Signal du Jour - short vol in VXX

A few extra points of VRP until the end of the lazy summer?

We were promised hell week. Instead, dip buyers said hell yes. Waiting for better prices two weeks ago was the right move—and taking them when they showed up was even better.

So now what?

As we often say at Sharpe Two: VIX 16 tells you everything you need to know. The odds of a calm week were always decent—no catalyst, no panic. But the real tests begin next week: CPI, Jackson Hole, and a wave of commentary on the state of the US economy.

Which brings us back to the “but” we mentioned on Sunday: keep some dry powder. Going all in now? Probably not the best timing—again.

Now that the usual warnings are in place, let’s talk about one of our favorite setups: short vol in VXX. Let’s take a look.

The context

A brief pop in VIX earlier this month—and already we’re back meaningfully lower at 16. That did not leave much room for VXX short sellers (or SVIX buyers) to build positions. And just as we were finishing the sentence that maybe VXX would take a bit longer to bleed out… it went ahead and dumped it all.

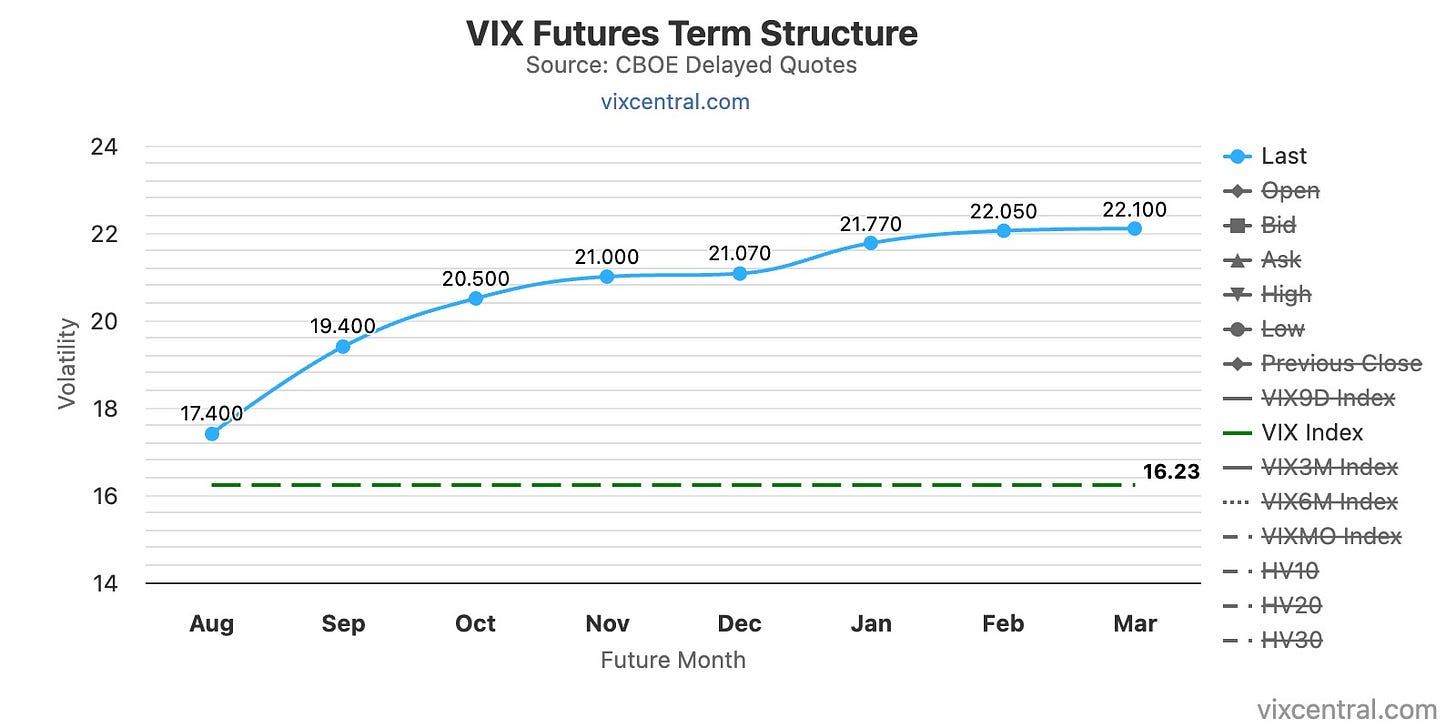

The slope you see? That’s a mirror of the VX futures term structure. VXX fund managers are forced buyers of the front and sellers of the back. In contango, that means buying the cheap and selling the rich—over and over again.

With contango now clearly steeper than it was late last week, you have your explanation for the -12% drop between Friday’s close and today.

If you had to do one thing and one thing only—managing your exposure based on the slope of that curve is a well-documented strategy. But if you want to add some variation, you can also look at the more traditional difference between realized and implied volatility.

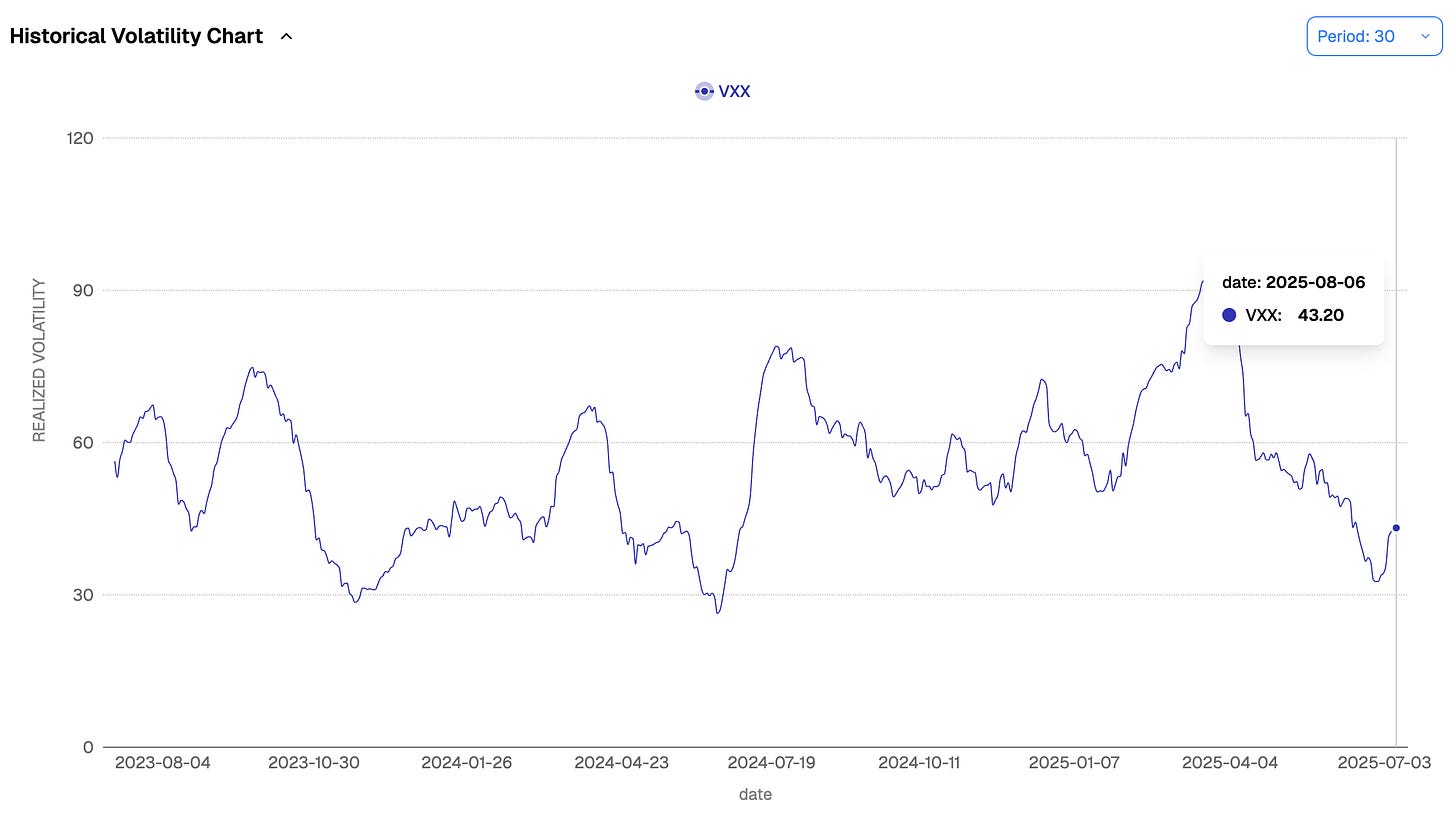

As one would expect, realized has been overall pretty quiet in VXX since April.

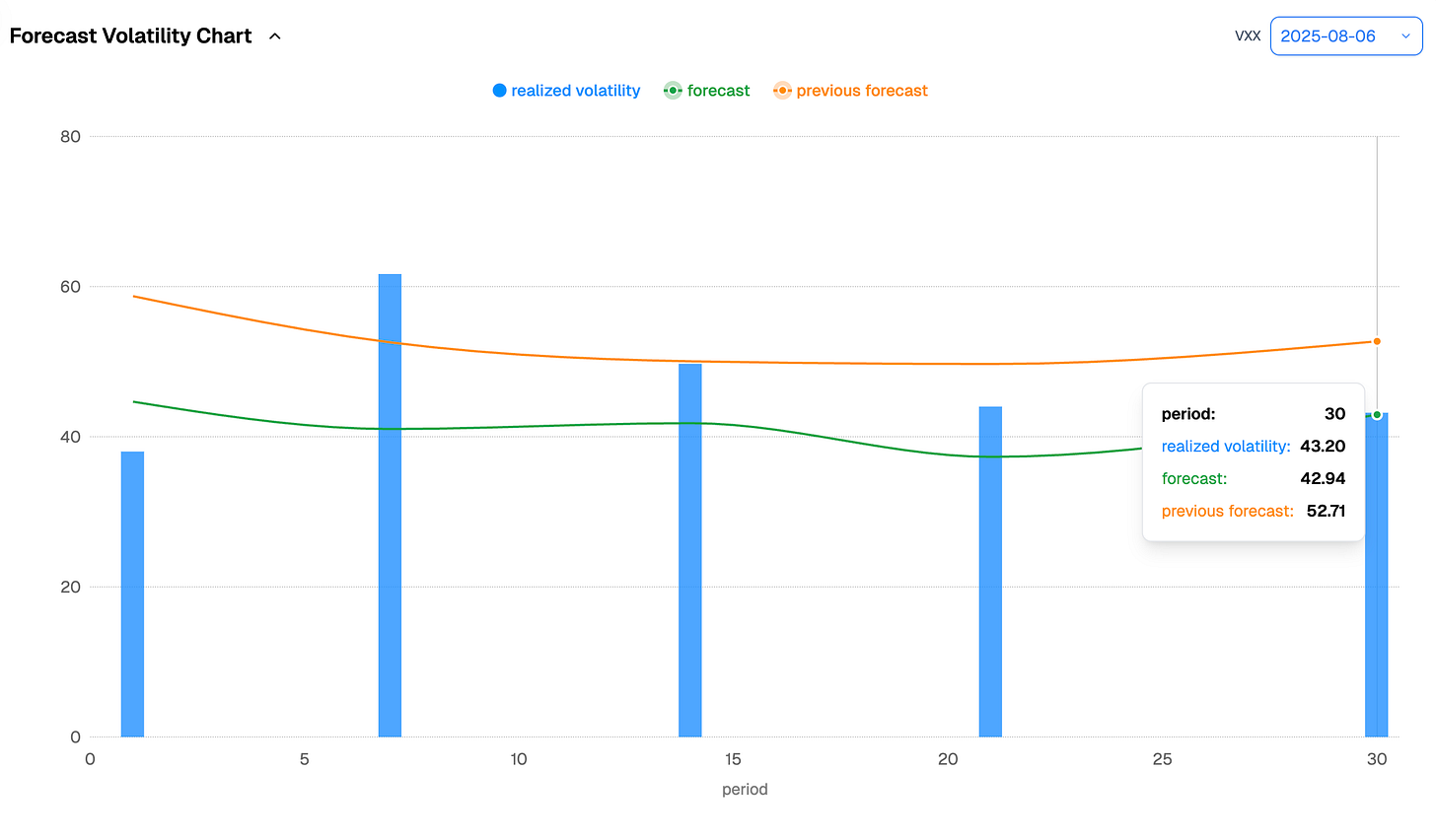

From an eye-watering 90 at the height of the tariff crisis to the low 30s last week as the lazy summer dragged on—it’s been quite the ride. With the calendar filling up again over the next few weeks as we head into September, it’s unlikely we revisit the 30s any time soon. That said, VIX 16 still tells you a lot about market expectations, and our realized volatility forecast for VXX is very much in line.

Could we see 60 in realized volatility over the next 30 days? Absolutely—though that is not our base case. We currently anticipate something in the 43 to 53 range. Still, vol of vol is highly sensitive, and being a little extra cautious never hurts.

With that in mind, let’s take a look at how much traders are willing to pay for insurance in VXX at the moment.