Signal du Jour - short vol in USO

A risky signal but historically profitable.

Tensions in the Middle East have escalated dramatically over the past week following the killing of a Hezbollah leader in an Israeli Defense Force airstrike in Lebanon.

Two days ago, Iran retaliated, as expected, and now Israel is weighing its response to the retaliation. This tit-for-tat dynamic feels reminiscent of what we saw in April. At this point, it’s hard to distinguish between genuine threats, rhetoric, and political theatrics.

It’s not just us feeling the uncertainty: with the VIX hovering around 20, the market is cautiously waiting for signs of de-escalation. Who really wants a broader conflict? Certainly not us.

Yet, while equities have remained just a few points off their all-time highs, oil prices have surged over the past two weeks. Today, we're focusing on a potential trade in USO. Things could get worse, but the real question is, how long until they get better?

Let’s dive in.

The context

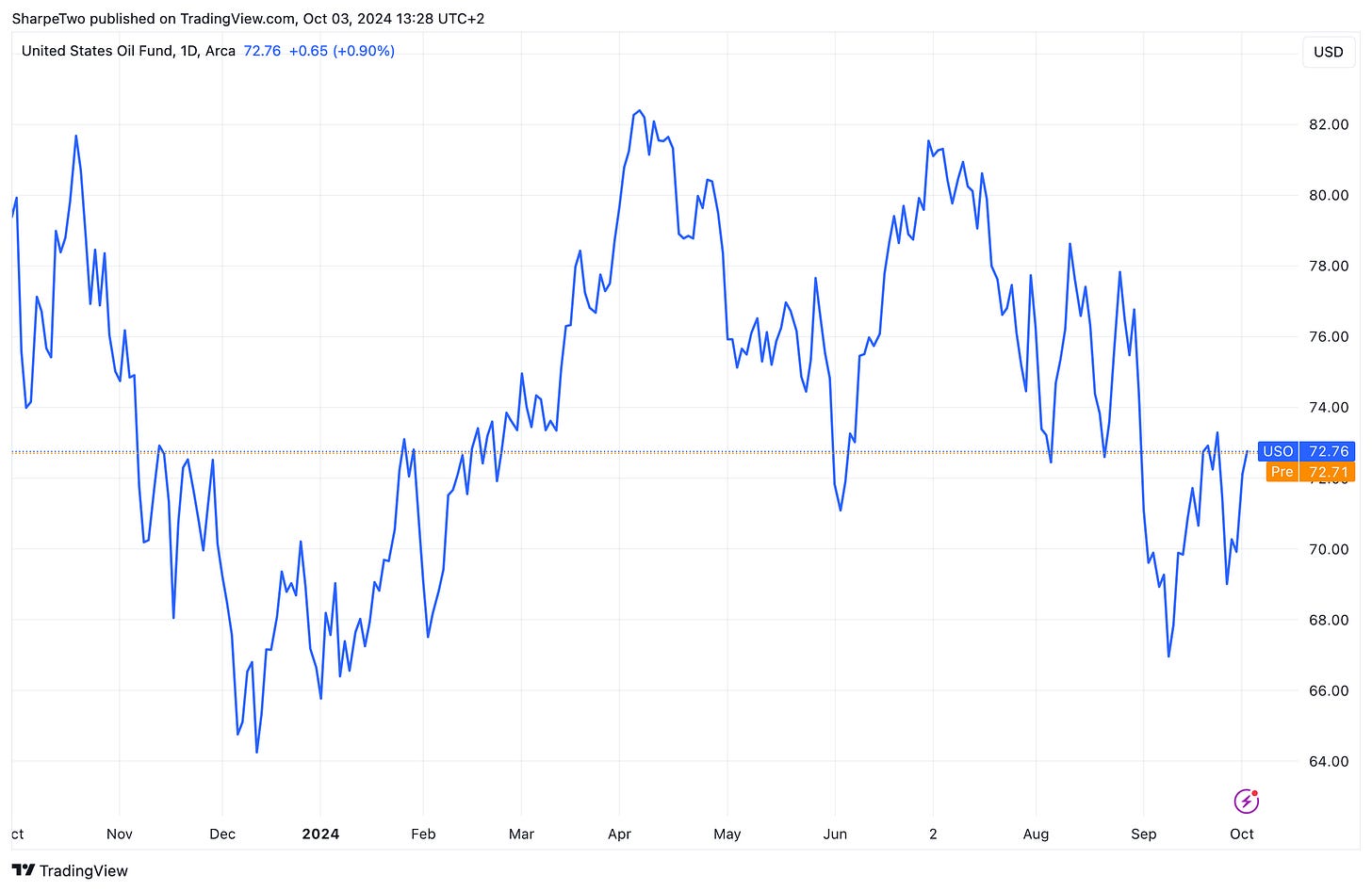

Many asset classes have performed exceptionally well in 2024, but oil is not one of them. Despite renewed tensions in the Middle East and multiple attempts by OPEC to influence prices, USO has been range-bound between $64 and $82 throughout the year.

Currently sitting in the middle of its range while rockets fly in the Middle East, USO doesn't appear overly concerned about the potential for an escalation in the conflict.

Yet a 64 to 82 range is not exactly tight, and this is pretty represented in the realized volatility measured in the product this year.

We’re looking at 30% annualized realized volatility over the last 30 days, the highest level we’ve seen this year—significantly more than the 23% observed in April. Of course, this could climb much higher if a misstep occurs in the telegraphed responses between the major players. But if we assume no one pushes us closer to a global conflict, realized volatility is expected to cool off from these highs, stabilizing around 27%.

Yet, a $64 to $82 range isn't exactly tight, and this wide trading band has been well reflected in USO's realized volatility this year.

This is purely a quantitative approach, ignoring the headlines that jolt the markets as they break. However, the uncertainty has seriously distorted options prices in oil-related products, creating interesting opportunities for volatility sellers.

Let’s explore those.

The data and the trade methodology

Let’s start by looking at a reconstitution of the 30-day VIX index for USO. The demand for 30-day options in USO is rising, to say the least.