Signal Du Jour - Short Vol in BITO

51 articles later, our first trade in BTC.

It's been a bustling three months and 50 articles since we launched Sharpe Two, yet today marks our first foray into the Bitcoin complex. Why the wait? A mix of richer opportunities elsewhere and the limitation of showcasing just a handful of trades weekly, despite our extensive analysis behind the scenes. If your curiosity is piqued, feel free to reach out about our beta program for our API—we're eager to share more.

Back to the Sujet du Jour - a lot has happened since the false SEC announcement and the real introduction of BTC ETFs, and after a slow start, the flows have pushed the price of BTC really close to the barrier of 50,000 USD.

50,000 USD for a piece of digital money, greedy energy-wise and unusable as a currency in most corner shops. There are definitely some things we don’t understand in this world. Yet, thankfully, we know quite a bit about finding good volatility trades.

So, let’s look into this one.

The context

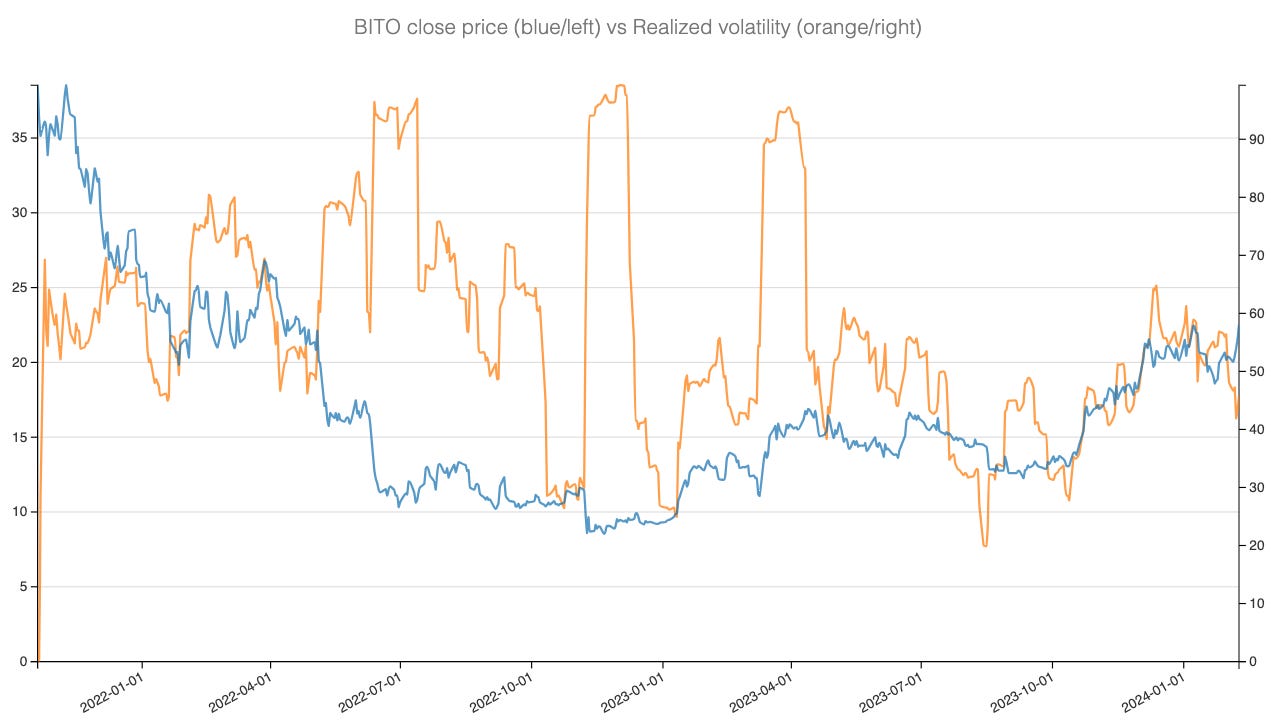

The crypto landscape has undergone seismic shifts since FTX's bankruptcy just 15 months ago and CZ's departure from Binance. U.S. regulators have intensified their scrutiny on exchanges, aiming to shield consumers from the kind of compliance failures and lapses in consumer protection that marked such a significant downfall. Yet, contrary to predictions of crypto's prolonged downturn, the market has bounced back astonishingly. The launch of Bitcoin ETFs has been a key driver, pushing Bitcoin near a two-year high, with BITO tracking Bitcoin futures prices mirroring this ascent. Interestingly, as BITO's realized volatility shows a gradual decrease, it raises a crucial question.

Think about it: if you were asked to quote a price for a BITO straddle at 22, how much would you weigh in on the recent realized volatility downtrend? Probably not too much; given Bitcoin's inherent volatility, any unforeseen event could significantly impact its price in an instant.

And it's likely many volatility traders remain skeptical about the asset's stability.

Let's dive into the data to uncover more.

The data and the trade methodology

As loyal followers of Sharpe Two will attest, we have a penchant for spotting opportunities where the Variance Risk Premium (VRP) appears overpriced. While many analysts might lean on implied volatility (IV) extracted directly from options prices, we prefer a hands-on approach.