Signal Du Jour - Short Vol in US equities

Realized is climbing and the market still overpay for risk

It’s been a few days of ups and downs in the equity markets, driven by the ripple effects of last week’s crash in silver and gold. But that isn’t the whole story: tech stocks keep coming back with news that, while not horrible, simply isn’t good enough for increasingly impatient investors.

MSFT got punished, and so did AMD. Google was spared, shedding only 2% pre-market today despite announcing it would double its AI spending. Oooooh, spooky. Circular debt and irresponsible spending are back in the conversation. Is AI a bubble? Anthropic may have provided part of the answer with Claude Code and Cowork having their own “ChatGPT moment”: the sudden rate of adoption over the last six weeks has created real fear in the SaaS space, both listed and private. Why would you keep paying so much for software (and the consulting to operate it) when… you can just ask Claude?

As is usual with technology, the truth lies somewhere between the supra-optimistic and those who are only just waking up (after years of memes about how “stupid” ChatGPT was) to the fact that their jobs might not be so safe anymore.

This introduction to the tech landscape is longer than usual, but only because the market is obsessed with it right now. We see so many signals arguing to short volatility in the tech sector. However, since we already covered SMH last week, we thought we’d move away from it—though not too far. When you consider the impact of the “Mag 7” and the tech space on US equities, the volatility here also turns out to be quite expensive.

Let’s have a look.

(Note: If you want to see the details of all our signals across 400+ tickers, come try the platform for a few weeks here.)

The context

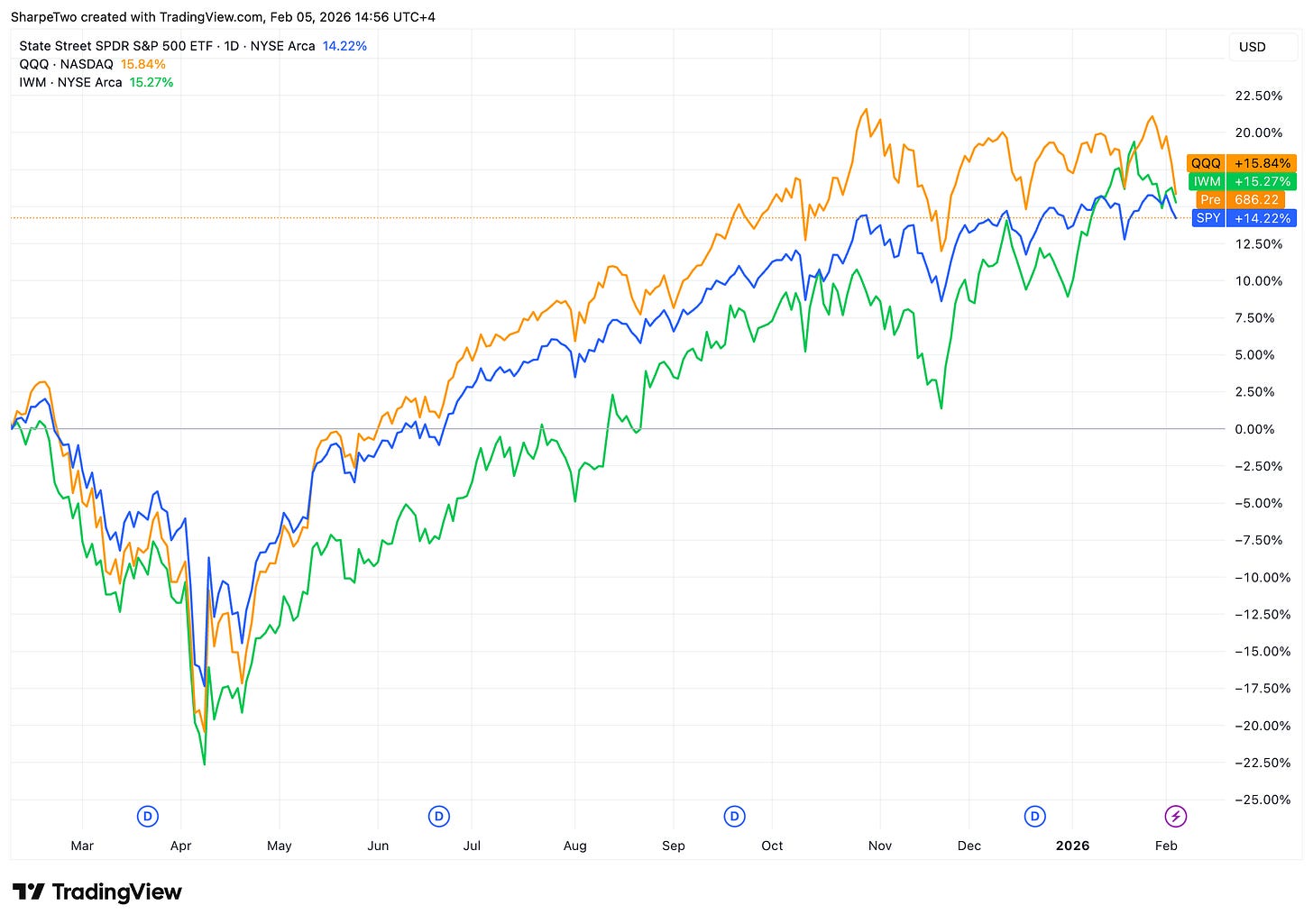

Since the election of Donald Trump, the US equity market seems to be constantly walking on eggshells. Sure, we ended last year with yet another stellar performance, with US equities up 15%+ across the board. When you recall they were down 15% or more in April, it was quite the reversal in performance… though not necessarily in mood.

Since September, the major indices have been pretty much flat, with the exception of IWM, which is front-running the nomination of the next FOMC Chair, supposedly more flexible on these matters than J. Powell.

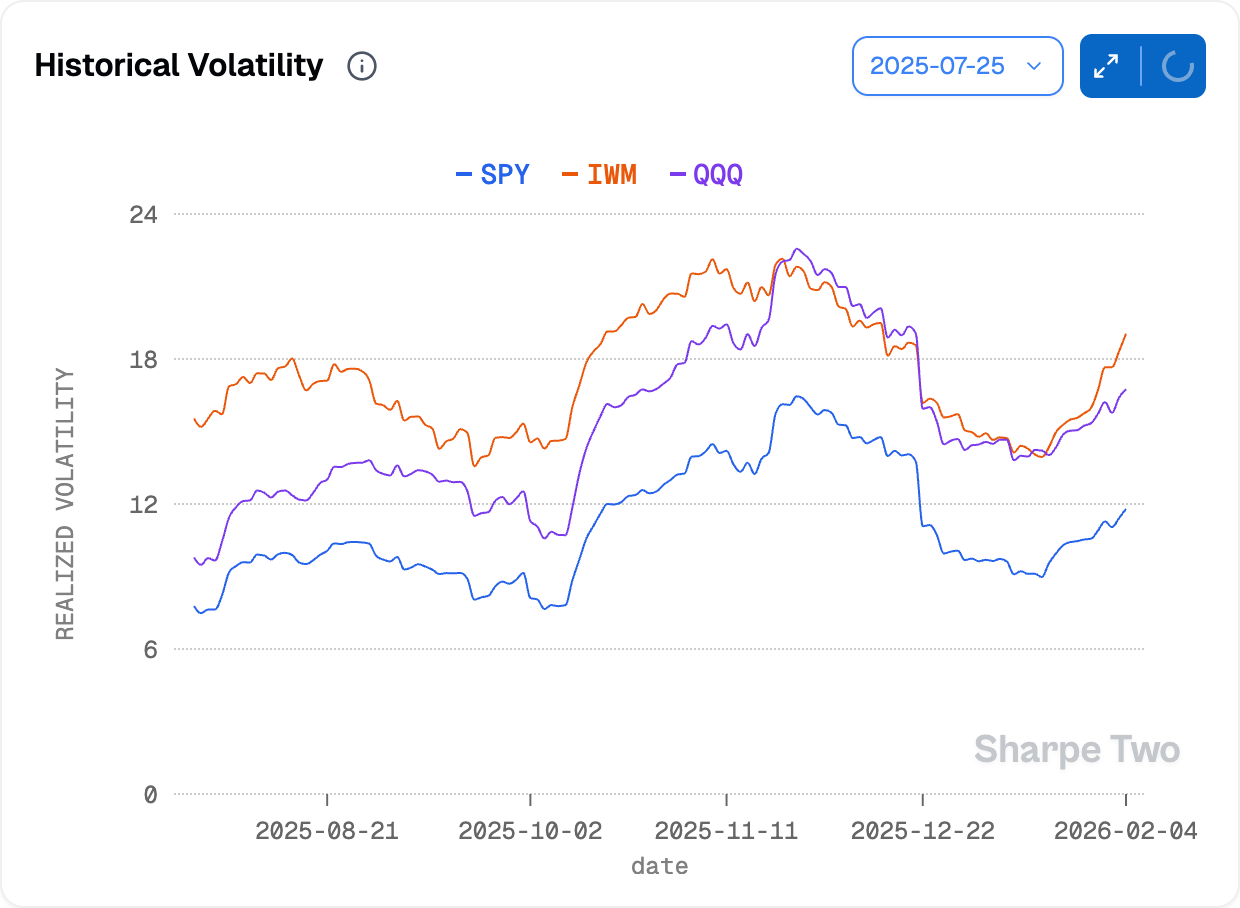

What is the best way to characterize this uncertainty? By looking at realized volatility.

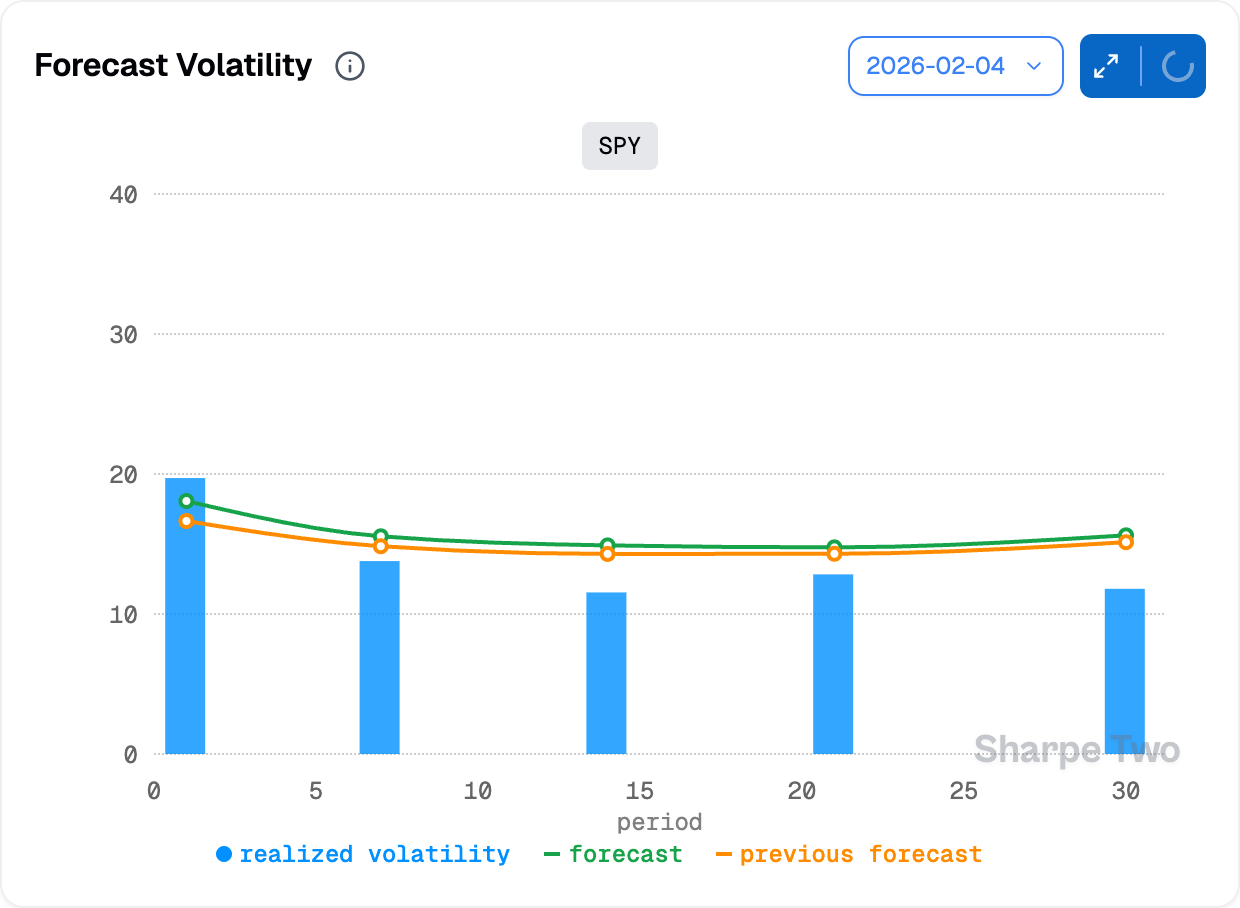

It has been steadily climbing following the end-of-year calm and is already hovering around 12%, up from just 9% only three weeks ago. Could it go much higher? Absolutely, especially in a market dominated by headlines and where the shadow of April 2025 is still living rent-free in the minds of many investors. The recent run on silver certainly isn’t bringing any extra serenity. As such, we currently predict volatility will reach 16% over the next 30 days.

Needless to say, the steady climb is likely to continue. This isn’t too surprising when you consider we have a jobs report, a CPI print, and then, obviously, the infamous NVDA earnings report on the horizon. There are enough potential catalysts here to push investors to keep buying hedges and potentially… overpay for them.

This has been a recurring theme over the last few months. Let’s look at where we stand today.