Signal Du Jour - Short Vol in SMH

Harvesting the premium while the AI bubble is not in the headlines.

As expected, the Fed kept rates unchanged and signaled no urgency to decrease them any further, at least until May 2026... As for how he intends to work with the next Chairman, since President Trump has already mentioned he would announce his top pick, Powell “had nothing for you.”

The market got the message loud and clear: let’s keep betting on a weakening dollar, reaching lows we haven’t seen in years, and buy some stocks! After weeks of a cautious climb, the S&P 500 finally reached the 7,000 mark. We remember a not-so-distant past when 7,000 was the price of the Nasdaq 100, and even 10k felt like a fantasy. If you think Nasdaq 100 50k is a stretch... think again. It is more likely to happen before we see S&P500 back to 2000. Pick your side.

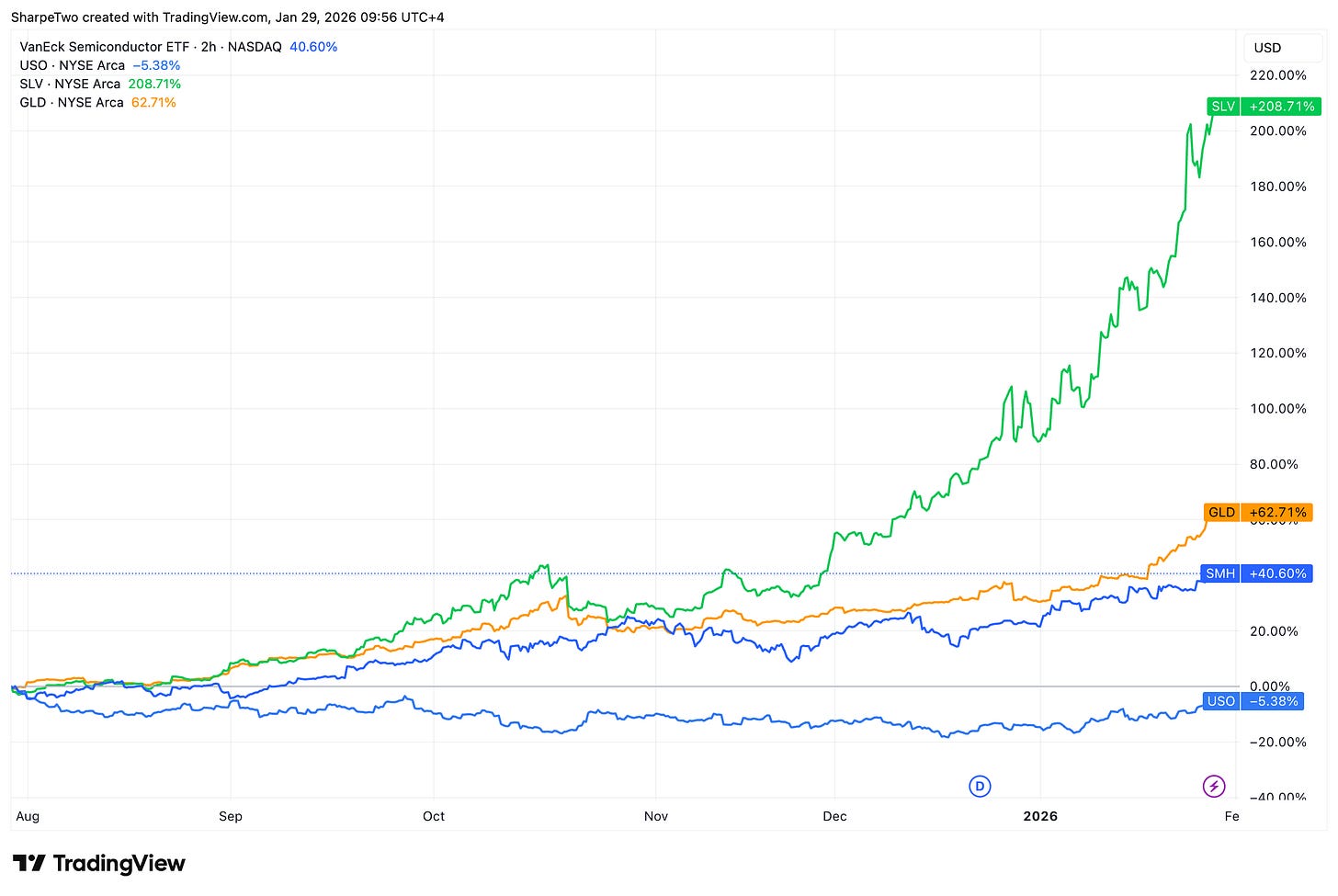

While the story in commodities is still unfolding, with gold and silver in levitation and Oil implied volatility jacked up as rumors of imminent US intervention in Iran get more meat on the bone with the aircraft carrier arriving in the Mediterranean, we are changing our footing. This week, we will look away from the geopolitical noise and consider a short volatility position in the semiconductor industry.

Let’s have a look.

The context

In Q4 2025, the "AI bubble" narrative popped up every week, fueled by alarming financial investigations into the circular nature of money in the sector, flowing from hyperscaler to hot AI startup and back to infrastructure provider. So far in 2026? None of that. The world is too focused on the fireworks in the commodities sector to notice.

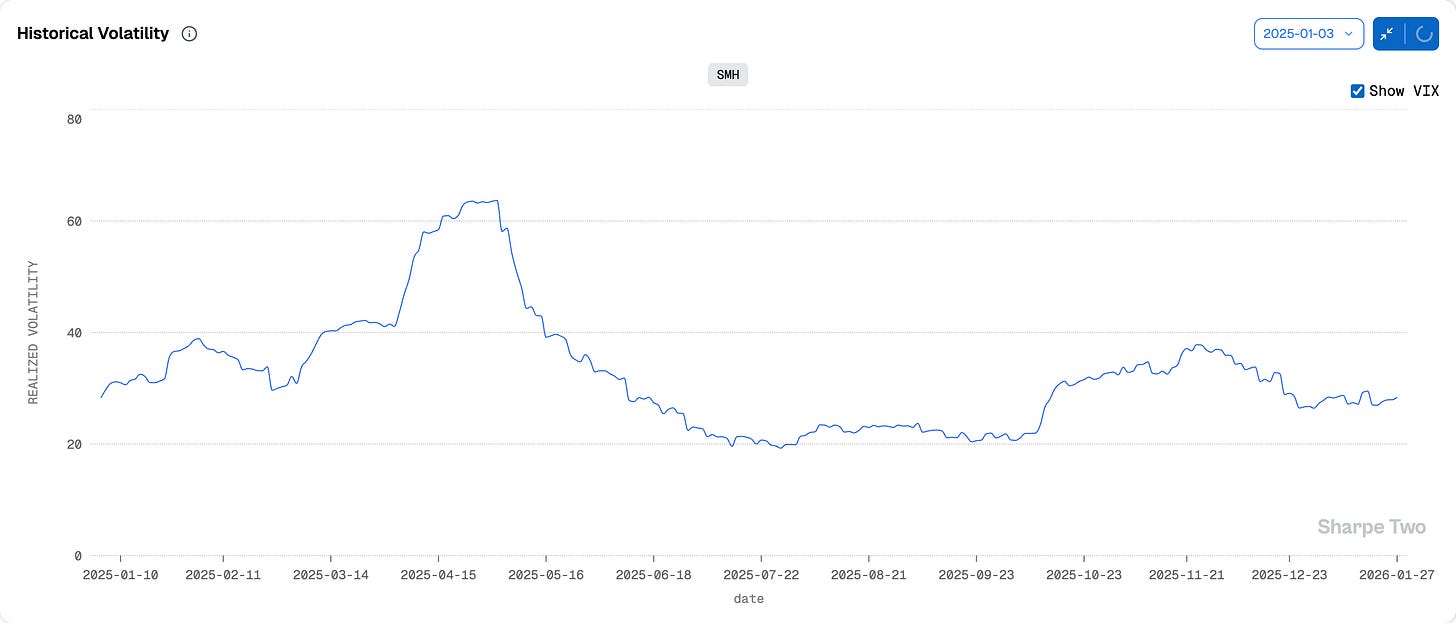

There is nothing to be ashamed of regarding a 40% performance over the last six months, but who needs NVDA when one can hold... Silver? Yet, a sneak peek at the price action over the last six months shows that holding SMH hasn't exactly been a walk in the park. Realized volatility has been fairly elevated in the product.

Once the jitters of April were digested, realized volatility bottomed at around 20%. Then, in a matter of weeks, it came back in full force, spiking to almost 40% right before Thanksgiving, accurately reflecting the concerns investors showed in Q4.

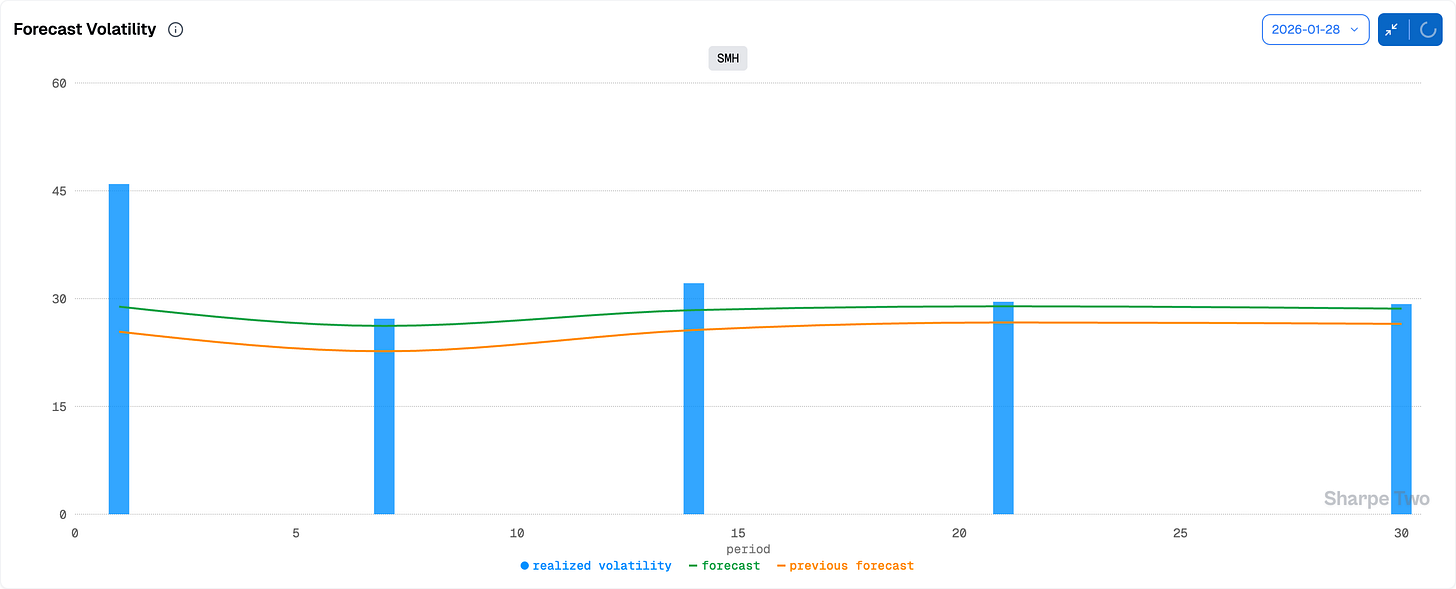

Currently, we are sitting in the middle of that range at about 29%. While big tech earnings failed to impress, they also didn't add much to the "worry tally" for investors. As such, our forecast for the next 30 days seems on point: volatility is unlikely to go meaningfully lower, but equally unlikely to spike unless a new catalyst pops up or renewed interrogations appear in the headlines.

With that in mind, let’s go see what the options markets are pointing to and see how we can structure a trade in SMH.