Signal du Jour - Short Vol in IBIT

Volatility has finally returned after more than three months of calm. With it came new opportunities — although some of the old recipes still work just fine. We were very close to writing yet another piece about shorting volatility in US indices: with nearly 10 points of VRP in SPY as we speak, why look elsewhere?

To be honest, every week we bring you new ideas and corners of the market to explore, but there is no reason to get distracted either. For most retail traders, the curse of performance is execution. Doing too many things at once quickly becomes overwhelming.

Volatility in US indices — and across sector ETFs — has been overpriced for much of the year. Trading only that would have been enough to deliver an outstanding annual performance. When trading is done right, with an edge and under prime conditions, it quickly becomes boring — especially if you manage to resist the sirens of 0DTE.

But boring does not sit well with a newsletter audience. This is as much about sharing profitable ideas as it is about keeping things fun and engaging. So what a relief when IBIT popped up on our screen this morning. Look at us — dabbing with the cool kids after weeks spent trading regional banks, IWM, or worse… XLV.

Do not get your hopes up though: there will still be no technical analysis and certainly no “call walls.” Just selling options to those afraid (legitimately) of missing out — or (legitimately, again) of the ultimate rug pull. Pick your side; we will happily quote a market to both camps.

Let’s dig in.

The context

Trump had been explicit about turning America into a crypto powerhouse during his campaign — and the least we can say is that he delivered. Deregulation across the industry is moving at full speed, and the price of Bitcoin has surged to new all-time highs.

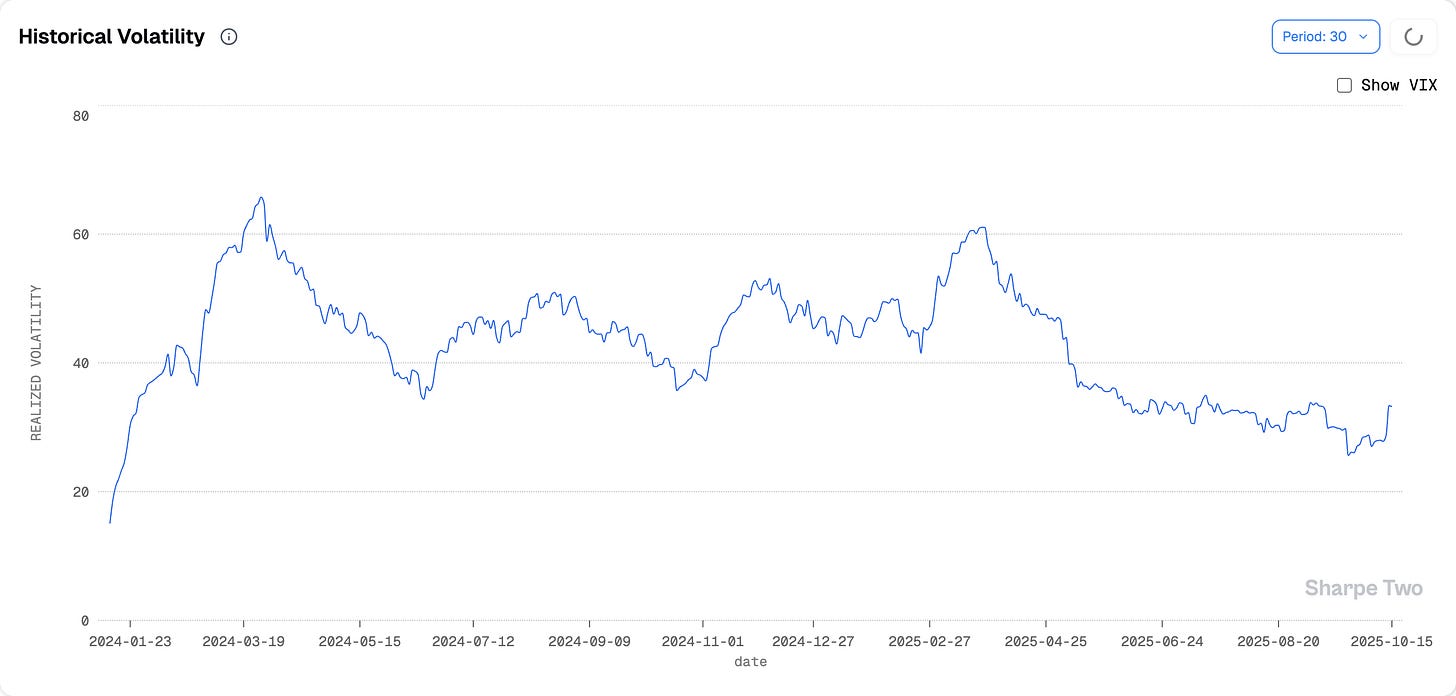

Yet volatility never disappeared. The flash crash last Friday was a stark reminder that fortunes in this space can flip fast. IBIT dropped nearly 14% from its early-October peak, with about 8% of that on Friday alone — enough to rattle many and spark a sharp jump in realized volatility.

From 25 to 33 in just two weeks for the 30-day annualized realized volatility — that is respectable. One could argue that the market’s perception of the asset has evolved and that relatively low realized volatility is now justified, as Bitcoin has become accessible to both retail and institutional investors. But it is still not without risk, and many will remember that at this time last year, realized volatility was firmly in the 50s.

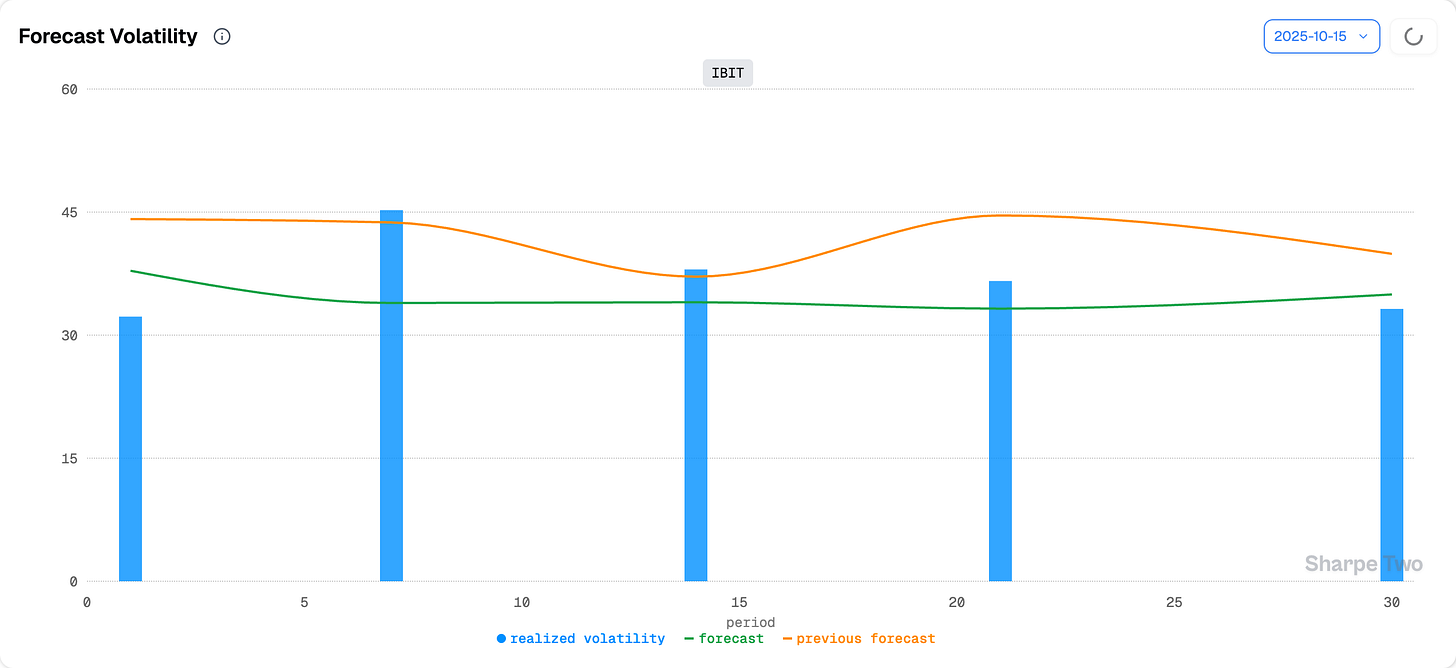

With that in mind, it is difficult to make a compelling forecast. Our model does not expect the current bout of volatility to keep creeping higher. Instead, we should remain in the range we are in now, between 35 and 40.

Still, it is Bitcoin — and you never really know. One should be mindful of sizing. That said, it is precisely because it is Bitcoin, and nobody truly knows, that the options market offers opportunity. Let us see how we can take advantage of this lack of consensus.