Signal du Jour - short vol in EWZ

Finding good opportunities in this low volatility regime.

We hope you enjoyed the long weekend as much as we did. Last week, we left the market digesting NVDA's earnings and hovering near all-time highs, while the VIX closed again on Friday below 12.

We tried to stay off social media but got drawn into some interesting debates about the current low-volatility regime. The usual points came up: selling volatility is overcrowded and dangerous, and you must be a complete degen to ignore the inherent economic risks and partake in such a trade.

However, the advantage of selling volatility is that you don’t have to stick to markets where the premium is thin. Why focus only on American markets when you can go global?

Today, we’re looking into EWZ, the ETF that tracks Brazilian equities.

Let’s dive in.

The context

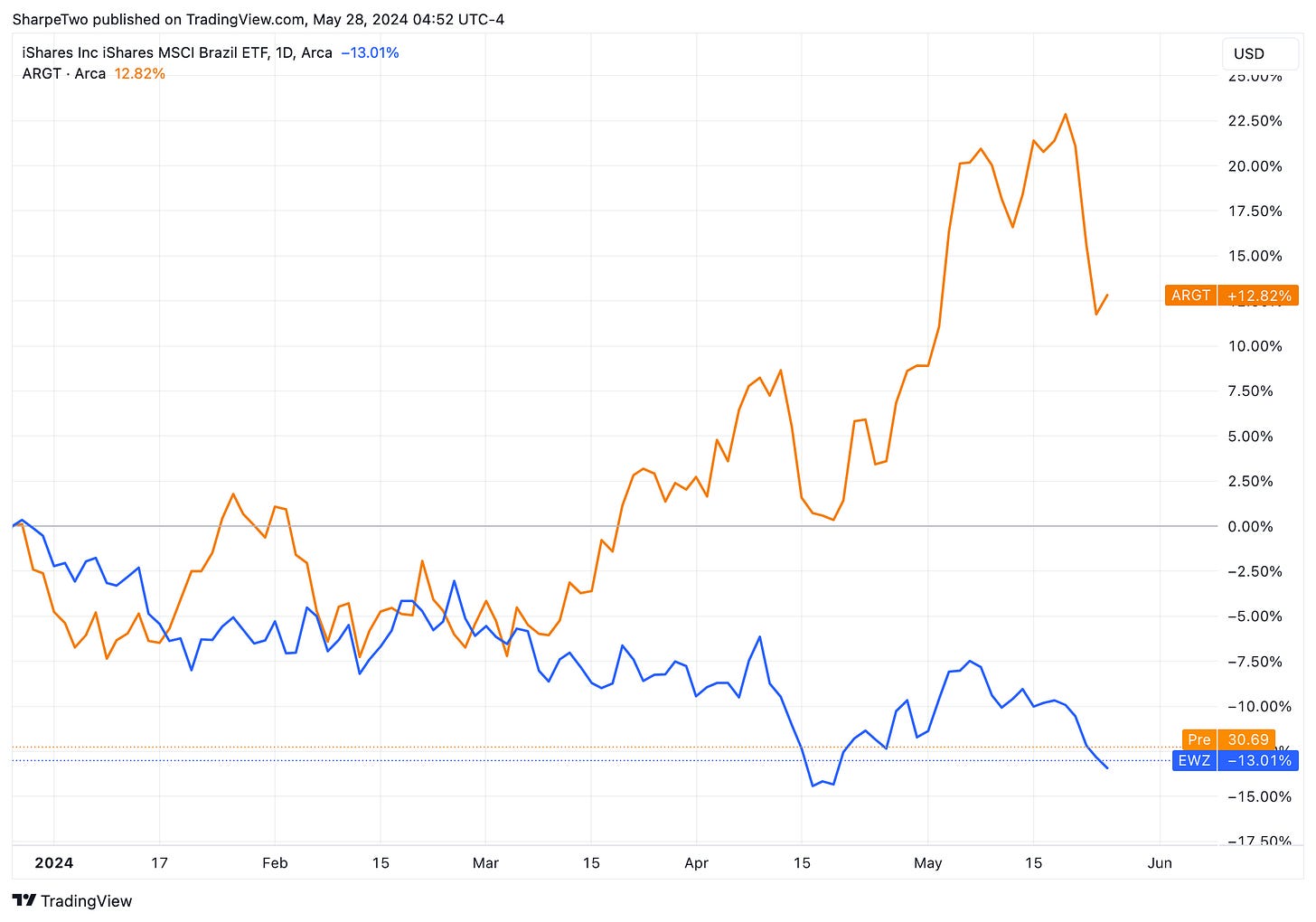

Brazilian equities have had a mixed year so far in 2024. While American equities have posted a solid 10% gain, EWZ has lost more than 10%, making it one of the major laggards among the larger economies. Various explanations exist for this underperformance, with a reasonable one being that some Latin American economies, particularly Argentina, have become more attractive.

This isn’t our primary focus at Sharpe Two, but the decoupling is noteworthy. Now, let’s look at the volatility realized by EWZ over the past few years.

Despite the gloomy year-to-date performance and a technically defined bear market, realized volatility has never really picked up. In fact, it decreased throughout Q1 before rising slightly in Q2. Yet, we are still in the lowest quartile observed in the index over the past two years.

This paradoxical situation, where the index is technically in a bear market but realized volatility is quite low, presents interesting opportunities for volatility sellers.

Let’s take a look.

The data and the trade methodology

Let’s start by looking at the variance risk premium in EWZ, using the 35 DTE straddle and comparing it to an average of the observed movement over 35 days in the underlying.