Signal Du Jour - Short Vol in EWY

Stretched VRP in South Korea

4999.89 — That's likely the last time we won't see the SP500 surpassing 5000.

Yet, the market remains eerily calm.

It's a nerve-wracking quietude, but commitment to the process is key. We've seen our long volatility indicators flip more towards green than red in the past couple of days. Despite this, we're holding off on diving too deeply into that signal—just yet.

It's easy to get caught up in the US equity market and overlook the myriad opportunities unfolding across the globe.

Our gaze remains fixed on Asia as the Lunar New Year approaches, heralding a period of diminished activity across the continent—affecting trading volumes as well.

Having explored FXI recently, our attention now shifts to South Korea through the lens of the ETF EWY.

Let's dive in.

A side note— We understand it's just as frustrating for you as it is for us to be limited to just one piece of our research daily. To address this, we've launched a beta program for our API, providing access to all the ratings on our ETF baskets. Interested? Drop us a message to join in.

The context

South Korea, nestled on the peninsula bordering North Korea, has witnessed extraordinary economic growth over the past four decades. Its economic ascent, fueled by a booming electronics manufacturing sector, has seen the rise of global giants like Samsung and LG—household names familiar to our readership.

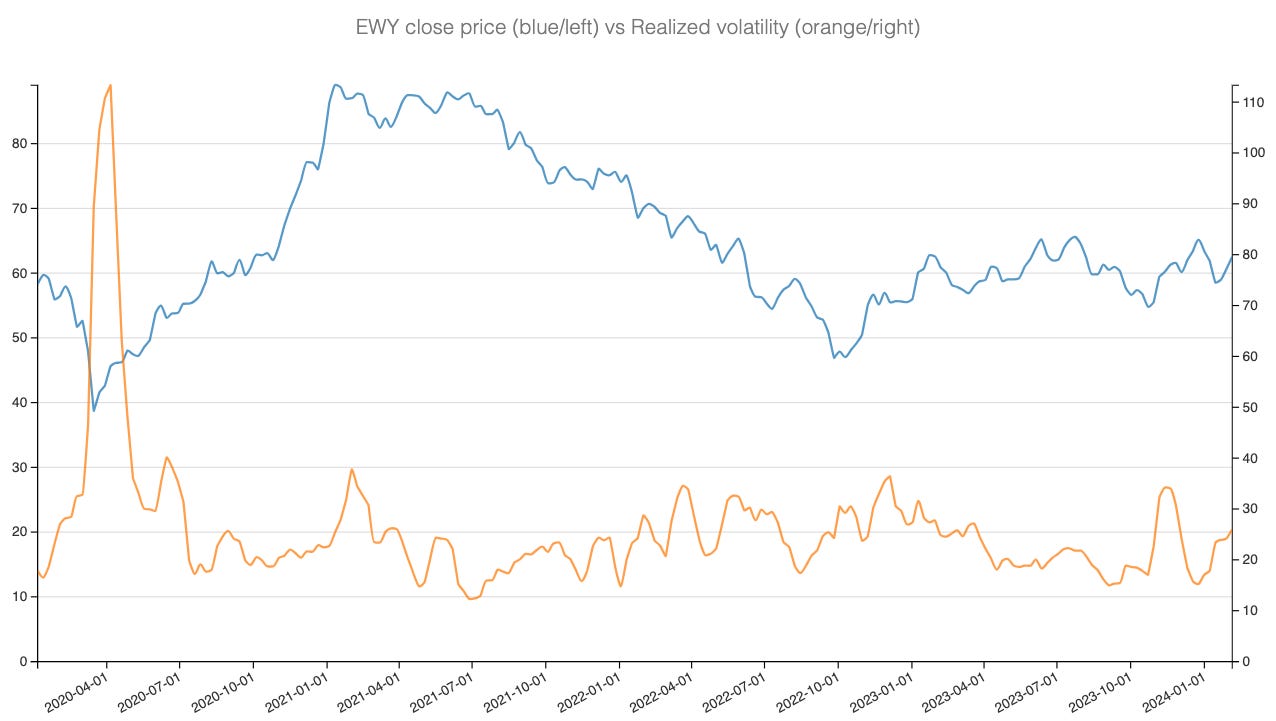

The stock market saw a remarkable rebound from the COVID-19 downturn, surging by 125% in just a few months. However, the post-COVID period has been challenging. Impacted by its reliance on powerful neighboring economies and global economic shifts, the market has since relinquished 33% of its gains from the 2021 peak.

Despite the market's significant drop since its COVID-19 peak, the descent occurred in an orderly fashion. Surprisingly, even at the height of pandemic-induced volatility, the market's realized volatility did not reach extreme levels, oscillating between 15 and 35. Presently, it stands at 23.8, comfortably in the middle of this range.

This steadiness in realized volatility is a silver lining for sellers of implied volatility, suggesting a potentially attractive premium within the index. A glance at a reconstructed VIX for EWY (also accessible via our API) reveals a stark contrast to historical volatility.

Since March 2023, there have been notable spikes in implied volatility, with the index currently near its low at 25.6. More intriguingly, except for a few exceptions, there seems to be a consistent variance risk premium available for option sellers.

Let's dive deeper into the data.

The data and the trade methodology

Continuing our examination, we'll compare the price of at-the-money (ATM) straddles in EWY with the subsequent movements in the underlying asset to get a better feel of the Variance Risk Premium.