Signal du Jour - short vol in US equity

Enjoy the quiet summer

We’re back after two weeks off—and what better welcome than yet another round of rumors about Trump trying to oust Powell?

Markets have been fairly tame over the past six weeks, drifting slowly higher with the occasional wobble when a flurry of tweets or a rogue headline hits the wires. Yesterday followed the script: first came news from the White House that Trump was exploring removing Powell early (again), then the walk-back a few hours later.

It is the kind of noise that frays investors’ nerves—but nothing excessive. The VIX is still sitting at 17. And yes, it did “spike” two points yesterday, only to give most of it back once things calmed down.

Do not get us wrong—we’re not saying nothing will ever happen again. Far be it from us to join the Trump Always Chickens Out camp.

We’re in the business of spotting moments when the market overpays for insurance—and stepping in to provide it. And the least we can say is that it has been a great time to offer liquidity in US equities over the past few weeks. We see no immediate reason to change that tune.

Let’s dive in.

The context

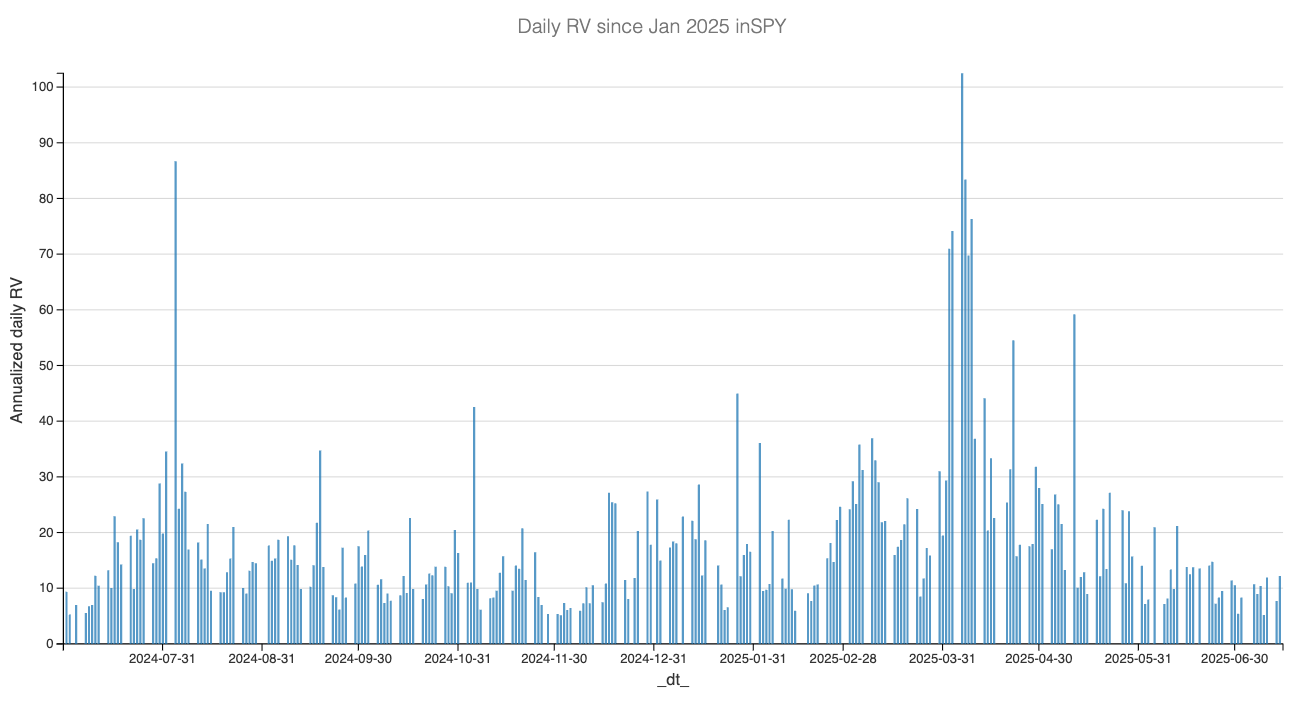

Q3 in US equities has been the perfect continuation of Q2: a lazy grind higher that’s starting to compound. SPY is now up almost 7% on the year, while QQQ is flirting with 10%. Hard to believe both were down 20% at one point, but since May, realized volatility has quietly faded—now it’s barely showing up at all.

The market is so quiet, it’s boring. Right before our summer break, we encouraged you to step away from the screens—and we genuinely hope you did. Over the past month, daily realized volatility has barely scratched 20. Even yesterday’s brief swoon on the Powell rumor barely moved the needle.

But as always, past performance is no guarantee of what comes next. Still, volatility tends to cluster—and for lack of any compelling new narrative, our forecasts are pointing to more of the same.

Let’s pause on that. A forecast is useful for setting expectations, not for achieving perfection. The way we read it: realized vol has been low, and we do not expect it to break meaningfully above 15 over the next 30 days. If it lands right around 12, that is even better.

Now, if a fresh catalyst emerges—something that truly shakes up market participants—and if that shift gets picked up in the data, then yes, we will reassess. And the forecast will adjust accordingly.

With that baseline in place, let’s compare it to what traders are actually paying for protection in the options market.