Signal Du Jour - Short Vol in NUGT

First trade of the year, and a spooky one.

Happy New Year 2026.

We wish you all the happiness in the world, starting with a tight group of loved ones, good health, and some fun while trading options. If it is not fun, you do not have to trade. Being long the S&P 500 is more often than not a great strategy, especially when you remember that the vast majority of hedge fund managers, yes, the people who sometimes look at you like you do not belong, have a hard time beating it. There is no glory in making money the hard way. A dime is a dime, especially when you can reinvest it … in quality time with your loved ones. How about that for a full virtuous circle?

That said, if you are still here, it means you are having as much fun as we are trading options. So let us get to it, because the world moves, and it moves fast. Venezuelan oil now has a U.S. stamp on it, Trump tariffs may be overturned on Friday, and in the meantime precious metals keep trading higher.

This is where we will focus for the first trade of the year. Today, we are looking at a trade in NUGT.

Let us take a look.

The context

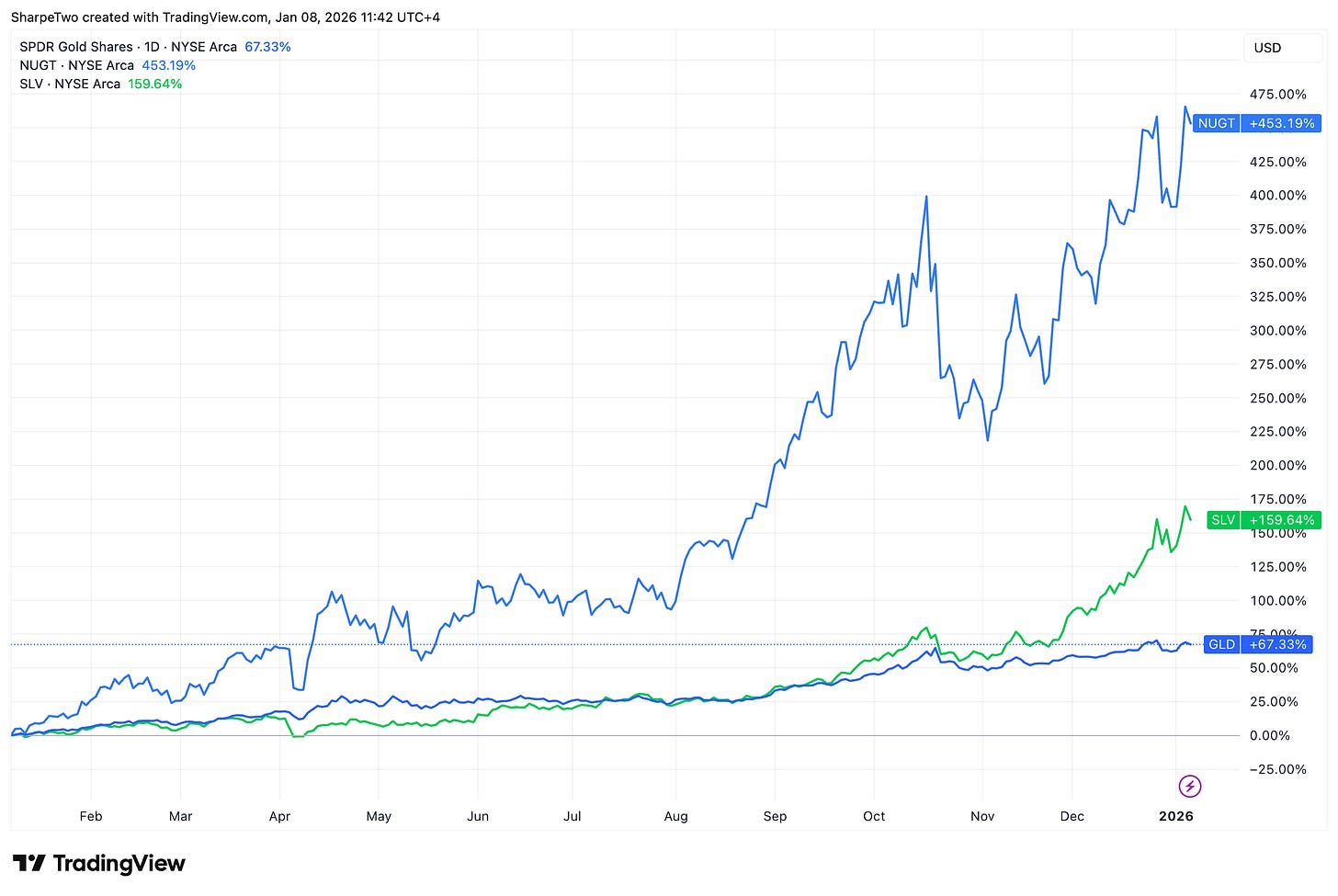

The precious metals complex was one of the big winners of 2025. GLD returned a whopping 65%, while SLV posted an astonishing performance of 145%.

How do we explain that? The apparent willingness of the U.S. to decouple parts of the global economy from the dollar cannot be ignored, nor can the fact that other major economies have started to look for alternatives to the dollar since the beginning of the tariff wars.

Recent geopolitical developments are more likely to keep investors active than to calm the volatility observed in these products. One of the more interesting takes we have heard recently is that if BTC is the so-called digital gold, many investors still prefer to hold physical gold. In that framework, short BTC and long GLD is not a terrible strategy.

But back to our primary topic of interest. NUGT is linked to GLD, as it gives exposure to the gold mining sector with two times leverage. Combined with the beauty of compounding in a strong trend, that is how you end up with a +453% performance over the last twelve months.

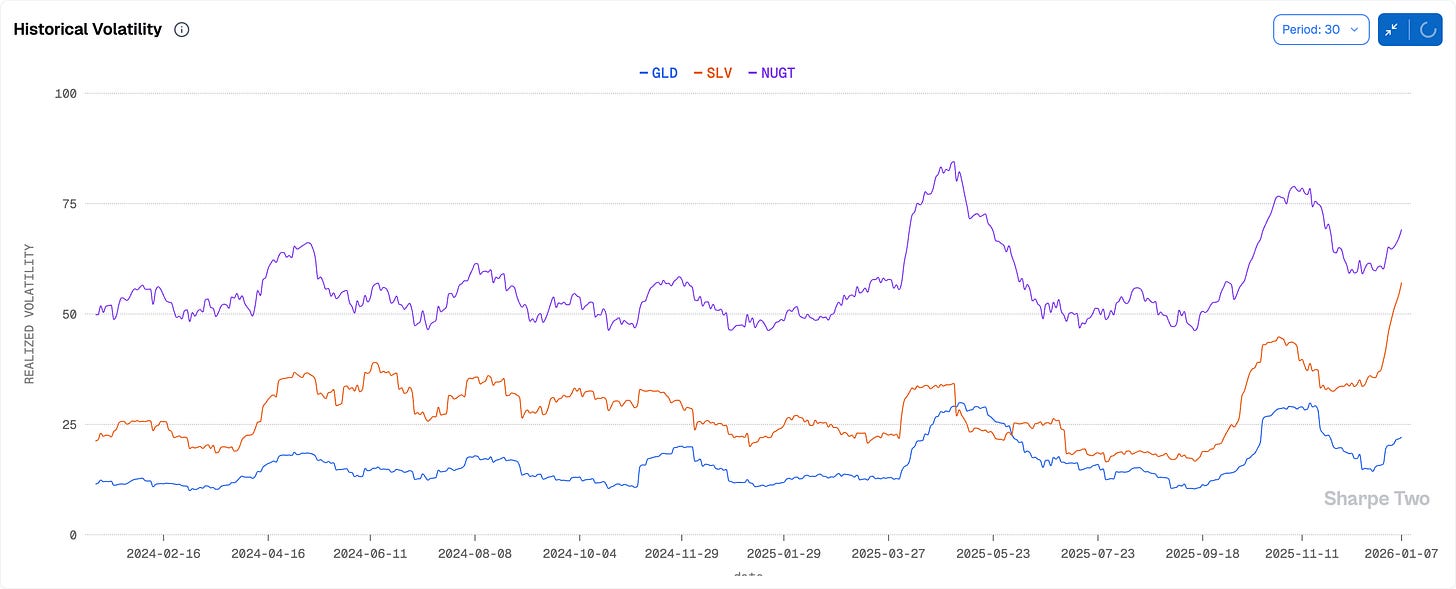

That comes at a cost: much higher realized volatility.

Realized volatility currently sits close to 70% in NUGT, compared to about 22% in GLD. If you are uncomfortable with the moves in GLD, be mindful of this trade. Seventy percent is no small feat. You need to be comfortable with daily moves of ±2% without overthinking it, while letting the thesis play out.

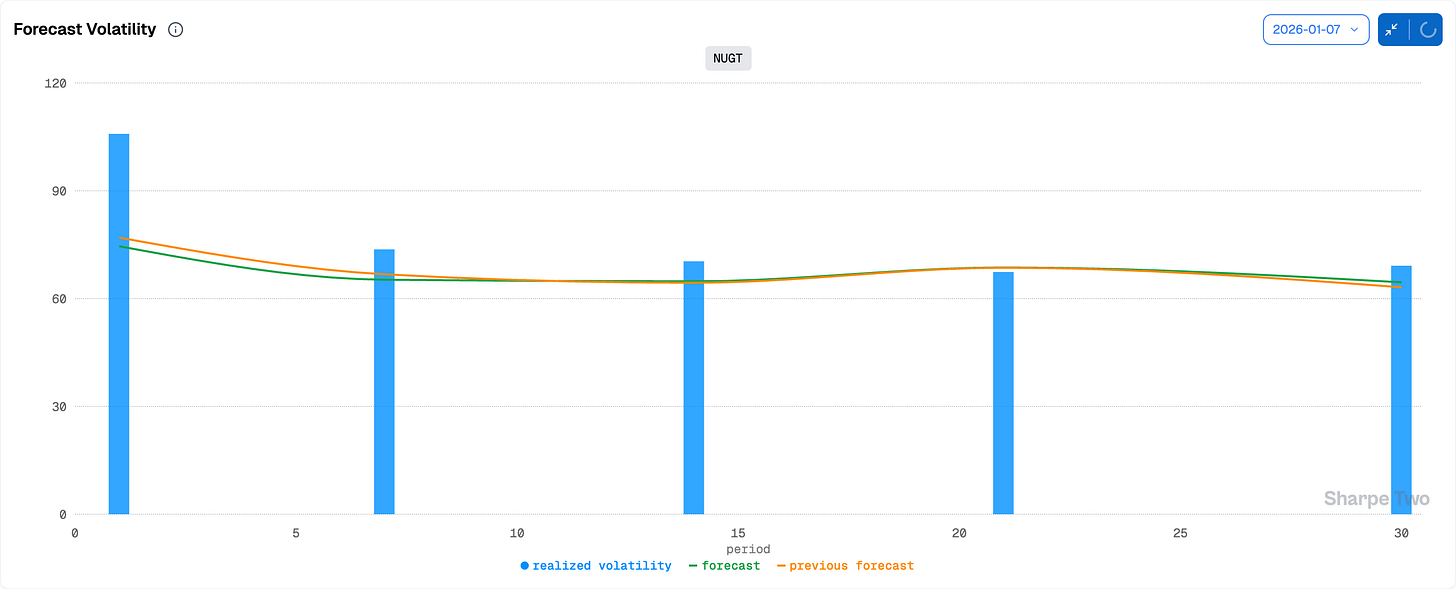

Let us take a look at our expectations for realized volatility over the next month:

At 30 days, we do not necessarily see it going much higher than where it stands today. That said, nothing is guaranteed. We have NFP and CPI over the next seven days, and those could serve as the right catalysts to push the precious metals complex one way or the other.

Are you scared yet? It is only the first article of the year. Let us take a deep breath and go back to the fundamentals. What we just laid out is most likely how traders busy buying options will frame the situation to justify buying puts and calls, skewing demand and making them, more often than not, overpriced.

Let us have a look.