a stock's value, sending it soaring or plummeting.

Navigating stock picks within this volatile sector can be challenging for those not deeply versed in its intricacies. This is where the value of XBI shines: it mitigates the risk associated with individual stock performances. Even if one stock in the ETF's portfolio takes a hit, its impact on the overall fund is cushioned, providing a more stable reflection of the sector's health.

We're not biotechnology experts; we've generally kept a distance from these stocks—even during the COVID era. However, we excel at analyzing volatility to unearth compelling trading opportunities.

Like much of the market, XBI experienced a significant bull run since November 2023, surging almost 50% within four months! Concurrently, its realized volatility has been on a decline, currently standing at 31%, which is on the lower end of its two-year average.

Despite this relative tranquility in the sector, it's improbable that volatility sellers have adjusted their prices downward to reflect the reduced risk in the indices. If the sector remains calm yet the cost of insurance remains elevated, this discrepancy offers an excellent opportunity to consider short volatility positions.

Let's dive into the data to explore this setup further.