Signal du Jour - short vol in UNG

How to ride the vol crush?

Today marks the 100th edition of Sharpe Two—no small feat, and we couldn't be prouder. A heartfelt thank you to our 725 subscribers and the unwavering support from our paid subscribers and Discord members. This newsletter wouldn't still be here without you. For this special occasion, this post is free.

Last week ended on a rocky note, with markets bracing for crucial tech earnings this week and the next FOMC meeting scheduled for May 1st. So, what can we expect? An acceleration of the sell-off or a violent rebound to the upside?

Even after 100 articles, we at Sharpe Two will not publish research on market direction. Instead, we'll stick to our principles and seek opportunities where implied volatility is overpriced compared to the actual risk in the underlying asset.

Now that the geopolitical tensions have subsided, we're turning our attention back to the commodities sector. Today, we'll explore a trade in UNG, the ETF that provides exposure to natural gas.

Let's take a closer look.

The context

Natural gas is slightly less correlated to what happens between nations, but that doesn't mean it's completely immune to it, either. At the onset of the war in Ukraine, natural gas prices jumped to a level we hadn't seen in a decade, a move exacerbated by supply chain issues in a post-COVID world and the fact that we were in the middle of winter.

However, when tensions in the Middle East raged, natural gas didn't move as much. In fact, since the beginning of the year, not only has realized volatility been on the way down, but UNG has also been slowly drifting lower.

The downward drift is mostly due to this ETF's composition—it uses futures, and the natural contango in the curve means that the fund must always rebalance something cheap with something expensive.

It's also evident that UNG has barely moved throughout March, and its realized volatility is pinned just below 45. However, it's unlikely that options prices would have compressed too much. Why? Even if geopolitics in the Middle East are less important to the price of natural gas, they still impact it—if a more regional conflict were to erupt, it's likely that Russia would be involved, and therefore, the price of natural gas would not remain idle.

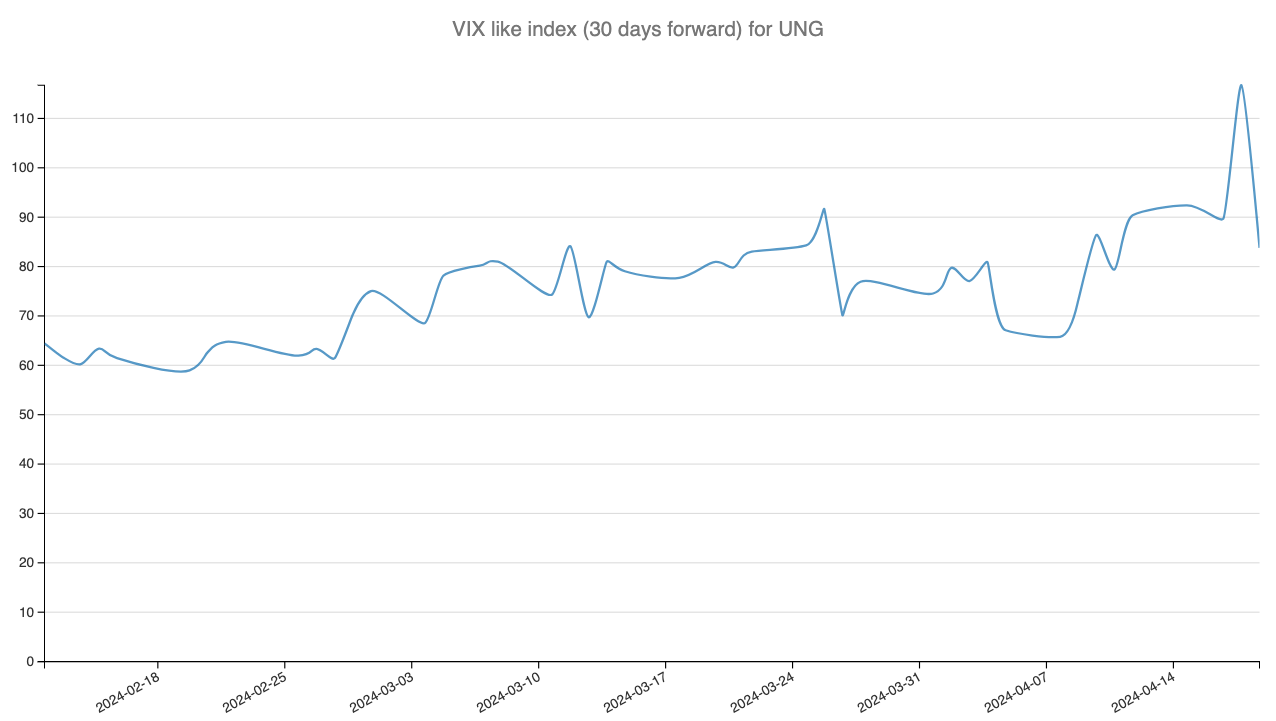

As you can see from this chart, a reconstruction of the VIX index using UNG options prices shows that implied volatility in the ticker went up as the developments unfolded. And as we finally received "measured" news from Iran and Israel on Friday, it dropped from over 100 to below 90. Nevertheless, it still represents a significant opportunity for short volatility sellers at that level.

Let's take a closer look at the data.

The data and the trade methodology.

A crash from 110 to 88 in a week is indeed impressive. First, we must ensure that we're not selling something too cheap. Here's the distribution of the VIX-like index for UNG over the past three years.

We're still above average and far from what would be considered low-volatility regimes.

We can also observe the volatility crush in the term structure for UNG.

The curve was severely backwardated on Thursday, but by Friday evening, it had already flattened quite a bit. We're always reluctant to sell volatility when the curve is backwardated unless it has given clear signals that it's going through a normalization process. That seems to be the case here, so we would favor the front part of the curve to initiate our short straddle.

However, we need to check if it is indeed the most expensive part. To do that, we'll compare the price of an ATM straddle for a given DTE against the realized movement in the underlying. For example, a 7 DTE straddle will be compared to an average of 7 DTE moves in the underlying. Here's what the variance risk premium looks like alongside the term structure.

As expected, the variance risk premium is particularly pronounced in the short-term expiry and disappears in the back month. With that in mind, we propose the following trade methodology.

The Trade Methodology

Sell the ATM straddle in UNG, expiring on 05/17, for $1.73.

Hold it until expiration or exit at a 25% profit, around $1.30.

As you can see, we didn't choose the super-short expiration. We feel that you can get the same level of VRP for more premium and, more importantly, less gamma risk in 28 days.

Let's now discuss some of the past performance and the risks.

The performance and the risks

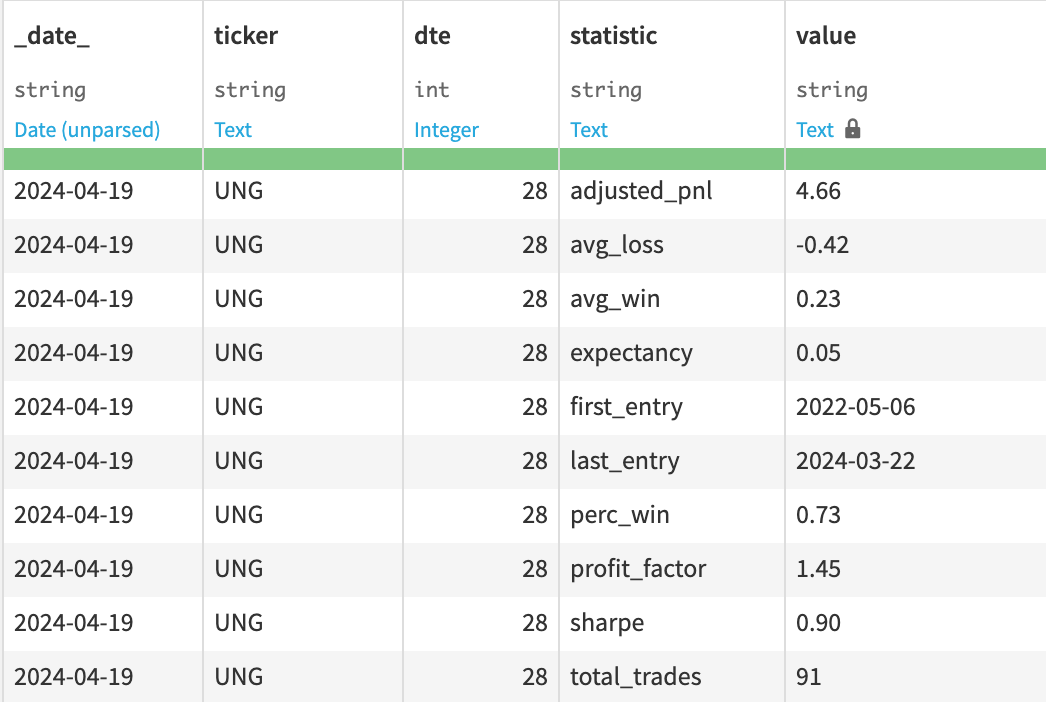

Let's start by reviewing how selling all 28 DTE straddles in UNG has performed over the past few years.

After the tough period of early 2022, marked by the beginning of the war in Ukraine, selling straddles in UNG was profitable, as the market would still overpay for insurance, probably fearful of what could happen in the underlying. The effect has been slowly winding down since the end of 2023. However, the current volatility crush leads us to believe this trade will be profitable. Here are a few statistics that are always helpful for managing risks and performance.

The important thing to consider is that the volatility profile in this underlying has losses significantly outperforming the wins. This means one has to be careful about the overall context surrounding natural gas. If a trend appeared and led to significant losses, it would be prudent to manage early and exit the trade. However, we're hopeful that the next two weeks will be relatively quiet on the natural gas front, particularly now that geopolitics is behind us and the focus is back on the macroeconomy.

That said, size your positions reasonably to protect your capital. This trade has a good chance of success, yet unreasonable expectations shouldn't ruin it.

Data, charts, and analysis are powered by Thetadata and Dataiku DSS.

Have access to our indicators using our API.

Book a consultancy call to talk about the market with us.

Contact at info@sharpetwo.com.

Disclaimer: The information provided is solely informational and should not be considered financial advice. Before selling straddles, be aware that you risk the total loss of your investment. Our services might not be appropriate for every investor. We strongly recommend consulting with an independent financial advisor if you're uncertain about an investment's suitability.