Signal du Jour - short vol in URA

Leaving equities alone while we wait for Jay Powell.

All eyes are on Jay as central bankers converge on Jackson Hole. The market has been angsty enough to shake out the most leveraged players, as big hands trimmed positions sitting near all-time highs. But nothing has really been decided yet, despite a -2% move in SPY driven by the narrative that AI companies are in bubble territory. Bubble or not, VIX at 17 hardly looks concerned about what the month ahead might bring. Then again, best to revisit that view in 24 hours.

Jackson Hole is a stage Powell has often used for his sternest economic commentary. And if there is one thing we know (and will miss) about the future ex-Chairman, it is that he choreographs his messages carefully, leaving little doubt about the intended path of monetary policy.

While we wait, today we step outside the equity asset class and look at URA, the uranium ETF—a product that offers exposure to the uranium theme and to companies engaged in mining it.

Let’s take a look.

The context

URA has had a strong year so far as we head into the final four months—up almost 30%. If not for a modest summer pullback, it could be flashing something closer to +40% by now.

Investor enthusiasm around uranium is tied to its potential role in the green transition. One striking example: tech CEOs openly considering smaller, yet powerful, reactors attached to their data centers to aid cooling. But that vision comes with risks. The road from concept to reality is paved with obstacles, particularly on the legislative side. And as uranium prices pulled back from their summer highs, URA’s performance naturally stalled.

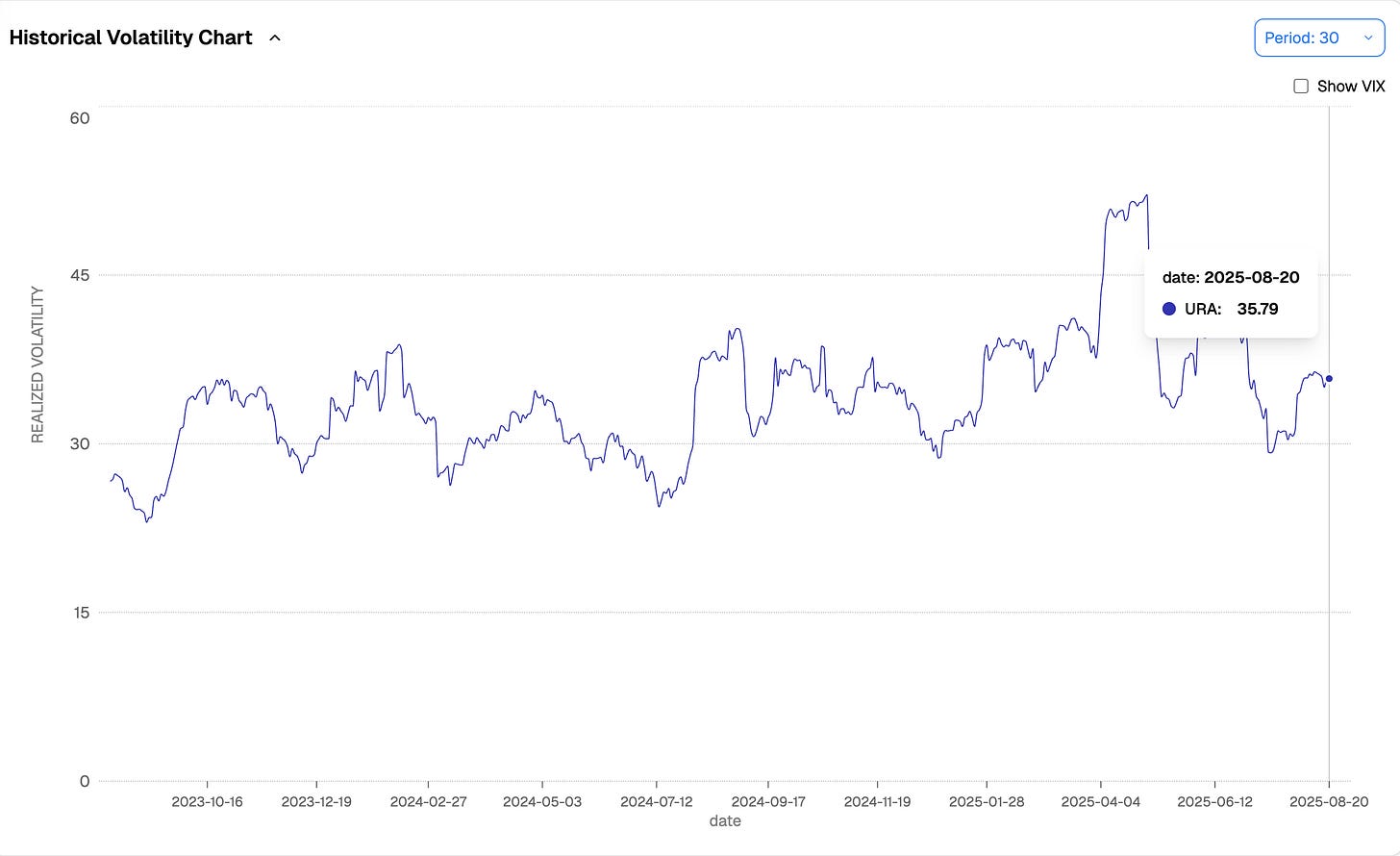

Against that backdrop, it is no surprise to see realized volatility picking up over the past few weeks.

After a brief dip below 30%, annualized realized volatility is now back in the middle of its two-year range, around 35%. The notable point is how stable realized volatility has been: it rarely pushes above 40 despite wild geopolitical headlines, and it is just as rare to see it stay below 30 for long.

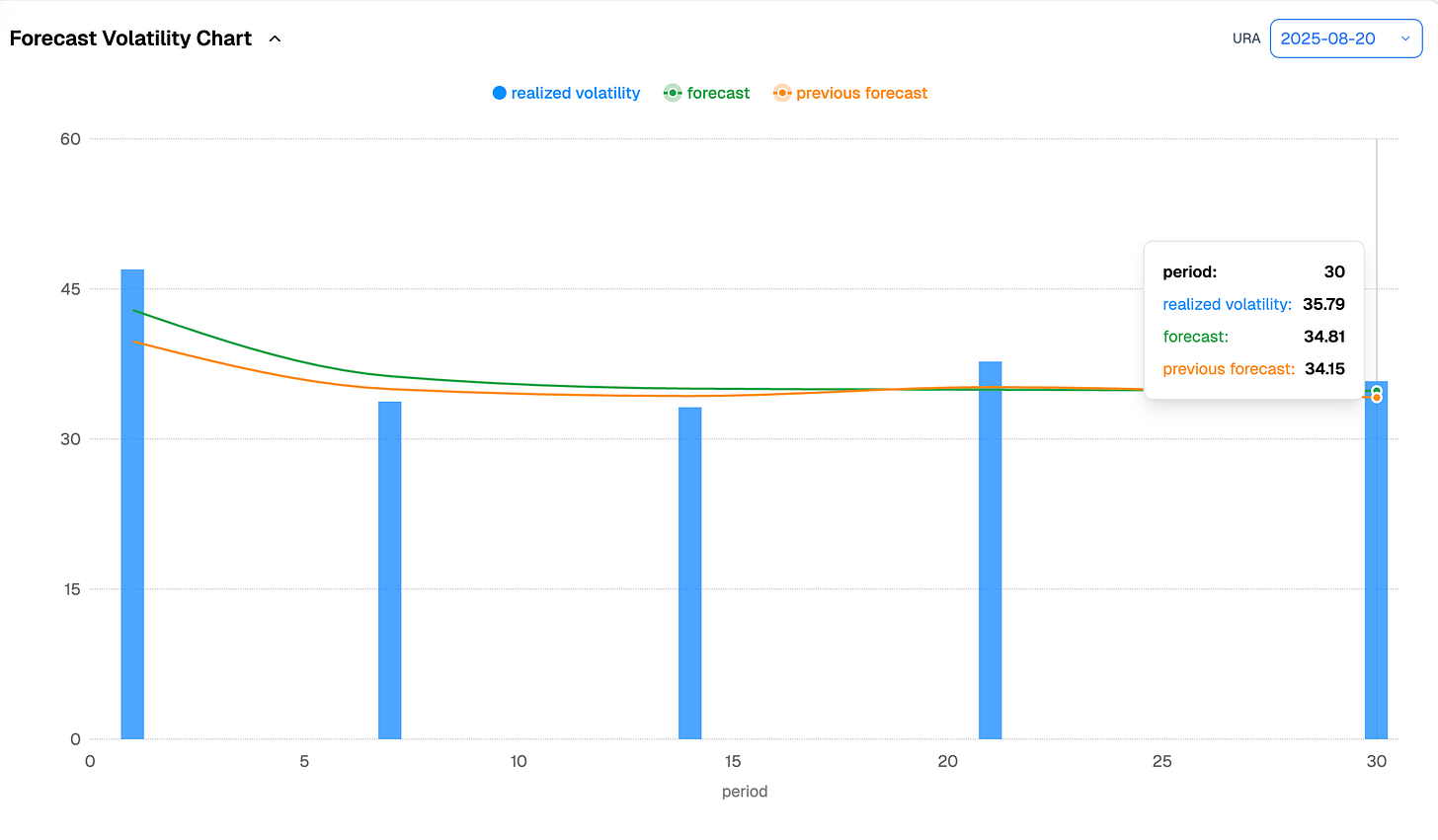

That stability is useful. Forecasts become more reliable when realized volatility is anchored. Right now, as expected, our best projection lines up almost perfectly with the current 30-day realized volatility.

In other words: more of the same, despite the constant noise about the Fed, rate cuts, or the state of the economy. Of course, forecasts are only forecasts. If geopolitics truly spun out of control over the next few days, or if serious U.S. recession fears pushed VIX above 22 for a sustained stretch, that would mark a regime change—and this chart would suddenly look very different.

Until then, we treat this tight prediction as something reliable enough to lean on for the rest of the analysis.