Signal du Jour - short vol in EFA

Venturing outside of the US equity market

Another Monday in the market, and after two dense weeks on the macroeconomic and earnings fronts, it will be interesting to see if realized volatility maintains the higher levels observed throughout April, particularly last week.

However, it's not a given; the calendar is pretty empty for the next ten days. VIX 13.5 suggests that intraday movement will need some serious justifications, hitting the newswire to stay as elevated as it was recently.

With that in mind, we will trade EFA, an ETF that exposes investors to international equities, excluding the US.

Let's have a look.

The context

EFA is an equally weighted ETF that invests in major markets and provides exposure to quality stocks in Europe, Australia, and Asia.

You will recognize some of the most prominent companies in Europe among its main constituents and have a relatively balanced exposure to sectors, although skewed towards financial services and industrials, which are sectors relatively strong in the aforementioned geographies.

As expected, EFA's performance correlates with the leading benchmark, the S&P 500. We can observe the same pattern from the end of Q3 2023 to the end of Q1 2024, with a monster rally taking it 20% higher.

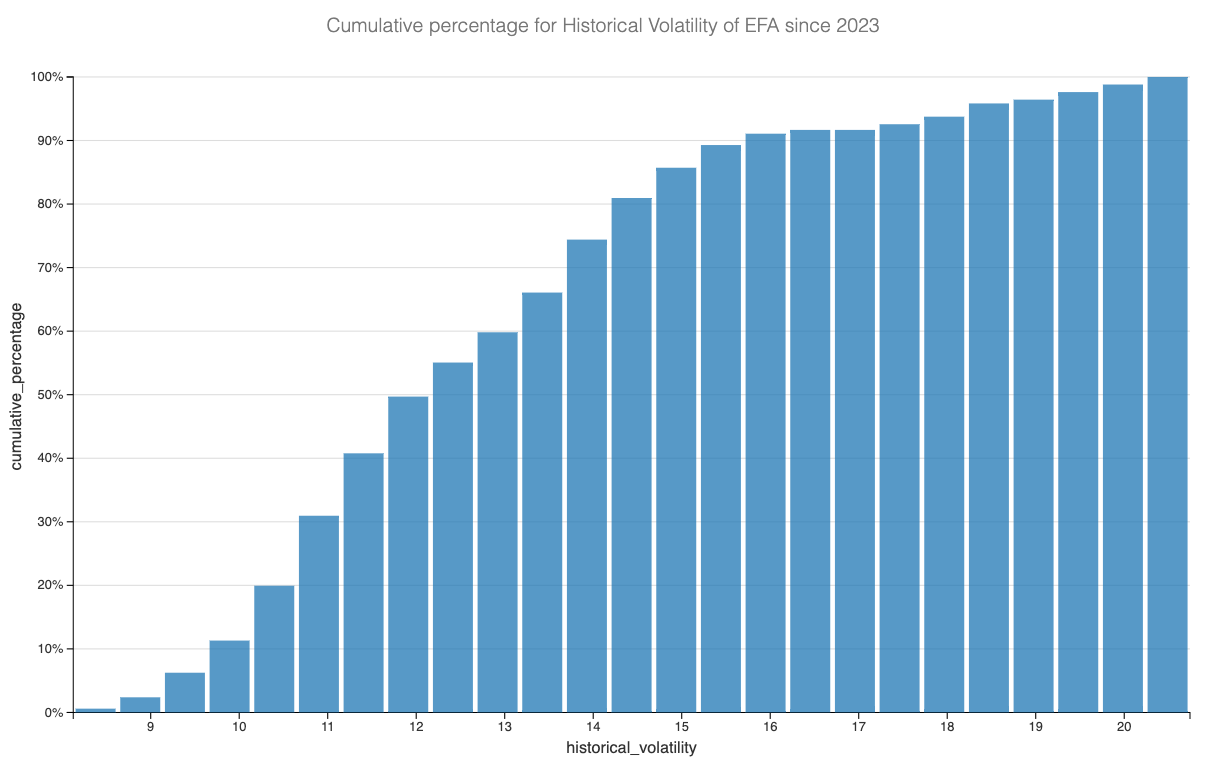

On the realized volatility front, things have been fairly quiet in 2023, and except for a brief passage around 20 during the regional debt crisis in the US, the ETF spends much more time between 10 and 15.

With a reading of 13.3 at the close last Friday, we are at the normal value observed over the past 18 months.

With that in mind, let's examine the data to see how the options market perceives risk in this instrument.

The data and the trade methodology

Let's start by looking into the VRP at 30 days using the straddle prices. We will compare them to an average 30-day movement in the underlying.

Without normalization, we can see that this ETF spent a fair amount of time with a 30-day VRP below 1. What can we do with that information? It shows that as a relatively stable ETF, the options market usually apprehends the risk at 30 days relatively accurately and would even understate some of the movements in the underlying (particularly to the upside, as this ETF overall goes up over time).