Signal du Jour - short vol in VXX

Don't be reckless: You Live Only Once.

After quite the end-of-the-month movement in equities, investors are left dazed this morning, wondering if the rally will continue or if it’s another trap before another leg down.

We have an opinion on the matter, but that’s not our primary objective at Sharpe Two. We aim to stay as market-neutral as possible and find trades where volatility is overpriced, offering a decent premium as soon as we enter a trade.

In this super-low volatility regime, it’s harder but not impossible. One thing that is consistently overpriced is the volatility of volatility. And for good reason—when volatility spikes, it takes no prisoners, leaving short straddle positions with painful losses. There’s your disclaimer.

That being said, for those willing to manage the risk, there are often some pretty good profits to enjoy.

Today, we look at a trade within VXX, one of the infamous volatility products whose name immediately brings to mind "Volmageddon" for many traders.

Let’s dive in.

The context

It’s been over six months since the market has alternated between euphoric periods and calmer moods. If we put aside the tensions between Israel and Iran in April, nothing has managed to dent the general optimism. The market shrugged off economic risks and stayed composed when Jay Powell announced twice that inflation was still too high to reassess the level of interest rates. Also, have you noticed how the phrase “soft landing” has disappeared from the landscape? Even though the Fed Chairman didn’t take a victory lap, the combination of the market at an all-time high, unemployment at a historically low level, and a GDP firmly in positive territory makes it pretty clear to most participants: it is time to deploy money, not take it back, and let’s do so unhedged. YOLO.

Consequently, this year, the VIX and its realized volatility are at historically low levels.

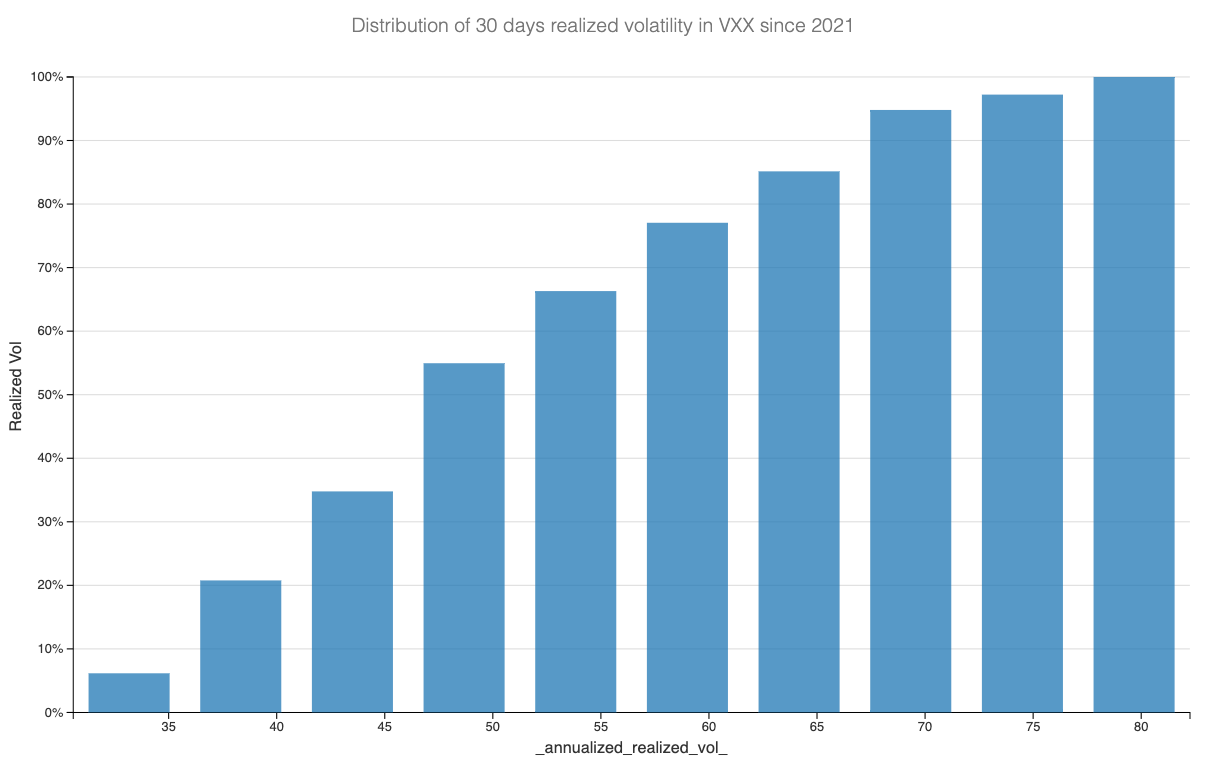

In fact, after a rise in April, we are back towards the lowest level observed over the past three years: currently sitting at 37.5, we are in the second decile. Everything is set up for a quiet summer unless something meaningful happens in the next two weeks.

Now, realized volatility always looks in the rearview mirror. It’s not recommended to drive a car in this condition. In this case, we need to look at the implied volatility (the only true forward-looking measure in the market) and put it in the context of what has been realized recently. Let’s have a look.

The data and the trade methodology

Let’s start by examining the implied volatility term structure in VXX. We recomputed the VIX index using options prices and followed the CBOE methodology.