Signal du Jour - Short vol in EWQ

Harvesting the risk premium from the French snap election

Today is the birthday of the author of this Newsletter. Therefore, this article is accessible to everyone :) Enjoy !

Our system caught an interesting signal this morning, prompting us to propose a short trade in EWQ, the ETF providing investors with exposure to French equities.

No, we are not suggesting this as revenge for the lackluster football they’ve produced in the Euro Cup. Instead, it's purely because the context and the data align.

Let’s take a closer look.

The context

It was a significant surprise 25 days ago when a French electorate forced President Macron to call for snap elections after the strong signal sent at the latest European elections. With the far right harnessing 32% of the votes, this result is among the most shocking in the country's history. Needless to say, the market didn’t like it much.

It took exactly a week for French equities to swing from up 9% year-to-date to down 2%, as the prospect of populist parties ruling the country deterred investors. Both the far left and the far right share a similar economic program—not exactly pro-enterprise but promising to increase public spending even further.

Spooky spooky. Or is it really?

In this context, the market's answer has been to cut some exposure to France and wait for better clarity, which is fairly typical. We’ve even read a few articles suggesting taking a short position on French equities or OAT. We remain a little skeptical.

Far be it from us to become political experts overnight. However, from a pure contextual perspective, the likelihood of either extreme arriving in power after the second round of elections on 7/7 is almost certain. Therefore, is this really a trade? If anything, markets can only be positively surprised in the short term if the President's party performs much better than anticipated.

As usual, we will maintain our market neutrality and examine the options data to see if they may exaggerate what will likely happen in the next few weeks. Let’s review the realized volatility in EWQ.

The market has definitely been stressed out in June, similar to what was observed in April when rockets were flying between Iran and Israel. However, it is far from the levels seen during the combined impact of the war in Ukraine and hyperinflation in Europe.

With a fairly understood and predictable outcome and a reasonable level of fear that does not signal a change in paradigm for French equities, let’s examine the option data and see how we can structure a trade.

The Data and the Trade Methodology

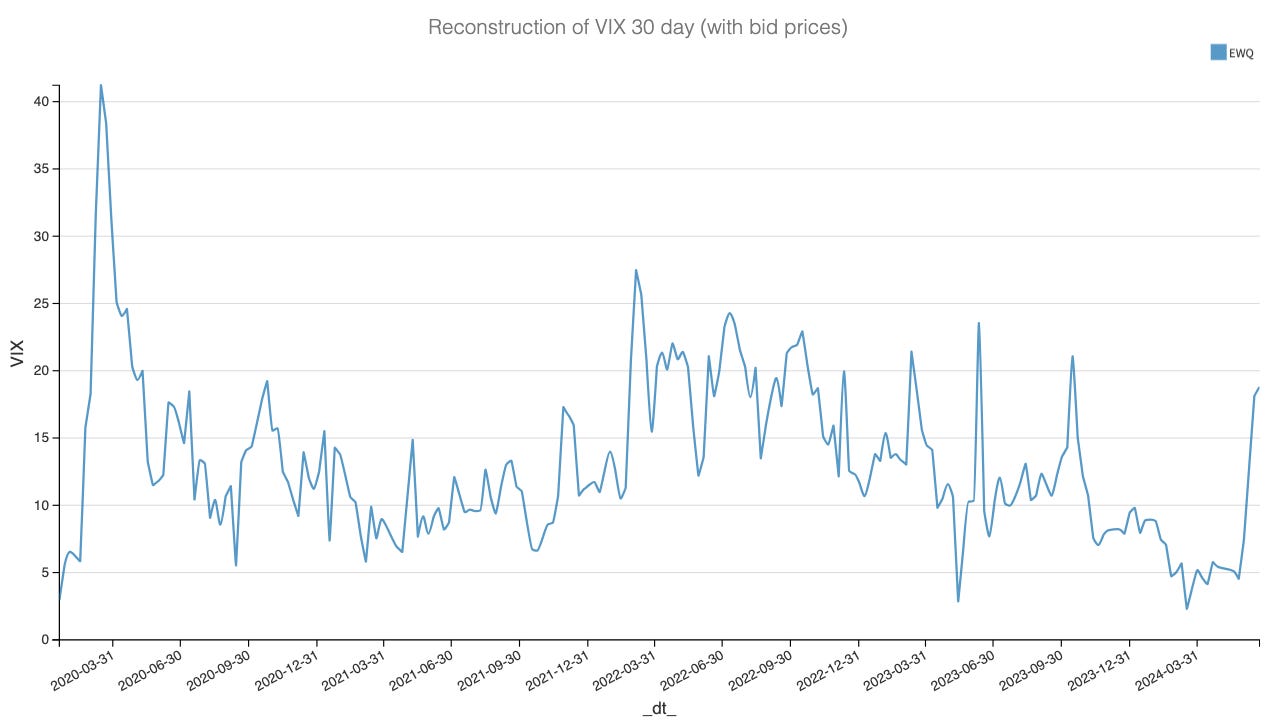

Let’s start by reconstructing the VIX index for EWQ using bid prices in the option data.

EWQ is not the most liquid contract, and it always skews some metrics around. Still, the essential point is clear—the jump in implied volatility has been significant, putting us at levels observed in 2022 when the global market was in turmoil, and a global recession was on everyone’s mind. Is this justified? This is an open question, and opinions may vary.

At Sharpe Two, we will focus on the actual spread between realized and implied volatility. Again, we use the bid price data to plot the Variance Risk Premium (VRP) distribution as the ratio between implied and realized volatility.

Currently, this ratio is at 1.05, which is almost the highest we have recorded since 2021. Don't be misled by the use of bid prices; there are VRPs in this trade depending on the time of year, and typically, you have to work on your execution. Except today, you have to work a little less.

A side note: often, the money in VRP trades for retail is in the bid/ask spread. We've heard complaints about some of our trades being in illiquid products. If it were liquid, the big players would be involved, making it a much noisier and less profitable trade. Trading requires patience and finding good prices. Someone suggesting otherwise may lack credibility.

Let’s now examine the expiration cycle in EWQ to determine where to place a trade.

As expected, the entire cycle is inflated when you build a z-score for each VRP measured at each maturity, especially the front month where there is the most uncertainty. Therefore, we propose the following trading methodology:

Short the ATM straddle in EWQ expiry July 19.

Placing this trade today is acceptable; tomorrow, right before the market closes in Europe, is even better.

Normally, we would encourage you to keep the trade for two weeks. Not this time. We strongly suggest removing the position early next week while the uncertainty related to the vote is being digested.

The liquidity in EWQ is not amazing. However, if you want better markets and access to the CAC index, we strongly encourage you to go there.

Let’s now discuss some of the performance of this trade and some of the risks.

The performance and the risks

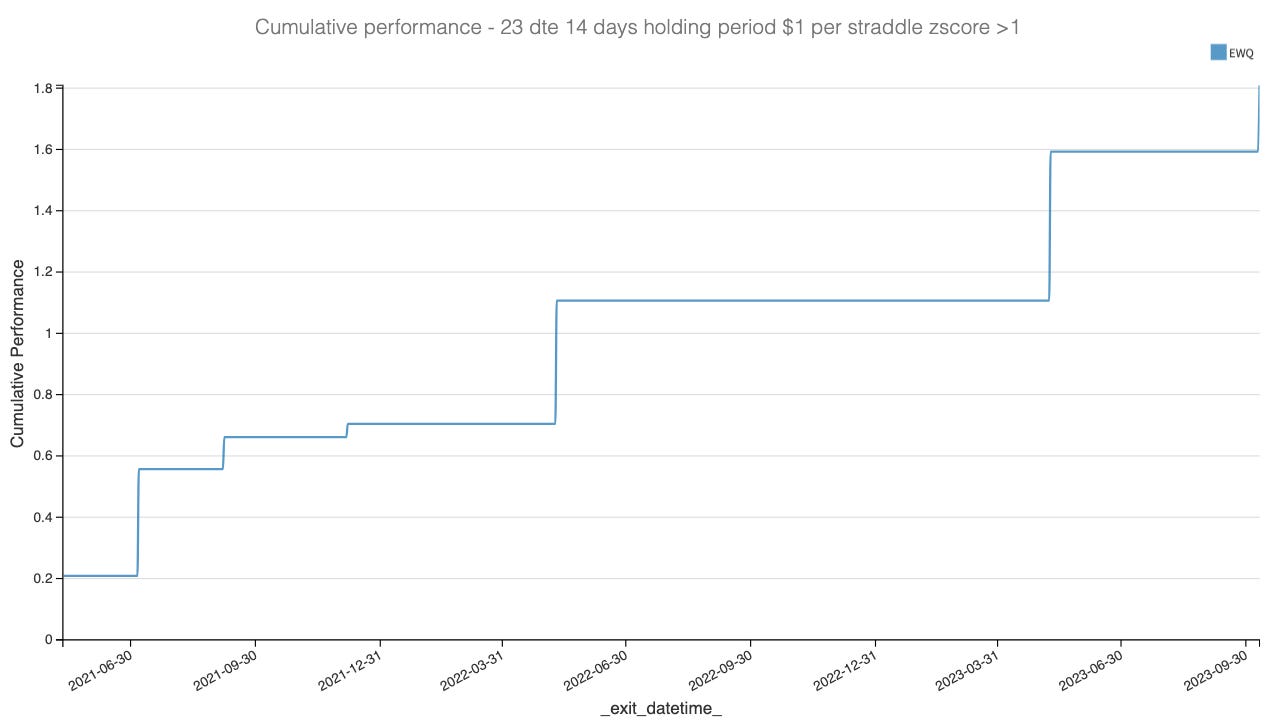

Let’s start by reviewing the performance of selling straddles in EWQ only when the VRP is stretched.

Obviously, there haven't been many signals over the years, but the ones that have occurred have been of very high quality. A caveat: this curve assumes we hold the trade for two weeks. However, because the election is over two rounds, we wouldn’t recommend keeping it that long. It is acceptable, but we suspect the market will pick up as we get closer to the second round and may even accelerate after that.

Think about it—if the results are not as bad as feared or at least as anticipated (political deadlock), why wouldn’t we go back up to 9%? Conversely, if it is truly a disaster (one of the extremes gains an absolute majority in the House), then the CAC may not stay flat for long.

In any case, as usual, size your positions reasonably. This is a variance game: one bad trade is all it takes for your portfolio to snap in half.

Data, charts, and analysis are powered by Thetadata and Dataiku DSS.

Have access to our indicators using our API.

Book a consultancy call to talk about the market with us.

Contact at info@sharpetwo.com.

Disclaimer: The information provided is solely informational and should not be considered financial advice. Before selling straddles, be aware that you risk the total loss of your investment. Our services might not be appropriate for every investor. We strongly recommend consulting with an independent financial advisor if you're uncertain about an investment's suitability.