Signal du Jour - short vol in TLT

With inflation behind us, let's review opportunities in bonds.

A short week lies ahead of us: the market will be closed on Wednesday to celebrate Juneteenth. Yet, we also have the quarterly expirations on Friday, promising some unusual movements and colorful market hypotheses to explain what is happening.

We will stick to our traditional variance risk premium analysis. For some people, it is hard to believe this approach works despite writing about it for months in Sharpe Two, building on decades of industry research. Some readers still expect something more “quantitative,” as if the solution lay in complexity. It doesn’t. You should be wary of anything that sounds sophisticated as a way to make money. In the best-case scenario, the catch is often that this level of sophistication is impossible for retail traders to implement. In the worst-case scenario...

Today, we focus on TLT. With the FOMC and inflation talks behind us, the heightened level of realized volatility observed over the past few days will likely revert to normal.

Let’s have a look.

The context

The Fed left the rate unchanged at the restrictive level of 5.25%, and although they opened the door to a potential rate cut in September (if the data make it possible, of course), the rate trajectory over the next six months is still uncertain. You have the perfect space for memes between what the Fed says, what the market expects, and what the Fed actually does.

TLT, in the meantime, has had difficulty finding direction.

Since the massive rebound initiated at the end of last year in hopes of seeing the Fed cut rates six times, most of the movement has reversed. Since then, the rate has also relaxed a bit, as the market is finding some sort of equilibrium independently from inflation readings and FOMC chatter.

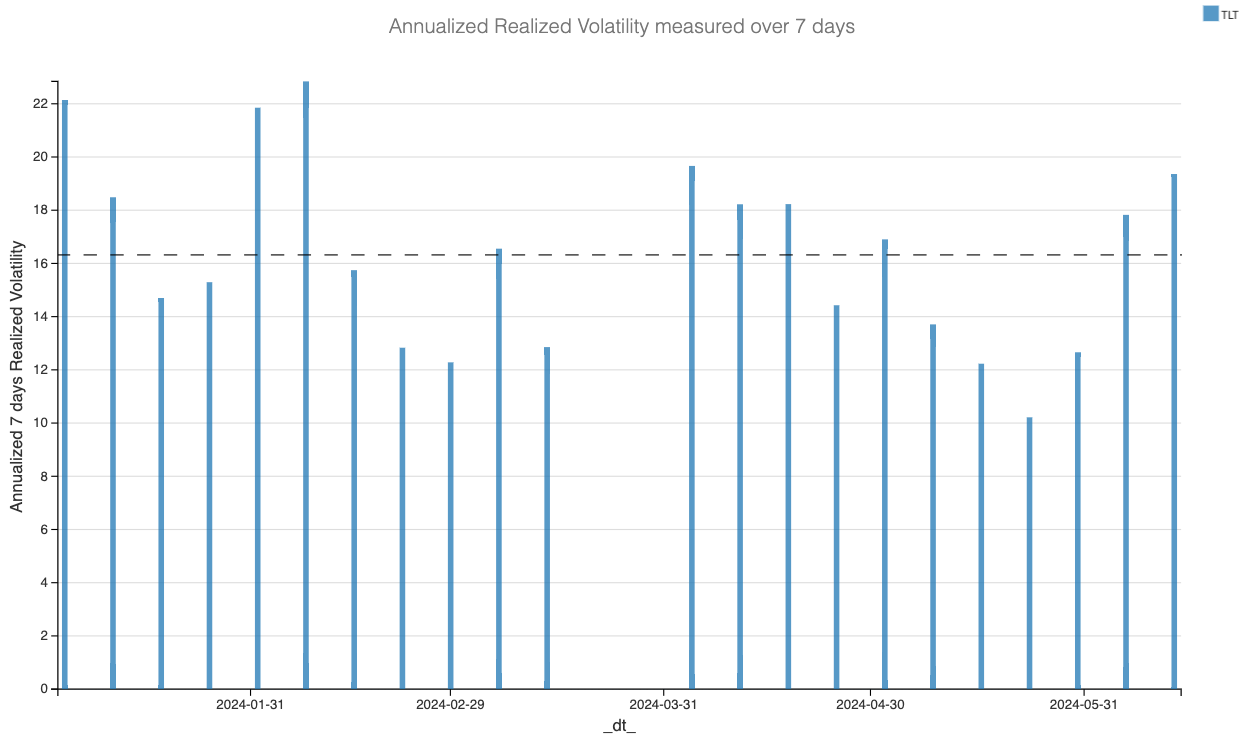

As a consequence, the realized volatility in the product has calmed down from the high readings observed in 2022 and 2023 when uncertainty was high.

Yet, in early June and the days leading up to the latest FOMC meeting, realized volatility returned to its highest level observed this year. However, it was still well below the threshold of 16, which could be considered a pivot for regime detection in TLT.

Therefore, we end up in a situation where nothing meaningful on the calendar should be agitating TLT. We are still in a relatively calm regime, yet last week was one of the most agitated weeks of 2024.

All these elements combined suggest that realized volatility will most likely revert gradually over the next few days, and the price of options may overstate what will happen.

Let’s have a look.

The data and the trade methodology

Let’s start by understanding how the implied volatility in TLT has behaved over the past 12 months compared to the realized volatility.