Signal du Jour - USO Sharpe 1.9 Win Rate 50%

"Gettin' Arab Money" - Busta Rhymes.

Sharpe Two has been in the Middle East for the past few weeks.

Irrelevant, we give you that, but it sets the stage for something that we have in store for you today.

We secretly hoped to pen an article about oil during our time in the region. Given the dramatic market movements we've witnessed as the year winds down, we're thrilled to finally share our insights directly with you.

We're zeroing in on USO, the United States Oil ETF, in this piece. This fund offers investors exposure to crude oil through futures contracts and boasts some intriguing characteristics (contango, we're looking at you).

We'll delve deeper into these aspects in a future article – another great reason for you to subscribe and follow us on Twitter.

Trust us; you don’t want to miss out on this!

The (volatile) Context

Oil prices have taken an unexpected plunge in the past week, baffling many commodity desks.

The news has been quite eventful – from the ineffectiveness of price caps on Russian exports despite sanctions to production cuts by Saudi Arabia and the ongoing conflict in the Middle East. These factors had previously driven a steady increase in prices.

Yet, contrary to bullish expectations, oil prices started to plummet from mid-October and sharply declined last week, approaching the year's lows. Some analysts suggest this drop reflects reduced demand from major players like China and India, hinting at an impending recession. At Sharpe Two, while we don't speculate on such macroeconomic predictions, we closely monitor market volatility and whether current price movement anticipations are justified.

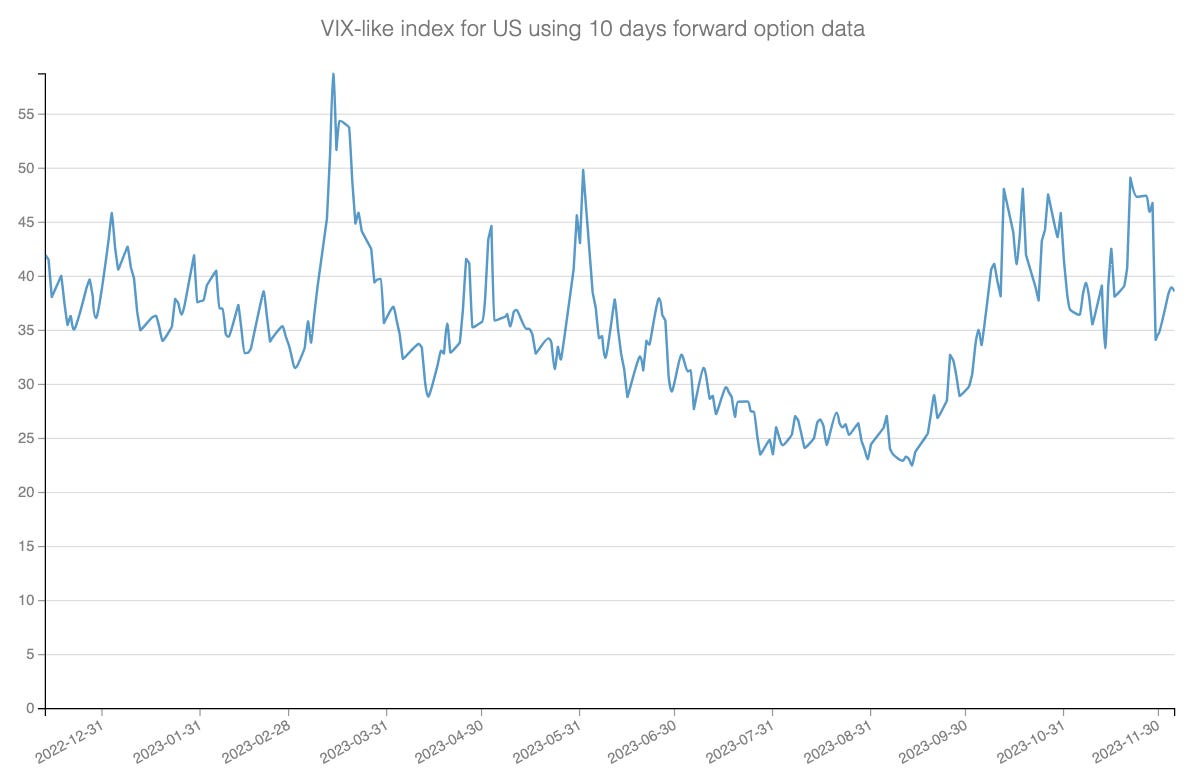

The recent price swings have catapulted realized volatility from this year's lows to its highs at an astonishing rate. These levels, while still below those observed at the start of the war in Ukraine, are significant. Such dramatic shifts have likely caused substantial losses for some traders; consequently, many are now considering the purchase of insurance contracts at a premium.

This emerging trend in trader behavior leads us to look closely at short-dated options contracts.

Now, let's dive into the data.

The Signal and The Trade Methodology

Let's be clear – we're not suggesting oil has finished its movements. Far from it.

In fact, with all the market rebalancing observed in the past two weeks, we're keenly following the market's trends and believe that the movements will continue to be unpredictable.

This chart reconstructs the VIX index for USO using only short-dated options. We're still observing elevated levels compared to this year's low.