Signal du Jour - Short Vol in EWY

The biggest political risk is out, now what?

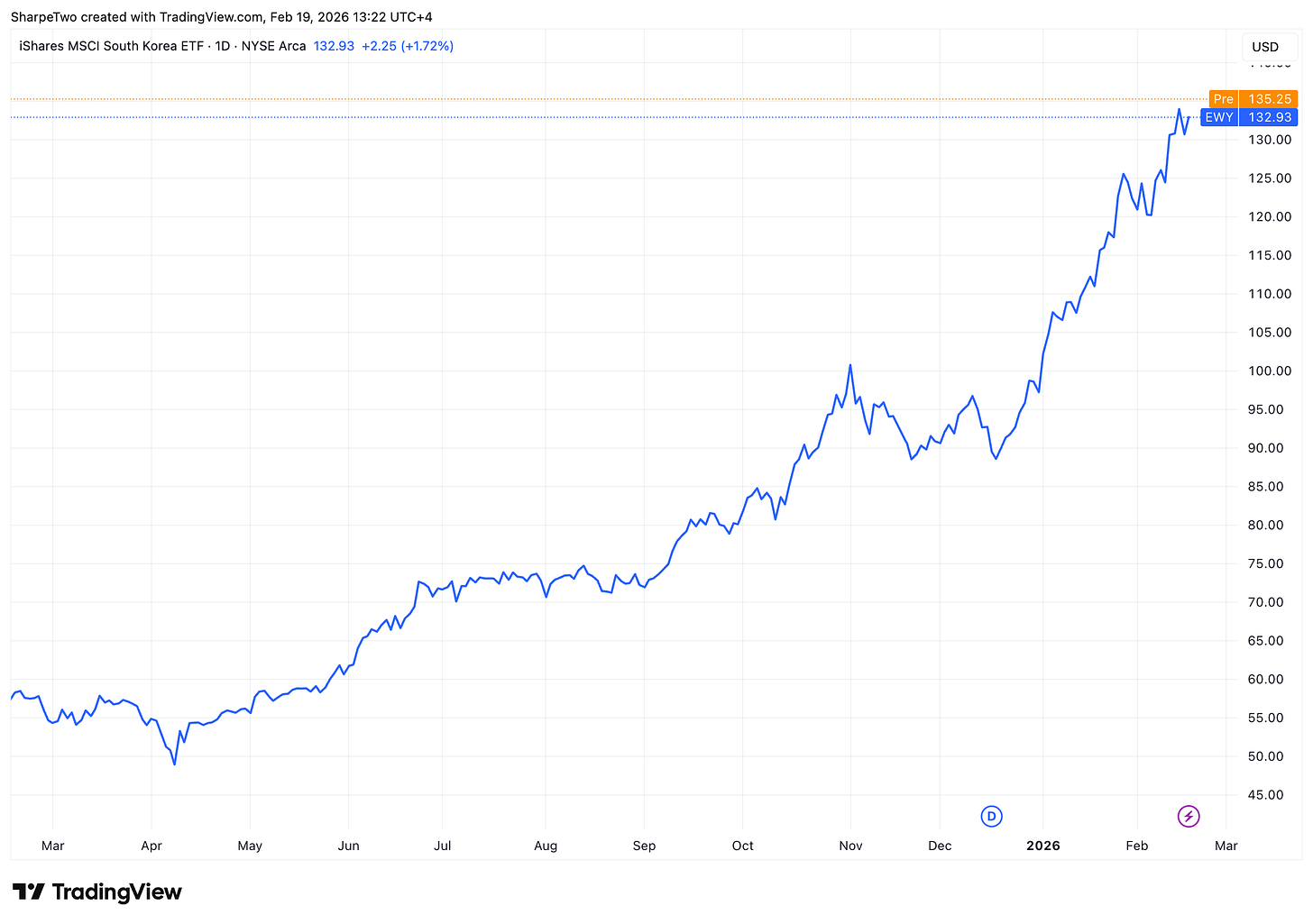

South Korea has been the quiet story of 2026. While the rest of the world has been fixated on tariffs, AI capex cycles, and whatever Powell says next, the KOSPI has surged past 5,000 for the first time, making it the best-performing major stock market in the world this year, up over 31%. Over the last four months, the move is even more dramatic: 62.33% from the October low of $81.89. Samsung, which now makes up roughly 28.2% of the KOSPI's total market cap, has been the engine behind much of this. The company is raising HBM4 memory prices by 30% amid a global AI chip shortage, and the market is rewarding that pricing power handsomely.

And then today we learnt that former president Yoon Suk Yeol was found guilty of insurrection and sentenced to life in prison, avoiding the death penalty, for his December 2024 martial law attempt. His defense minister received 30 years. Whatever you make of Korean politics, this is a resolution; the kind of binary event that was looming over the market for months and the outcome removes a source of genuine uncertainty.

Yet the premium embedded in EWY options right now is some of the most extreme we have seen in any single-country ETF this year. With Trump's 25% tariff threat on Korean exports still lingering and the verdict now behind us, our short vol signal list lit up on EWY, and the data behind it deserves a closer look.

Let's have a look.

The Context

The rally in EWY has been relentless but not reckless despite its meteoric performance: the index almost tripled since the low of a year ago in the midst of the tariffs war. It is fundamentally driven, as the uncertainty looming after the biggest political crisis in years at the end of 2024 has been resolved but also as the semiconductor cycle is heating up, powered by Samsung and a broader reassessment of Korean assets after the political crisis.

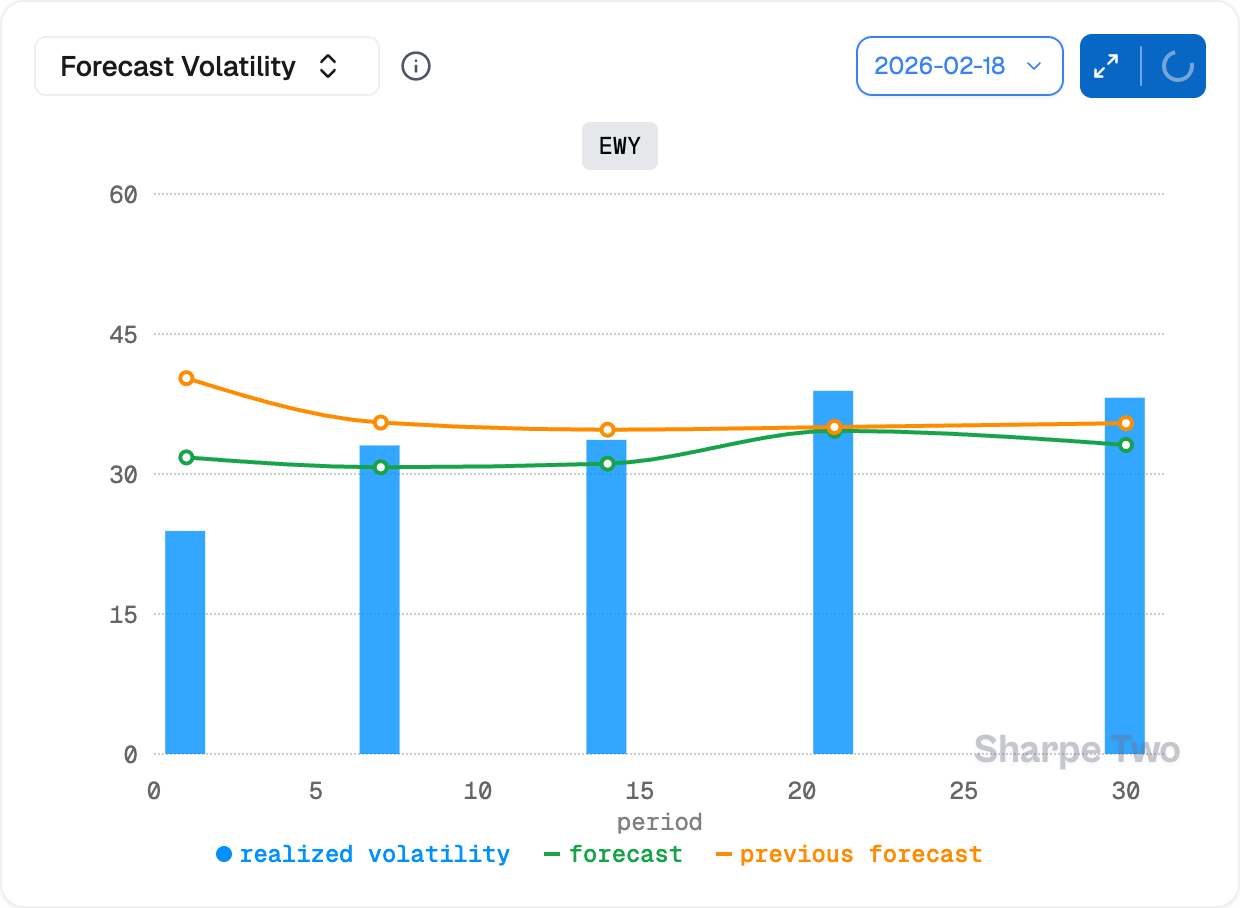

Realized volatility tells a more nuanced story than the headline return suggests. At 30 days, EWY's realized volatility sits at 38%; elevated for sure but not extreme for a country under the scrutiny of the US administration for its close ties with China. Yet the current reading is well above the 80th percentile and while volatility has some mean-reverting properties, one has to be ready to see things stay like this for a while: volatility clusters, and until a genuinely new piece of information appears, things may stay on the more volatile side for a while. What could that be? NVDA earnings next week, for instance, which could trickle down to the Korean market, whose reliance on Samsung is as much a vulnerability as a strength.

That said, while our forecasts do not see immediate compression ahead, they do not see a major expansion either. At the close yesterday, we were anticipating a reduction to 34% over the next few weeks, and that sums it up well: things will keep moving, but not more than what we have experienced over the past few weeks.

With that in mind, let's see how the options market has reacted and where the best opportunities lie.