Signal du Jour — Short Vol in KRE

The great rotation has a volatility premium attached

After the Great Depression in 2025 or arguably 2023 for regional banks the Great Rotation: while the SP 500 has stayed afar from its brief flirtation with 7k (closing yesterday at 6,914) small caps are on a tear. The Russell 2000 is up nearly 7% since the start of the year, and it has been one of the most aggressive rallies in years.

Regional banks are leading the charge, and the catalyst is not hard to find: Kevin Warsh, Trump's pick for Fed Chair, is seen as friendlier to domestic lending. But the big news yesterday was the House has just rebuking the tariffs imposed on Canada. It is hard to get perfect visibility on the legality of these tariffs, but for the moment, the market has decided to shrug off the concerns over Main Street. And why not after all? If even the job reports are better than anticipated, what is it exactly that this American economy can't handle?

KRE, the regional banking ETF, is currently sitting at multi-year highs, far from the scare of spring 2023: can you believe it has already been 3 years since the collapse of SVB...?

Yet underneath the calm, the options market is pricing a little bit more uncertainty than the stock has been showing.

Let's have a look.

The Context

Regional banks have had a great time since the end of 2025, adding almost 20% in a little less than 3 months. Long gone are the peregrinations around Thanksgiving. The combination of deregulation hopes, a steeper yield curve, and the prospect of a more accommodative Fed Chair has lifted the sector.

KRE has climbed steadily, and the price action has been very much one-sided; no gaps, no panics, just a nice grind higher. Quite the difference from September and October last year, when realized volatility was on the rise as the uncertainty over AI financing was peaking.

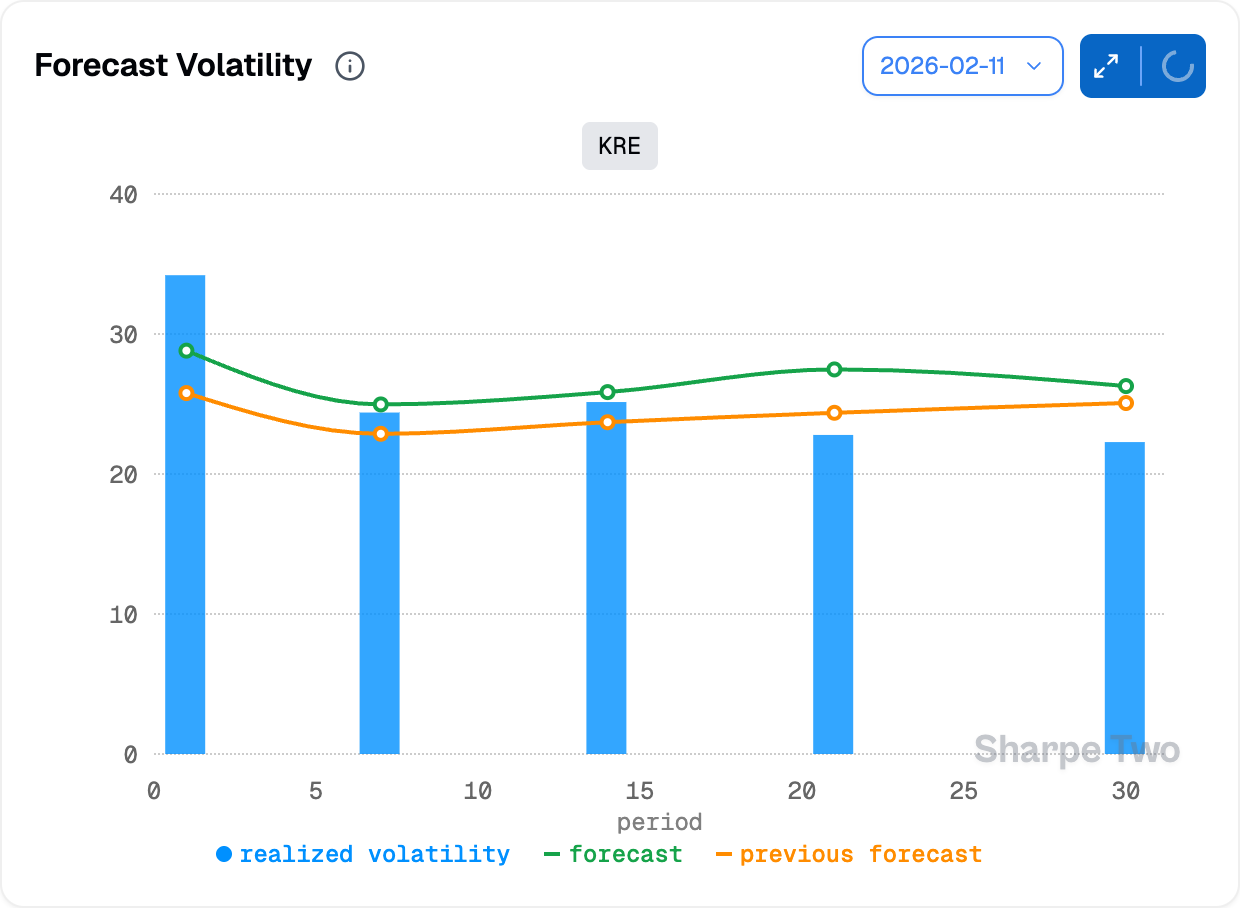

The climb higher, however, has been accompanied by a rise in realized volatility. After bottoming in early December at 17%, realized vol has drifted up to 22.28%.

What to make of this number? It starts to feel… on the higher side, doesn’t it? Actually, it is right at the 50th percentile of its two-year range. The two-year median is 22.07%, with the 20th percentile at 19.64% and the 80th at 28.27%. Dead center. The stock is moving, but within its normal range and on paper, nothing is out of order.

So what's next for realized volatility? Our forecast for the next 30 days points to realized volatility drifting higher, toward 25%, up from the current level — and you indeed have a few catalysts on the horizon, starting with CPI this Friday. That said, a drift higher in vol is the base case, and we are not convinced a spike is imminent.

However, considering the pace at which headlines reach the marketplace, one will have to stay on their toes and make sure nothing fundamentally disrupts the realized volatility expectations over the next two weeks.

With that in mind, let us see what the options market is telling us.