Signal Du Jour - Short Vol in Oil

Very smart who can predict the next spike.

In case you missed it, our analytics platform is now available for a 14-day trial at $14. You can find all the assets we use in our trading, test our ML models, and join our Discord for that time period.

Trading sessions pass and start to look pretty similar: new diplomatic escalations, either in Iran or between the US and the EU over Greenland.

Some economic figures roughly in line with expectations, mixed with renewed threats around central bank independence.

In the meantime, equities are only mildly affected by all of this, although not completely naïve either. VVIX is back well above 100, and VIX sits around the 16 handle, where it has spent most of the past two quarters, waiting for the next salvo of worrisome headlines to venture above 20.

Very smart who can predict when that will actually happen. One thing is certain: it will. Hopefully you took advantage of the relatively low VIX readings over the past three weeks to put on some longer-dated hedges.

We are right at the start of earnings season and, for a change, JPM disappointed quite a bit. It will be interesting to see how tech results are received later this month, coinciding with the first FOMC of the year. If you are looking for catalysts, you may have a few right here.

In the meantime, we will try to capitalize on the tensions in the commodities market. After a trade in NUGT last week, we will consider USO today.

Let us have a look.

The context

With the swift intervention in Venezuela and the effective looting of the largest oil reserves on the planet, the oil market has been anxiously watching the next move from Donald Trump, especially as the rhetoric around Iran has been heating up by the day.

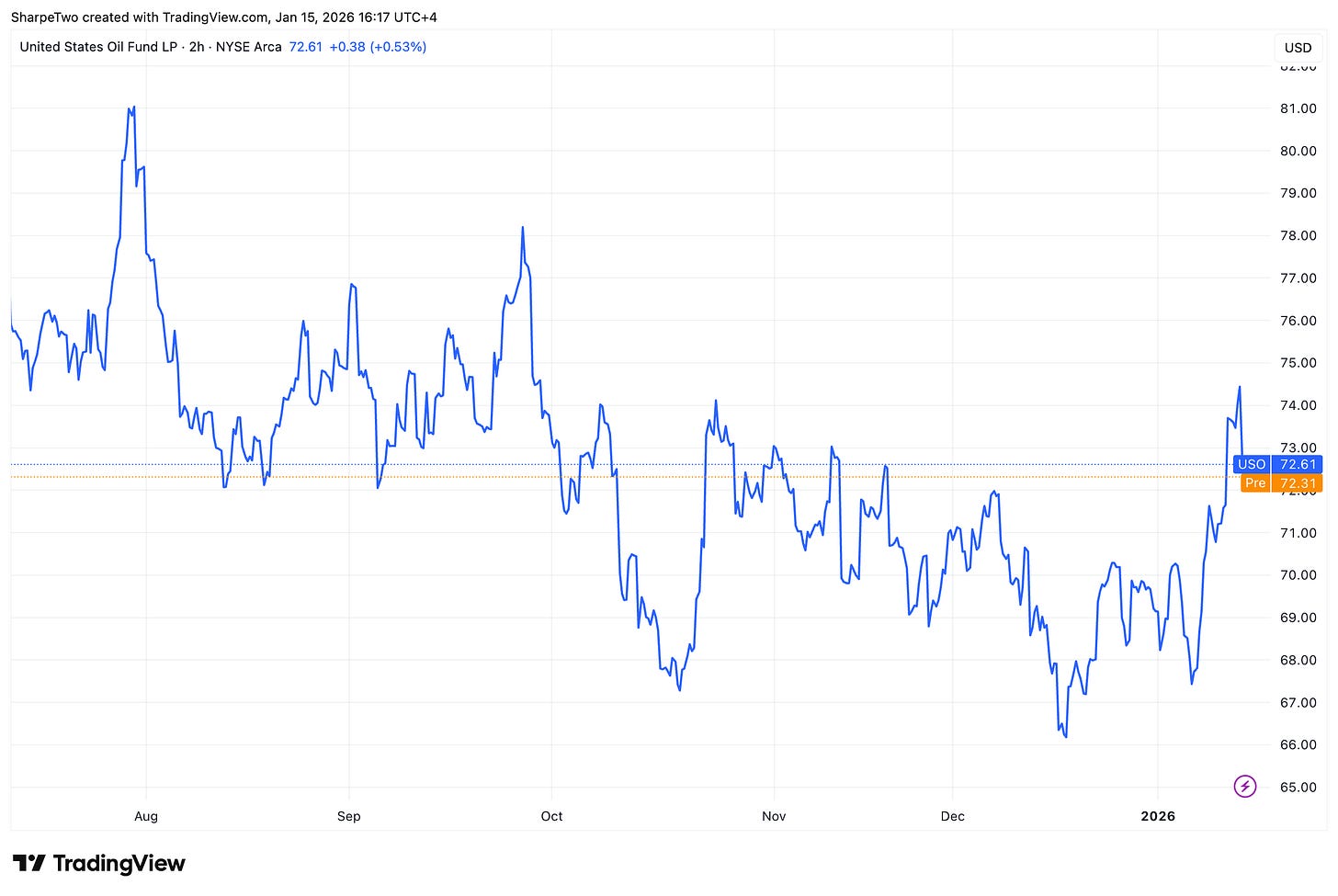

USO traded around $68 on January 2nd. We were almost 10% higher a few days ago, when the prospect of a US military intervention was growing more plausible by the hour. Since then, the tone has softened and, with it, the price of oil. But for how long? Once again, very smart who can predict that accurately.

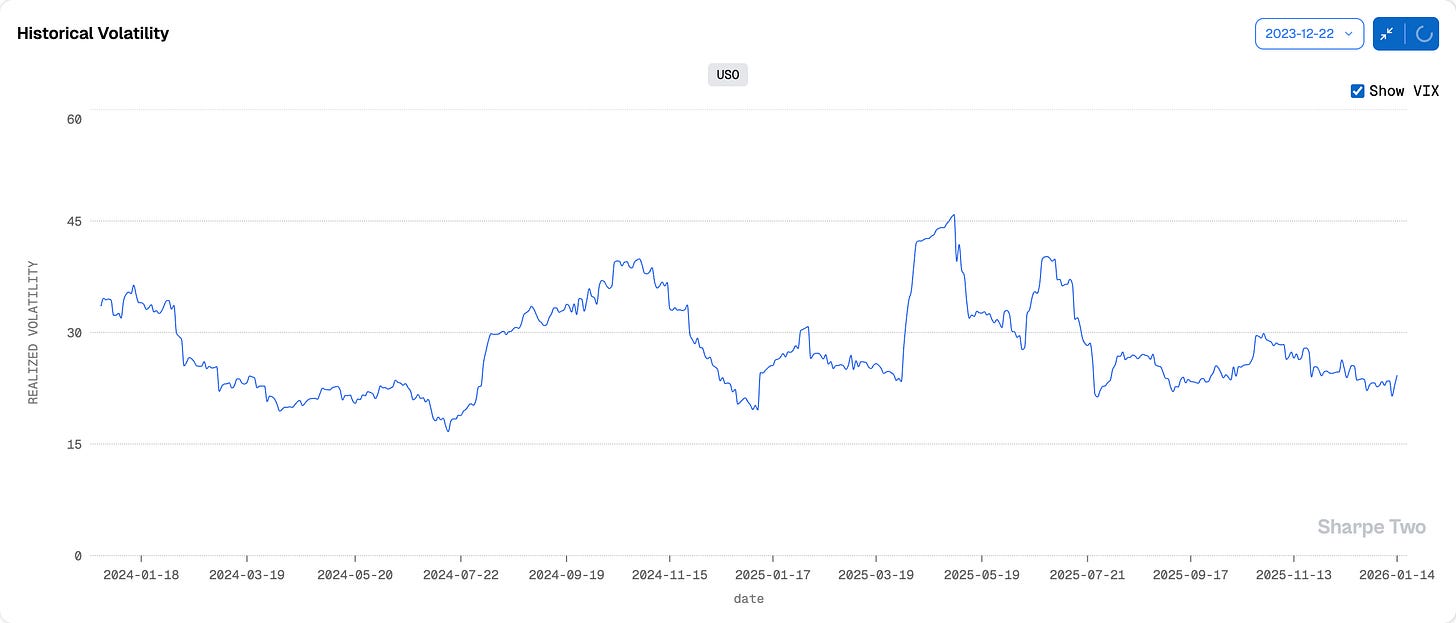

From a realized volatility perspective, as one would expect, things have picked up meaningfully since the end of 2025.

Yet in the grand scheme of things, this remains very reasonable. At 24.3%, we are still far from the highs of H2 2025, when realized volatility flirted with 30%, or from the most volatile months of the past two years, October 2024 and April 2025, when we moved well above 40%.

This does not mean it cannot get there very fast. Although we are no commodities experts, it is hard to see how a military intervention in Iran would not drive oil prices higher, at least in the very short term, and with it realized volatility. These exogenous effects are difficult to capture in a data-driven forecast, yet they cannot be ignored.

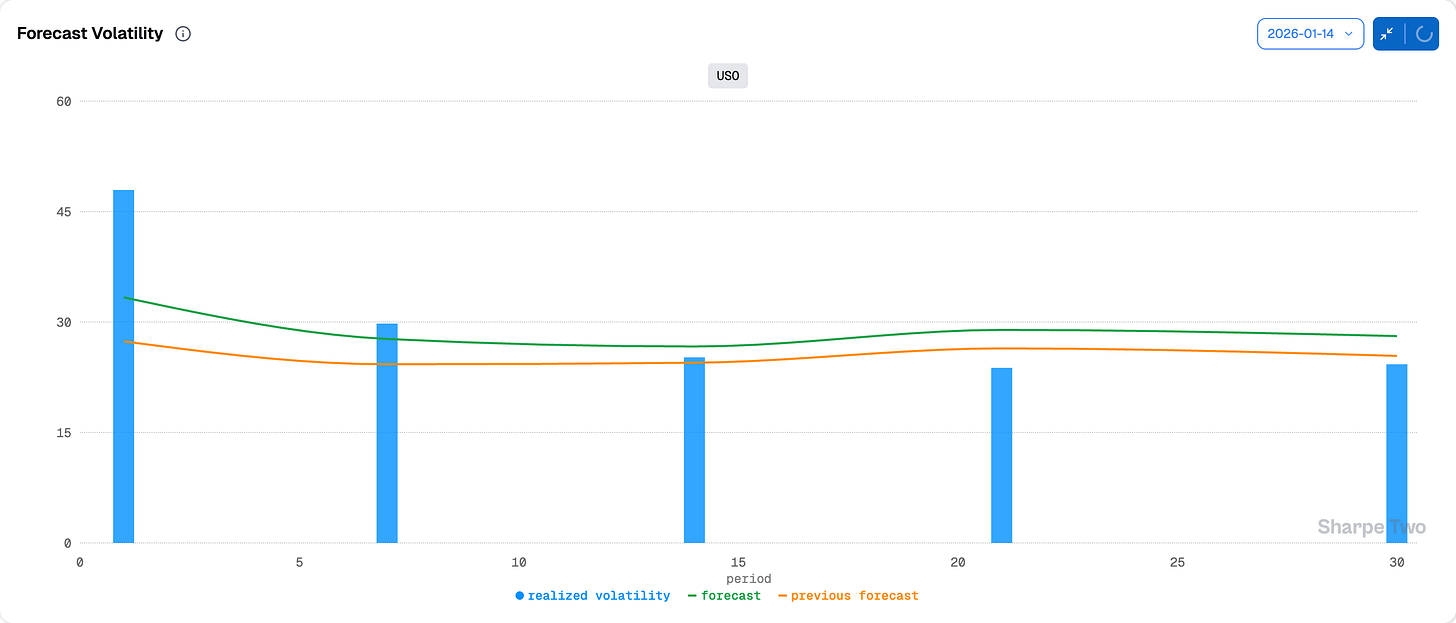

As it stands, we do see realized volatility continuing to grind higher, potentially into the high 20s. But as mentioned above, you only need a match for it to be propelled much higher than that.

While this is obviously concerning, it is also precisely why we believe there may be a trade here. It is extremely likely that the options market is overstating the price of variance, given how difficult the current geopolitical environment is to assess.

Let us go have a look.