Signal Du Jour - short vol in KRE

Now that the monetary policy is clear...

We did not even bother waiting for the end of the press conference. The main event was hardly worth swapping a few hours of sleep for an extra 15 minutes of Jay Powell. Rate cut? Done. Clarification that 50 bps was never on the table? Also done. Pretty much locked in another two 25 bps cuts before year-end? Yes, that too.

Curtains down. You can encore all you want, but there is nothing else to see. Go home.

What still baffles me is how the marketplace—starting with the financial media—manages to get itself worked up like teenagers screaming before a Billie Eilish concert: “Jaaaay, we love youuu!”

Jay does not care about your trades or your speculation. Whatever you think of him will not affect his sleep. He cares about the data, his dual mandate, and what he is having for dinner. It is true—we love Jay, a model of consistency and integrity in a world with the attention span of the X Blue Bird.

And like Jay, where we also care about the data and our own dual mandate: trading for ourselves while delivering value to our readers. And yes, we will miss him dearly when May 2026 comes around.

With that in mind, let us turn to today’s trade in KRE, the ETF that tracks the regional banks. Not the first time we have touched on it—we did a short video a few weeks ago (worth checking out if you want a sneak peek at the S2 platform).

Let’s take a look.

The context

Regional banks have had a strange year. Down almost 20% at the height of the tariff storm, now up a solid 7% on the back of lower-rate expectations.

That part still throws us off sometimes: are banks not supposed to make money when rates are high? Yes—but lower rates also mean lower default risk, which in turn improves balance-sheet quality.

Fair enough. That is why we do not waste too much time on macro riddles and instead stick to something more predictable: volatility. And as you would expect, realized vol in KRE has been anything but mild in 2025.

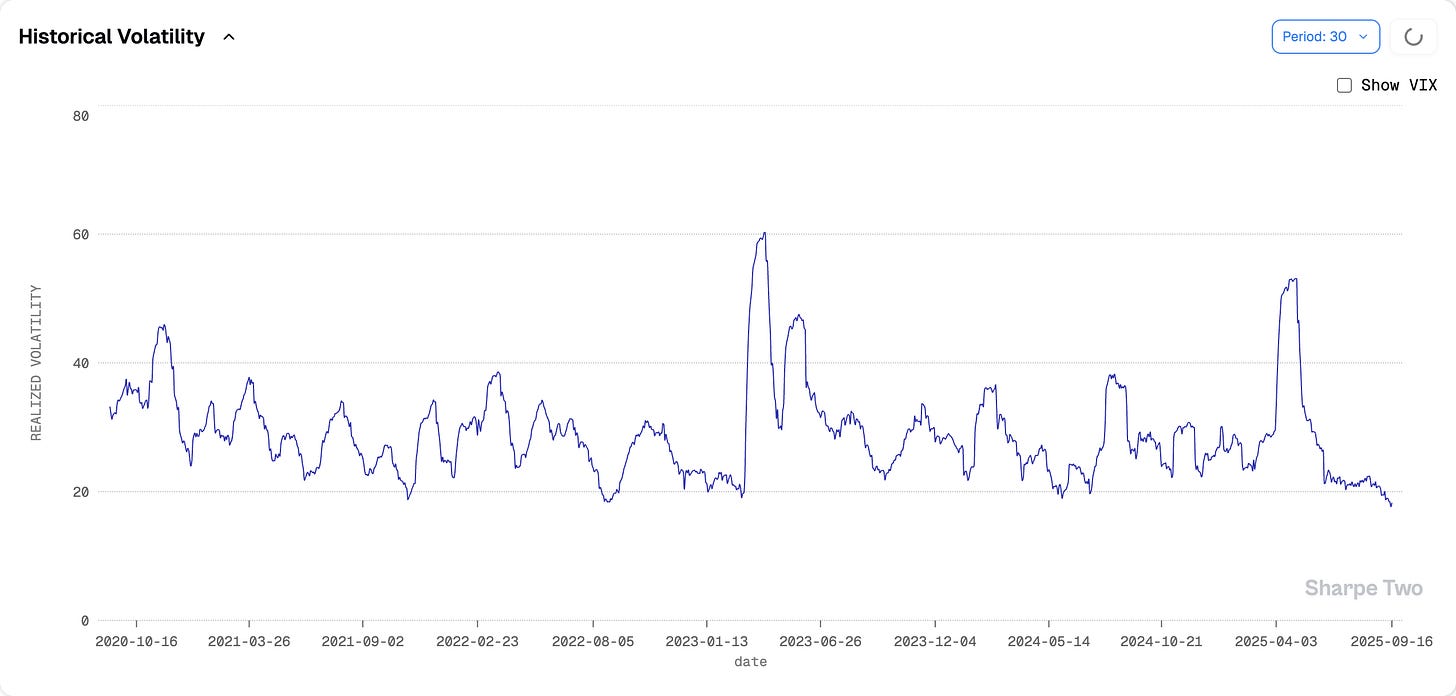

After a spike to 45%, realized vol has cooled off completely and now trades at the lowest levels in five years. Aside from a brief dip in August 2022—before Powell rattled markets at Jackson Hole—and a few moments in 2021, we have not seen KRE this quiet in a long time.

And while the market always has new ways to surprise, with the rate cut behind us and clearer guidance on monetary policy for the coming months, it is hard to see realized volatility meaningfully picking up from here.

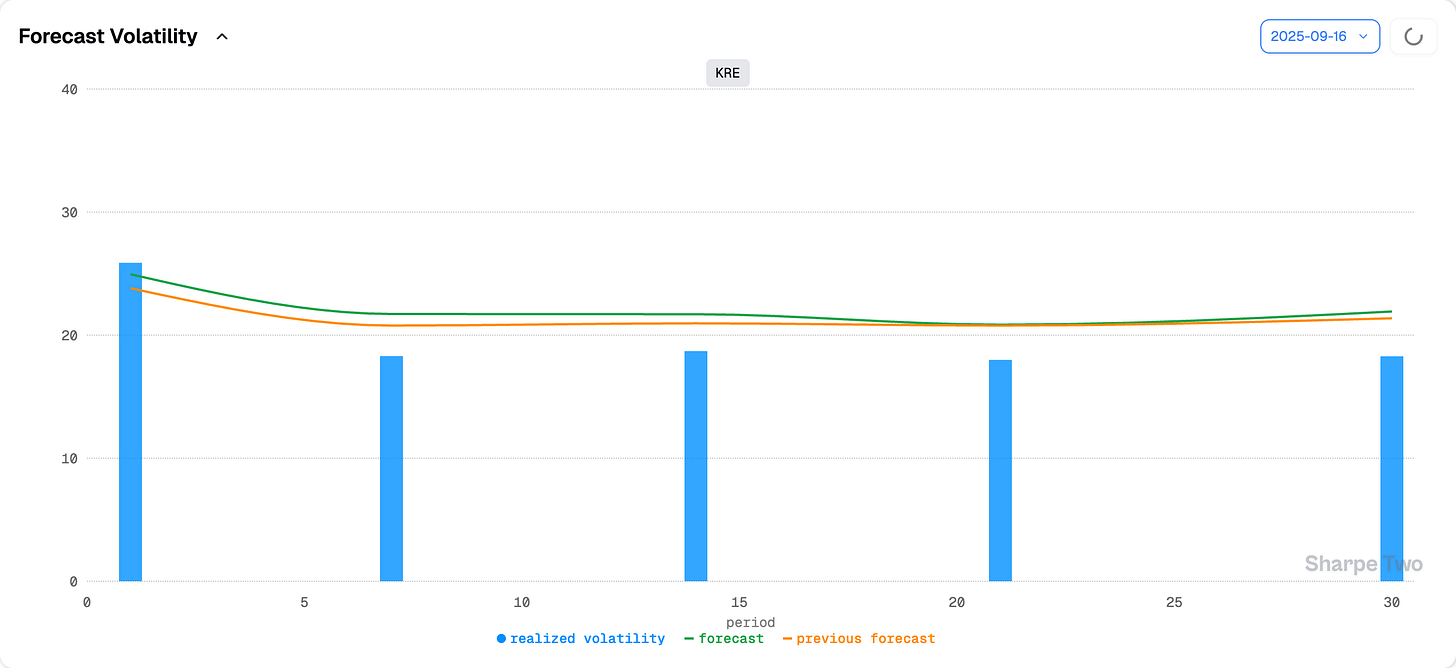

That is why we lean toward our forecast: maybe a drift higher toward 20, but no obvious catalyst for serious disruption. KRE has been trading quietly, and it could very well stay that way for a while.

With this in mind, let us see what the options market is paying and how we could structure a trade in KRE.