Signal Du jour - short vol in BITO

A strong signal but the window is closing.

We are back after a few days off during the quiet 4th of July week. Equities are up (obviously), and volatility hasn’t moved much (why would it?).

We're returning to our traditional schedule of Signal Du Jour, and we have a little teaser to start with—we’ve been asked multiple times to publish the results of these trades. Starting next week, we will do a recap of the previous month. June has been really good, and if you are part of our Discord Channel (get in touch for the pricing details), you had it even better.

One last thing: if you are new to Sharpe Two, you can find all our metrics through our API. We’ve recently added significant historical data—take a look and don’t hesitate to reach out!

That being said, let’s look at what is happening in BITO, the ETF offering exposure to Bitcoin through futures on the CME.

The context

Narratives change quickly in the financial markets. Eighteen months ago, after the collapse of SBF, Bitcoin traded well below $20,000, and many observers predicted a crypto winter with a potential Bitcoin price drop below $10,000 within six months. They believed institutions would stay away from cryptocurrencies until things settled.

Eighteen months later, Bitcoin is comfortably trading above $50,000, driven up by institutional money, especially through the various ETFs approved by the SEC earlier this year. However, it remains well below the all-time highs of around $75,000 observed a few months ago.

This is another example of why we avoid major directional calls and focus on volatility, which is much more predictable.

Contrary to some beliefs we regularly read on social media, BITO's volatility is fairly stable, usually hovering around 40%. While this is elevated compared to SPY, it's far from the extreme volatility Bitcoin experienced up until five years ago. The asset class is maturing overall, and the risk of a major spike in volatility has significantly decreased over the years.

Currently sitting at 35%, the realized volatility over the last 30 days is on the lower side of what we've observed recently. Could it rise again? Definitely. When? That’s hard to predict.

It’s precisely because this is hard to predict and because Bitcoin is still perceived as a risky asset class that options prices are likely to overstate the actual risk in the product.

Let’s have a look.

The data and the trade methodology

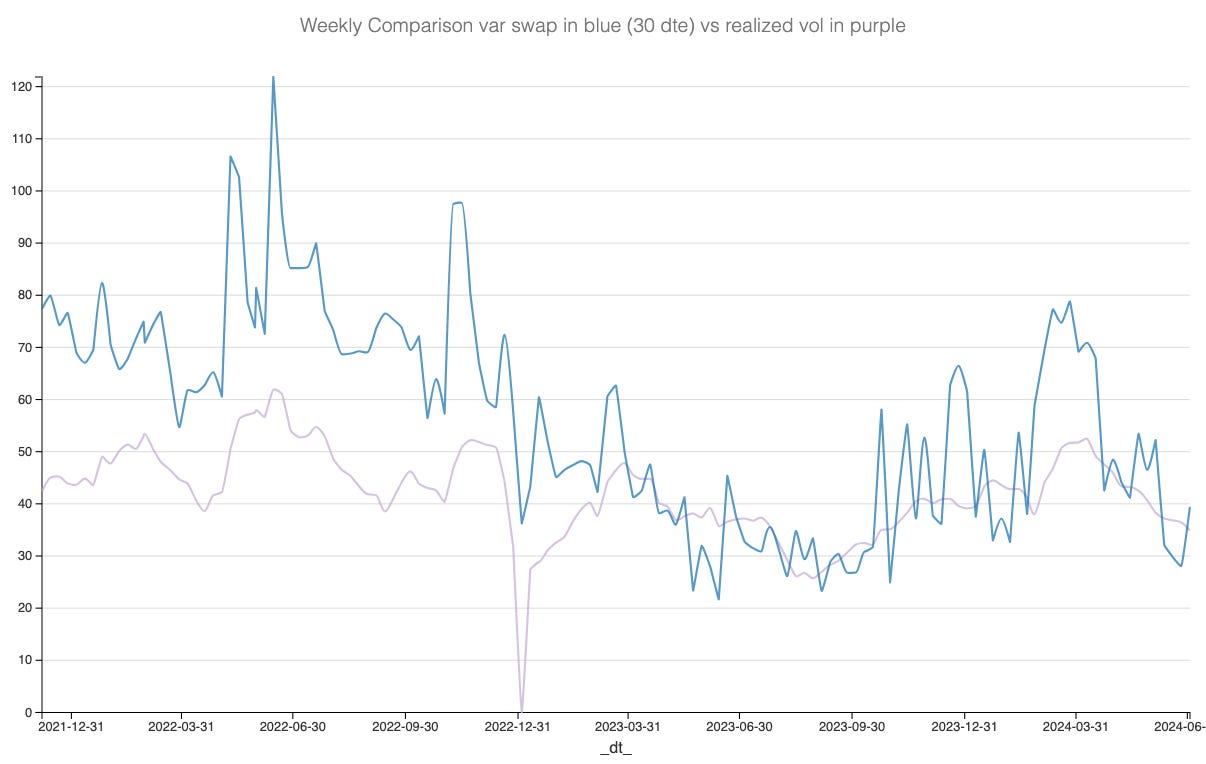

Let’s start this section by examining the implied volatility in BITO over the past few years and comparing it with the realized volatility in the product.

The first conclusion from this chart is clear: the days when you could sell straddles in BITO on repeat every week and collect the premium over the realized volatility are gone.