Signal du Jour - short vol in BOIL

Too hot to handle?

The markets are swinging, but—so far—they’re holding. VIX popped back above 20 yesterday after chatter that the BBB (Big, Beautiful Bill) might face rougher waters than the market had priced. How this saga plays out? We’ll see. Everyone has a comfort movie—not necessarily a classic, but the one you queue up when it’s grey and you’re bored stiff. The US debt ceiling debate has become that film for markets: not great, not new, but somehow always on.

Still, there’s nothing especially juicy in US equities. We dipped into some long vol positions late last week and again early this week, but the data is muddled. Unless there’s a clean dislocation or the nascent contango in the term structure confirms itself, there’s no need to force a trade. Sometimes the better move is to do nothing.

So, this week, the focus shifts to BOIL—the wild child, a levered ETF chasing natural gas with all the subtlety of a firecracker in a broom closet.

Let’s see what’s on offer.

The context

BOIL has had a spectacularly rocky year. It pumped close to $100 through the winter, only to get absolutely annihilated—collateral damage from the broader commodity carnage kicked off by the Trump tariffs war. The ETF has since found some footing, but the ground is still far from stable.

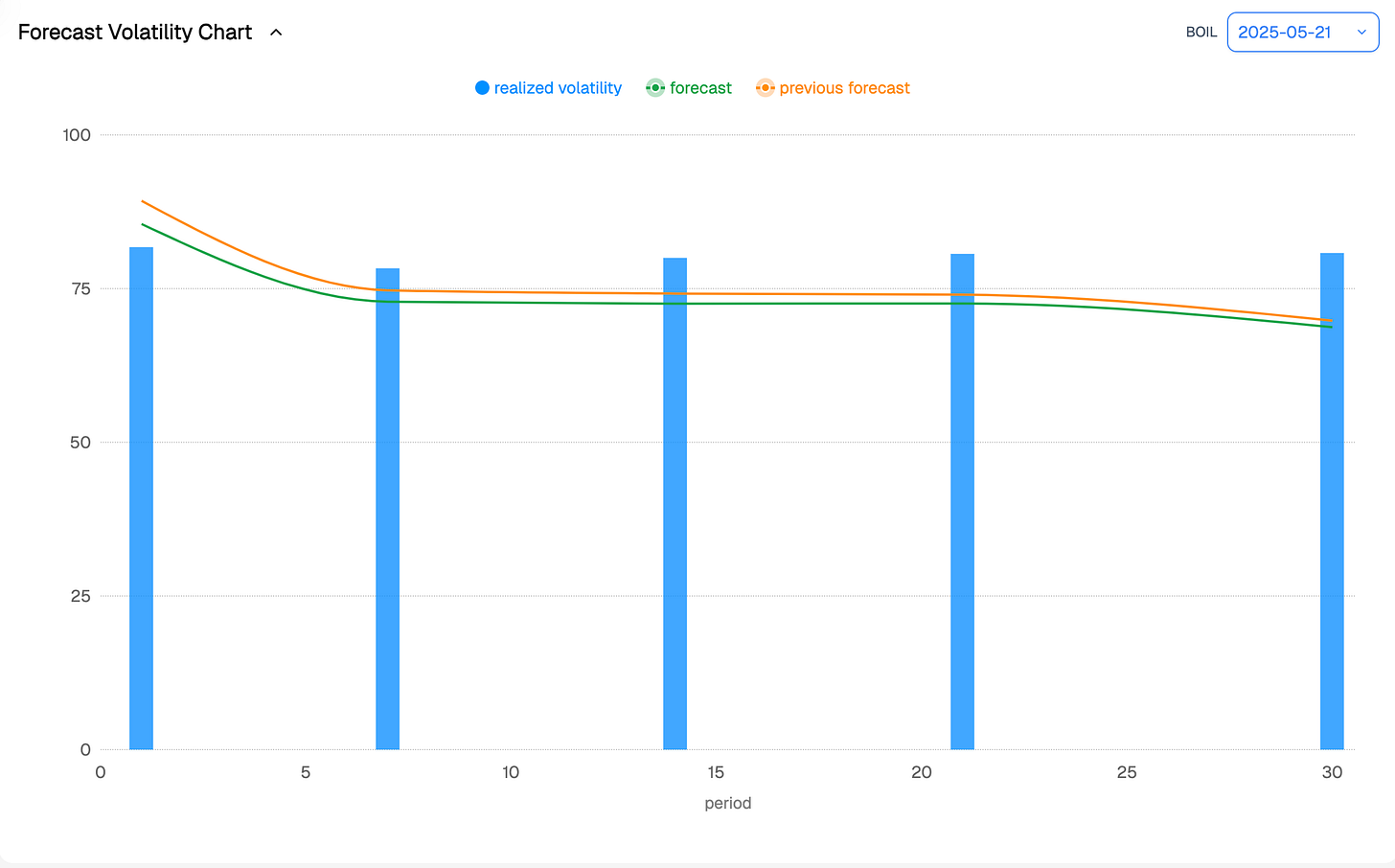

The instrument’s triple-levered return—three times whatever the natural gas futures are doing on any given day—does most of the heavy lifting in this rollercoaster. Unsurprisingly, realized volatility has been sky-high, though things have cooled off recently.

We’re not seeing anything like the fireworks of summer 2024 yet, but the vol is trending lower, as it often does when the market drifts into summer lethargy and nobody’s sweating the cold. The last month of realized volatility was almost entirely driven by downside moves—no surprise there—but since then, things have settled back into something resembling normal.

Once again, these are all backward-looking signals. But the lack of anything blatantly abnormal in the data leaves the door wide open for the usual cycle—barring any real structural shock, things should get “calmer” in the natural gas complex. If we lean on history and run a simple projection of realized volatility for the next month, it lines up: the data says things are cooling off.

Right now, every signal points toward a quieter stretch, especially on the 30-day horizon where realized vol looks set to drift below 70%.

With that, it’s time to see what the option market is pricing—and how to structure a trade that fades this “slower regime.”