Once again, the world hasn’t ended—yet.

We're keeping an eye on the market’s response to the upcoming GDP data release. However, NVDA, after initially dropping as much as 10% following its earnings announcement last night, has recouped most of those losses and is now only down by a modest 2%. For traders accustomed to NVDA's typical realized volatility of around 70% in August, this is just another day at the office.

And since we've made it through this tumultuous August relatively unscathed—despite a swift and intense selloff and the VIX spiking above 60—we're considering a trade that might still seem daunting to many in the marketplace. Today, we're looking at a short volatility position in VXX.

Let’s dive in.

The context

Looking back, people may be talking about August 2024 for years. Consider this: if the markets were to drop 20% in the next six months, many would look back at that tumultuous first week of August as a clear warning signal that insiders had seen coming and acted upon by exiting the market.

Conversely, if the market stabilizes, this period might be recalled as another "Volmageddon" akin to what happened in February 2018. Although the triggers are different—back in 2018, some ETFs blew up, which hasn’t been the case this time—the impact on the marketplace has echoed similar sentiments.

Since then, the overall market mood has darkened slightly or, at the very least, failed to return to the euphoria enjoyed until early July.

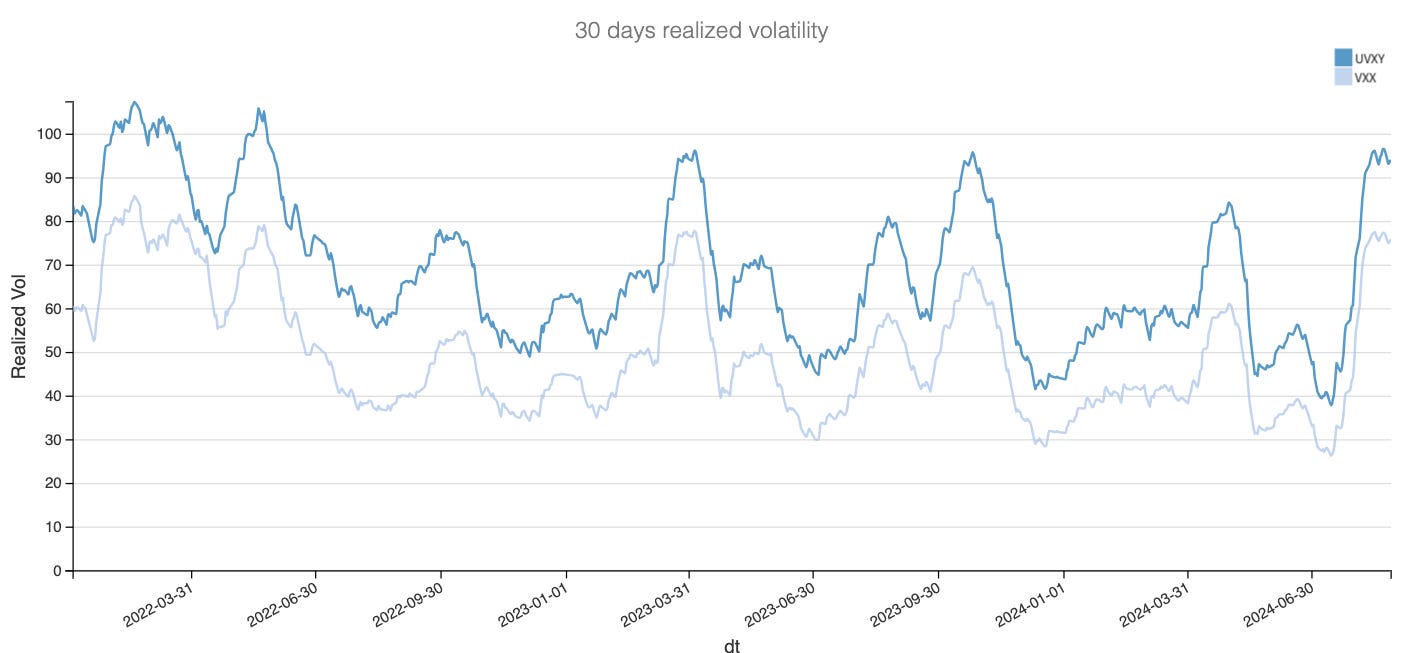

Despite the promise of a new rate cut cycle, some better economic data than late July, and a generally solid earnings season, the markets have yet to set new all-time highs. True, a 10% rebound over roughly two weeks was nothing short of remarkable, but still—the VIX didn't manage to return to its lowest readings of the year and, more notably, realized volatility in related products remains stubbornly high.

We may be peaking, and the 30-day realized volatility will descend from here. Realized volatility typically reverts to its long-term average, and with a less congested calendar ahead—and the world evidently not ending—it doesn’t seem too far-fetched to anticipate a downturn.

However, August's recent turmoil may still be fresh in the minds of options traders, prompting them to demand substantial premiums for shorting volatility in these products. Let’s dive into the data to see what it reveals.

The data and the trade methodology

Let’s begin by juxtaposing the realized volatility we've discussed with the level of implied volatility, utilizing the price of 30-day-to-expire options in VXX for our analysis.

Keep reading with a 7-day free trial

Subscribe to Sharpe Two to keep reading this post and get 7 days of free access to the full post archives.