Signal du Jour - short vol in USO

What happens after August 8th?

Apparently, Fed Chair Powell was hawkish yesterday. At least, that is what the financial media decided after a “massive” 0.5% dip in the S&P 500 as the press conference wrapped up.

We listened carefully. He was not hawkish. He was not dovish either. He was Powell—predictable as ever in his “data dependency” and “cautious optimism” about the economy’s resilience. He pointed to a likely rate cut in September, post-Q1 data. And after three years of textbook choreography between the Fed and the markets, you should know this by now: do not rush Powell’s tempo—and do not bet against it either.

As the market was “tanking,” we briefly touched VIX 17. That may have been your cue to sell VRP in US equities. We were hoping for slightly better entry levels, but with blowout earnings from Meta and MSFT, we might not get another clean shot until later in August, as Jackson Hole creeps into view.

In the meantime, pickings are slim. Realized vol is at a five-year low. Daily realized volatility printed 11% yesterday… on an FOMC day.

Thank God for President Trump, though—his ultimatum on Russia just made the VRP in USO great again. That’s where we’ll turn our focus today.

The context

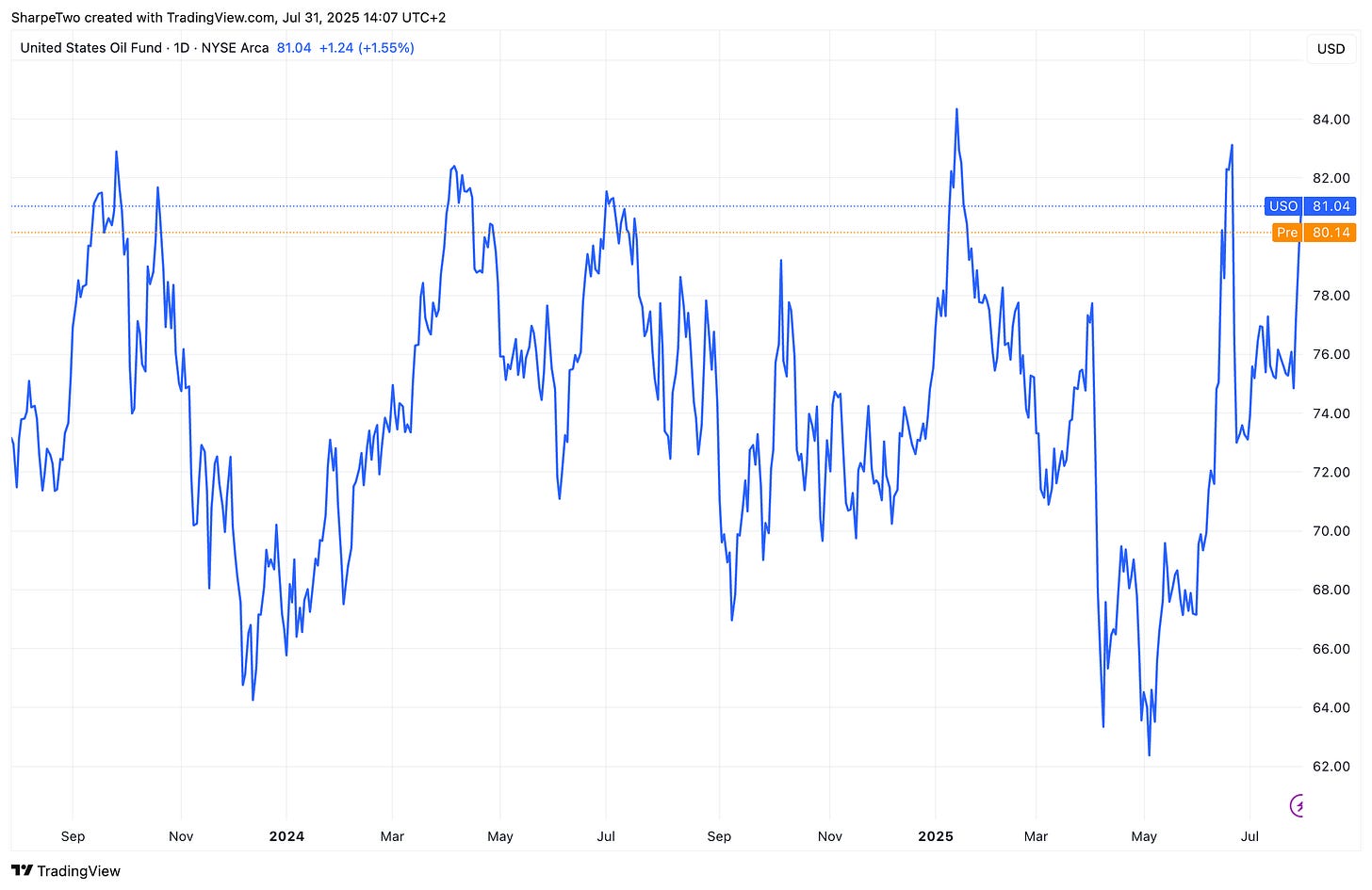

The oil market has had a wild year. And yet, somehow, prices are still hovering around the same range we've seen over the past two years. Along the way, we were ready to call it dead. During the Israel–Iran war, many were eyeing the $100 mark like it was a done deal.

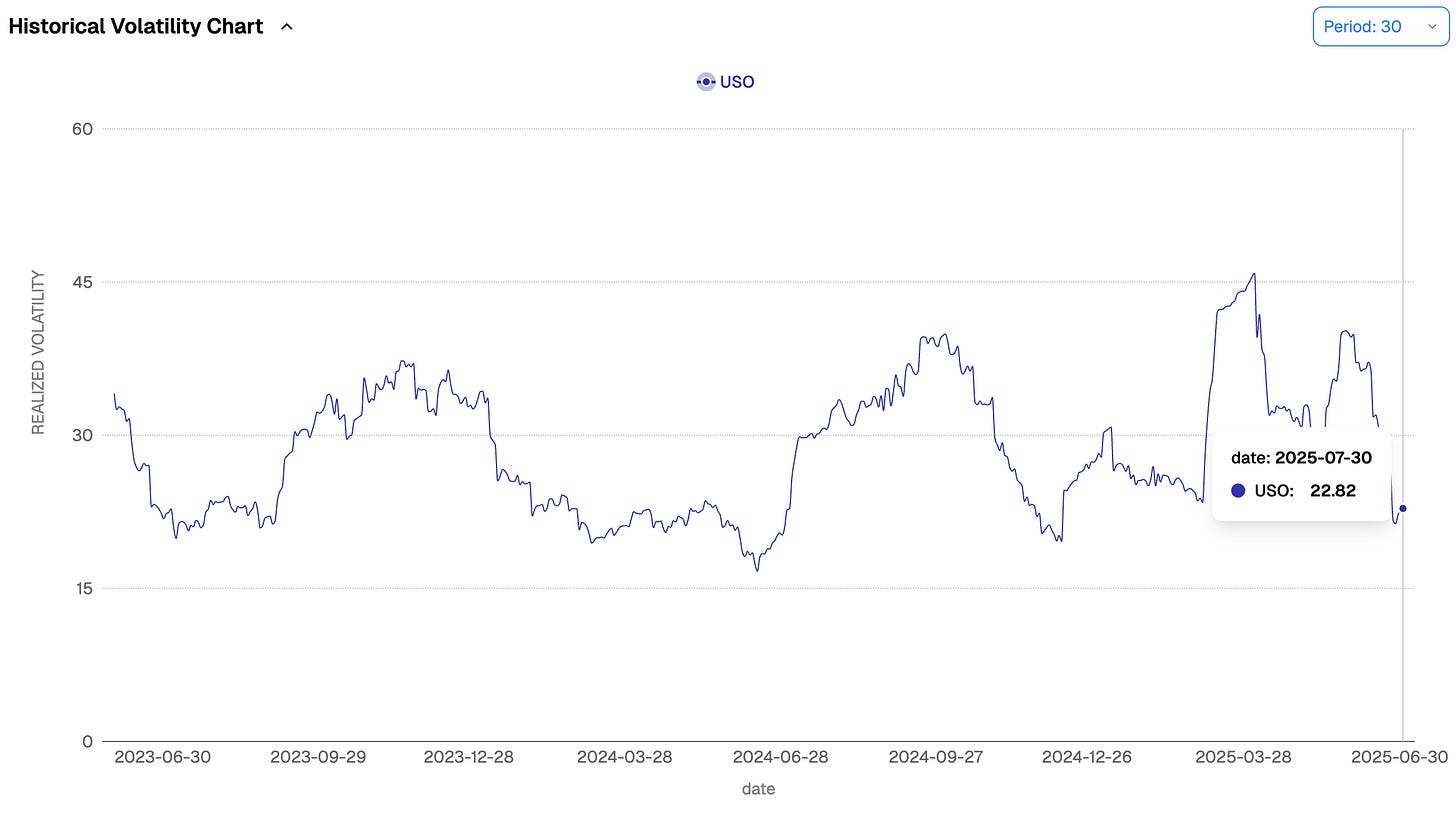

In the end, here we are—right back at the top of the two-year range. Realized volatility has been just as erratic.

After spending much of Q1 and early Q2 flirting with the low 40s, realized vol collapsed in Q3 as the Israel–Iran conflict de-escalated. Now sitting at 22.82%, the market does not exactly scream tension (yet). But that could change fast, especially if the U.S. ultimatum to Russia—set for August 8—leads to a sharp deterioration in relations between the two powers. We are not there yet, but it is critical to know where the risk sits.

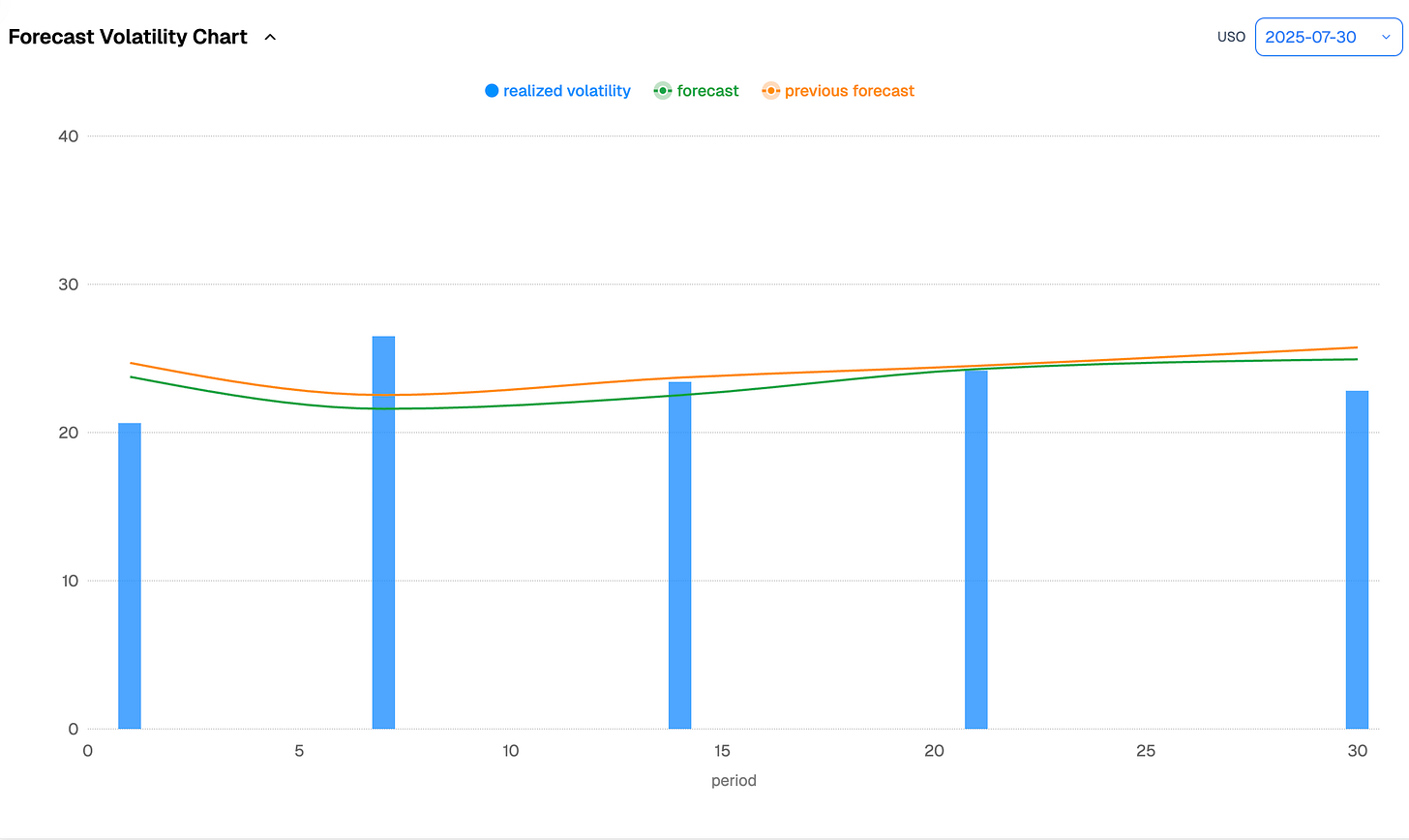

And that context matters when looking at the forecast for realized volatility.

We do not currently expect USO to trade much differently from how it has behaved recently. Barring surprises, 30-day realized volatility should remain anchored in the mid-20s. You would need a serious geopolitical escalation for USO to truly wake up and break meaningfully above 30%.

That is not to say it cannot happen. But keep some perspective—if it does, it will be front-page news across every financial outlet. And that will probably be your cue to unwind the trade.

In the meantime, let us see how the options market is pricing the risk of something happening.