Signal du Jour - short vol in KWEB

A good candidate for the list of premium printers.

The Fed chairman, Jay Powell, testified before Congress over the past two days and stuck to the same theme he’s been on since the beginning of the year: the Fed will remain data-dependent to decide when to ease financial conditions. So far, the labor market is still strong, while inflation is slightly more elevated than the Fed would like to see.

Response from the market? “Let’s buy more.” Just kidding. Well, not really. We don’t think there is a direct causation between the speech and the relentless move up in equities. However, in the absence of any new substantial information regarding the state of the economy or the rate trajectory, was the push-up unexpected?

Not for us to say. As usual, we prefer to look at the different volatility markets worldwide to find opportunities that are as market-neutral as possible. When the VIX is at 12.5, it’s a bit harder to find these trades, but as we have shown numerous times, it is not impossible. Today, we write about KWEB, an ETF you probably haven’t heard of before, and that’s okay (probably even better): it tracks the performance of Chinese internet companies.

Let’s take a look.

The context

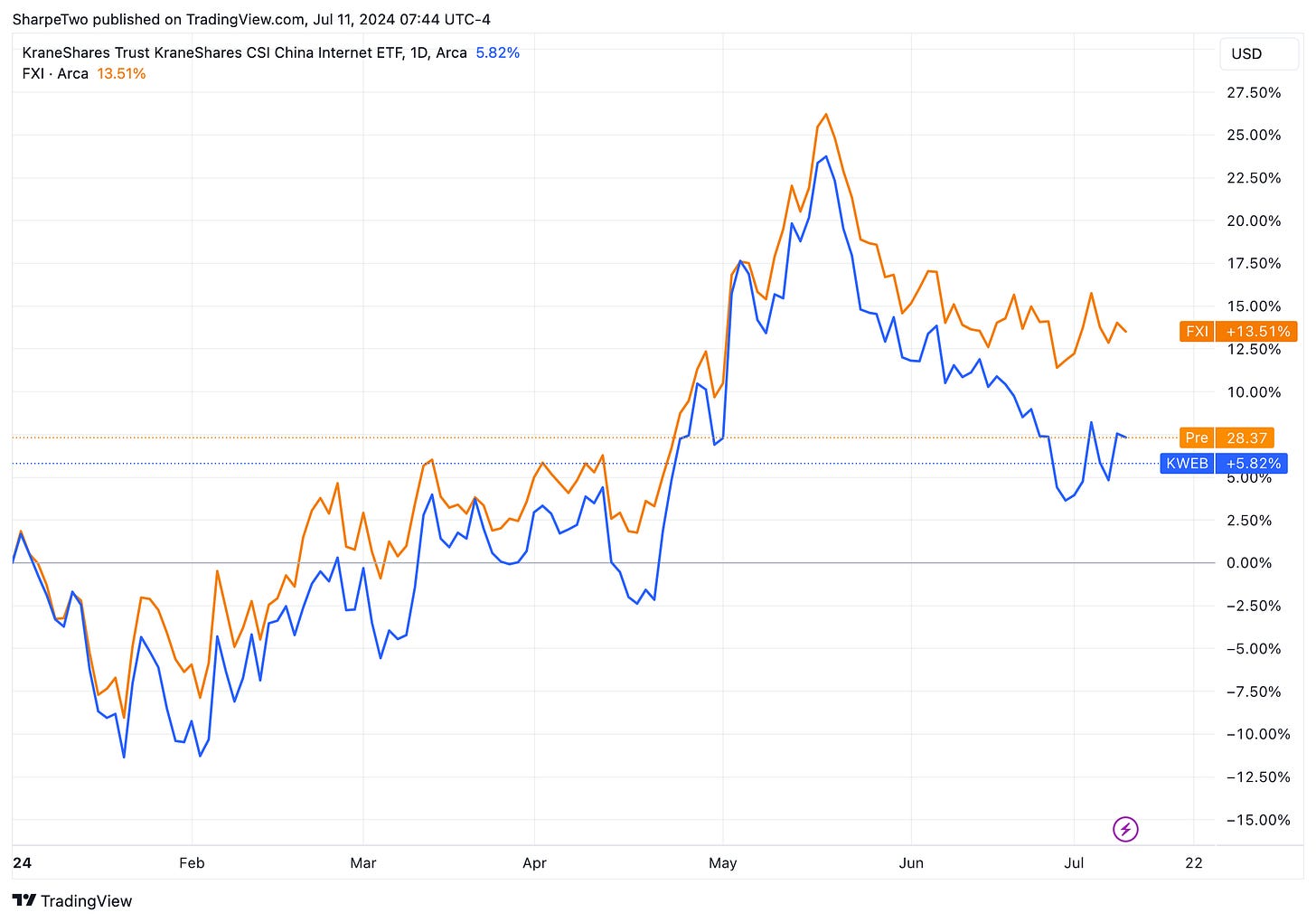

Despite a rough start, Chinese stocks are up roughly 13% year-to-date, trailing significantly behind the SP500 (+17%) and the Nasdaq (+23%). You might have expected an ETF comprising Chinese internet companies to outperform FXI, but it’s the opposite. Despite the global push for technology companies worldwide, KWEB is up a mere 5.8% this year. In comparison, NVDA is up 160% (sure, it’s not an internet company, but you get the idea).

Before diving into the volatility analysis, let’s understand what is in this ETF. KWEB has been around for about ten years. It is quite concentrated in companies mainly active in e-commerce and communication, and as such, its main holdings are Tencent and Alibaba, representing about 25% of the fund’s positions.

The realized volatility in KWEB has been on a steady downtrend since the beginning of the year and is now at a low of 22.5%.

This doesn’t mean that the volatility in the product can’t spike. In fact, with the earnings season just around the corner, one will have to be extra cautious that one of the main holdings doesn’t bring back volatility to the product. With realized volatility being this low right now, there is a good probability that options prices significantly overstate the risk currently observed in the underlying.

Let’s have a look.

The data and the trade methodology

Let’s now visualize the implied volatility in KWEB, calculated using all of the out-of-the-money options with 30 days to expiration (commonly called a variance swap).