Signal du Jour - Sharpe Ratio 1.85 Win Rate 72%

Has volatility peaked in UNG?

Yesterday's equity market faced some turbulence as Fed Chair Jerome Powell quashed hopes for a March rate cut. Interestingly, the VIX remained relatively unfazed.

That's alright, though. The beauty of trading a broad and varied array of ETFs lies in the diverse opportunities that present themselves.

Our focus today shifts to the natural gas sector, specifically through UNG. February has just begun, and despite the potential for further drops in temperature, we anticipate a slowdown in the recent volatility of natural gas prices.

This scenario paves the way for volatility traders, especially those keen on selling insurance premiums in the market.

Let’s take a closer look.

The context

While we saw a brief spike in natural gas prices in early January, driven by predictions of prolonged cold in Europe, prices have generally trended downwards throughout the winter. This trend was accentuated by UNG's inherent price decline – a characteristic of the ETF's reliance on futures contracts. Due to the contango effect in these contracts, UNG’s value is structurally inclined to decrease over time.

To address this, the ETF underwent a reverse split, changing its ratio from 1 to 4. This recalibrated its price from around $5 to $20 by issuing new units (in ETF terminology, a unit is akin to a share).

Natural gas, as a vital commodity, is highly sensitive to weather conditions and geopolitical factors. This makes UNG an inherently volatile product, presenting unique challenges and opportunities for traders.

The recent spike in UNG's price was as rapid in its decline as it was in its ascent, pushing its historical volatility to the highest levels of the year. Currently at an impressive 90%, UNG ranks as one of the most volatile assets on our watch list.

Why does this present a good opportunity? As volatility sellers, we understand that volatility is inherently mean-reverting. After peaking, it's likely that volatility will gradually diminish.

Our focus isn't on predicting the future movements of UNG's price. Rather, we anticipate that option sellers will maintain elevated quotes as a precaution against potential drops in temperature or geopolitical shocks that could affect natural gas prices.

Let's dive into the data to further understand the opportunities this scenario presents.

The data and the trade methodology

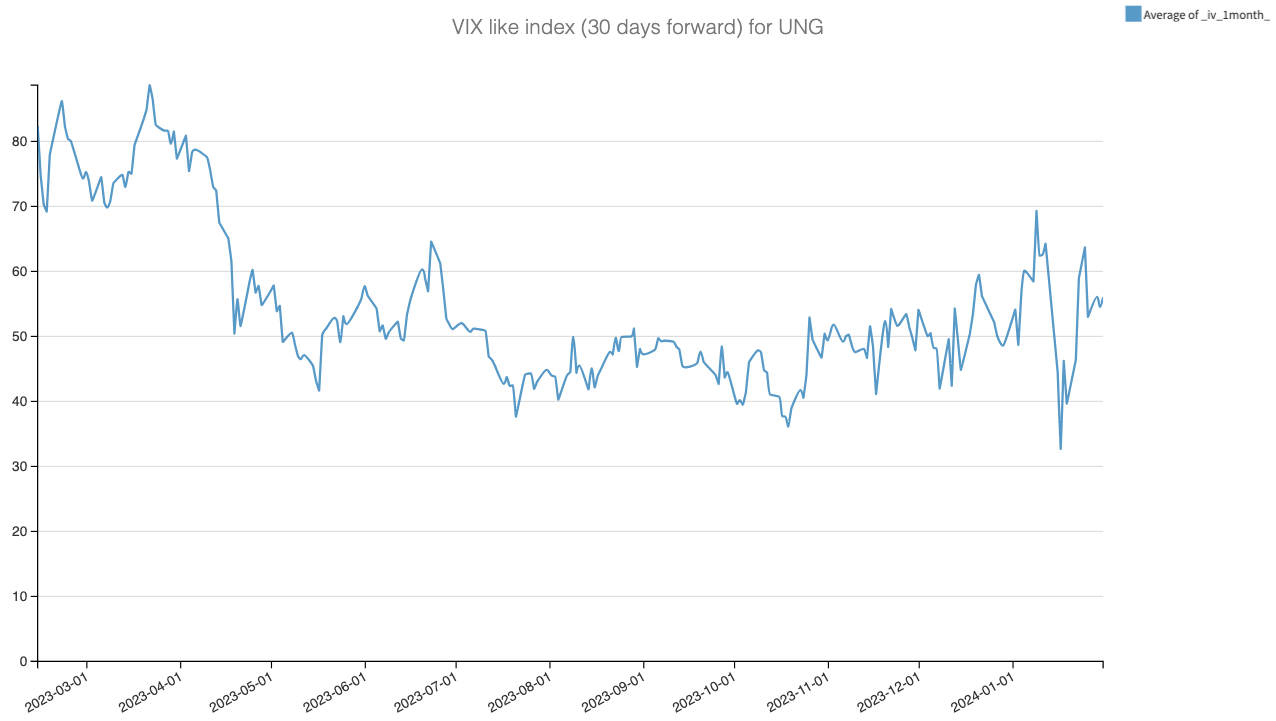

To start our analysis, we applied the CBOE methodology to create a VIX-like index for UNG.

While the index isn't at the extreme highs seen in early January, when Europe was first hit by a cold wave, it remains relatively high. This level of implied volatility suggests the potential for some trading opportunities on the sell side.